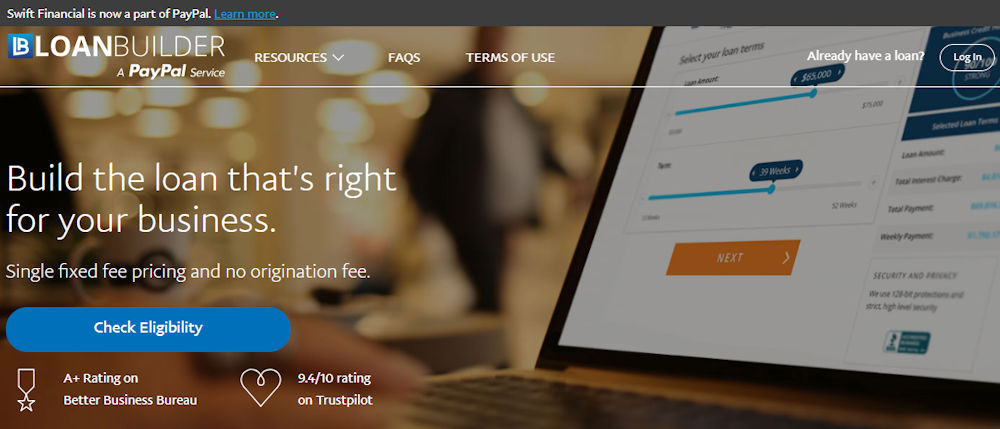

What is PayPal LoanBuilder?

PayPal LoanBuilder is a credit card-based lending solution for small business owners who need fast access to funds. Unlike traditional lines of credit or business loans, LoanBuilder connects directly to your business credit card, so you can borrow up to 85% of your available line of credit, up to $100,000.

LoanBuilder’s approval process is quick and easy. You just need to provide some basic information about your business and authorize PayPal to access your credit card account. Once approved, you can access funds in minutes. This makes it an excellent option for businesses that need an emergency cash injection or who want to cover temporary expenses.

One of the main benefits of LoanBuilder is its flexibility. You can choose the amount you want to borrow and repay the loan at any time without repayment penalty fees. Additionally, these loans have no collateral or collateral requirements, making them an attractive option for businesses with limited credit or who do not want to collateralize assets.

However, it is important to note that LoanBuilder charges a fee. Inventory fees range from 5.99% to 12.99%, and there is a $29 late payment fee. Additionally, you must have an eligible business credit card with a sufficient line of credit to use LoanBuilder.

If you’re considering using PayPal LoanBuilder, it’s important to compare it to other financing options. Consider factors such as costs, terms, and flexibility to determine whether LoanBuilder is the right solution for your business.

Overall, PayPal LoanBuilder is a fast and accessible financing option for small business owners. With a streamlined approval process and the flexibility to borrow and repay as you see fit, LoanBuilder can give you access to the funds you need when you need them. However, it’s important to be aware of the costs and compare LoanBuilder to other options before making a decision.

How to Apply for a Loan with PayPal LoanBuilder

So, you’re considering applying for a loan, and you’ve heard about PayPal LoanBuilder. But what exactly is PayPal LoanBuilder? Let us discuss in depth about this service and how you can apply for a loan through this platform.

PayPal LoanBuilder is a feature that allows you to borrow funds directly from your PayPal account. This is a quick and easy process that can provide quick access to the funds you need. Let’s explore step by step how to apply for a loan with PayPal LoanBuilder:

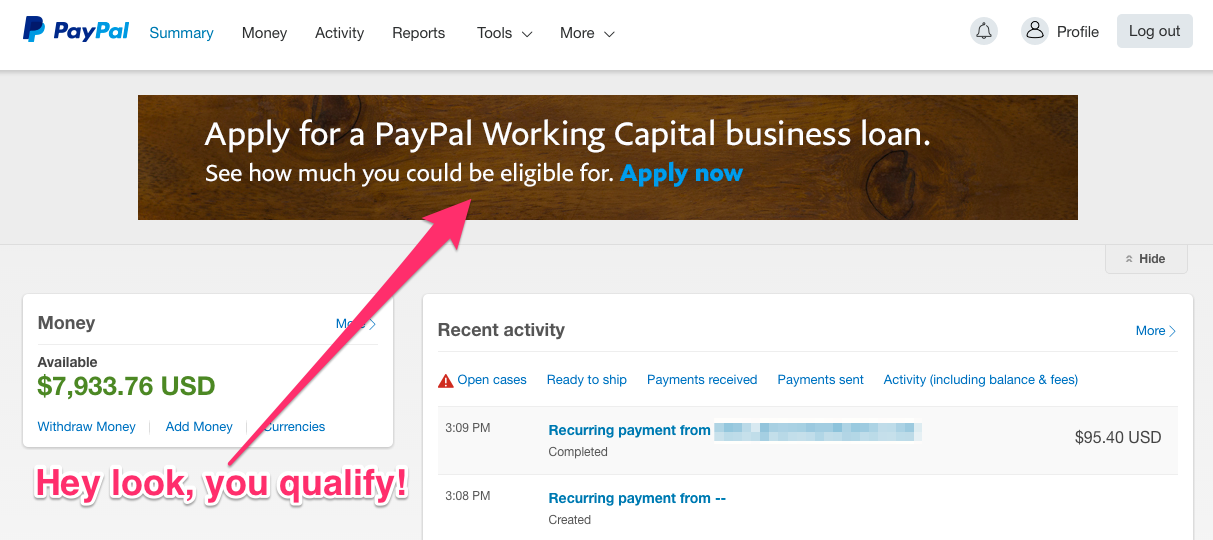

1. Login to Your PayPal Account: Login to your PayPal account and go to the Account Summary page.

2. Find the LoanBuilder Option: Look for the “LoanBuilder” option on the Account Summary page. You may need to click “View Details” to find it.

3. Select Loan Amount: Enter the loan amount you want to apply for. PayPal will give you an estimate of your monthly payments and loan term.

4. Review Loan Terms: Review loan terms carefully, including interest rates, fees, and repayment terms.

5. Submit Application: Once you agree to the terms, click the “Submit Application” button.

6. Wait for Approval: PayPal will review your application and notify you of its approval. This process usually takes several minutes to several hours.

7. Receive Funds: If your loan is approved, funds will be immediately credited to your PayPal balance.

PayPal LoanBuilder is a great option for small businesses and individuals who need fast access to funds. It can be used for a variety of purposes, such as funding a business project, paying unexpected expenses, or covering personal expenses.

However, it is important to remember that any loan, including loans via PayPal LoanBuilder, must be repaid. Make sure you can afford the monthly payments and have a clear plan for repaying the loan on time to avoid additional fees or problems on your credit history.

PayPal LoanBuilder: Loan Solutions for Small Businesses

As a small business owner, you may have experienced difficulties in mobilizing funds to expand your business. Whether it’s to purchase new equipment, pay employee salaries, or increase production, insufficient funds are often an obstacle to business growth. However, with PayPal LoanBuilder, you can have access to flexible and easily accessible loans to help scale your business.

What is PayPal LoanBuilder?

PayPal LoanBuilder is a loan program offered by PayPal, one of the largest financial companies in the world. This program is specifically designed to help small and medium businesses (SMEs) access the funds needed to develop their businesses. Using advanced technology and extensive experience in finance, PayPal LoanBuilder can offer loans that are faster, easier and safer than traditional loans.

How Does PayPal LoanBuilder Work?

PayPal LoanBuilder works in a simple and fast way. Here are the steps you need to take to get a loan from PayPal LoanBuilder:

- List : You need to register to use PayPal LoanBuilder via the official PayPal website. You will be asked to enter your business information, such as business name, address, and telephone number.

- Qualification : After you register, PayPal will conduct an assessment of your business to determine your eligibility for a loan. This assessment is based on the information you provide, including your business’s financial history.

- Select Loan : If you meet the criteria, you will be able to choose the loan amount you want, ranging from $500 to $500,000.

- Check Payment Options : You will be able to choose a payment option that suits your needs, including loan term and monthly payments.

- Receive Loans : Once you approve the loan, the funds will be transferred directly to your PayPal account.

Benefits of Using PayPal LoanBuilder

PayPal LoanBuilder offers several benefits for small businesses, including:

- Fast Process : The loan process with PayPal LoanBuilder is very fast and easy. You can choose a loan and receive funds within minutes.

- Flexible : PayPal LoanBuilder offers flexible loan options, so you can choose the loan term and monthly payment that suits your needs.

- No Hidden Fees : PayPal LoanBuilder has no hidden fees, so you only have to pay loan interest and no other fees.

- Security : PayPal LoanBuilder is very safe, as it uses advanced technology and a strong security system to protect your information.

Terms and Conditions

PayPal LoanBuilder has several terms and conditions that you need to fulfill, including:

- Businesses that Meet the Criteria : You must have a business that meets PayPal LoanBuilder criteria, including a good financial history and a legitimate business.

- Minimum 9 Months Business Age : You must have a business that is at least 9 months old to meet the criteria.

- Minimum $20,000 Annual Income : You must have an annual income of at least $20,000 to meet the criteria.

How to Increase Your Chances of Getting a Loan

If you want to increase your chances of getting a loan from PayPal LoanBuilder, here are some tips you can do:

- Check Your Credit : Make sure you have good credit before applying for a loan.

- Prepare Required Documents : Make sure you have all the necessary documents, including your business’s financial history.

- Choose the Right Loan Term : Choose a loan term that suits your needs to increase your chances of getting a loan.

Conclusion

PayPal LoanBuilder is a flexible and accessible lending solution for small businesses. By using advanced technology and a strong security system, PayPal LoanBuilder can offer loans that are faster and safer compared to traditional loans. If you have a small business and need funds to grow your business, then PayPal LoanBuilder could be the right choice. Make sure you meet the necessary terms and conditions and prepare the necessary documents to increase your chances of getting a loan.

Benefits and Limitations of Using PayPal LoanBuilder

PayPal LoanBuilder Benefits and Limitations: Complete Guide

PayPal LoanBuilder is an innovative business lending tool that can provide flexible financing solutions for small businesses. However, as with any financial product, there are benefits and limitations to consider before using it.

Benefit:

Fast Approval Process: PayPal LoanBuilder offers a very fast approval process, usually only taking a few minutes. This can be especially important for small businesses that need immediate funding.

Flexible Loan Terms: These loans feature flexible repayment terms that can be tailored to your business needs. Additionally, you can access funds immediately after approval, giving you complete control over how they are used.

Competitive Interest Rates: PayPal LoanBuilder generally offers competitive interest rates compared to other financing options. This is especially important for small businesses struggling to secure affordable rates.

Ease of Use: The PayPal LoanBuilder platform is user-friendly and easy to navigate. You can access your account at any time, monitor your loan status, and make payments.

Limitation:

Limited Loan Amounts: PayPal LoanBuilder only offers loans in limited amounts, usually up to $50,000. This may not be enough to meet the needs of larger businesses.

Strict Qualifications: PayPal LoanBuilder has strict eligibility requirements, including a strong credit history and stable business income. Small businesses that are just starting out or are unproven may not be eligible.

Additional Fees: Just like other loan options, PayPal LoanBuilder requires additional fees, such as origination fees and late payment fees. It is important to account for these costs in your financial planning.

Personal Guarantee: In some cases, PayPal LoanBuilder may require a personal guarantee from the business owner. This means that the business owner is personally responsible for repayment of the loan if the company is unable to pay it.

Overall, PayPal LoanBuilder can be a valuable financing solution for qualified small businesses that need fast, flexible access to funds. However, it is important to be aware of the limitations and consider them carefully before taking out a loan. By considering these benefits and limitations, you can make an informed decision about whether PayPal LoanBuilder is right for your business.