Multiple users and account sharing on PayPal

There are times when sharing a PayPal account with other people makes sense. Maybe you and your partner want to manage your finances together, or you run a business with colleagues and want to make the payment process easier. However, before you share your PayPal account with others, it’s important to know the pros and cons.

One of the main advantages of sharing a PayPal account is its convenience. You and other users can share funds, make transfers, and make payments without having to transfer money to each other. Additionally, sharing a PayPal account can make it easier to track joint expenses and share costs.

However, there are also some downsides to sharing a PayPal account. First, there are security risks. If one user shares their PayPal credentials with another person, that person can access the account without the other user’s knowledge. And if one user forgets to log out of their PayPal account on a public computer, someone else can access the account without their consent.

Additionally, sharing PayPal accounts can make it difficult to resolve disputes. If a financial dispute occurs between users who share an account, PayPal may have difficulty determining who is responsible for the transaction. This may cause delays in resolving disputes and may result in financial losses for users who are not responsible for the transaction.

If you decide to share your PayPal account with others, it is important to take steps to protect the account. Make sure you only share your PayPal credentials with people you trust, and make sure to always log out of your account when not using it. You can also use PayPal features like Two-Step Verification to add an extra layer of security to your account.

Overall, sharing a PayPal account can be an easy way to manage finances with other people. However, it is important to know the pros and cons before you share your account. By taking steps to protect your account, you can minimize the risks of sharing a PayPal account and take advantage of its convenience.

Risks and security concerns with shared PayPal accounts

Sharing a PayPal account may seem like an easy way to manage finances together, but it can pose significant security risks. When you share an account, you are essentially giving someone else access to your balance, financial information, and previous transactions.

One of the main risks of account sharing is fraud. If someone gains access to your account, they can make unauthorized purchases, transfer funds, or even steal your identity. Additionally, if your account is used for fraudulent activity, you may be liable for any losses incurred.

Another risk is data breaches. If PayPal’s database is hacked, your shared account will be vulnerable to theft and misuse. Even if your main account isn’t hacked, a shared account may be easier to access, opening the door to cybercriminals.

Sharing accounts can also lead to financial disputes. If you don’t completely trust the person you share your account with, they could overspend or even steal from you. This can lead to relationship breakdown and financial difficulties.

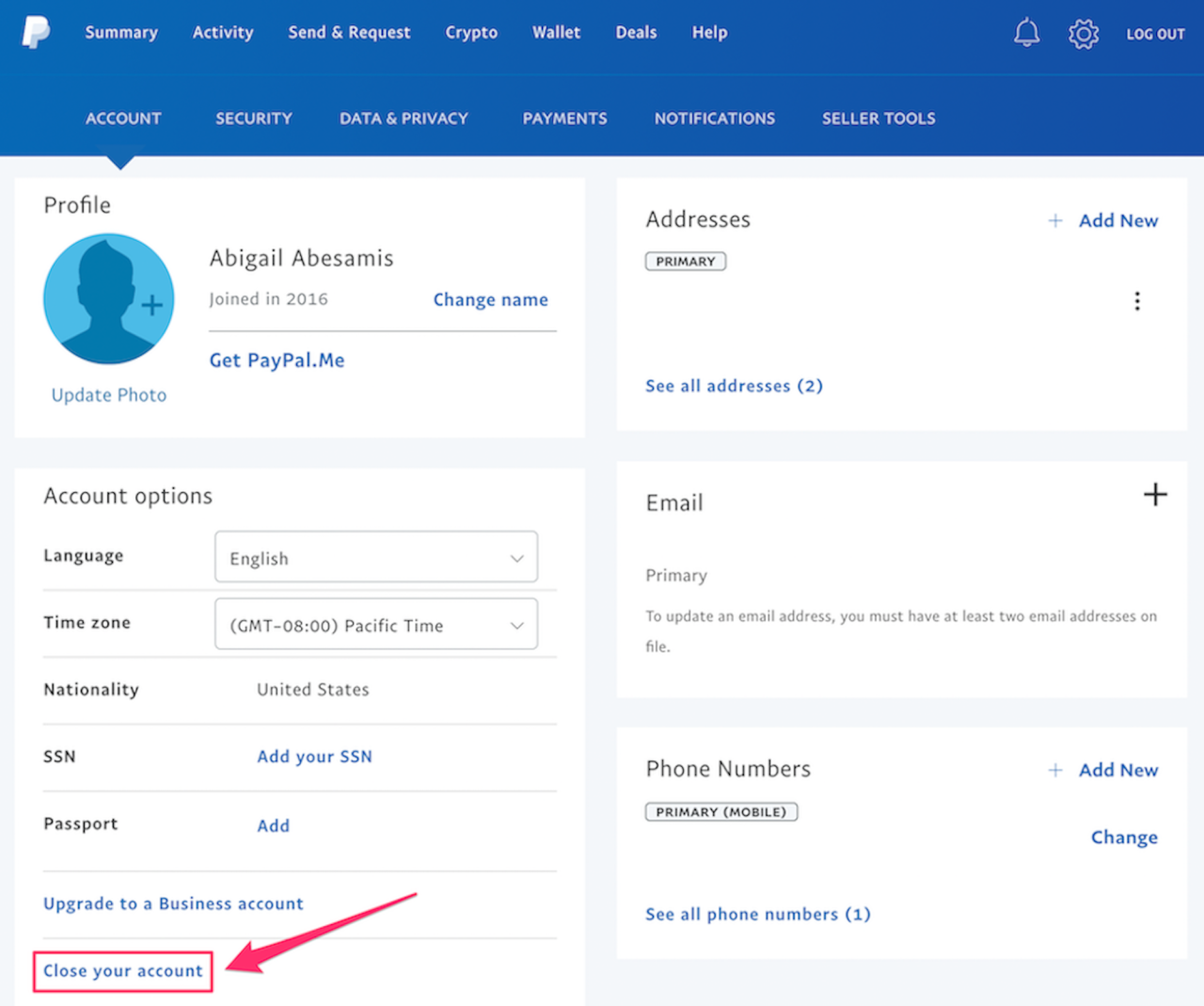

Lastly, sharing accounts may violate PayPal’s terms of service. PayPal does not allow users to share accounts, and doing so may result in your account being disabled or closed. If you need to manage finances together, there are safer ways to do it, such as creating a joint account or using a unified payments service.

To protect yourself from the risks of sharing a PayPal account, it is recommended to create your own private account. If you want to manage your finances together, consider creating a joint account with clear rules and boundaries. You should also use strong passwords and two-factor authentication to increase the security of your account.

By taking these steps, you can secure your finances and avoid the potential risks associated with sharing a PayPal account.

How to safely manage a PayPal account for multiple users

Sharing a PayPal account among multiple users can be a convenient way to manage finances together, but it’s important to do it securely. Setting up a PayPal business account can provide an added level of security and convenience.

A business account allows you to add multiple users with different roles, such as admin, finance, or standard. This role determines the access and permissions a user has to an account. As the primary account holder, you can customize user roles to meet your specific needs.

Additionally, you can utilize the “PayPal Business” feature to set more granular permissions. This gives you more control over each user’s activities, such as setting transaction limits or restricting access to sensitive information.

Using the “ PayPal Checkouts ” feature is another option that offers additional security. This allows you to create multiple “payment buttons” with different permissions. You can create custom buttons for certain users, so that they can only access certain functions.

Clear communication between users is also very important. Make sure all users understand their roles and responsibilities, as well as account limitations. This will help prevent errors or misuse.

As the primary account holder, you have the responsibility to monitor account activity on a regular basis. Pay attention to any unusual or unauthorized transactions. Act quickly and take appropriate action if you suspect suspicious activity.

Lastly, don’t forget to carry out regular security audits. Review user accounts, update permissions if necessary, and enable additional security measures such as two-factor verification or transaction notifications.

By following these security measures, you can be sure that your PayPal account is managed safely even if it has many users. This will provide peace of mind and help prevent potential fraud or abuse.

Can two people living in different parts of the country share and both login to one PayPal account?

Can Two People in Different Locations Share and Login to One PayPal Account?

In today’s digital era, technology has made everything easier and faster. One clear example is the use of online payment systems such as PayPal. However, a question that often arises is whether two people living in different locations can share and log into one PayPal account? This article will explain the capabilities and limitations of a PayPal account, as well as provide advice on how to use PayPal accounts together.

What is PayPal?

PayPal is an online payment service that allows users to make online transactions more easily and safely. Using a PayPal account, users can make payments, receive payments, and transfer money to bank accounts or credit cards. PayPal has become one of the world’s most popular online payment services, with more than 300 million active users.

Can Two People Share a PayPal Account?

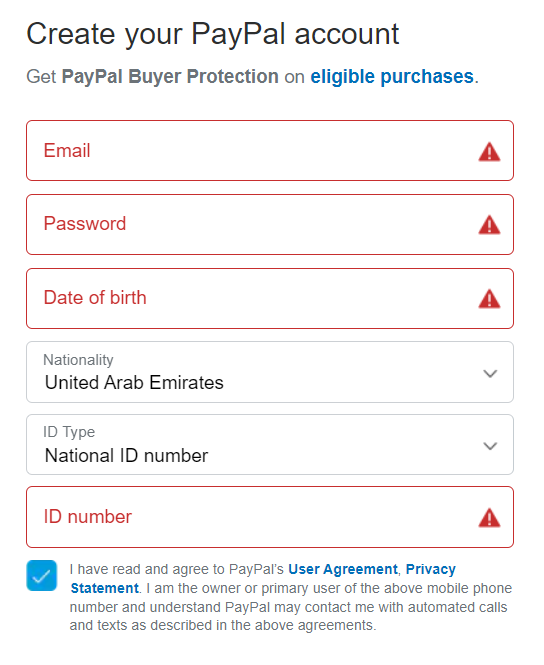

Officially, PayPal does not allow two people to share an account. When you create a PayPal account, you must provide personal information and a unique email address. If two people share an account, then they must use the same personal information and email address, which can cause problems in terms of security and privacy.

However, if you still want to share your PayPal account with someone, then there are several ways you can do it. First, you can add additional users to your account. PayPal allows you to add up to 8 additional users to your account, with customizable access rights. Additional users can make transactions, monitor balances, and receive notifications about account activity.

Second, you can use the “family account” feature offered by PayPal. This feature allows you to add family members or business associates to your account, with customizable access rights. However, keep in mind that this feature is only available to users who have a PayPal Premier or Business account.

How to Share a PayPal Account with Others?

If you want to share your PayPal account with someone, then here are some steps you can take:

- Create a PayPal account : Make sure you have an active PayPal account.

- Add additional users : Log in to your PayPal account and add additional users.

- Adjust access rights : Adjust access rights for additional users, so that they can only perform permitted transactions.

- Share login information : Share your PayPal account login information with additional users.

- Monitor account activity : Monitor your PayPal account activity regularly to ensure that there are no unwanted transactions.

PayPal Account Sharing Limitations

While sharing a PayPal account is possible, there are some limitations to keep in mind. Here are some limitations to keep in mind:

- Security : Sharing a PayPal account can increase security risks, as more people have access to your account.

- Privacy : Sharing a PayPal account can reduce your privacy, because more people can see your transactions and account information.

- Responsibility : If additional users make unwanted transactions, then you can be held responsible for those transactions.

Conclusion

While sharing a PayPal account is possible, there are some limitations to keep in mind. Sharing a PayPal account may increase security risks and reduce your privacy. Therefore, before sharing a PayPal account with someone, make sure you have considered all the limitations and risks involved.

If you still want to share your PayPal account with someone, then make sure you have added additional users to your account and adjusted their access rights. Monitor your account activity regularly to ensure that there are no unwanted transactions.

In conclusion, sharing a PayPal account can be a good choice if you want to make transactions with someone in a different location. However, make sure you have considered all associated limitations and risks, and have added additional users to your account and adjusted their access rights.