PayPal’s impact on credit scores

Imagine you are shopping online, ready to make a purchase. You click the “Pay” button and the “PayPal” option appears. You’re wondering, does using PayPal affect my credit score?

The answer is not as clear as you might hope. Technically, PayPal itself doesn’t directly affect your credit score. However, using PayPal for certain reasons may have an indirect impact on your score.

One way PayPal can impact your credit score is through the loans it offers. Some PayPal loan services, such as PayPal Credit and Venmo Credit, require a credit check. If you apply for and receive one of these loans, your credit score may be affected by a hard draw.

In addition to loans, PayPal can also affect your credit score indirectly through using it to make purchases. While PayPal itself doesn’t report your activity to the credit bureaus, using PayPal can impact how you manage your finances overall.

For example, if you use PayPal to track your expenses, you may be more likely to pay your bills on time and avoid overspending. This can lead to a better credit score over time.

However, if you use PayPal to spend excessively or fail to pay your PayPal bill on time, it can have a negative impact on your credit score. Outstanding credit or closed accounts can hurt your credit score.

It’s important to note that PayPal offers a built-in credit score monitoring system called “PayPal Credit Health”. This feature can help you track your credit score and provide warnings if anything could be misused. By taking advantage of this feature, you can take steps to protect your credit score when using PayPal.

Ultimately, PayPal’s impact on your credit score depends on how you use it. If you use PayPal responsibly to manage your finances and make wise purchases, it is unlikely to negatively affect your credit score. However, if you use PayPal to borrow money or don’t manage your finances carefully, it can have a negative impact on your credit score.

Using PayPal Credit to build credit

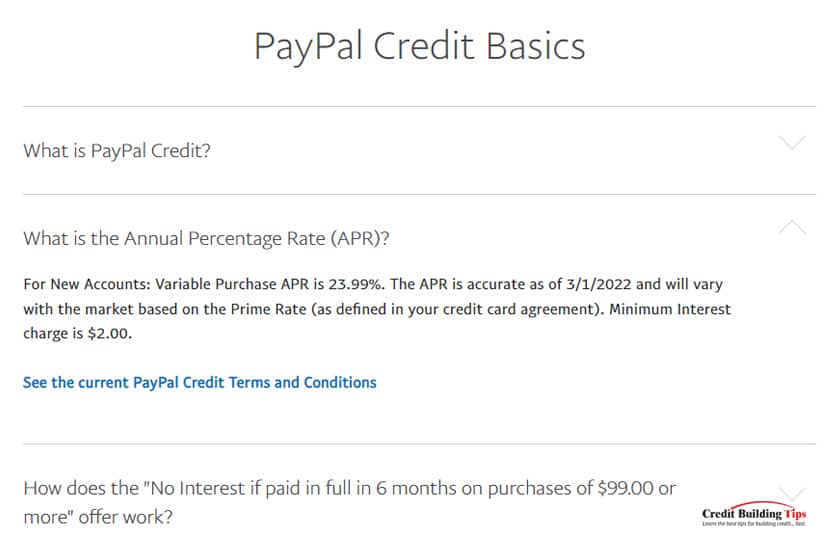

You may already know PayPal as a convenient online payment gateway, but did you know that you can also use its services to build a credit history? PayPal Credit is a special credit option that allows you to make purchases now and pay for them later, without having to apply for a credit card.

Even though PayPal Credit is not a traditional credit card, it can still impact your credit score. When you use PayPal Credit, the account will appear on your credit report as a “revolving credit account.” This type of account differs from installment loans, such as personal loans or mortgages, because it does not have a fixed maturity date. Instead, you make a minimum monthly payment, and your balance is rolled over to the next month.

Responsible use of PayPal Credit can help build your credit history by showing that you can manage your credit well. Making payments on time and keeping balances low shows potential lenders that you are a reliable borrower. This can help improve your credit score, which in turn can give you access to better interest rates and more favorable loan terms in the future.

However, keep in mind that irresponsible use of PayPal Credit can also damage your credit score. Paying late or spending excessively can lead to a lower credit score. This is why it is important to use PayPal Credit wisely and only make purchases you can afford.

Overall, PayPal Credit can be a valuable tool for building your credit history. By using it responsibly, you can improve your credit score and gain access to greater financial benefits in the future. However, it is important to remember that any use of credit must be done carefully and good management is key to maintaining good credit health.

Steps to improve your credit score with PayPal

PayPal, the digital payments giant, has had an unexpected impact on credit scores. While using PayPal itself doesn’t directly affect your credit score, there are ways to leverage the platform to improve your credit score indirectly.

One way is to build a positive payment history. When you make timely payments through PayPal, this information is reported to the credit bureaus, which improves your payment score. Timely payments are a major factor contributing to a good credit score.

Another important step is to reduce credit use. PayPal’s Credit Builder Loan can help you with this. With these loans, you borrow a small amount of money and make monthly payments. If you repay the loan on time, it will be added to your credit history as a well-managed credit account. This can help lower your credit utilization ratio, which is an important metric in determining credit scores.

PayPal also offers a free credit tracking service. This service gives you access to your credit report and credit score. By monitoring your credit score regularly, you can identify any negative changes and take steps to address them.

Additionally, PayPal allows you to link your bank account. If you make automatic payments through PayPal using your bank account, those payments may also be reported to the credit bureaus. This can further improve your payment history.

Using PayPal wisely can have a positive impact on your credit score. By making payments on time, reducing credit usage, tracking your credit score, and linking your bank accounts, you can leverage the PayPal platform to improve your overall credit score.

Remember that building good credit takes time and consistent effort. However, by using PayPal smartly, you can speed up the process and achieve a higher credit score.

Can you build your credit score using PayPal?

Building a Credit Score with PayPal: Is It Possible?

In today’s digital era, PayPal has become one of the most popular online payment methods. Many people use PayPal to make online transactions, but did you know that you can also build your credit score using PayPal? In this article, we’ll explain how you can build a credit score with PayPal and what you need to know before you get started.

What is a Credit Score?

Before we discuss building a credit score with PayPal, let’s first define what a credit score is. A credit score is a value that shows how good you are at managing credit and paying bills on time. A credit score is usually calculated based on your credit history, including the amount of debt, the length of time you’ve had credit, and how good you are at paying bills.

How Can PayPal Help Build a Credit Score?

PayPal has several features that can help you build your credit score. Here are some ways PayPal can help:

- PayPal Credit : PayPal Credit is a credit service that allows you to buy things online using credit. By using PayPal Credit, you can build your credit score by making payments on time.

- PayPal Working Capital : PayPal Working Capital is a lending service that allows you to borrow money for business purposes. By using PayPal Working Capital, you can build your credit score by making payments on time.

- PayPal Monthly Payments : PayPal Monthly Payments is a service that allows you to buy things online by making monthly payments. By using PayPal Monthly Payments, you can build your credit score by making payments on time.

Tips for Building a Credit Score with PayPal

Here are some tips that can help you build your credit score with PayPal:

- Pay bills on time : Make sure you pay your bills on time to build a good credit score.

- Use PayPal Credit wisely : Don’t overuse PayPal Credit, as this can affect your credit score.

- Check your credit history : Make sure you check your credit history regularly to ensure that all information is accurate.

- Do not make delayed payments : Make sure you don’t make any late payments, as this can affect your credit score.

Advantages and Disadvantages of Building a Credit Score with PayPal

Here are some advantages and disadvantages of building a credit score with PayPal:

Excess:

- Easy to use: PayPal is very easy to use, even for those who have never used a credit service before.

- Flexible: PayPal offers several payment options, so you can choose the one that best suits your needs.

- Secure: PayPal uses advanced security technology to protect your transactions.

Lack:

- Fees: PayPal may charge certain fees for some services, such as PayPal Credit and PayPal Working Capital.

- Credit risk: If you don’t pay your bills on time, you could be at risk of bad credit.

- Limitations: PayPal doesn’t offer extensive credit services, so you may need to look for other options if you need more credit.

Conclusion

Building a credit score with PayPal can be an effective way to improve your credit score. By using PayPal Credit, PayPal Working Capital, and PayPal Monthly Payments, you can build a good credit score by making payments on time. However, keep in mind that PayPal does not offer extensive credit services, so you may need to look for other options if you need more credit. By using the tips we’ve shared, you can build a good credit score with PayPal.

FAQ

- Can PayPal help build a credit score?

Yes, PayPal can help build a credit score using services like PayPal Credit, PayPal Working Capital, and PayPal Monthly Payments. - How to build a credit score with PayPal?

You can build your credit score with PayPal by making payments on time, using PayPal Credit wisely, and checking your credit history regularly. - Does PayPal offer extensive credit services?

No, PayPal does not offer extensive credit services, so you may need to look for other options if you need more credit. - Is PayPal safe to use?

Yes, PayPal uses advanced security technology to protect your transactions.