Linking a credit card to PayPal

Hi everybody! Tired of the hassle of entering your credit card number every time you make an online purchase with PayPal? Don’t worry, because this article will guide you step by step on how to link a credit card to your PayPal account for a more convenient and secure payment experience.

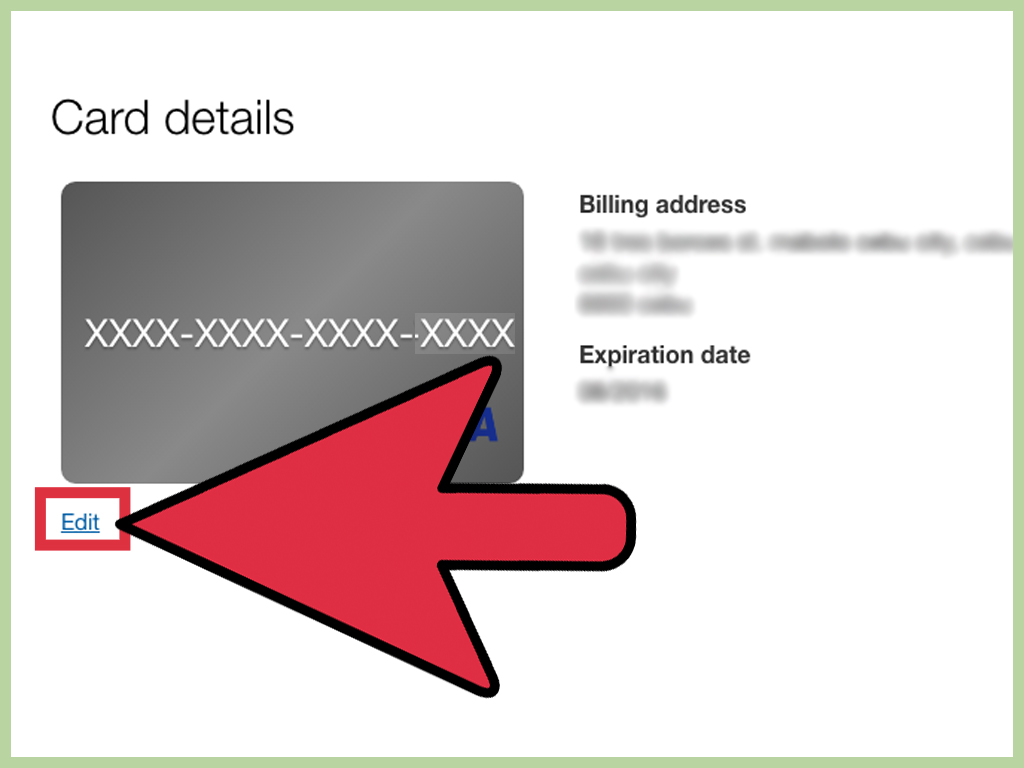

Starting the process is very easy. Just log in to your PayPal account and click the “Wallet” tab. From there, you will see the option to “Add Bank Card”. Click it, then carefully enter your credit card details, including the card number, expiration date, and security code. Once all the information is filled in, click the “Add Card” button.

Happy! Your credit card is now linked to PayPal. Next, you need to confirm that you are the rightful owner of the card. PayPal will charge a small amount to your card and send a verification code to your statement. Just enter this code into PayPal to complete the verification process.

From now on, you can use your linked credit card to make online payments quickly and easily. When you select PayPal as your payment method, you will be presented with a list of saved credit cards. Just select the card you want to use, and PayPal will automatically process your payment.

By linking your credit card to PayPal, you not only save time and effort when making online transactions, but also increase your security. Your credit card information is stored securely by PayPal, so you don’t have to enter it every time. Additionally, PayPal offers additional protection against fraud, giving you peace of mind when shopping online.

So, what are you waiting for? Follow the steps outlined in this article to link your credit card to PayPal today and enjoy an easier and safer online shopping experience.

How to pay with a credit card via PayPal

When you want to shop online or send money to someone, PayPal is a convenient and safe platform to use. However, to take full advantage of PayPal, you need to link your credit card to your PayPal account. This process is easy and only requires a few simple steps.

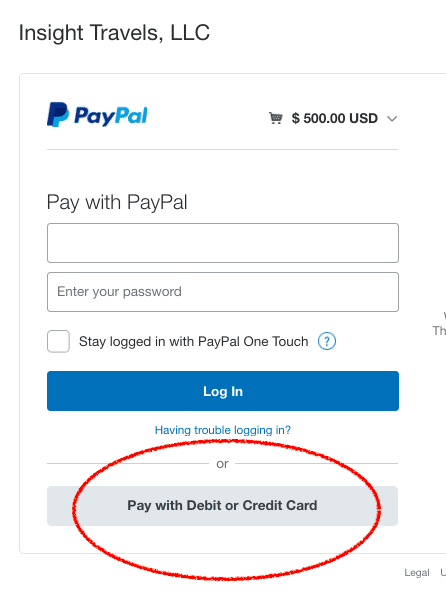

The first step is to log in to your PayPal account. Once inside, navigate to the “Wallet” tab and click “Link credit or debit card.” You will be redirected to a page where you can enter your credit card details, including card number, expiration date, and security code.

Once you have entered all the necessary details, click “Link Card.” PayPal will verify your credit card information and link it to your account. This may require additional verification, such as entering a code sent to your registered phone number or email address.

Once your credit card is linked to PayPal, you can use it to easily make payments when shopping online or sending money. To do this, simply select PayPal as your payment method and follow the on-screen instructions.

Linking your credit card to PayPal has a number of benefits. Firstly, it is very safe. PayPal uses high-level encryption technology to protect your financial information, ensuring that your credit cards are protected from fraud and misuse.

Plus, linking your credit card to PayPal is also convenient. Once your card details are saved, you don’t need to re-enter them every time you want to make a payment. You simply select PayPal and continue your transaction.

Lastly, linking your credit card to PayPal also gives you the flexibility to pay in the way that works best for you. Whether you want to use a credit card for reward points or prefer to manage your finances with a debit card, PayPal lets you choose the payment method that best suits your needs.

In conclusion, linking your credit card to PayPal is a simple and secure process that provides many benefits. It allows you to make online payments easily and securely, giving you the flexibility to pay in the way that works best for you.

Credit card fees and limitations on PayPal transactions

Linking a credit card to PayPal can be a practical and convenient step, making it easier for you to shop online and make money transfers. However, it is important to understand the fees and limitations associated with using credit cards on PayPal.

Credit card fees on PayPal transactions vary depending on the card type and service provider. Generally, there is a fixed fee or certain percentage charged for each transaction, which can add to the overall costs. Additionally, some credit cards may have foreign currency exchange fees or other fees associated with international transactions.

In addition to fees, there are also certain limitations on PayPal transactions made using credit cards. For example, some credit cards have daily or monthly transaction limits that limit the amount of money you can spend through PayPal. Additionally, some credit cards may not allow certain types of transactions, such as purchasing cryptocurrency or making transfers to online casinos.

To avoid unwanted surprises, it is important to carefully review your credit card’s terms and conditions before using it with PayPal. This will help you understand all associated fees and limitations, allowing you to make an informed decision about whether to link your credit card to your PayPal account.

If you frequently make PayPal transactions using a credit card, you may want to consider a credit card designed specifically for online shopping. These cards often offer lower transaction fees, higher limits, and additional benefits such as rewards points or purchase insurance.

Additionally, PayPal also offers alternative payment options such as PayPal account balance, bank account, or debit card. This can be a more cost-effective or flexible option compared to using a credit card.

In conclusion, connecting a credit card to PayPal can be convenient, but it is important to understand the fees and limitations involved. By reviewing your credit card terms and exploring alternative payment options, you can make an informed decision about how to best use PayPal to meet your online shopping needs.

Can you use your credit card for PayPal?

Using a Credit Card on PayPal: A Complete Guide

PayPal is an online payment service that allows you to make transactions easily and safely. With PayPal, you can make payments to sellers, receive payments from customers, and even transfer money to bank accounts. However, before you can make a transaction with PayPal, you must have a payment method associated with your account. One of the most commonly used payment methods on PayPal is credit cards. In this article, we’ll talk about how to use a credit card on PayPal and some things you need to know before doing so.

Why Use a Credit Card on PayPal?

Using a credit card on PayPal has several advantages. Here are some reasons why you might want to use a credit card with PayPal:

- Comfort : Using a credit card on PayPal allows you to make transactions easily and quickly. You don’t have to worry about having cash on hand or making lengthy bank transfers.

- Security : Credit cards offer a higher level of security than other payment methods. If you make a transaction with a credit card and there is a problem, you can file a claim with your bank.

- PointsRewards : Many credit cards offer rewards points programs that allow you to collect points for every transaction you make. By using a credit card on PayPal, you can collect reward points more quickly.

How to Use a Credit Card on PayPal

Using a credit card on PayPal is very easy. Here are some steps you need to take:

- Create a PayPal Account : If you don’t have a PayPal account, create one first. You can register on the PayPal website.

- Add Credit Card : Once you have a PayPal account, add your credit card. You can do this by clicking the “Add Credit Card” button on your account page.

- Enter Credit Card Information : You will be asked to enter credit card information, including card number, expiration date, and security code.

- Credit Card Verification : PayPal will send you a verification code to verify your credit card. You must enter this code to complete the verification process.

- Ready to Use : Once your credit card is verified, you are ready to make a transaction with PayPal.

Things You Need to Know

Before using a credit card on PayPal, there are a few things you need to know:

- Transaction Fees : PayPal will charge a transaction fee of 2.9% + IDR 3,000 for every transaction you make with a credit card.

- Security Code : Make sure you enter the correct security code for your credit card. If you enter the security code incorrectly, your transaction will not be successful.

- Transaction Limits : PayPal has a transaction limit for each credit card. Make sure you check the transaction limits before making a transaction.

- Money refund : If you made a transaction with a credit card and want to make a refund, you must submit a claim to the seller or PayPal.

Security on PayPal

PayPal has several security features to protect your transactions. Here are some of the security features offered by PayPal:

- SSL Encryption : PayPal uses SSL encryption to protect your transactions from unauthorized access.

- Account Security : PayPal has an account security feature that allows you to enable two-factor security and more.

- Transaction Supervision : PayPal has a transaction monitoring team that monitors every transaction to detect suspicious transactions.

Conclusion

Using a credit card on PayPal can make your online transactions easier. However, there are a few things you need to know before doing so. Make sure you understand the transaction fees, security codes, transaction limits, and security features offered by PayPal. By using your credit card on PayPal wisely, you can make online transactions safely and comfortably.