Using PayPal as a payment method instead of a credit card

As a savvy online user, you might consider switching from using credit cards to PayPal for your payment transactions. This article will guide you through this journey, highlighting the benefits, steps, and tips to ensure a safe and smooth experience.

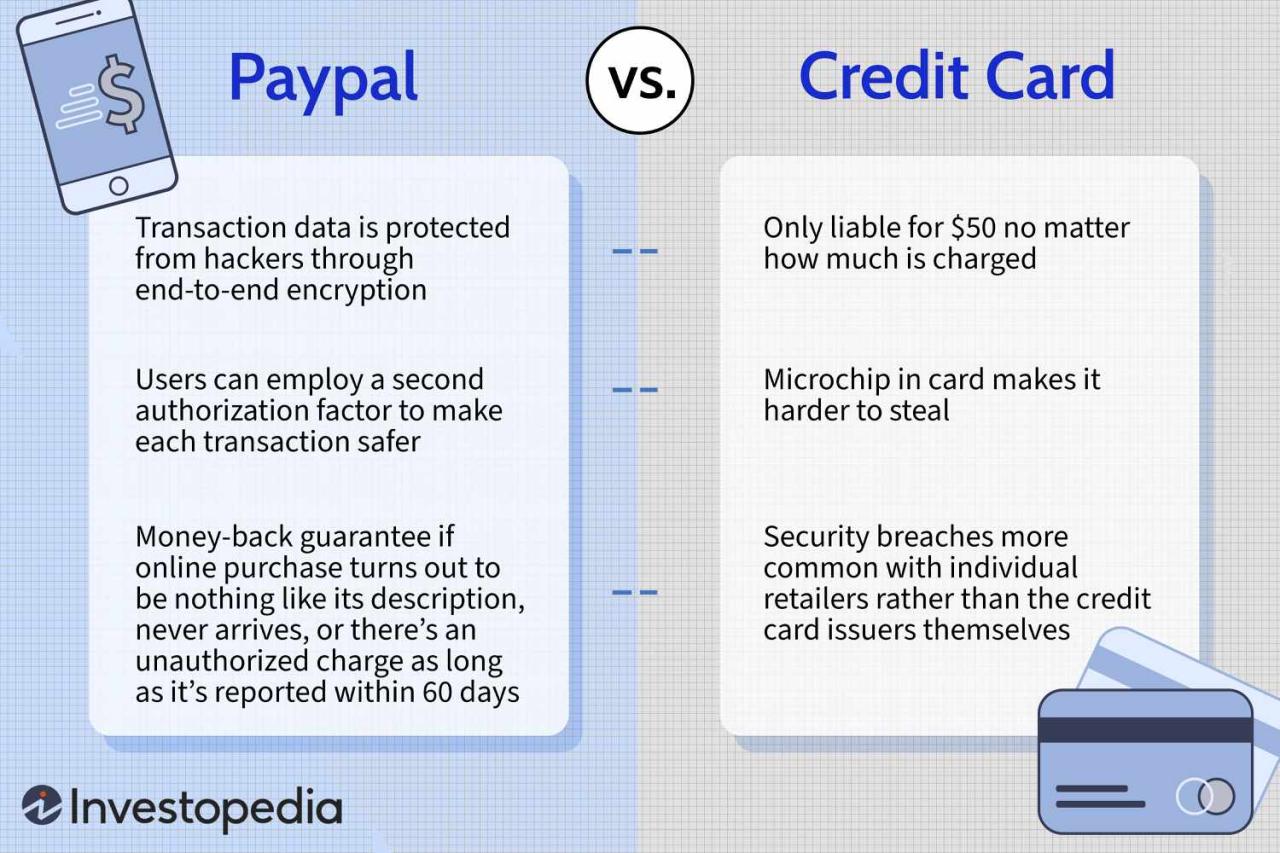

Why is PayPal Better than Credit Cards?

PayPal offers several advantages over traditional credit cards. First, enhanced security. PayPal acts as an intermediary, keeping your financial information private from merchants. This reduces the risk of fraud and identity theft.

Additionally, PayPal provides greater flexibility. You can fund your PayPal account via a variety of methods, including bank accounts, credit cards, and debit cards. This ensures comfort and convenience for the user.

Lastly, PayPal offers comprehensive buyer protection. If you are dissatisfied with your purchase or have a problem, PayPal provides a dispute resolution mechanism that can help resolve any issues you may have.

Steps to Switch to PayPal

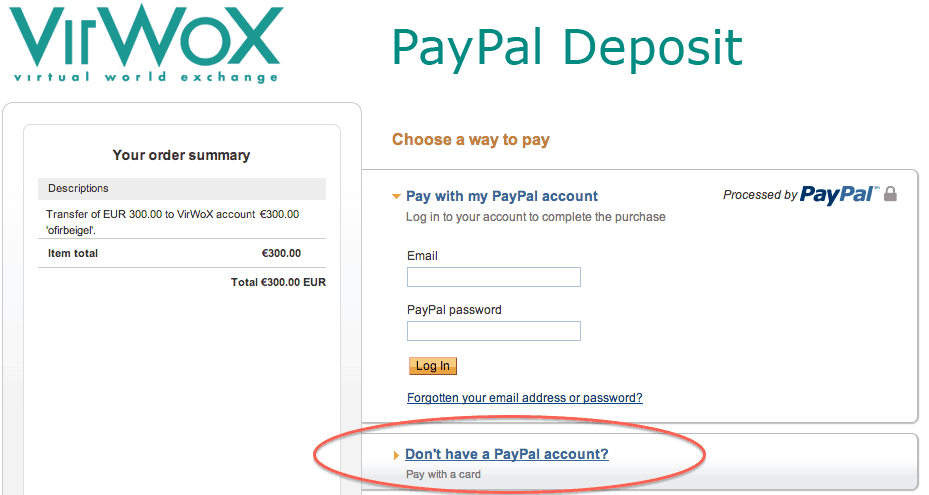

Switching to PayPal as your payment method is easy. First, create a PayPal account by visiting their website. Once your account is active, link your bank account or credit card to fund your transactions.

Once your account is connected, you can use PayPal to make online payments. When you checkout, select PayPal as your payment method. You will be redirected to the PayPal login page where you can enter your credentials and complete the transaction.

Tips for PayPal Security

Although PayPal is safe, there are some precautions you can take to ensure your security:

Create a strong and unique password.

Enable two-factor authentication.

Beware of phishing emails that try to trick you into sharing your login information.

Check your transaction history regularly for unusual activity.

In conclusion, switching from credit card to PayPal as your payment method can provide many benefits. Enhanced security, greater flexibility, and buyer protection make PayPal an attractive option for online shoppers. By following the steps outlined above and practicing these security tips, you can enjoy a safe and smooth payment experience when using PayPal.

How PayPal functions for online and in-store purchases

Tired of using credit cards to shop online and in-store? Maybe it’s time to try PayPal instead. PayPal is a safe and convenient payment service that allows you to make transactions without having to divulge your financial information.

PayPal works by linking your bank account or debit card to your PayPal account. When you make a purchase, you can choose to pay using PayPal and the funds will be debited from your linked account. Interestingly, you can also withdraw funds from your PayPal account to your bank account at any time.

Besides convenience, PayPal also offers several key advantages over credit cards. For one, PayPal protects your financial information with encryption and other security measures. Second, PayPal offers buyer protection that can help you get your money back in the event of a purchase dispute.

To use PayPal for online purchases, simply select PayPal as a payment option at check-out and log in to your account. For in-store purchases, download the PayPal app and link your debit or credit card. When you’re ready to pay, simply scan the QR code or enter the PIN code to complete the transaction.

PayPal is widely accepted at a variety of online and brick-and-mortar stores, including Amazon, eBay, and Walmart. It’s also a popular option for subscription payments, such as Netflix and Spotify. So, if you are looking for a safer and more convenient way to make payments, PayPal is an option worth considering.

While PayPal doesn’t charge fees to create an account or send money to friends and family, there are some fees associated with using PayPal for business or international purchases. However, these fees are usually lower than credit card fees.

Overall, PayPal is a safe, convenient and cost-effective payment service. If you want to reduce credit card use or increase the security of your shopping transactions, PayPal is a great choice. With its ease of use and broad reach, PayPal makes it easy for you to shop with confidence and security.

Differences between using PayPal and a traditional credit card

Switching from credit card to PayPal as a payment method can be a wise decision for several important reasons. First of all, PayPal adds an extra layer of security to your transactions. When you use a credit card, you reveal sensitive information every time you make a payment. In contrast, PayPal functions as an intermediary, meaning the merchant never sees your financial details. PayPal’s buyer protection feature also offers additional peace of mind. If you experience problems with your order, you can file a dispute with PayPal and get a refund, even if the seller doesn’t cooperate.

Apart from security, PayPal also provides convenience. You can link multiple credit cards and bank accounts to your PayPal account, making it easy to pay from multiple sources. Paying with one click is also an option, so you can speed up the payment process. From a seller’s perspective, accepting PayPal payments is more efficient than processing credit cards manually, because transactions are handled electronically.

While PayPal offers several advantages, it is important to be aware of some of its disadvantages. One of the main problems is cost. PayPal charges fees for some transactions, such as international transfers and payments from credit cards. Additionally, some merchants may not accept PayPal, or may charge additional fees for its use. Therefore, it is important to check first before relying on PayPal as your primary payment method.

Additionally, PayPal may limit your account if it detects suspicious activity. This can cause delays or even freezing of your funds, which can be inconvenient. While this is a necessary security precaution, it can cause frustration if you try to access your funds immediately.

Overall, switching to PayPal as a payment method can provide greater security and convenience. However, it is also important to consider the costs and limitations associated with the platform. By considering these factors, you can determine whether PayPal is the right choice for your payment needs. If you want a payment method that is safe, convenient, and widely accepted, PayPal could be a wise choice.

Can you use PayPal like a credit card?

Using PayPal Like a Credit Card: Convenience and Benefits

PayPal is one of the most popular online payment systems in the world. With more than 400 million active users, PayPal has become the first choice for many people to make online transactions. However, what if you want to use PayPal like a credit card? Is that possible? In this article, we will explain how you can use PayPal like a credit card and what the benefits are.

What is PayPal?

Before we talk about using PayPal like a credit card, let’s explain what PayPal is first. PayPal is an online payment system that allows users to make transactions easily and safely. With PayPal, you can make payments, receive payments, and send money to others using your email address and password. PayPal also offers a variety of security features to protect your transactions, such as data encryption and fraud protection.

Using PayPal Like a Credit Card

So how can you use PayPal like a credit card? Here are some ways:

- Online Payment : You can use PayPal to make online payments at various online stores, such as eBay, Amazon, etc. You only need to enter your email address and PayPal password to make a payment.

- PayPal Card : PayPal offers a debit card that you can use to make payments in physical stores and online. This PayPal card can be linked to your PayPal account, so you can make payments using your PayPal balance.

- Recurring Payments : You can set up recurring payments using PayPal, such as electricity bill payments or insurance premium payments.

- Payment at Physical Stores : Some physical stores also accept payments with PayPal, so you can make payments using your PayPal balance.

Benefits of Using PayPal Like a Credit Card

Using PayPal like a credit card has several benefits, including:

- Security : PayPal offers high security to protect your transactions. With PayPal, you don’t have to give your credit card information to anyone else.

- Convenience : PayPal allows you to make transactions easily and quickly, without needing to carry a credit card or cash.

- Flexibility : You can use PayPal to make payments at various online and offline stores, as well as set up recurring payments.

- Protection : PayPal offers fraud protection and high data security, so you can make transactions with confidence.

- No Credit Card Required : With PayPal, you don’t need to have a credit card to make online or offline transactions.

Disadvantages of Using PayPal Like a Credit Card

While using PayPal like a credit card has some benefits, there are also some drawbacks you need to consider:

- Cost : PayPal may charge fees for some types of transactions, such as money transfer fees or currency conversion fees.

- Limits : PayPal may have a limit on the number of transactions you can make in one day or in one month.

- Skills : You need to have internet access and a PayPal account to make transactions with PayPal.

- Support : PayPal may not be supported by all online or offline stores, so you need to check whether PayPal works before making a transaction.

Conclusion

Using PayPal like a credit card can be a smart choice for making online and offline transactions. With PayPal, you can make transactions easily, safely and flexibly. However, you need to consider several disadvantages that may arise, such as fees and transaction limits. By understanding the benefits and drawbacks of using PayPal like a credit card, you can make wiser decisions about how to use PayPal in everyday transactions.