Overview of PayPal’s IPO in 2014

In the financial world of 2014, all eyes were on a highly anticipated event: PayPal’s initial public offering (IPO). After years of being a subsidiary of eBay, PayPal is finally ready to separate itself and become an independent entity.

PayPal’s IPO broke records as the largest offering of the year, generating more than $6.8 billion in revenue. Investors are flocking to get a piece of this fast-growing digital payments company, which has become an integral part of e-commerce and online transactions.

PayPal’s IPO success was largely due to the strength of its brand and impressive customer base. With more than 148 million active accounts, PayPal has built a broad network of payers and recipients, making it a convenient and trusted choice for online payments.

Additionally, PayPal is benefiting from the broader trend toward digital payments. The shift from cash and checks to electronic payment methods has created a favorable environment for PayPal. The company has also been able to innovate with new products and services, such as PayPal One Touch and PayPal Credit, which have further increased its appeal to consumers.

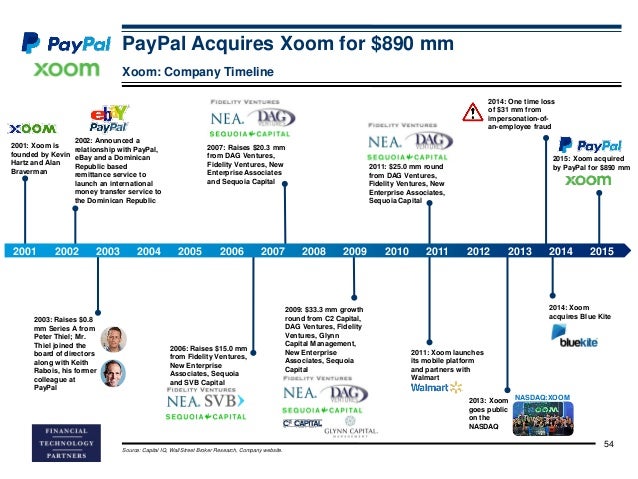

After the IPO, PayPal continued to experience significant growth. The company has expanded its reach geographically, acquired several companies, and introduced new features and products. This diversification has helped PayPal reduce its dependence on eBay and strengthen its position in the digital payments market.

Today, PayPal is a major player in the fintech industry, serving businesses and individuals around the world. The 2014 IPO marked a watershed moment in the company’s journey, paving the way for continued success and growth in the years to come.

Post-spin-off financial performance

After separating from eBay in 2015, PayPal experienced rapid financial growth. The company’s revenue jumped from $9.2 billion in 2014 to $15.45 billion in 2015, marking a significant increase of 68%. This exponential growth is driven by the worldwide adoption of PayPal’s digital payment services.

In addition to the increase in revenue, PayPal also reported an impressive net profit. In 2015, the company posted net income of $2.42 billion, a 150% increase from the $966 million earned in 2014. This increase in profitability was due to a combination of revenue growth and better cost efficiency. PayPal managed to reduce its operational costs significantly, leading to increased profit margins.

PayPal’s earnings per share (EPS) also saw a remarkable increase of 145% from $1.31 to $3.21. This increase in EPS reflects the company’s overall strong financial performance and is a key indicator of the value created for shareholders.

Despite PayPal’s impressive financial performance, its share price experienced volatile movements after the spin-off. The company’s share price fell immediately after the IPO, but then recovered and continued to rise. By the end of 2015, PayPal’s stock price had increased by more than 50% from its initial public offering price.

Overall, PayPal’s financial performance after the spin-off was very positive. The company experienced significant revenue and profit growth, supported by widespread adoption of its services. Increased profitability, EPS and share price demonstrate the value created for shareholders and position PayPal for continued growth and success in the future.

Challenges and opportunities as a separate company

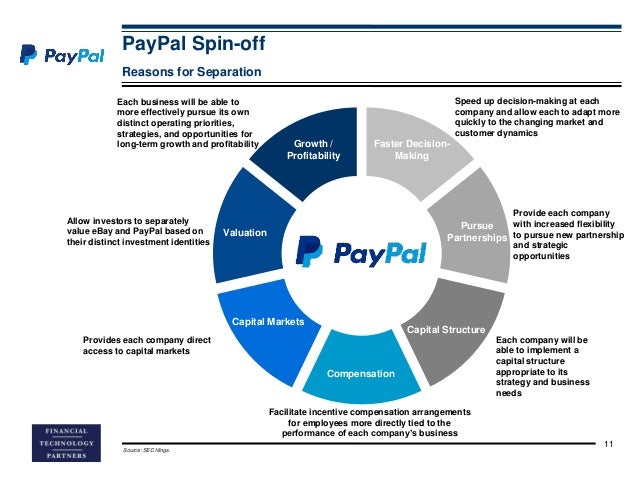

When PayPal spun off from its parent, eBay, in 2014, the company entered a new chapter with a series of challenges and opportunities. As a separate company, PayPal has full control over its operations, allowing the company to direct its focus toward growth and innovation.

One of the main opportunities facing PayPal is its ability to expand its reach into new markets. By no longer being tied to eBay’s business limitations, PayPal can pursue partnerships with other merchants and businesses. This allows the company to increase its user base and increase its transaction volume.

However, as a stand-alone company, PayPal also faces a number of challenges. One of its main concerns is its ability to maintain growth amid intense competition in the payments industry. Companies like Visa, Mastercard, and Apple Pay have all become strong competitors, and PayPal must continue to innovate to maintain its market share.

Additionally, PayPal must overcome increasingly stringent regulatory issues in the fintech industry. Governments around the world are working to implement regulations to ensure the security and stability of digital payment systems. PayPal must comply with these regulations, which can increase costs and operational burdens.

Despite these challenges, PayPal also sees many opportunities for the future. One of its main focuses is on mobile payments. With more people using smartphones to make purchases, PayPal is investing in a mobile payments platform that is easy to use and secure.

PayPal is also exploring new areas such as lending and financing. The company has launched several loan products designed to help small businesses gain access to capital. By expanding its offerings beyond core payments, PayPal aims to become a more comprehensive financial services provider.

Overall, PayPal’s separation from eBay presents a series of challenges and opportunities for the company. By controlling its own operations, PayPal has the opportunity to expand its reach and innovate. However, companies also face stiff competition and increasingly stringent regulations. As PayPal continues to navigate this changing landscape, the company has the potential to continue to be a leader in the digital payments industry.

Can PayPal succeed as a spun-off public company in 2014?

Can PayPal Succeed as a Spun-Off Public Company in 2014?

In 2014, PayPal was separated from eBay and became an independent public company. This raises questions about PayPal’s ability to succeed as an independent company. In this article, we will discuss PayPal’s ability to compete in the digital payments industry and how the company can leverage its position as an independent company to increase growth and profitability.

Background

PayPal was founded in 1998 by Peter Thiel and Max Levchin, and was originally called Confinity. The company later merged with X.com, another company founded by Elon Musk, and became PayPal in 2001. In 2002, PayPal was acquired by eBay for approximately $1.5 billion. For more than a decade, PayPal was part of eBay and helped increase the e-commerce company’s sales.

However, in 2014, PayPal was separated from eBay and became an independent public company. This raises questions about PayPal’s ability to succeed as an independent company. Can PayPal compete with other companies in the digital payments industry? Can the company leverage its position as an independent company to increase growth and profitability?

PayPal capabilities

PayPal has several advantages that can help it succeed as an independent company. First, the company has a large and loyal user base. With more than 150 million users worldwide, PayPal has access to a vast market and can leverage these users to increase revenue.

Second, PayPal has sophisticated technology and a strong security system. The company has invested a lot of resources in developing technology and security systems that can protect users from fraud and data loss.

Third, PayPal has an extensive network with banks and other financial institutions. The company has collaborated with many banks and financial institutions to provide broader and more flexible payment services.

PayPal Challenge

However, PayPal also has some challenges to overcome. First, the company has to face stiff competition from other companies in the digital payments industry. Companies like Apple Pay, Google Wallet, and Amazon Pay have become strong competitors in the digital payments market.

Second, PayPal must increase its innovation capabilities and adapt to technological changes. Companies must continue to develop new technologies and services to meet user needs and improve user experience.

Third, PayPal must face strict regulations from governments and financial institutions. Companies must meet stringent regulatory standards and overcome challenges arising from regulatory changes.

PayPal Strategy

To overcome challenges and take advantage of opportunities, PayPal has developed several strategies. First, the company has increased investment in technology development and innovation. PayPal has acquired several small companies to increase its innovation and technology capabilities.

Second, PayPal has expanded its network and collaboration with banks and other financial institutions. The company has collaborated with several banks and financial institutions to provide broader and more flexible payment services.

Third, PayPal has increased its focus on user experience and customer service. The company has developed a strong security system and provided better customer service to increase user satisfaction.

Conclusion

Can PayPal succeed as an independent company in 2014? The answer is yes. With a large and loyal user base, advanced technology, and extensive networks with banks and other financial institutions, PayPal has advantages that can help it succeed.

However, companies also have to face challenges arising from intense competition, technological changes, and strict regulations. To overcome these challenges, PayPal has developed effective strategies, such as increasing investment in technology development, expanding networks and cooperation, and increasing focus on user experience and customer service.

Thus, PayPal can leverage its position as an independent company to increase growth and profitability. This company can become one of the leading companies in the digital payments industry and increase user satisfaction.