PayPal Buy Now Pay Later: A Flexible and Convenient Payment Solution

In recent years, PayPal has become one of the most popular and widely used online payment methods worldwide. One of the features that makes PayPal so popular is PayPal Buy Now Pay Later, which allows users to make purchases online and pay later with more time flexibility.

In this article, we’ll talk about PayPal Buy Now Pay Later, including its advantages, disadvantages, and how it works. We will also provide examples of how PayPal Buy Now Pay Later can help users make online purchases.

What is PayPal Buy Now Pay Later?

PayPal Buy Now Pay Later is a feature that allows users to make purchases online and pay for them later with more time flexibility. This feature allows users to purchase goods or services online and pay for them over a period of weeks or months, instead of having to pay directly at the time of purchase.

Advantages of PayPal Buy Now Pay Later

PayPal Buy Now Pay Later has several advantages that make it very popular among users. Here are some of the advantages of this feature:

- Time Flexibility : PayPal Buy Now Pay Later allows users to make purchases online and pay later with greater time flexibility. This means that users can buy goods or services online and pay for them over a few weeks or months, instead of having to pay directly at the time of purchase.

- Comfort : PayPal Buy Now Pay Later is very convenient to use, because users can make purchases online and pay later without having to carry cash or a credit card.

- Security : PayPal Buy Now Pay Later is very safe to use, because users can make purchases online and pay later using a verified PayPal account.

- No Fees : PayPal Buy Now Pay Later has no additional fees, because users only need to pay the amount corresponding to the price of the goods or services purchased.

Disadvantages of PayPal Buy Now Pay Later

Although PayPal Buy Now Pay Later has several advantages, it also has some disadvantages. Here are some disadvantages of this feature:

- Payment Limits : PayPal Buy Now Pay Later has a payment limit determined by PayPal, so users cannot make online purchases with amounts that exceed this limit.

- Flower : PayPal Buy Now Pay Later may have interest charged to users if they do not pay off their debt by the specified time.

- Late Payment : If users do not pay their debts at the specified time, they may be subject to fines or additional fees.

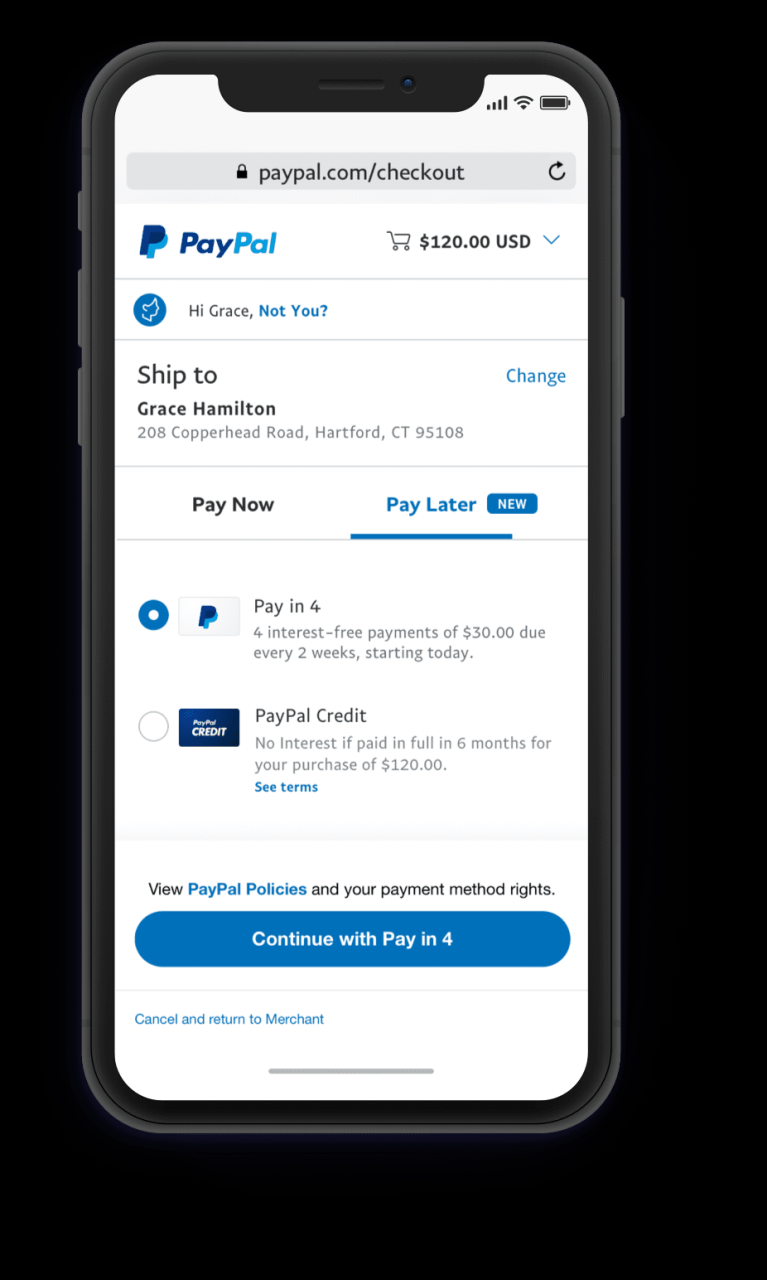

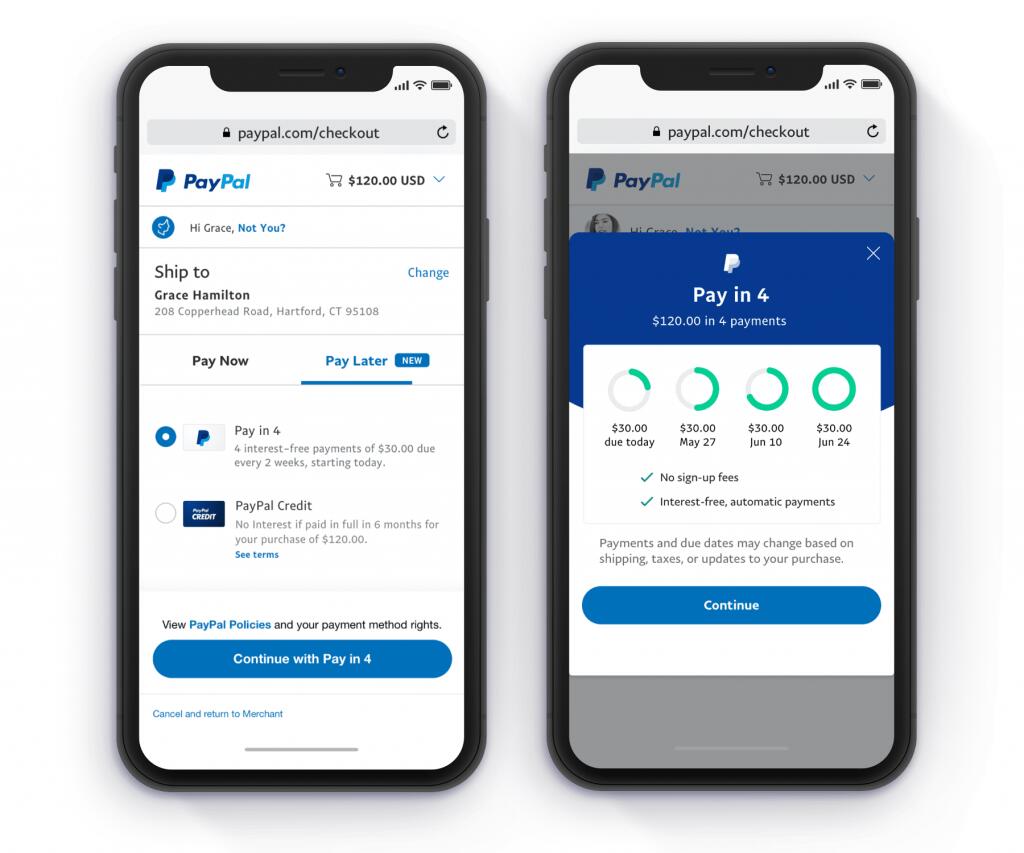

How PayPal Buy Now Pay Later Works

PayPal Buy Now Pay Later works in a very simple way. Here is how this feature works:

- User Creates a PayPal Account : Users must create a verified PayPal account to be able to use this feature.

- User Makes a Purchase : Users can make purchases online using their PayPal account.

- User Selects PayPal Buy Now Pay Later : Users can select PayPal Buy Now Pay Later as a payment method at checkout.

- User Receives Confirmation : Users will receive confirmation that their purchase has been successful and that they have flexible time to pay off their debt.

- User Pays Debt : Users can pay off their debts in a few weeks or months, depending on the predetermined payment schedule.

Example of Using PayPal Buy Now Pay Later

Here’s an example of how PayPal Buy Now Pay Later can help users make online purchases:

Let’s say you want to buy a new laptop online, but you don’t have enough cash to pay for it in person. By using PayPal Buy Now Pay Later, you can buy the laptop and pay for it over a few weeks or months, depending on the payment schedule you set.

Conclusion

PayPal Buy Now Pay Later is a very flexible and convenient feature to use, because users can make purchases online and pay later with more time flexibility. Even though it has several disadvantages, the advantages of this feature make it very popular among users. By using PayPal Buy Now Pay Later, users can make online purchases more flexibly and conveniently.