PayPal’s withdrawal policies for new accounts

PayPal Withdrawal Policy for New Accounts

When opening a new PayPal account, it is important to understand the withdrawal policies that apply to that account. This policy is designed to protect users from fraudulent activity and ensure compliance with financial regulations.

Before making a withdrawal, new accounts will be subject to a holding period. The length of this period varies depending on factors such as account type, transaction history, and verification requirements. During this period, funds cannot be withdrawn.

Once the holding period ends, withdrawals can be made via a variety of methods, including bank transfer, debit card, or other PayPal balance. However, there is a limit to the number of withdrawals that can be made from a new account. These limits aim to prevent fraudulent activity and protect users from loss of funds.

To increase the withdrawal limit, users can verify their identity by providing the required documents, such as a driver’s license or passport. The verification process helps PayPal confirm a user’s identity and reduces the risk of fraud.

Additionally, some new accounts will also be subject to a temporary limit on the number of withdrawals that can be made per day or per week. These limits are imposed to prevent fraudulent activity and protect the integrity of the PayPal platform.

Over time, as users build a good reputation by making legitimate transactions and complying with PayPal policies, withdrawal limits will be gradually increased. This allows users to access and use their funds more flexibly.

However, users should be aware that violating PayPal policies or engaging in suspicious activity may result in withdrawal restrictions or even account suspension. Therefore, it is very important to comply with the policies and use the PayPal platform responsibly.

By understanding and complying with PayPal’s withdrawal policies for new accounts, users can ensure the safety of their funds and enjoy a smooth experience when using PayPal services.

Restrictions on withdrawing funds in the first 24-48 hours

PayPal is a leading online payment service that allows users to send and receive money easily. However, new users may face restrictions when trying to withdraw funds in the first 24-48 hours after creating an account.

These restrictions are enforced as a security measure to prevent fraud and money laundering. PayPal needs to verify the identity of new users before allowing them to withdraw large amounts.

In the first 24-48 hours, new users can only withdraw funds from trusted sources, such as a bank account or debit card. Funds originating from unknown sources, such as private remittances, cannot be withdrawn within this period.

Additionally, the amount that new users can withdraw is also limited. These withdrawal limits vary depending on factors such as country of residence, account type, and transaction history.

After a period of 24-48 hours, new users can withdraw their remaining funds without any restrictions. PayPal’s identity verification process may take additional time, but is usually completed within a few days.

To speed up the verification process, new users are encouraged to provide their personal information, such as address, telephone number, and date of birth. They can also link their bank account or debit card to their PayPal account.

While these withdrawal restrictions can be frustrating for new users, they are important to protect both users and PayPal from fraudulent activity. By complying with these restrictions, new users can help keep their accounts secure and ensure that their transactions are safe.

If new users have questions or concerns regarding these withdrawal restrictions, they can contact PayPal customer service for further assistance. Customer service representatives will be able to provide more detailed information about withdrawal policies and help users resolve any issues they may encounter.

How to verify your PayPal account for smoother withdrawals

How to Verify Your PayPal Account for Smoother Withdrawals

PayPal is a great service for sending and receiving money online, but it can sometimes be a hassle when you try to withdraw funds from a new account. To prevent fraud, PayPal has a stricter withdrawal policy for new accounts, and if you haven’t verified your account, you may face withdrawal delays or restrictions.

The first step to verifying your PayPal account is to provide personal information, such as your full name, address, and phone number. PayPal will also ask you to create an account password. Once you provide this information, you will receive an email from PayPal with a verification link. Click the link to complete the verification process.

In some cases, PayPal may require additional information to verify your account. This may include a copy of your form of identification, such as a driver’s license or passport, or proof of address, such as a utility bill. If PayPal requests additional information, please provide it as soon as possible to avoid withdrawal delays.

Once your account is verified, you should be able to withdraw funds without any problems. However, it is important to remember that PayPal has daily and monthly withdrawal limits. These limits vary depending on the type of account you have, so be sure to check PayPal’s terms and conditions to find out your specific limits.

If you’re having trouble trying to withdraw funds from your PayPal account, the first thing you should check is whether your account has been verified. If you haven’t verified your account, follow the steps outlined above to complete the verification process. If your account has been verified and you are still having problems, you can contact PayPal customer service for help.

By verifying your PayPal account, you can help prevent withdrawal delays and ensure that you can access your funds in a timely manner. The verification process is quite easy and only takes a few minutes, so it’s best to complete it as soon as possible.

Can you withdraw money off a new PayPal account?

Can You Withdraw Money from a New PayPal Account?

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal has become the first choice for many people to make online transactions. However, for those who have just created a PayPal account, there may be some questions about how to withdraw money from the account. In this article, we will discuss in detail the ability to withdraw money from a new PayPal account.

Terms and Conditions

Before we talk about how to withdraw money from a new PayPal account, it’s important to understand the terms and conditions that apply. Here are some conditions that need to be met:

- Verify email address : You must verify the email address used to register for a PayPal account.

- Identity verification : You must verify your identity by uploading a valid identity document, such as a KTP or driver’s license.

- Add a credit or debit card : You must add a valid credit or debit card to your PayPal account.

- Activate the withdrawal option : You must enable the withdrawal option in your PayPal account.

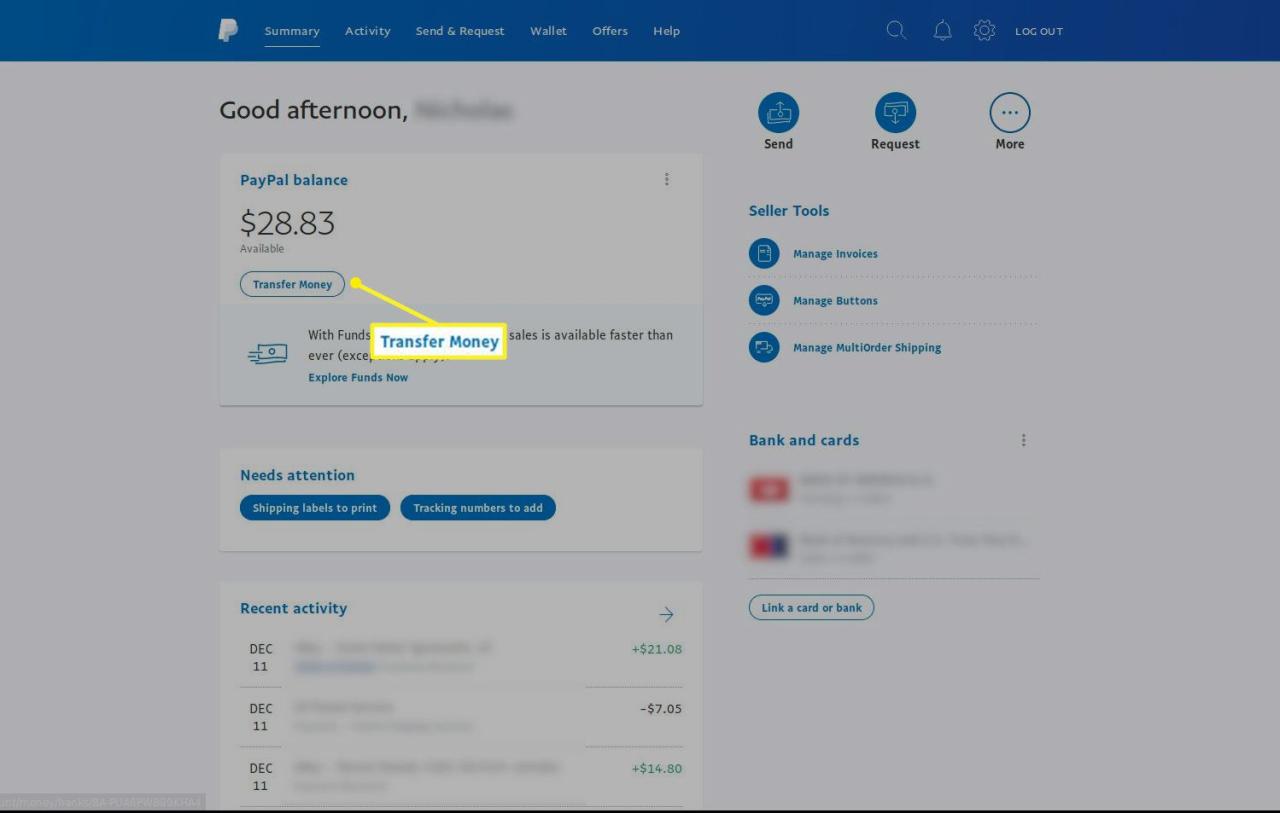

How to Withdraw Money from a New PayPal Account

If you have fulfilled all the terms and conditions above, then you can withdraw money from your new PayPal account in the following ways:

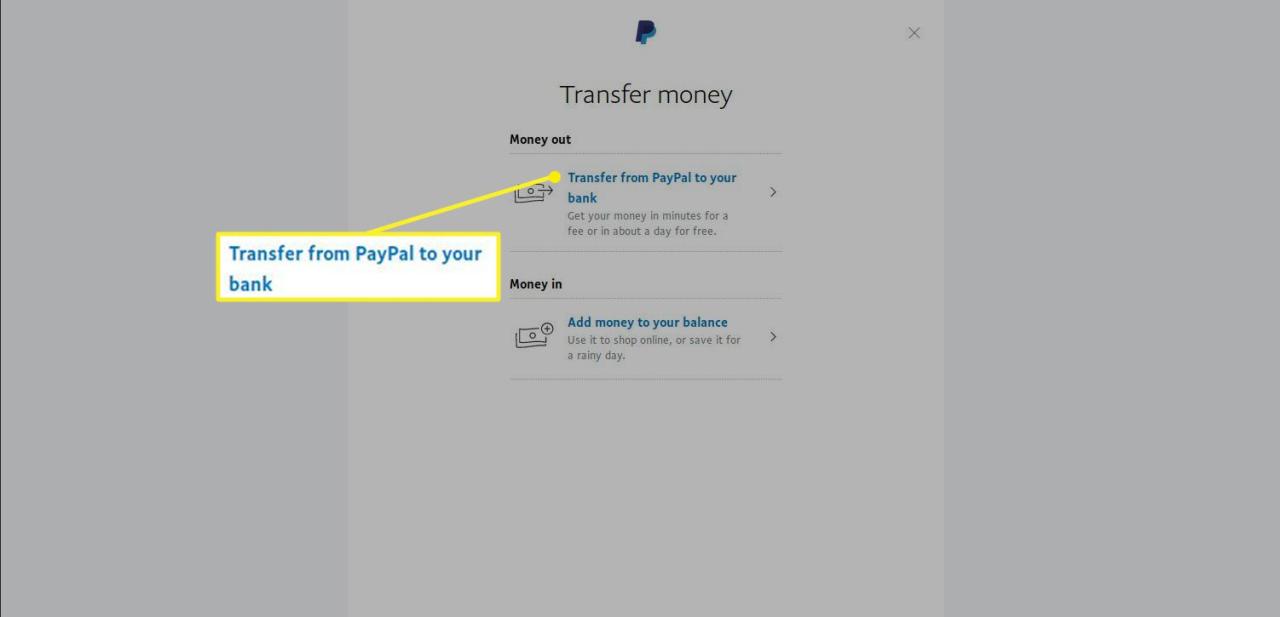

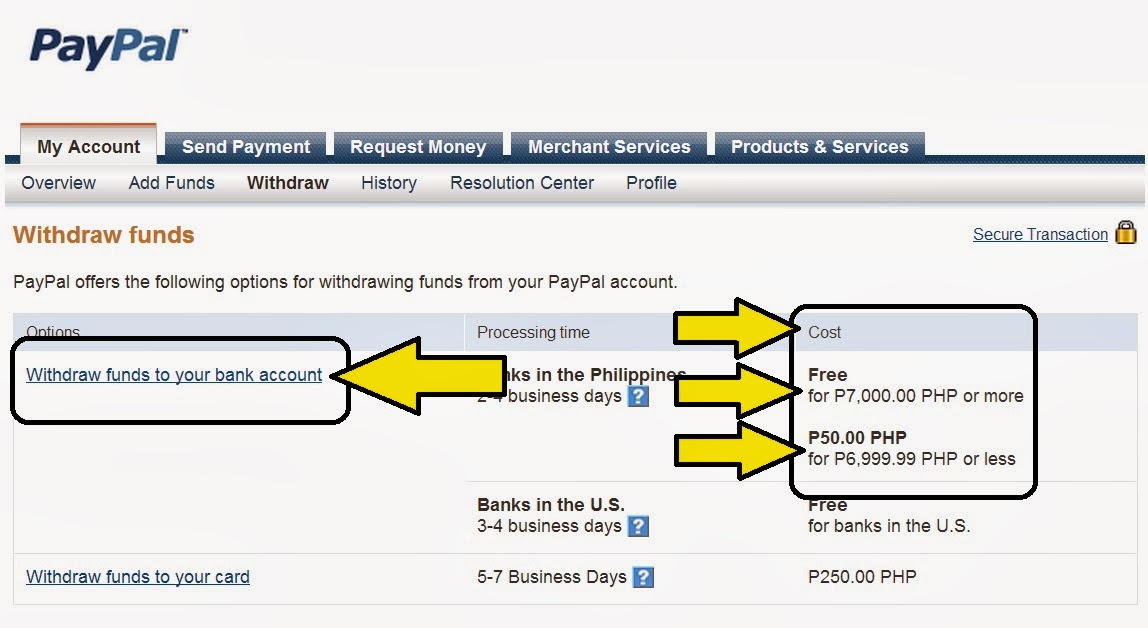

- Withdrawals to Bank Account : You can withdraw money from your PayPal account to your registered bank account. This process usually takes several business days, depending on the bank you use.

- Withdrawals to Debit Card : You can withdraw money from your PayPal account to a registered debit card. This process usually takes a few minutes to a few hours, depending on the bank you use.

- Withdrawals to PayPal Debit Card : If you have a PayPal Debit Card, you can withdraw money from your PayPal account to the card. This process usually takes several minutes to several hours.

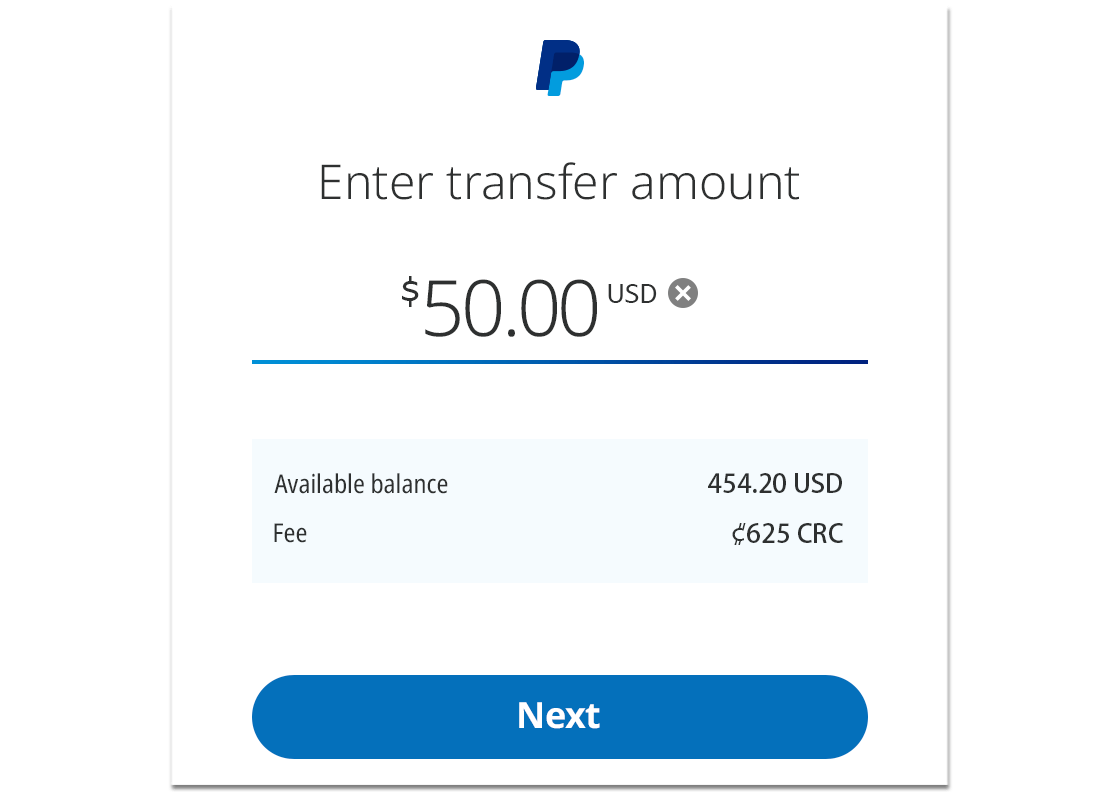

Withdrawal Fees

Please note that there are withdrawal fees that apply when you withdraw money from your PayPal account. These withdrawal fees are usually a percentage of the amount of money withdrawn, as well as transaction fees charged by PayPal. Here are some common withdrawal fees:

- Withdrawal fees to bank accounts : 0.5% – 2% of the amount withdrawn, depending on the country and bank you use.

- Fees for withdrawals to debit cards : 0.5% – 2% of the amount withdrawn, depending on the country and bank you use.

- Withdrawal fees to PayPal Debit Card : 0% – 1% of the amount withdrawn, depending on the country and bank you use.

Withdrawal Limitations

Please keep in mind that there are withdrawal limitations that apply when you withdraw money from your PayPal account. These limitations usually consist of the maximum amount of money that can be withdrawn in one transaction, as well as the number of transactions that can be made in one day. Here are some common withdrawal limitations:

- Withdrawal limits : IDR 10,000,000 – IDR 50,000,000 per transaction, depending on the country and bank you use.

- Number of transactions : 5 – 10 transactions per day, depending on the country and bank you use.

Conclusion

Thus, we can draw the conclusion that you can withdraw money from a new PayPal account by fulfilling the applicable terms and conditions. However, keep in mind that there are withdrawal fees and withdrawal limitations that apply. Therefore, it is important to understand the terms and conditions before making a withdrawal transaction.

Tips and Tricks

Here are some tips and tricks that can help you withdraw money from your PayPal account more effectively:

- Identity verification : Make sure you verify your identity before making a withdrawal transaction.

- Add a credit or debit card : Make sure you add a valid credit or debit card to your PayPal account.

- Activate the withdrawal option : Make sure you enable the withdrawal option in your PayPal account.

- Check withdrawal fees : Check withdrawal fees before making a withdrawal transaction.

- Check withdrawal limitations : Check withdrawal limitations before making a withdrawal transaction.

By understanding the terms and conditions, and following the tips and tricks above, you can withdraw money from your new PayPal account more effectively and efficiently.