What is PayPal’s Market Cap?

PayPal’s market capitalization, also known as market cap, is an important metric that provides an idea of a company’s overall value on the stock market. Simply put, it is PayPal’s share price times the number of shares outstanding. In other words, it represents the total value of company shares owned by shareholders.

Market capitalization is a crucial factor considered by investors to assess the size and stability of a company. Companies with larger market capitalization are generally considered to be more mature, stable, and have better growth potential. For PayPal, a high market capitalization indicates strong investor confidence in the company’s ability to compete and grow in the highly competitive digital payments market.

In addition to company size, market capitalization can also provide insight into PayPal’s financial performance. An increase in market capitalization can indicate revenue growth, business expansion, or increased profitability. Conversely, a decrease in market capitalization may signal a decrease in market share, increased competition, or operational challenges.

However, it is important to note that market capitalization is not the only indicator of a company’s health. Other factors to consider include cash flow, debt-to-equity ratio, and profit margins. Additionally, market capitalization can fluctuate significantly due to market sentiment and unexpected market events.

Overall, PayPal’s market capitalization is an important metric that provides insight into the company’s size, stability, and financial performance. While it is a useful indicator for investment decision making, it is important to remember that it is just one of many factors to consider before investing in PayPal.

History of PayPal Growth and Development

PayPal Market Capitalization: An Important Indicator of Growth and Development

In the world of finance, market capitalization (market cap) is an important metric that measures the overall financial value of a company. For digital payments giant PayPal, market cap provides insight into its rapid growth and development.

Originally launched as a money transfer service in 1998, PayPal has rapidly grown to become a leading payment service provider globally. Over the years, the company has made strategic acquisitions, expanded service offerings, and gained significant market share.

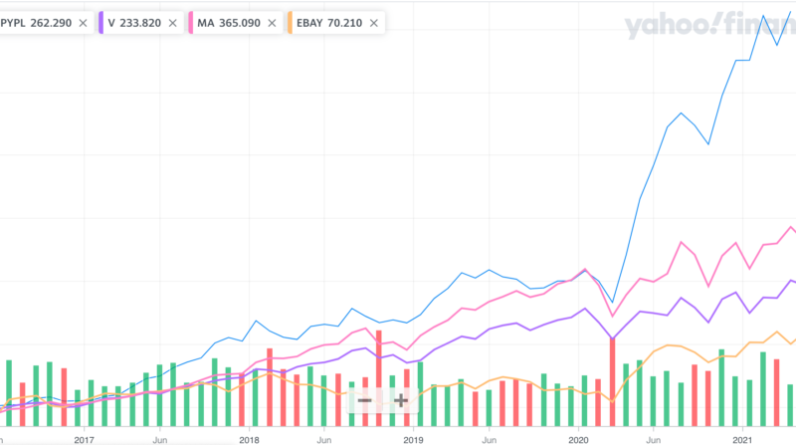

PayPal’s growth is reflected in its continued increase in market cap. In 2002, when PayPal went public, its market cap was around $1.5 billion. In the following decade, its market cap increased rapidly, reaching $43 billion in 2012.

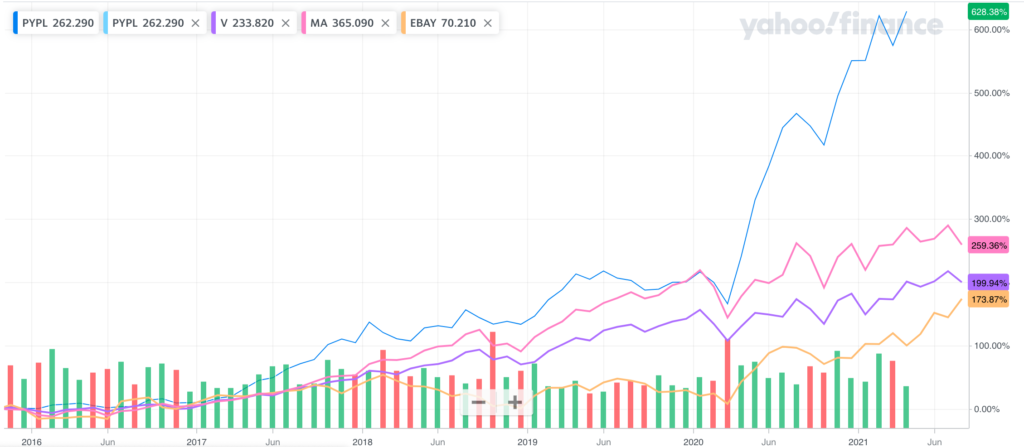

In 2015, PayPal spun off from eBay, its parent company. This move gives PayPal greater freedom and flexibility to drive its own growth. Since then, PayPal’s market cap has continued to soar, surpassing $300 billion in early 2023.

PayPal’s market cap reflects several factors. First, it is a dominant player in the rapidly growing digital payments market. The company has a large user base, with more than 400 million active accounts.

Second, PayPal has diversified its service offerings. From a simple money transfer service, the company now offers a variety of payment solutions, including online checkout, merchant services, and loans.

Third, PayPal invests heavily in innovation and technology. The company continues to develop its platform and services to meet changing customer needs.

PayPal’s market cap isn’t just a financial measurement. This is also an indicator of investor confidence in the company. A high market cap indicates that investors are confident in PayPal’s future growth prospects.

As PayPal continues to expand its operations and explore new growth opportunities, its market cap will likely continue to increase. This is a testament to the strength and resilience of PayPal’s business, as well as its potential to shape the digital financial landscape in the years to come.

PayPal Market Cap: History, Growth, and Future Projections

PayPal is one of the world’s largest digital payments companies, founded in 1998 by Peter Thiel and Max Levchin. Since then, the company has experienced rapid growth and become one of the largest companies in the digital payments industry. In this article, we will discuss the PayPal market cap, history, growth, and future projections of this company.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin, who were two founders who interacted closely with Elon Musk, the founder of SpaceX and Tesla. Initially, the company was called Confinity and focused on payments via palm pilot devices. However, in 2000, Confinity merged with X.com, an online financial company founded by Elon Musk.

In 2001, X.com changed its name to PayPal and focused on digital payments. In 2002, PayPal was acquired by eBay for $1.5 billion. However, in 2015, eBay decided to spin off PayPal as a separate company and list it on the stock exchange.

PayPal Growth

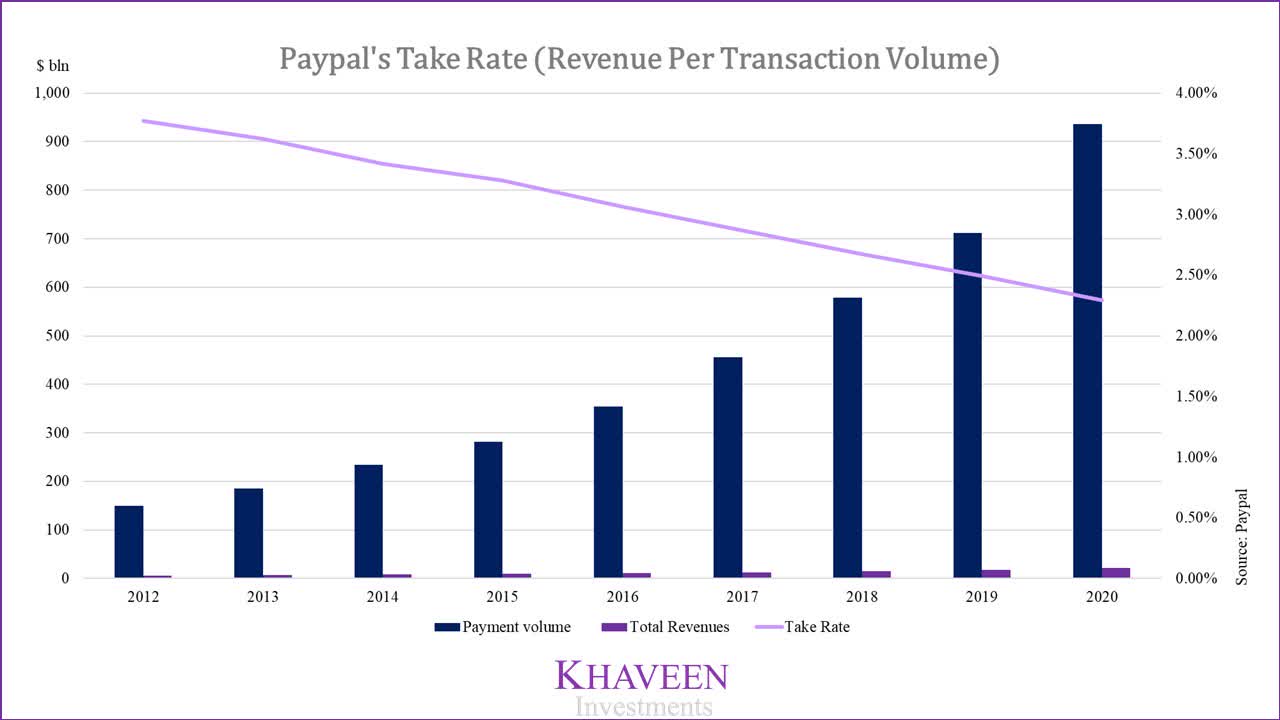

Since being acquired by eBay in 2002, PayPal has continued to experience rapid growth. In 2015, PayPal had 170 million active users and carried out transactions worth $269 billion. In 2020, the company had 325 million active users and carried out transactions worth $936 billion.

PayPal’s growth can be seen from several aspects, such as:

- Number of active users: increased from 170 million in 2015 to 325 million in 2020.

- Transaction value: increased from $269 billion in 2015 to $936 billion in 2020.

- Revenue: increased from $8.3 billion in 2015 to $21.4 billion in 2020.

PayPal Market Cap

PayPal market cap is the market value of this company, which is calculated based on the number of shares outstanding multiplied by the share price. By 2022, PayPal’s market cap will reach $250 billion.

The growth of PayPal market cap can be seen from the last few years, such as:

- In 2015, PayPal’s market cap reached $40 billion.

- In 2018, PayPal’s market cap reached $100 billion.

- In 2020, PayPal’s market cap reached $200 billion.

- By 2022, PayPal’s market cap will reach $250 billion.

PayPal Future Projections

PayPal has several strategies to increase growth and improve its position in the digital payments industry, such as:

- Developing wider digital payment services, such as PayPal One Touch and PayPal Here.

- Develop broader e-commerce platforms, such as Magento and WooCommerce.

- Increasing consumer awareness and trust in PayPal as a safe and trustworthy digital payments company.

- Develop international growth strategies, such as expansion into Europe and Asia.

Thus, PayPal is predicted to continue to experience rapid growth and improve its position in the digital payments industry.

Conclusion

PayPal is one of the world’s largest digital payments companies, founded in 1998 by Peter Thiel and Max Levchin. Since then, the company has experienced rapid growth and become one of the largest companies in the digital payments industry. PayPal’s market cap will reach $250 billion in 2022 and is predicted to continue to increase in the next few years.

With a strong growth strategy and improving its position in the digital payments industry, PayPal is predicted to continue to be one of the largest companies in this industry. Therefore, investing in PayPal can be an attractive option for investors who want to profit from the growth of the digital payments industry.

PayPal Future Projections and Growth Trends

Now we will discuss another important aspect of PayPal, namely its market capitalization. Market capitalization, often abbreviated as “market cap”, is the total market value of a company, calculated by multiplying the number of outstanding shares by the current share price.

For PayPal, market cap is a very important metric because it provides a picture of its financial strength and health. A high market cap indicates that investors believe in the company’s growth prospects and value its shares positively.

Currently, PayPal has a very large market cap, making it one of the companies with the largest capitalization in the world. This reflects PayPal’s leading position in the digital payments market and investors’ confidence in its ability to continue to grow and expand.

PayPal’s market capitalization is very important to monitor because it provides an indication of the company’s value and its future performance. Investors often use market cap as an indicator to compare different companies and make investment decisions.

Additionally, changes in market cap can provide insight into investor sentiment towards PayPal. An increase in market cap is usually interpreted as an indication of investor confidence, while a decrease in market cap can indicate concern.

However, it is important to remember that market cap is not a perfect measure of company performance. Other factors, such as revenue, profitability, and growth, also need to be considered when evaluating PayPal’s financial health.

Nonetheless, market cap remains an invaluable metric that can provide insight into PayPal’s market position, investor confidence, and its future growth prospects.