Understanding PayPal payment reversals

When you make purchases online, PayPal is a safe and convenient way to complete your transactions. However, sometimes buyers may need to cancel payment. Here’s everything you need to know about PayPal payment cancellation and how it works.

PayPal payment cancellation occurs when a buyer requests a refund for a completed transaction. These cancellations may occur for various reasons, such as items not received, items not matching the description, or unauthorized purchases.

The PayPal payment cancellation process begins with the buyer submitting a dispute through the PayPal Resolution Center. The buyer must provide the reason for the cancellation and supporting evidence, such as a tracking number or proof of damage to the item.

Once a dispute is filed, PayPal will review the case and make a decision. If PayPal decides to cancel the payment, the funds will be returned to the buyer’s PayPal account. This process usually takes between 10 to 30 business days to complete.

As a seller, you can appeal a PayPal payment cancellation if you believe the buyer does not have a valid reason. The appeal process involves providing supporting evidence, such as tracking information showing that the item was shipped or photos showing that the item is in good condition.

It is important to note that not all PayPal payment cancellations are successful. If the buyer does not provide a valid reason or sufficient supporting evidence, PayPal may reject the cancellation. In this case, the buyer will not receive a refund.

To avoid payment cancellations, merchants must ensure that the goods they sell are of high quality and their descriptions are accurate. Merchants must also provide tracking information or proof of delivery to buyers. By taking these steps, merchants can minimize the risk of payment cancellations and ensure that their customers have a positive shopping experience.

Overall, canceling PayPal payments can be a complex process. However, by understanding how it works and taking steps to prevent it, merchants and buyers can ensure that their transactions are safe and secure.

When PayPal can reverse payments

Now, let’s discuss situations where PayPal can cancel a payment. This is important information to know, as it can help you understand your rights and obligations as a seller and buyer.

First of all, PayPal can reverse payments if the transaction is unauthorized. This means that if someone uses a stolen credit card or bank account to make a purchase, PayPal can cancel the payment and return the funds to the legitimate account owner.

Additionally, PayPal can reverse payments if the goods or services purchased do not match the description provided by the seller. For example, if you order a laptop and receive a brick, PayPal will cancel the payment and refund your money.

Payment may also be canceled if the seller does not deliver the purchased goods or services within a reasonable time. The time period considered reasonable varies depending on the specific product and service involved.

Additionally, PayPal can reverse payments in the event of a dispute. This means that if you have a problem with the seller, you can submit a dispute via PayPal. If PayPal finds that a seller is violating its terms of service, it will cancel the payment and refund your money.

Of course, there are some exceptions to this rule. For example, PayPal usually will not reverse a payment if an incorrect write-up was made by the buyer. Additionally, PayPal may not reverse payments if transactions occur between friends and family.

Understanding when PayPal can cancel a payment is critical to protecting yourself as a seller and buyer. By knowing these rules and regulations, you can reduce the risk of financial loss and ensure that your transactions are safe and secure.

How to protect yourself from payment reversals

When you receive payment via PayPal, it’s like pocketing cash. However, there are times when a transaction may be canceled or rejected, known as a payment reversal. This can be frustrating and detrimental to your business.

Payment cancellation can occur for various reasons. Buyers may claim items purchased do not match the description, were never received, or do not function as intended. Most reversals occur within 30 days of payment being made, but some can be requested up to 180 days later.

To protect yourself from payment reversals, there are several steps you can take:

– Provide clear and accurate product or service descriptions. Buyers are more likely to oppose payment if they feel cheated.

– Communicate regularly with customers. If problems occur, resolving them quickly and easily can help prevent reversals.

– Use a reliable delivery service. Buyers tend to request a reversal if the goods they purchased never arrived or were late.

– Keep records of all transactions. This will help you dispute any claims of unauthorized reversal.

If you experience a payment reversal, don’t panic. You can appeal with PayPal within 10 days after the reversal occurs. Make sure you provide documentation that supports your claim, such as proof of delivery or communication with the customer.

PayPal will generally decide disputes within 30 days. If you win, the payment will be returned to your account. If you lose, you may have to accept the reversal.

Processing payments through PayPal is convenient, but it is important to be aware of the risk of payment reversals. By taking the proper steps to protect yourself, you can minimize the impact of reversals and keep your business running smoothly.

Can PayPal payments be reversed?

Can PayPal Payments Be Reversed?

PayPal is one of the most popular online payment platforms in the world. With more than 400 million active users, the platform allows people to make and receive payments easily and securely. However, at times you may have experienced difficulties with transactions you have made via PayPal, and wondered whether PayPal payments can be reversed.

In this article, we’ll cover PayPal’s ability to reverse payments, as well as what you need to know before making a payment through the platform.

What is PayPal Payment Reversal?

PayPal payment reversal is a process that allows PayPal to reverse transactions that have been made. This means that the payment you have made will be refunded to your account, and the seller will not accept the payment.

Conditions for PayPal Payment Reversal

PayPal can only reverse payments under certain conditions. Here are some conditions that allow PayPal to reverse a payment:

- Payment not accepted : If you make a payment for an item or service that is not received, you can ask PayPal to reverse the payment.

- Payment is not appropriate : If you make a payment for a good or service that is not what you want, you can ask PayPal to reverse the payment.

- Invalid payment : If you make a payment using invalid information, such as an expired credit card, PayPal may reverse the payment.

- Fraud : If you are a victim of fraud, PayPal can reverse your payment to protect you.

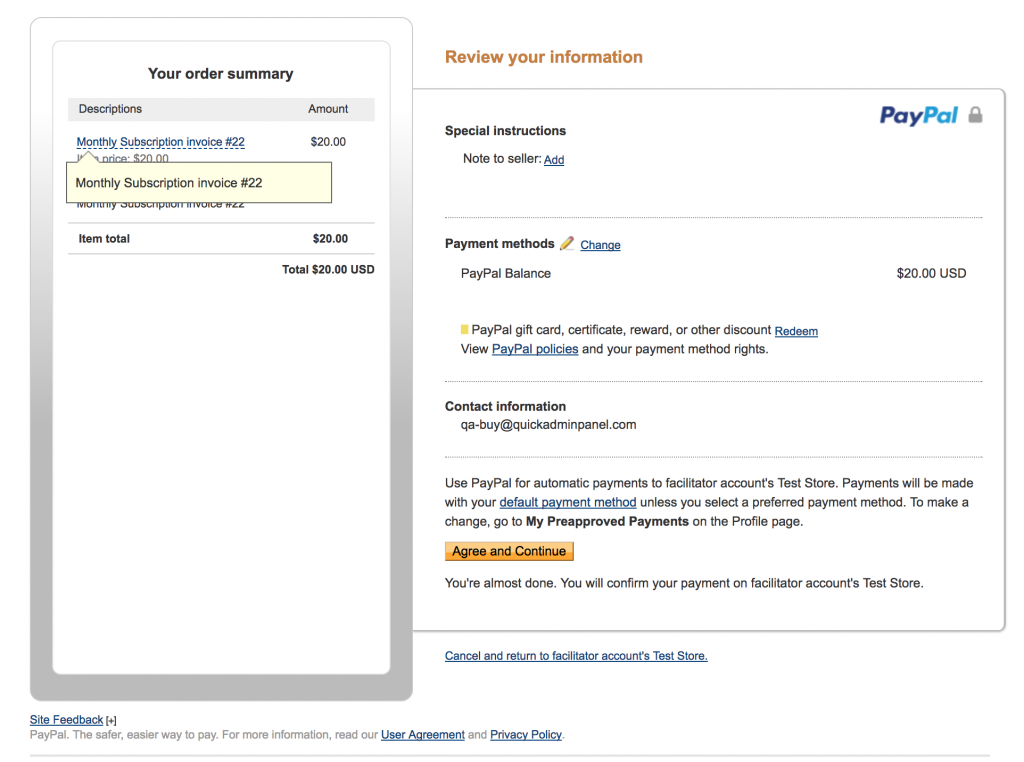

How to Request a PayPal Payment Reversal

If you wish to request a PayPal payment reversal, you can do so in the following way:

- Log in to your PayPal account : You must log in to your PayPal account to request a payment reversal.

- Select transaction : Select the transaction you want to reverse.

- Click “Report a Problem” : Click the “Report a Problem” button next to the transaction you want to reverse.

- Choose a reason : Select a reason to reverse the payment.

- Wait for a response : Wait for a response from PayPal to process your request.

Time Required for the Reversal Process

The time required for the PayPal payment reversal process may vary depending on the conditions and complexity of the transaction. However, usually the reversal process can be completed within a few working days.

PayPal Payment Reversal Fee

PayPal payment reversal fees may vary depending on the type of transaction and conditions. However, usually PayPal payment reversal fees are as follows:

- Reversal fees for domestic transactions: free

- Reversal fee for international transactions: around 2-3% of the transaction amount

Tips to Avoid Problems with Payment Reversals

Here are some tips to avoid problems with PayPal payment reversals:

- Make sure the information used is valid : Make sure the information used to make payment is valid and not expired.

- Check goods or services before making payment : Check goods or services before making payment to ensure that they are what you want.

- Don’t make payments for other people : Do not make payments for other people, as this may increase the risk of fraud.

- Save proof of transaction : Save proof of transactions, such as invoices or receipts, as proof that you have made a payment.

Conclusion

In conclusion, PayPal payment reversal is a process that allows PayPal to reverse transactions that have been made. However, this process can only be carried out under certain conditions and PayPal payment reversal fees may vary depending on the type of transaction and conditions. Therefore, make sure you understand the conditions and fees for PayPal payment reversal before making payments via this platform.

By understanding how PayPal payment reversal works, you can have a safer and more comfortable transaction experience. Don’t hesitate to contact PayPal if you have questions or problems with your transaction.