What is PayPal Money on Hold?

What Are Held Funds on PayPal?

Ever wondered why your funds aren’t immediately available in your PayPal account after making a transaction? Well, that’s because PayPal may have withheld the money.

Holding funds is PayPal’s action to temporarily hold funds received from a sale. This practice helps protect buyers and sellers from fraudulent activity or risky transactions.

Here are some common reasons why PayPal holds funds:

New accounts: PayPal often holds funds from new accounts to build reputation and reduce the risk of fraud.

Suspicious actions: If PayPal detects unusual or risky activity, they may withhold funds for further investigation.

Transaction type: Certain types of transactions, such as receiving money from high-risk countries, may trigger a funds block.

Large number of transactions: Selling a large number of goods or services in a short period of time may raise red flags for PayPal and result in funds being held.

The length of time funds are held varies depending on the reason for the block and your account type. Typically, funds are held for a few days, but it can take up to 21 days in some cases.

Once PayPal completes their investigation, they will automatically release the funds. You can speed up the process by providing additional proof, such as a shipping tracking number or confirmation of receipt of the item.

If you feel your funds are being held unfairly, you can contact PayPal’s customer support team. They will review your account and help resolve any issues.

Here are some tips to avoid having funds withheld:

Build a good reputation on PayPal by making legitimate transactions.

Be alert for unusual or suspicious activity.

Avoid accepting payments from high-risk countries.

Keep transaction amounts moderate.

Provide accurate and complete information when making transactions.

By following these tips, you can reduce the risk of your funds being held and ensure timely availability of funds.

Reasons Why Funds Are Placed in Hold Status

So, have you ever experienced your PayPal funds being held? This can be frustrating, right? Let’s discuss the reasons why your funds may be in “hold” status.

First of all, PayPal often holds funds when there are problems with transactions. For example, if a buyer files a dispute or claims for a refund, your funds may be held until the problem is resolved. Additionally, if your account activity is deemed suspicious or high risk, PayPal may also hold your funds for further review.

Additionally, there are some rules and restrictions that can trigger a “hold” status on your funds. For example, if you are a new user or have a limited transaction history, PayPal may hold funds to ensure the reliability of your account. The same applies if you receive a large amount of money in a short period of time or from a new source.

Another factor that can cause funds to be withheld is your type of business. If you sell goods or services that have a high risk of disputes or refunds, your funds may be held more frequently. For example, if you sell event tickets or electronic goods, your funds will likely be withheld.

Lastly, PayPal may hold funds if your account is still being verified. The verification process usually involves providing personal information, such as a Social Security number or bank statement. If you have not completed this process, your funds may be held until you do.

Now that you know the reasons why your funds might be on hold, how can you solve them? In many cases, PayPal will release funds automatically after a few days or weeks. However, if your funds are being held due to a specific problem, you may need to take some steps to resolve it.

If funds are withheld due to a dispute or refund claim, you will need to respond to the dispute or claim by providing relevant documentation. If funds are withheld due to suspicious account activity, PayPal will notify you and advise you of the steps you need to take to verify your account.

Sometimes, you may not be able to solve the problem yourself. If so, you can contact PayPal customer service for assistance. They can review your account and explain why your funds are being held. They will also provide instructions on how to release your funds.

So, those are some reasons why your PayPal funds might be on hold and how to solve them. Remember, PayPal is committed to protecting you and other users from fraud and suspicious activity. By understanding the reasons why your funds may be being held, you can take the necessary steps to release your funds quickly and easily.

Explanation of PayPal Money on Hold: How to Overcome and Prevent It

PayPal is one of the most popular online payment methods used by people all over the world. With PayPal, users can make online transactions easily and safely. However, there are times when PayPal can hold funds that we send or receive, which is commonly known as “Money on Hold”. In this article, we will discuss what Money on Hold is, how to deal with it, and tips to prevent it.

What is Money on Hold?

Money on Hold is a situation where PayPal holds the funds we send or receive, so that we cannot access or use these funds. This usually happens when PayPal detects suspicious or unusual activity on our account.

Why Does PayPal Hold Funds?

PayPal holds funds as a security measure to protect users from online crime and fraud. Here are some reasons why PayPal might hold funds:

- Suspicious activity : PayPal has a sophisticated security system that can detect suspicious activity on our accounts, such as unusual transactions or incorrect use of passwords.

- Identity verification : PayPal may hold funds if we have not verified your identity or address.

- Unusual transaction : If we make an unusual transaction, such as sending funds to another country or making a transaction with a large amount, PayPal may withhold funds.

- Involvement in online crime : If PayPal detects that we are involved in online crime, such as fraud or money laundering, our funds will be withheld.

How to Deal with Money on Hold

If our funds are held by PayPal, there are several ways to solve the problem:

- Contact PayPal Customer Service : First of all, we must contact PayPal Customer Service to ask for clarification regarding the status of our funds. They can help us understand why our funds are being withheld and how to resolve the issue.

- Identity Verification : If PayPal asks for identity verification, we must immediately complete the verification process.

- Notify PayPal about the Transaction : If we make an unusual transaction, we must notify PayPal of the transaction and provide the necessary evidence.

- Wait for the Investigation Process : PayPal may need time to investigate our transactions. We have to be patient and wait for the investigation process to complete.

Tips to Prevent Money on Hold

Here are some tips to prevent Money on Hold:

- Identity Verification : Make sure we have verified your identity and address before making a transaction.

- Use a Strong Password : Use a strong and unique password for our PayPal account.

- Don’t Share Account Information : Do not share our PayPal account information with other people.

- Don’t Make Unusual Transactions : Do not make unusual transactions, such as sending funds to other countries or making transactions with large amounts.

- Update Account Information : Make sure we update our PayPal account information regularly.

Conclusion

Money on Hold is a situation where PayPal holds the funds we send or receive. However, by understanding the reasons why PayPal holds funds and following tips to prevent it, we can reduce the risk of Money on Hold. If our funds are withheld, we must contact PayPal Customer Service and follow the investigation process. Thus, we can overcome the Money on Hold problem and use our funds safely.

Frequently Asked Questions (FAQ)

- How long does it take to overcome Money on Hold?

The time it takes to resolve Money on Hold can vary depending on the situation. However, usually the investigation process can take several days to several weeks. - How do I contact PayPal Customer Service?

We can contact PayPal Customer Service via telephone, email, or live chat on the PayPal website. - Can Money on Hold be avoided?

Yes, Money on Hold can be avoided by understanding the reasons why PayPal holds funds and following tips to prevent it. - How do I update PayPal account information?

We can update our PayPal account information through the PayPal website or through the PayPal application on our mobile phone.

In this way, we can understand better about Money on Hold and how to overcome and prevent it.

How to Overcome and Prevent PayPal Money on Hold

What is PayPal Money on Hold?

PayPal Money on Hold is a mechanism to maintain the security of financial transactions. When a transaction’s funds are placed on hold, it means PayPal is holding those funds temporarily to review account activity and reduce the risk of fraud.

Why Are Funds Withheld?

There are several reasons why PayPal might hold funds, such as:

New accounts: New accounts are high risk because PayPal has not yet established a reliable transaction history.

High value transactions: Transactions that exceed a certain threshold may be held for review.

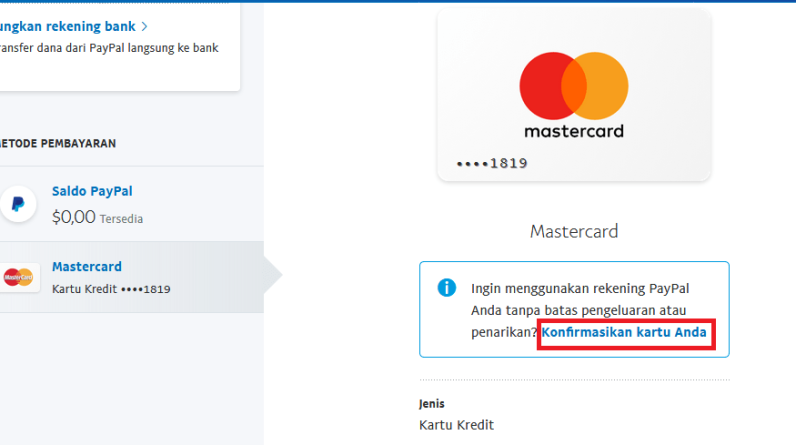

Unverified accounts: Unverified accounts using a credit card or bank account may trigger a hold on funds.

Unusual activity: PayPal monitors account activity to identify unusual activity, such as sudden changes in transaction volume or patterns.

How to Avoid Funds Withholding

To minimize the risk of funds being held, you can take the following steps:

Build a reliable transaction history: Execute transactions regularly to establish a good history.

Avoid high-value transactions: If you must make a high-value transaction, contact PayPal first to discuss alternative options.

Verify your account: Make sure your account is verified by connecting a credit card or bank account.

Avoid unusual activity: Avoid sudden changes in transaction patterns or transaction amounts.

How to Overcome Fund Holds

If your funds are on hold, don’t panic. There are several steps you can take:

Contact PayPal: Contact PayPal via phone, email, or live chat support to find out why funds are being held.

Provide proof: If requested, provide PayPal with the proof necessary to verify your identity or transaction.

Wait: In most cases, PayPal will release funds after the review is complete. The period of detention may vary depending on the reason for detention.

Conclusion

PayPal Money on Hold is an important step to protect buyers and sellers from fraud. By understanding the reasons for holding funds and taking steps to avoid them, you can minimize the risk of experiencing this problem. If your funds are on hold, don’t hesitate to contact PayPal to clarify the situation and speed up the release process.