The Beginning of PayPal

The origins of PayPal began in 1998, when Elon Musk, Peter Thiel, and Max Levchin founded a company called Confinity. The idea is to create an easier way for people to transfer money online. In the beginning, Confinity’s main focus was on encryption software for the security of online transactions.

However, in 1999, Confinity merged with X.com, a fintech company founded by Elon Musk. This merger brought PayPal under the X.com umbrella, which was later renamed PayPal in 2001.

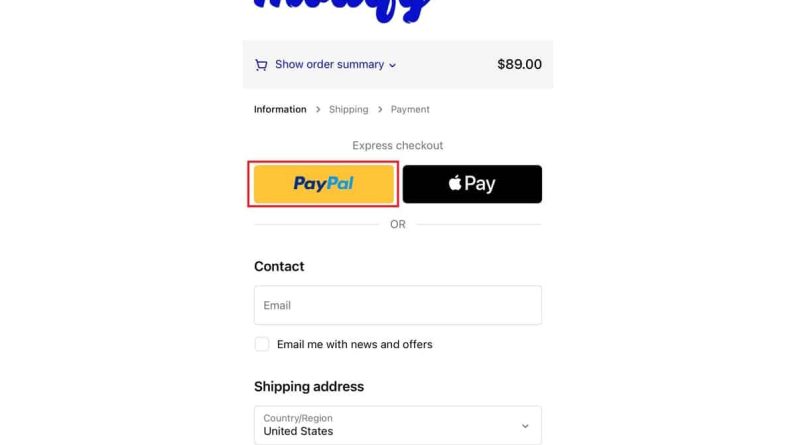

In its early years, PayPal faced stiff competition from some of the payment industry giants, such as Western Union and MoneyGram. However, PayPal has managed to differentiate itself by offering a more convenient and secure service. For example, instead of entering credit card or bank information directly into a merchant’s website, PayPal users can log into their PayPal account and authorize payments from there.

This feature is very popular among online shoppers, who appreciate the convenience and security it provides. As a result, PayPal quickly gained traction and became one of the most popular online payment methods in the world.

In 2002, PayPal was acquired by eBay, a leading e-commerce platform. This acquisition gives PayPal access to a much wider audience, and further strengthens its position as a leader in the online payments space.

As the e-commerce market grows, PayPal continues to expand its offerings. The company introduced new features, such as PayPal Here for mobile payments and PayPal Credit for consumer financing. By providing a comprehensive suite of payment solutions, PayPal has become an important partner for businesses and consumers around the world.

From encryption-focused startup to global payments giant, PayPal’s journey has been marked by constant innovation and adaptation. As the payments industry continues to evolve, you can be sure that PayPal will continue to play an important role in shaping the future of digital finance.

PayPal’s Development to Become a Global Company

PayPal’s journey to dominance as a global company began with humble beginnings. In 1998, Max Levchin, Peter Thiel, and Luke Nosek founded Confinity, a software company focused on security and digital payments.

However, a big leap occurred in 2000 when Confinity merged with X.com, an online banking company founded by Elon Musk. This merger led to the birth of PayPal, which initially served as a payment system for X.com.

As time went by, PayPal started to attract attention for its innovative approach to online transactions. In 2002, eBay, the largest online marketplace at the time, acquired PayPal for $1.5 billion. This acquisition was the catalyst for PayPal’s exponential growth.

With eBay’s huge user base, PayPal quickly became the dominant payment option for online transactions worldwide. The company continues to expand its reach by partnering with other businesses, such as Amazon and Yahoo!.

In 2015, PayPal was separated from eBay and became an independent company. This move allows PayPal to focus on its own growth and innovation. The company continues to invest in new technology, such as PayPal Here which allows businesses to accept payments via mobile devices.

Additionally, PayPal expanded its service offerings by introducing PayPal Credit, a credit service designed for online shoppers. By providing easy financing options, PayPal further strengthens its position as the leading destination for online payments and transactions.

Today, PayPal is a global technology giant with more than 350 million active users. The company has revolutionized the way people send and receive money, and opened up new opportunities for businesses of all sizes.

From its humble roots as a payments system to its role as a global financial company, PayPal’s journey is a testament to its tenacity, innovation and transformative impact on the world of business and finance.

History of PayPal: From the Beginning to Becoming One of the Largest Online Payment Systems in the World

PayPal is one of the largest online payment systems in the world, allowing users to make transactions online easily and safely. However, have you ever known how PayPal was first created and developed into what it is today? Let’s look at the history of PayPal from the beginning to becoming one of the largest online payment systems in the world.

The Beginning of PayPal (1998)

PayPal was created in 1998 by two people, namely Peter Thiel and Max Levchin. The two of them first met at Stanford University, California, United States. Peter Thiel is a graduate of the Department of Physics and Philosophy, while Max Levchin is a graduate of the Department of Computer Science. They both have the same vision, namely to create an online payment system that is easy, safe and efficient.

Initially, PayPal was called Confinity, which was a company created by Peter Thiel and Max Levchin to develop mobile payment technology. Confinity later merged with X.com, a company created by Elon Musk, who also had the same vision. In 2000, Confinity and X.com merged into one company, which was later named PayPal.

PayPal Development (2000-2002)

In 2000, PayPal began developing its online payment system. They created technology that allows users to carry out online transactions using email as an identity. This system is very easy to use, because users only need to have an email account to be able to make transactions.

In 2001, PayPal began developing new features, such as automatic payments and interbank money transfers. They also started improving the security of their systems, using advanced encryption technology.

By 2002, PayPal had become one of the largest online payment systems in the world. They have over 1 million user accounts, and do $3 billion in transactions per year.

Takeover by eBay (2002)

In 2002, PayPal was taken over by eBay, the world’s largest e-commerce company. The takeover was carried out for $1.5 billion. At the time, PayPal had more than 2 million user accounts, and was doing $5 billion in transactions per year.

After being taken over by eBay, PayPal continued to develop its online payment system. They created new features, such as credit card payments and international money transfers.

New Feature Development (2008-2015)

In 2008, PayPal began developing new features, such as PayPal Mobile, which allows users to make transactions online using their mobile phones. They are also starting to develop mobile payment technology, such as NFC (Near Field Communication).

In 2010, PayPal began developing its online payment system in Asia Pacific. They opened offices in Singapore, Hong Kong and Australia, to increase the use of online payment systems in the region.

In 2013, PayPal celebrated its 15th anniversary. At that time, they had more than 140 million user accounts, and carried out $180 billion in transactions per year.

Separation from eBay (2015)

In 2015, PayPal was separated from eBay, and became an independent company. This separation was carried out to increase PayPal’s flexibility and ability in developing its online payment system.

After being separated from eBay, PayPal continued to develop its online payment system. They created new features, such as PayPal One Touch, which allows users to make transactions online with one touch.

Current PayPal (2016-Present)

Currently, PayPal is one of the largest online payment systems in the world. They have more than 360 million user accounts, and carry out $720 billion in transactions per year.

PayPal continues to develop its online payment system, by creating new features and improving the security of their system. They also continue to increase the use of online payment systems throughout the world, especially in the Asia Pacific region.

In recent years, PayPal has made several acquisitions, such as the acquisition of Xoom, an online payments company that specializes in international money transfers. They have also collaborated with several other companies, such as Alipay, an online payment company that specializes in online payments in China.

Conclusion

PayPal has become one of the world’s largest online payment systems, with more than 360 million user accounts and carrying out $720 billion in transactions annually. PayPal’s history is a long and interesting one, starting from Confinity’s inception in 1998, to becoming the largest online payment system in the world today.

PayPal continues to develop its online payment system, by creating new features and improving the security of their system. They also continue to increase the use of online payment systems throughout the world, especially in the Asia Pacific region.

In recent years, PayPal has made several acquisitions and collaborations with several other companies, to increase the use of online payment systems throughout the world.

PayPal’s Achievements and Success in the Payments Industry

Tracing the Path to the Beginning of PayPal: A Success Story in the Payments Industry

The journey of PayPal, the giant payments platform that revolutionized the way we transact, began with a bold vision and unwavering determination. In the late 1990s, when the internet was just starting to take hold, Max Levchin, Peter Thiel, and Luke Nosek got together to put an idea into action: making online payments as easy as possible.

Originally called Confinity, the company focused on security software for handheld devices. However, when eBay, a rising online marketplace, faced a problem of counterfeiting in its transactions, Confinity saw an opportunity to solve the problem. Thus, PayPal was born.

PayPal provides a safe and easy solution for eBay users to send and receive payments. The platform is quickly gaining popularity due to its ease of use and advanced anti-fraud features. In 2000, eBay acquired PayPal, recognizing the platform’s tremendous value in complementing its marketplace.

eBay’s ownership accelerated PayPal’s growth exponentially. The platform extends beyond eBay, enabling individuals and businesses to conduct online transactions safely and conveniently. PayPal has become known for its excellent customer service and strict buyer protection.

Then in 2015, PayPal split from eBay, becoming an independent, publicly traded entity. This marks a new era of growth and innovation for PayPal. The company is expanding its offerings with new services, such as PayPal Credit and PayPal Checkout, providing comprehensive payment solutions to its customers.

Today, PayPal is a giant of the global payments industry with more than 300 million active users. It is a leader in peer-to-peer transactions, allowing people to send and receive money instantly. The platform is also widely used by businesses of all sizes, providing a safe and convenient way to process online payments.

PayPal’s journey from a humble startup to an industry leader is a testament to continuous innovation, smart execution and commitment to its customers. This company has revolutionized the way we conduct online transactions, making payments easier, safer and more convenient for all of us.