Types of Fees on PayPal

Hi everybody! In this article, we will discuss the types of fees you may be charged when using PayPal. By understanding these costs, you can plan your usage and avoid unwanted surprises.

Standard Transaction Fees

Every time you send or receive a payment via PayPal, you will be charged standard transaction fees. These fees vary depending on your country, type of transaction, and amount transferred. Typical rates range from 2.9% to 4.4% of the transaction amount, plus a small fixed fee.

Withdrawal Fees

If you want to withdraw money from your PayPal account to your bank account, you may be charged a withdrawal fee. These fees vary depending on the withdrawal method and currency used. For example, standard withdrawals to a bank account in the same currency usually have lower fees than withdrawals to a bank account in a different currency.

Payroll Costs

If you use PayPal to pay employees or contractors, you may incur payroll costs. These costs vary depending on the number of employees or contractors you pay, your country, and the type of payroll you use.

Microtransaction Fees

For transactions of small value, such as in-app micropayments or donations, PayPal charges a microtransaction fee. These fees are usually small fixed fees, charged in addition to standard transaction fees.

Additional cost

In addition to the fees mentioned above, PayPal may also charge additional fees in certain situations. For example, you may be charged if:

You exceeded your daily, weekly, or monthly transaction limits.

You use a credit or debit card to fund your payment.

You cancel or reverse the transaction.

How to Avoid Fees

While PayPal fees cannot be avoided completely, there are several ways to minimize them:

Use PayPal for larger transactions.

Consider using the same currency for transactions and withdrawals.

Batch your transactions to reduce individual transaction fees.

Use withdrawal methods with lower fees.

By understanding the types of PayPal fees and how to avoid them, you can better manage your expenses and utilize their services more effectively. Remember to check PayPal’s website or contact their customer service for the most accurate and up-to-date information on fees.

How to Avoid Unnecessary Costs

Hey everyone, if you use PayPal, you really need to know about the different types of fees you can expect. Knowing this will help you avoid unnecessary costs and save money.

Transaction Fees

This is the most common fee that PayPal charges. The fees vary depending on the type of transaction you make. For example, the cost of transferring money to friends or family is usually lower than the cost of purchasing goods or services.

Withdrawal Fees

If you want to withdraw money from your PayPal account to your bank account, you may be charged a fee. These fees also vary depending on the withdrawal method you choose. Generally, instant withdrawals incur higher fees than standard withdrawals.

Currency Conversion Fees

If you make a transaction in a currency different from your PayPal account currency, you will be charged a currency conversion fee. These fees can be quite high, so be sure to take them into account when making international transactions.

Dispute Fees

If you have a problem with a transaction and you submit a dispute, you may be charged a dispute fee. These fees can be quite expensive, so it’s best to try to resolve the issue directly with the seller or buyer first.

Business Account Fees

If you have a PayPal business account, you may be charged additional fees. These fees are usually higher than fees for personal accounts, so be sure to consider them when choosing an account type.

How to Avoid Unnecessary Costs

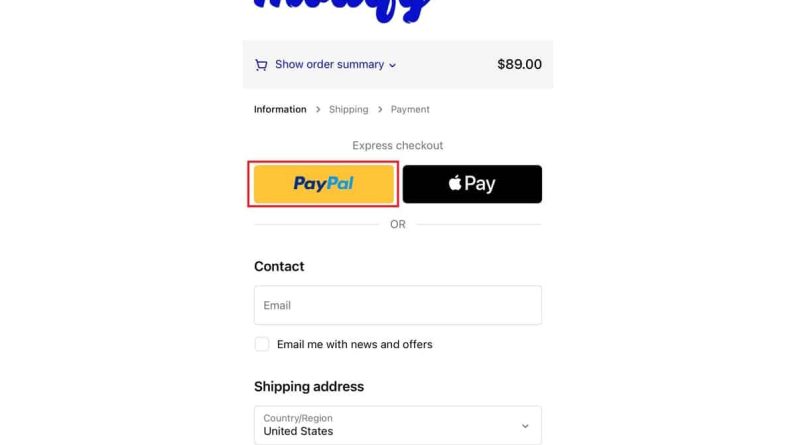

Use PayPal to transfer money to friends and family to avoid transaction fees.

If you have to withdraw money, choose the standard withdrawal method to avoid high instant withdrawal fees.

Avoid making transactions in a currency different from your PayPal account currency to avoid currency conversion fees.

Try to resolve disputes directly to avoid dispute fees.

If you don’t have many business transactions, consider using a personal account to avoid business account fees.

By understanding the types of fees on PayPal and how to avoid them, you can save money and maximize the benefits of this service. Always double-check fees before making a transaction to avoid unwanted surprises.

PayPal Fees: What You Need to Know

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal offers the convenience of fast and secure online payments. However, like other payment services, PayPal also has fees that you need to know about before using this service. In this article, we’ll discuss PayPal fees, what they include, and how you can save on fees when using PayPal.

What are PayPal Fees?

PayPal fees are fees charged by PayPal to users for using their online payment services. This fee is used to cover operational costs, transaction fees, and other costs associated with PayPal payment services. PayPal fees can vary depending on the type of transaction, your location, and the type of account you use.

PayPal Fee Types

Here are some types of PayPal fees you need to know:

- Transaction Fees : Transaction fees are fees charged by PayPal for each transaction you make. Transaction fees are usually charged as a percentage of the transaction amount.

- Currency Conversion Fees : If you make a transaction in a currency different from the currency you use with PayPal, you will be charged a currency conversion fee.

- Withdrawal Fees : Withdrawal fees are fees charged by PayPal if you want to withdraw funds from your PayPal account to a bank account or debit card.

- Return Fee : Return fees are fees charged by PayPal if you want to return funds to the seller for certain reasons.

PayPal Fees for Sellers

If you are a seller, you need to know the PayPal fees associated with your sales. Here are some PayPal fees you need to know:

- Transaction Fees : Transaction fees for sellers are usually around 2.9% + IDR 3,000 per transaction.

- Currency Conversion Fees : If you make a transaction in a currency different from the currency you use on PayPal, you will be charged a currency conversion fee of approximately 4.5% of the transaction amount.

- Withdrawal Fees : Withdrawal fees for sellers are usually around IDR 15,000 per transaction.

How to Save on PayPal Fees

Here are some ways to save on PayPal fees:

- Use a Business Account : If you are a seller, you can use a PayPal business account to save on transaction fees.

- Use the Same Currency : If you make a transaction in the same currency as the currency you use with PayPal, you will not be charged a currency conversion fee.

- Use a Debit Card : If you want to withdraw funds from your PayPal account, you can use a debit card to save on withdrawal fees.

- Make Efficient Transactions : Try to carry out transactions efficiently and not excessively to save on transaction costs.

Conclusion

PayPal fees are the ones you need to know about before using this online payment service. By knowing the types of PayPal fees and how to save on them, you can use PayPal more efficiently and effectively. Don’t forget to always check PayPal fees before making a transaction to avoid unwanted fees.

Tips for Managing Transaction Fees on PayPal

When using PayPal to make transactions, it is important to understand the various fees that may apply. Knowing these types of fees will help you plan your expenses and minimize your transaction costs.

One of the most common fees is the Processing Fee. This fee is charged every time you make a transaction and is usually a percentage of the amount transferred. This percentage varies depending on the type of transaction and the country you are in.

Currency Conversion Fees apply when you transfer funds between different currencies. This fee is charged for converting currency from one currency to another. The amount of these fees varies depending on the current exchange rate and the currency involved.

Withdrawal Fees are charged when you withdraw funds from your PayPal account to your bank account. These fees are usually fixed, regardless of the amount you withdraw. However, some banks or financial institutions may charge additional fees for receiving funds through PayPal.

In addition to these fees, PayPal also charges additional fees in certain situations. For example, additional fees may apply if you conduct transactions outside normal business hours, use certain features, or receive payments from high-risk countries.

To minimize your transaction costs, consider the following suggestions:

Choose the transaction type that has the lowest processing fees.

Avoid transferring funds between different currencies whenever possible.

Withdraw larger amounts at once to reduce withdrawal fees.

Sign up for a PayPal Business account if you do a lot of business transactions.

By understanding the types of fees that may apply and implementing these strategies, you can manage your transaction fees on PayPal effectively and save money.