How currency exchange works on PayPal

In today’s world of global commerce, exchanging currencies is commonplace, and PayPal has become a gateway for millions of people to do this easily. When you use PayPal to make a transaction in a currency different from your base currency, the platform automatically performs the conversion by charging an exchange rate fee called the “PayPal exchange rate”.

PayPal exchange rates are determined based on the mid-market rate, plus a small margin that PayPal adds to cover transaction costs. The mid-market rate is the average exchange rate determined by the global foreign exchange market. The margin that PayPal applies varies depending on the currency involved and the amount transacted.

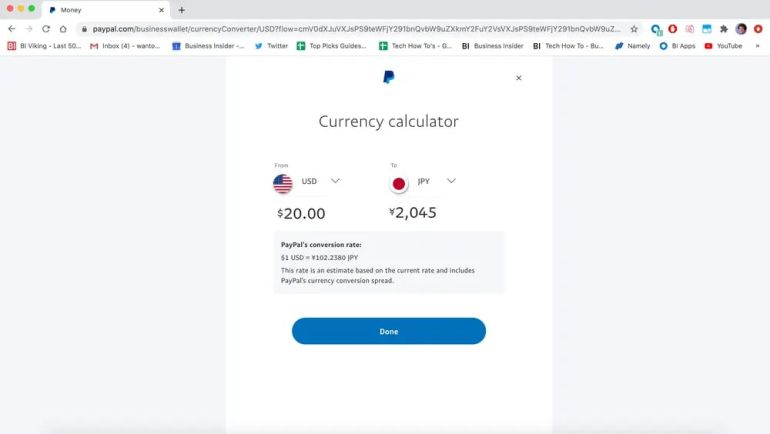

When you make a transaction on PayPal, the platform will provide a breakdown of conversion costs. You will see the exchange rate used, the margin applied, and the total amount to be debited. It is important to review these details before confirming your transaction to ensure that you understand the fees involved.

In addition to exchange rate fees, PayPal may also charge additional fees for foreign currency transactions. For example, if you send money to another country, PayPal may charge an outbound transaction fee. These fees vary depending on the destination country and the amount sent.

Understanding how currency exchange works on PayPal is essential to managing your finances effectively. By knowing the costs involved, you can make informed decisions when transacting in foreign currency. Here are some tips for optimizing your currency exchange on PayPal:

Check the market rate before making a transaction to compare it with PayPal’s exchange rate.

If you are making a large transaction, consider using an external currency exchange service that may offer more favorable exchange rates.

Use the “Send to Multiple Recipients” feature in PayPal to save on conversion fees when sending money to multiple recipients in different currencies.

Avoid making transactions on weekdays or during peak hours, as market volatility can lead to unfavorable exchange rates.

By following these tips, you can mitigate fees and ensure that you get the best exchange rates when transacting foreign currency on PayPal.

PayPal’s exchange rates and fees

When you make foreign transactions on PayPal, you may notice exchange rate differences. This is because PayPal uses your base currency to convert to the destination currency, adding a spread fee to the exchange rate.

This spread varies depending on the currency you are exchanging and current exchange rate fluctuations. PayPal also charges a 4.5% conversion fee for all foreign currency transactions. These fees are included in the exchange rate displayed.

To give a clear picture, let’s take an example. You want to send $100 USD to a friend in the UK. PayPal will use the current exchange rate to convert $100 USD to GBP, then add the difference. For example, if the current exchange rate is 1 GBP = $1.20, PayPal will convert $100 USD to approximately 83.33 GBP.

In addition to exchange rate and difference fees, PayPal may also charge additional fees if your friend receives funds in a different currency than you sent them. These fees vary depending on currency and other factors.

To avoid unexpected fees, check PayPal’s exchange rates and conversion fees before making a transaction. You can find this information in the “Fee Details” section when you set up your transaction.

Additionally, if you frequently make foreign currency transactions, consider creating a PayPal account in a different currency. This can help you save on conversion costs and get more favorable exchange rates. However, it is important to remember that exchange rate fluctuations can still impact your transactions.

So, when you make foreign transactions on PayPal, keep in mind that the exchange rates and fees involved may affect the amount you send and receive. Make sure you understand these fees before confirming your transaction. This way, you can manage your expenses effectively and avoid unwanted surprises.

Earning opportunities and limitations with PayPal currency exchange

When you receive a PayPal payment in a currency different from your account currency, PayPal will convert the amount automatically. This process is known as currency exchange. However, it’s important to know how PayPal currency exchange works so you can maximize your earnings and minimize fees.

PayPal uses mid-market exchange rates to convert currencies. These exchange rates are updated periodically throughout the day based on market exchange rate fluctuations. Additionally, PayPal charges a fee known as a currency conversion fee. This fee is usually around 3-4%, but can vary depending on the currency being converted.

Currency conversion fees can impact your earnings with PayPal. If you frequently receive payments in different currencies, these fees may add up over time. To minimize these costs, you can try to convert your own currency before making a payment via PayPal. However, this is only recommended if you have access to a better exchange rate than PayPal offers.

In addition to currency conversion fees, there are also other limitations on PayPal currency exchange. You can only convert currencies supported by PayPal. Additionally, there is a limit to the amount of money you can convert in a single transaction. These limits vary depending on your PayPal account type and the currency you want to convert to.

Overall, understanding how PayPal currency exchange works is essential to maximizing your earnings and managing your finances effectively. By considering the fees and limitations associated with currency exchange, you can make an informed decision that will help you get the most out of your PayPal account.

Can you make money exchanging currency via PayPal?

Earning Money by Exchanging Currency via PayPal: Is It Possible?

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal offers a variety of ways to send and receive money online. One of the most useful features of PayPal is the ability to exchange currencies. However, is it possible to make money by exchanging currency via PayPal? In this article, we will discuss this further.

How Does PayPal Set Currency Exchange Rates?

Before we understand how to make money by exchanging currency through PayPal, we must understand how PayPal regulates currency exchange rates. PayPal uses a currency conversion system that is based on real-time currency market values. This means that the currency exchange rates used by PayPal will fluctuate depending on currency market movements.

PayPal also charges currency conversion fees which vary depending on the type of transaction and country of origin. These currency conversion fees typically range between 2.5% to 4.5% of the transaction value. In addition, PayPal also charges transaction fees that vary depending on the type of transaction and country of origin.

Earn Money by Exchanging Currency via PayPal

Now, let’s discuss how to make money by exchanging currency via PayPal. Here are some ways you can do this:

- Taking Advantage of Differences in Currency Exchange Rates : If you have access to accurate currency market information and can predict currency exchange rate movements correctly, you can take advantage of currency exchange rate differences. For example, if you have funds in currency A which has a low exchange rate, you can exchange them into currency B which has a high exchange rate. Then, you can sell currency B for a profit.

- Using an Arbitration System : The arbitrage system is a strategy that involves buying currency on one market and selling it on another market at a higher price. By using PayPal, you can buy currency on one market and then sell it on another market at a higher price.

- Using Competitive Currency Exchange Services : There are several currency exchange services that compete with PayPal, such as TransferWise and WorldFirst. You can use these services to exchange currency and then transfer it to your PayPal account.

- Using a Scalping Strategy : Scalping strategy is a strategy that involves buying and selling currencies in a short period of time to take advantage of price differences. By using PayPal, you can scalp different currencies.

Risks and Limitations

However, keep in mind that making money by exchanging currency via PayPal also has some risks and limitations. Here are some things you need to pay attention to:

- Currency Exchange Rate Volatility : Currency exchange rates can change quickly and unpredictably. If you cannot predict currency exchange rate movements correctly, you may incur losses.

- High Currency Conversion Fees : Currency conversion fees charged by PayPal can be quite high, which can cut into your profits.

- Transaction Limits : PayPal has different transaction limits depending on the type of transaction and country of origin. If you make transactions that exceed these limits, you may experience losses.

- Security Risks : Online transactions always have high security risks. If you don’t use PayPal correctly, you can lose your money.

Conclusion

Making money by exchanging currency via PayPal is possible, but keep in mind that this has some risks and limitations. To make money by exchanging currencies via PayPal, you need to have good knowledge of the currency market, the right strategy and the ability to manage risks. Additionally, you also need to understand currency conversion fees, transaction limits, and security risks associated with online transactions.

In conclusion, if you want to make money by exchanging currencies via PayPal, make sure you have done good research and have enough knowledge about the currency market. Additionally, make sure you also use PayPal correctly and manage risks effectively.