PayPal services available in India

Hello everyone, I’m here to share some exciting news: PayPal is now available in India! This leading online payment platform allows you to make transactions easily, quickly and safely.

With PayPal, you can shop online, send and receive money, and make international payments without needing to share your financial information. The registration process is simple and only takes a few minutes.

Once you set up your PayPal account, you can link your debit or credit card. Alternatively, you can add balance to your account via bank transfer. This gives you flexibility in choosing the payment method that suits you best.

One of the main benefits of using PayPal is its security. Their advanced encryption technology protects your financial information, giving you peace of mind when you make transactions. The platform also has an advanced fraud detection system to help prevent unauthorized transactions.

Apart from security, PayPal is also known for its convenience. You can make payments in a few clicks, without having to enter your card details repeatedly. And with the PayPal mobile app, you can manage your account and make payments on the go.

PayPal is accepted by many merchants around the world, including leading online stores such as Amazon, eBay, and Flipkart. This makes it a convenient way to shop online without having to worry about payment compatibility.

So, if you are looking for a safe, fast, and easy way to make online transactions, PayPal is an excellent choice. With its availability in India, it is now easier than ever to take advantage of all the benefits this platform has to offer.

Sign up today for your PayPal account and enjoy the convenience and enhanced security of online transactions!

How to receive payments from international clients

Hi, are you looking for an easy way to accept payments from international clients? PayPal is here to help. PayPal services are now available in India, providing a convenient solution for receiving funds from abroad.

PayPal is a leading online payment service that allows you to receive money from anywhere in the world. With its presence in India, you can easily create a PayPal account and connect it to your bank account. That way, your international clients can quickly and securely send you payments.

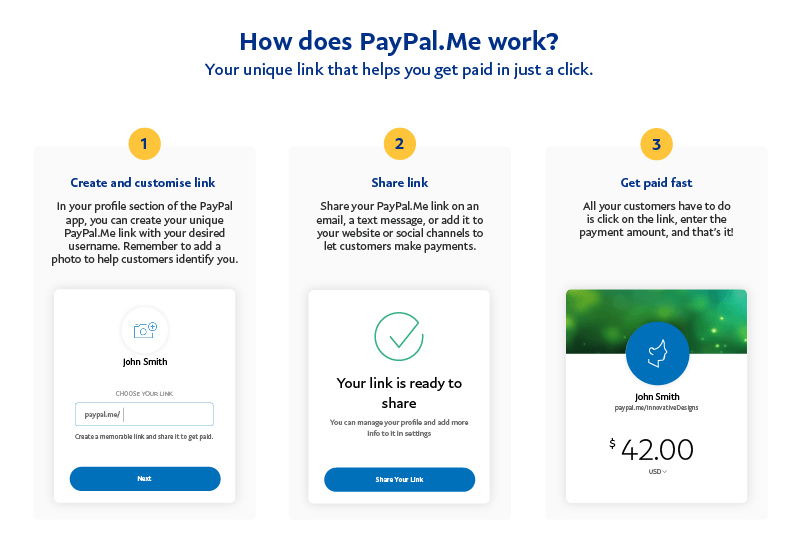

The process is very easy. First, create a PayPal account using your email address and password. Then, add your banking information to link your accounts. Once your account is verified, you are ready to receive payments.

To receive payments from clients, simply provide them with your PayPal email address. They can use their own PayPal account or credit card to send you money. PayPal will convert currencies automatically, so you don’t have to worry about exchange rates.

Once you receive your payment, you can withdraw it to your bank account whenever you want. PayPal also provides protection against unauthorized payments, so you can be sure that your funds are safe.

Apart from accepting payments from international clients, you can also use PayPal to send money abroad. This is especially useful if you do business with international suppliers or partners.

PayPal’s presence in India paves the way for Indian businesses to grow on the global stage. With the ease of accepting payments from international clients, you can expand your reach and increase your revenue.

So, if you want to accept payments from abroad easily, safely and conveniently, PayPal is the perfect solution for you. Create your account today and start accepting international payments easily.

Compliance with Indian regulations on PayPal payments

When you use PayPal in India, you can be assured that your service complies with applicable Indian regulations. PayPal has taken significant steps to ensure compliance, allowing you to transact with peace of mind.

One of the important regulations that PayPal implements is the Reserve Bank of India (RBI) Guidelines. RBI sets strict guidelines for online payment transactions in India. PayPal has clearly adhered to these guidelines, including the requirement to store user data locally on servers based in India.

In addition, PayPal has also complied with India’s Prevention of Money Laundering Act (PMLA). This law aims to prevent money laundering and financing terrorism. PayPal has implemented strict procedures and controls to identify and report suspicious activity, thereby maintaining the integrity of its payments platform.

These compliance measures strengthen PayPal’s commitment to providing secure and reliable payment services to users in India. By complying with regulations, PayPal ensures that your transactions are protected and you can make online payments with confidence.

Although PayPal complies with Indian regulations, it is important to remember that users also have a responsibility to comply with certain requirements. For example, RBI requires users to link their Aadhaar number with their PayPal account for certain transactions.

Compliance with Indian regulations is critical for the smooth and secure functioning of the online payments ecosystem in the country. PayPal understands this and has worked hard to ensure full compliance. By using PayPal, you can be sure that your transactions are legal, safe, and protected by Indian regulations.

Can we receive payments on PayPal in India?

Using PayPal in India: Can You Accept Payments?

PayPal is one of the most popular online payment methods in the world. With more than 400 million active users, PayPal has become the top choice for individuals and businesses for conducting online transactions. However, questions often arise about PayPal’s ability to accept payments in India. In this article, we will discuss PayPal’s capabilities in India and whether it is possible to accept payments in the country.

History of PayPal in India

PayPal entered the Indian market in 2011 by introducing online payment services for Indian users. However, at that time, PayPal only allowed Indian users to make payments to PayPal users in other countries, but did not allow them to receive payments from users in other countries.

In 2013, PayPal launched an inbound payments service for Indian users, allowing Indian users to accept payments from PayPal users in other countries. However, there are some limitations to this service, such as limits on the number of payments that can be accepted and limits on the types of transactions that can be made.

PayPal capabilities in India

Currently, PayPal allows Indian users to accept payments from PayPal users in other countries, but there are some requirements and limitations that must be met. Here are some of PayPal’s capabilities in India:

- Receive payment : PayPal allows Indian users to accept payments from PayPal users in other countries.

- Sending payment : PayPal allows Indian users to make payments to PayPal users in other countries.

- Manage accounts : PayPal allows Indian users to manage their accounts, including adding credit, debit cards and bank accounts.

- Using mobile applications : PayPal has a mobile app that allows Indian users to manage their accounts and make transactions anywhere.

However, there are some limitations to PayPal’s capabilities in India, such as:

- Limitations on payment amounts : PayPal has a limit on the payment amount Indian users can accept, which is usually around ₹10,000 to ₹50,000 per transaction.

- Limitations on transaction types : PayPal has restrictions on the types of transactions that Indian users can make, such as payments for services and products that cannot be accessed online.

- Transaction fees : PayPal has relatively high transaction fees, which may impact Indian users who wish to make transactions using PayPal.

How to Accept Payments on PayPal India

If you want to receive payments on PayPal India, you must meet the following requirements:

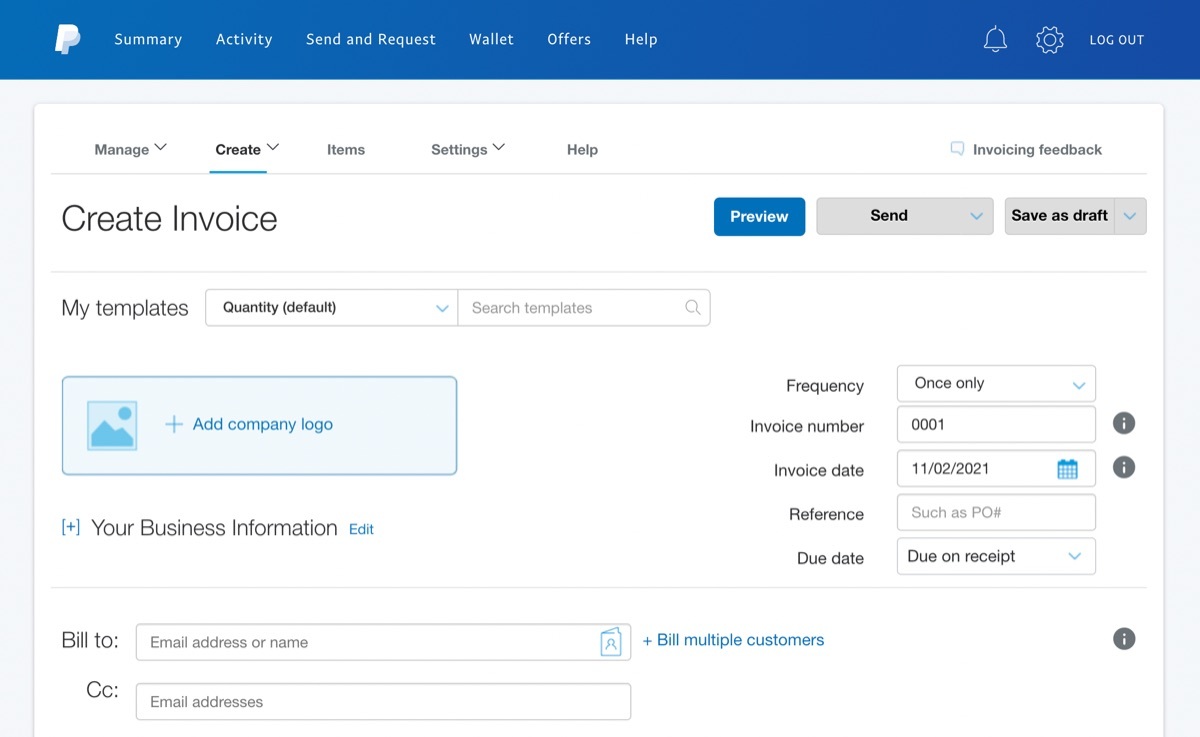

- Register a PayPal account : You must register for a PayPal account and choose the account type that suits your needs.

- Confirm account : You must confirm your account by entering the verification code sent by PayPal to your email address.

- Add a credit or debit card : You must add a credit or debit card to your PayPal account to be able to make transactions.

- Add a bank account : You must add a bank account to your PayPal account to be able to receive payments.

- Confirm bank account : You must confirm your bank account by entering the verification code sent by PayPal to your bank account.

Once you fulfill the above requirements, you can receive payments on PayPal India in the following ways:

- Send payment link : You can send a payment link to another PayPal user to make a payment to your account.

- Receive payment : You can accept payments from other PayPal users by making transactions in the PayPal app or through the PayPal website.

- Manage payments : You can manage your payments by checking your transaction history and account balance.

Advantages and Disadvantages of Accepting Payments on PayPal India

Here are some advantages and disadvantages of accepting payments on PayPal India:

Excess:

- Easy to use : PayPal has an easy-to-use interface and mobile app that allows you to manage your account anywhere.

- Safe : PayPal has a strict security system to protect your transactions.

- Global : PayPal allows you to accept payments from users all over the world.

Lack:

- Limitations on payment amounts : PayPal has limits on the number of payments Indian users can accept.

- Limitations on transaction types : PayPal has restrictions on the types of transactions that Indian users can make.

- Transaction fees : PayPal has relatively high transaction fees.

Conclusion

PayPal allows Indian users to accept payments from PayPal users in other countries, but there are some limitations and requirements that must be met. By understanding PayPal’s capabilities and limitations in India, you can use the service more effectively and safely. However, keep in mind that PayPal has several advantages and disadvantages that should be considered before using this service.