How non-PayPal users can send money

Although PayPal is a popular money transfer platform, it is not the only way to send money. If you’re not a PayPal user or prefer an alternative, don’t worry. There are a number of other methods available to you.

Let’s discuss some of the most common options:

Bank-to-Bank Transfer

This is a direct way to send money from one bank account to another. You can use online banking services or visit a bank branch in person. There are usually fees associated with these transfers, but the fees are generally low.

Money Transfer Application

There are several mobile apps that allow you to send money quickly and easily. Some popular applications include Venmo, Zelle, and Cash App. These apps usually charge a small fee, but they’re often cheaper than bank-to-bank transfers.

Postal Money Order

Postal money orders are an old, but still effective method for sending money. You can buy a postal money order at a post office or other money order agent. The recipient can cash the postal money order at a post office or financial institution. However, postal money orders usually have lower value limits and higher fees.

Wire Transfer

Wire transfers are a fast and secure method for sending large amounts of money. However, this method also usually has the highest costs. You can make a wire transfer through your bank or through a money transfer service.

Additionally, you can also consider the following options:

Gift Card

You can purchase gift cards from businesses frequented by the recipient. It’s a simple and convenient way to give money without having to worry about transfer fees.

Cash Prizes

If you are near the recipient, you can give a cash gift in person. This is an easy and safe way to transfer money, but you should be careful when carrying large amounts of cash.

Alternative Payment Services

Some businesses offer alternative payment services, such as Apple Pay or Google Pay. It allows you to send money safely and conveniently from your mobile device.

When choosing the best method for you, consider factors such as cost, convenience, speed, and security. With so many options available, you’re sure to find a way that suits your needs.

Methods to receive PayPal payments without an account

If you accept PayPal payments but don’t have an account, don’t panic! There are still ways to access your money without having to create a new account. In this article, we will discuss several methods for accepting PayPal payments without an account that can save you money and time.

Option 1: Xoom

Xoom is a money transfer service owned by PayPal. It allows users to send and receive money internationally without needing a PayPal account. To receive payments via Xoom, simply share your email address with the sender. They can send money to your email, and you can withdraw it to your bank account.

Option 2: PayPal Guest Checkout

PayPal Guest Checkout allows someone who doesn’t have a PayPal account to pay through PayPal using their debit or credit card. When the sender pays via PayPal, they will see the option to “Pay as a Guest.” They can enter their card information and complete the transaction. You will receive payment at the email address you provided.

Option 3: Transfer to Bank Account

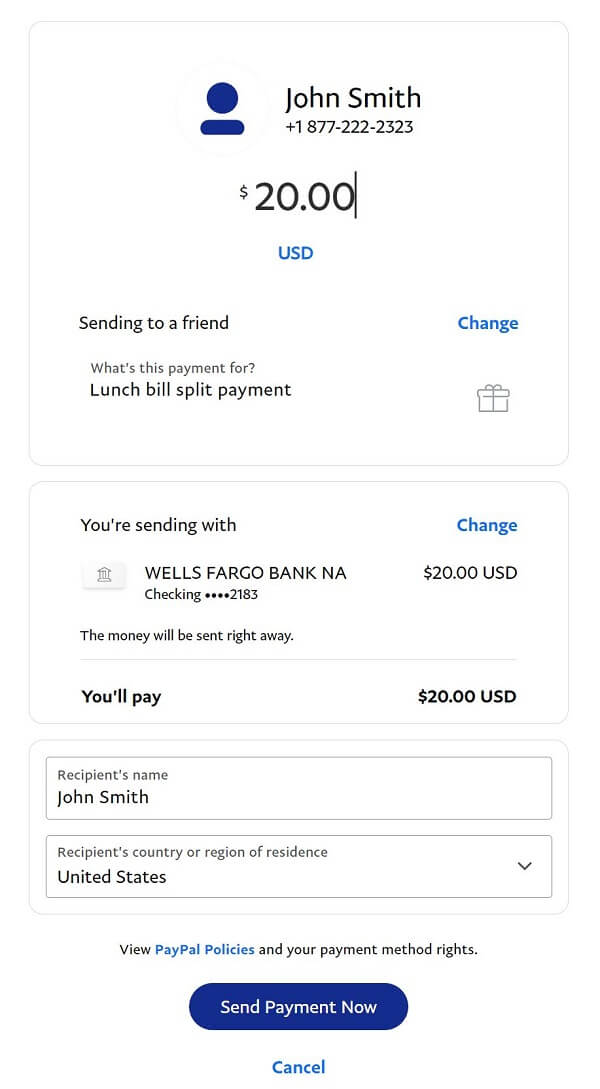

If the sender has a PayPal balance, they can choose to transfer the money directly to your bank account. To do this, they need to know your bank account number and SWIFT code. This transaction usually takes several business days to complete.

Option 4: Personal PayPal Card

If you want to receive recurring payments or want to access your funds faster, you can order a Personal PayPal Card. These cards function like prepaid debit cards and allow you to withdraw money from ATMs or use them for purchases. However, to get this card, you need to provide PayPal with some personal information, such as your Social Security number.

In all these methods, make sure to provide correct details to the sender. If there is an error in your email address or bank account number, you may not be able to receive payment. Additionally, if the amount you receive exceeds a certain limit, PayPal may ask you to verify your identity before you can access the funds.

PayPal’s guest checkout feature for non-members

Many people rely on PayPal to make online transactions safely and easily. However, what if you’re not a PayPal user and want to send money to someone? Don’t worry, because PayPal has a feature called “guest checkout” that allows non-members to make payments without having to create an account.

The way guest checkout works is quite easy. First, select PayPal as your payment method at checkout. You will be directed to the PayPal page where you can enter your credit or debit card information. Type in the amount you want to send, and PayPal will process the payment. So simple!

Guest checkout is very useful in some situations. For example, if you only make a single purchase and don’t plan to use PayPal again, then creating an account is not necessary. This can also be useful if you don’t want to provide your financial information to PayPal. Additionally, guest checkout allows you to avoid additional fees that may apply if you don’t have a PayPal account.

While guest checkout is a great option for occasional transactions, it’s important to note that you’ll miss out on some features available to registered users. For example, you won’t be able to track the status of your payment or submit a dispute. Plus, guest checkout may take longer to process payments compared to a PayPal account.

Overall, PayPal guest checkout is a convenient and safe solution for non-members to send money. This is a quick and easy way to make online payments without having to go through the hassle of creating an account. However, if you plan to make PayPal transactions regularly, then signing up for an account may be a better choice.

So, next time you’re not a PayPal user and want to send money, keep the guest checkout feature in mind. This is a great way to complete payments safely and easily, without needing to create an account.

Can someone without PayPal send money to someone with PayPal?

Sending Money without PayPal to a PayPal Account: How Possible?

In the digital era, international financial transactions have become easier and faster. One of the most popular platforms for conducting online transactions is PayPal. However, some people may not have a PayPal account, but want to send money to someone else who has a PayPal account. The question is, is it possible to send money without PayPal to a PayPal account? The answer is yes, but there are some limitations and alternatives to consider.

Why PayPal?

PayPal is one of the world’s largest online payment platforms, with more than 400 million active users. Security, convenience, and ease of use make PayPal a popular choice for conducting online transactions. With PayPal, you can send and receive money from anyone, at any time, and from anywhere in the world.

Send Money without PayPal to PayPal Account

If you don’t have a PayPal account, but want to send money to someone else who does, there are several ways you can do it:

- Using a credit or debit card : You can use a credit or debit card to send money to other people who have a PayPal account. However, keep in mind that transaction fees will be charged to you.

- Using another payment service : Some payment services such as Google Pay, Apple Pay, or Facebook Pay allow you to send money to other people who have a PayPal account.

- Use a money transfer service : Money transfer services like Western Union or MoneyGram allow you to send money to other people who have PayPal accounts.

- Using a currency exchange platform : Some currency exchange platforms such as TransferWise or XE Money Transfer allow you to send money to other people who have a PayPal account.

Limitations and Fees

While there are several ways to send money without PayPal to a PayPal account, keep in mind that there are some limitations and fees involved. Here are some things to consider:

- Transaction fees : Transaction fees will be charged to you, whether they are credit or debit card fees, money transfer service fees, or currency exchange platform fees.

- Transaction limits : Some payment platforms or money transfer services have transaction limits that must be considered.

- Processing time : Transaction processing times may vary depending on the platform or service used.

- Security : Transaction security also needs to be considered, especially if you use a credit or debit card.

PayPal Alternative

If you don’t want to use PayPal, there are several alternatives you can consider:

- Google Pay : Google Pay is a payment platform that allows you to send and receive money easily and securely.

- Apple Pay : Apple Pay is a payment platform that allows you to send and receive money easily and securely.

- Facebook Pay : Facebook Pay is a payment platform that allows you to send and receive money easily and securely.

- TransferWise : TransferWise is a currency exchange platform that allows you to send money with lower fees and faster processing times.

Conclusion

Sending money without PayPal to a PayPal account is possible, but there are some limitations and fees involved. Keep in mind that transaction security also needs to be considered, especially if you use a credit or debit card. If you don’t want to use PayPal, there are several alternatives you can consider, such as Google Pay, Apple Pay, Facebook Pay, or TransferWise.