Reasons for PayPal freezing linked bank accounts

Friends, have you ever experienced your PayPal account suddenly being frozen? It feels like someone is locking up our personal savings, doesn’t it? Well, there are several reasons behind freezing a PayPal account, and we will discuss them one by one.

First, PayPal may detect suspicious activity in your account. For example, if there is a lot of login activity from different locations in a short period of time or if there are repeated unsuccessful login attempts. PayPal’s security system is very sensitive, so any unusual activity could trigger a freeze.

Second, PayPal wants to verify your identity. They may ask for identity documents such as a passport or driver’s license to ensure you are a registered person. If you cannot provide valid proof of identity, PayPal may freeze your account to protect against fraud.

Third, there may be a problem with the bank connected to your PayPal account. If your bank has reported your account for suspicious activity or for reports of unauthorized transactions, PayPal may freeze your account as a precaution.

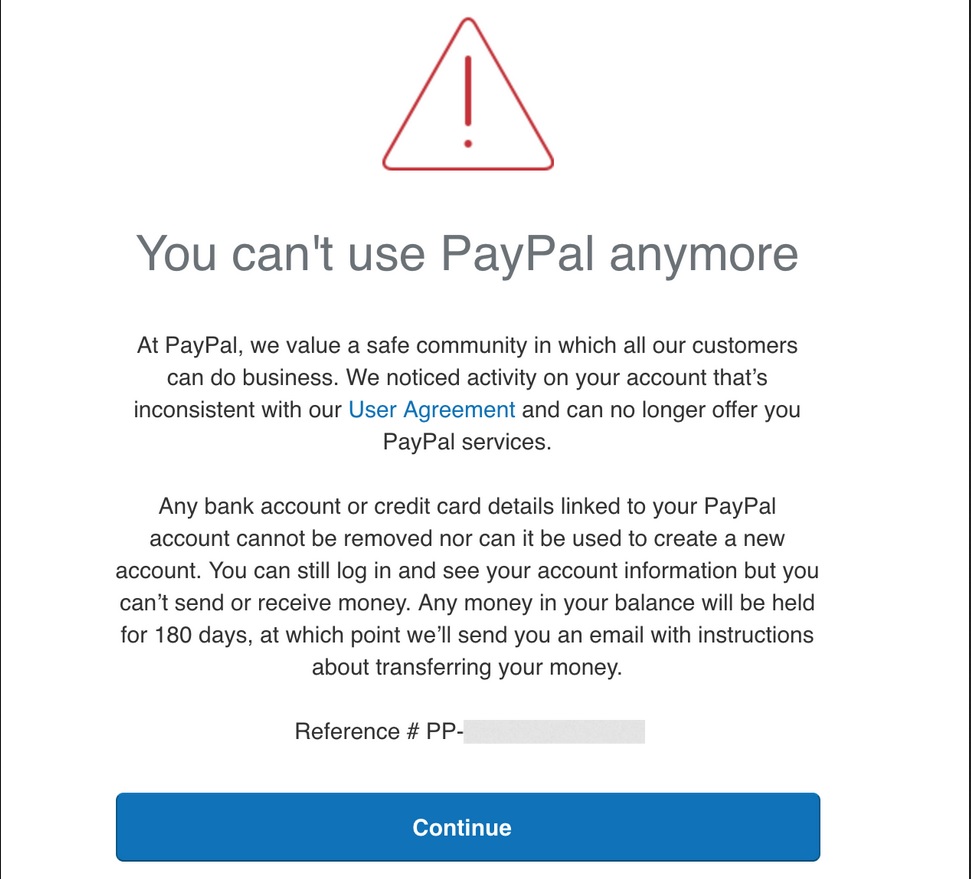

Fourth, you may be violating PayPal’s terms of service. For example, if you use your PayPal account for illegal activities such as gambling or selling prohibited items. PayPal has strict policies, and violating them can result in account suspension.

Fifth, you may have a negative balance in your PayPal account. This can happen if a transaction is returned or if you withdraw more funds than you have. PayPal may freeze your account until the negative balance is resolved.

Friends, if your PayPal account is frozen, don’t panic. Contact PayPal customer support and ask why. They will usually explain the problem and tell you what steps you need to take to restore access to your account. Remember to always be careful when using online payment services, and make sure to update your information regularly to minimize the risk of your account being frozen.

How to resolve a PayPal freeze on bank accounts

Friends, have you ever experienced the frustrating situation when the bank account linked to PayPal was suddenly frozen? Relax, you are not alone. There are several common reasons why PayPal takes this action.

First, PayPal may detect suspicious activity on your account. This may include unauthorized transactions, identity verification failures, or violations of PayPal’s terms of service. To resolve this issue, contact the PayPal customer support team and provide the necessary documentation to verify your identity.

Second, PayPal may hold your funds to resolve disputes. If a customer files a claim against a purchase made through PayPal, the funds will be held until the dispute is resolved. In this situation, you need to work together with the customer to resolve the problem. Otherwise, PayPal will review the evidence and make a decision on a case-by-case basis.

Third, your PayPal account may be frozen due to compliance issues. PayPal is subject to strict government regulations, and if they suspect illegal activity or money laundering, they reserve the right to freeze your account. To resolve this issue, provide relevant documentation to PayPal to verify the source of your funds.

Fourth, PayPal may freeze your account for security reasons. If they detect unusual activity or hacking attempts, they will freeze your account to protect you from potential fraud. In this case, reset your password, enable two-factor authentication, and notify PayPal immediately.

Lastly, your PayPal account can also be frozen due to exceeding transaction limits or policy violations. Make sure you comply with the PayPal transaction limits and terms of service set. If your account is frozen for this reason, please wait until the specified time limit before you can use your account again.

In conclusion, there are several reasons why PayPal may freeze a linked bank account. If this happens, stay calm and contact PayPal’s customer support team. By working with them and providing the necessary documentation, you can resolve the issue quickly and continue using your PayPal account.

Protecting your bank account from PayPal freezes

Reasons PayPal Freezes Linked Bank Accounts

If your bank account linked to PayPal is suddenly frozen, you may feel frustrated and confused. However, it’s important to understand why PayPal does this to protect your account and funds. Here are some common scenarios that can trigger an account freeze:

Suspicious Activity

PayPal closely monitors all transactions to detect suspicious activity. If the system detects unusual activity, such as unexplained spikes in transfer volume or payments to unknown accounts, PayPal may freeze your account as a precaution.

Transaction Conflicts

If there is a dispute involving transactions related to your linked bank account, PayPal may freeze the account to protect both parties. This usually occurs when the buyer claims that they did not receive the purchased item or if the seller alleges a fraudulent transaction.

User Complaints

If a customer complains about a transaction involving your linked bank account, PayPal may freeze the account while it investigates the matter. PayPal strives to resolve all complaints as quickly as possible and provide updates to the parties involved.

Violation of Terms of Service

PayPal has terms of service that all users must comply with. If you violate these terms, such as selling prohibited items or engaging in fraud, PayPal reserves the right to freeze your account.

Identity Verification

To ensure security and comply with regulations, PayPal may ask you to verify your identity from time to time. If you have not verified your identity or have provided inaccurate information, PayPal may freeze your account until verification is complete.

The next step

If your linked bank account is frozen, it’s important to contact PayPal immediately. Provide necessary documentation to verify your identity or resolve a dispute. PayPal will typically respond to inquiries and provide updates within a few business days.

By understanding why PayPal freezes linked bank accounts, you can take steps to protect your account and prevent future freezes. Always comply with terms of service, carefully track your transaction activity, and verify your identity when requested.

Can PayPal freeze my bank account?

What You Need to Know about Bank Account Freezing by PayPal

PayPal is one of the largest online payment platforms in the world, with millions of users in various countries. However, like other financial services, PayPal has policies and rules to protect its users and prevent fraud. One of the things you need to know is that PayPal can freeze your bank account under certain conditions.

In this article, we’ll talk about what can cause PayPal to freeze your bank account, how the bank account freeze process works, and what you can do to prevent or recover from a frozen bank account.

Why Does PayPal Freeze Bank Accounts?

PayPal may freeze your bank account for several reasons, including:

- Suspicious activity : If PayPal detects suspicious activity on your bank account, such as unusual transactions or large withdrawals, they may freeze your bank account to prevent fraud.

- Inaccurate information : If the information you provide to PayPal is inaccurate or incomplete, they may freeze your bank account until you update the correct information.

- Failure to meet KYC (Know Your Customer) requirements : PayPal has a KYC policy to ensure that its users are real people and do not serve malicious purposes. If you fail to meet KYC requirements, PayPal may freeze your bank account.

- Violation of PayPal policy : If you violate PayPal policies, such as using PayPal services for illegal or unethical activities, they may freeze your bank account.

- Involvement in fraud : If PayPal detects that you are involved in fraud or other illegal activities, they may freeze your bank account and report you to the appropriate authorities.

How does the process of freezing a bank account take place?

If PayPal decides to freeze your bank account, they will send an email to the email address registered to your PayPal account. This email will explain the reasons for freezing your bank account and the steps you need to take to restore your bank account.

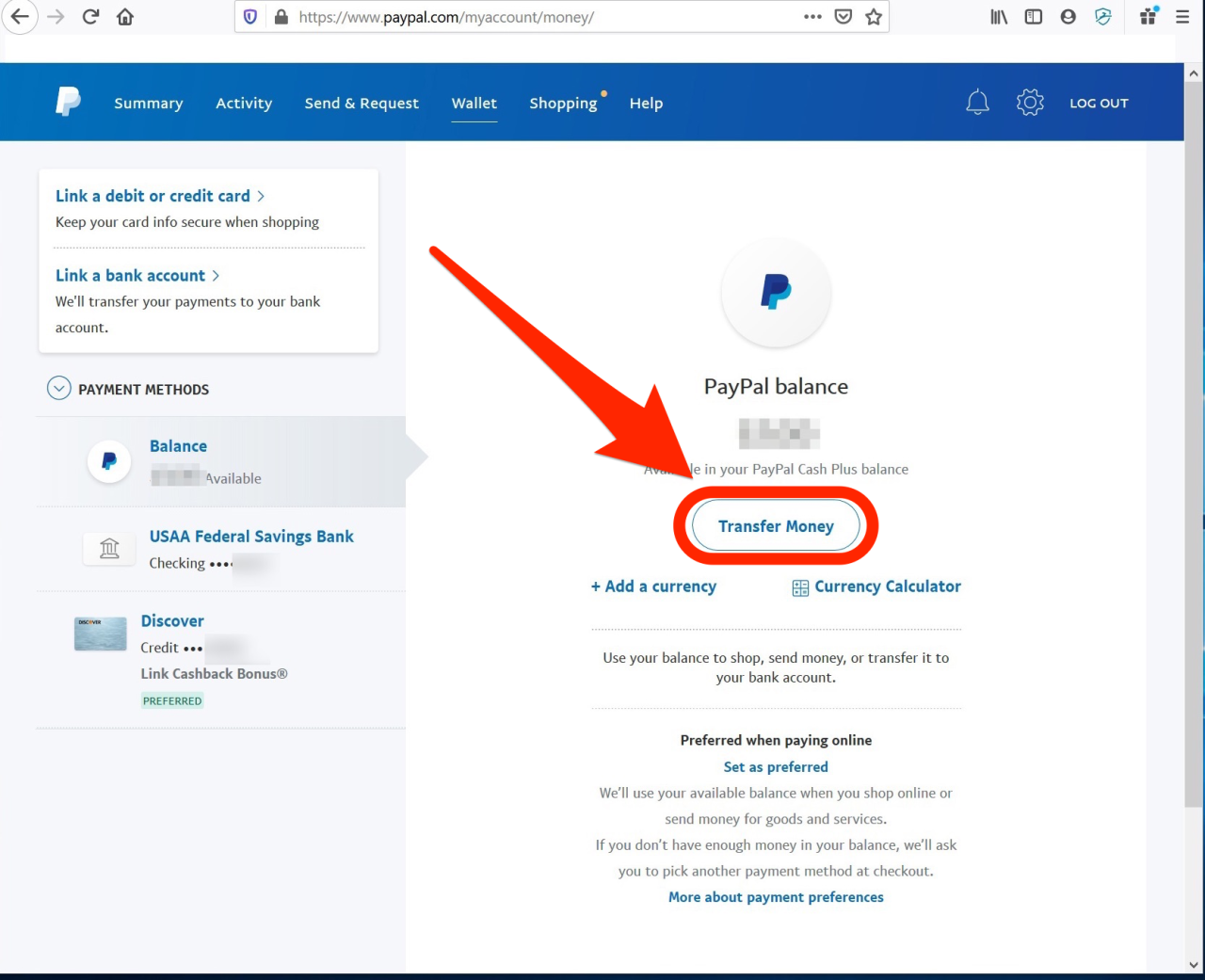

Once your bank account is frozen, you will not be able to make transactions or withdraw funds from your bank account. However, you can still access your PayPal account and view your transaction history.

What Can You Do to Prevent or Recover a Frozen Bank Account?

If your bank account has been frozen by PayPal, there are several things you can do to prevent or restore your bank account:

- Contact PayPal : Contact the PayPal support team to request clarification about the reasons for freezing your bank account and the steps you need to take to restore your bank account.

- Update information : Make sure the information you provide to PayPal is accurate and complete. Update the correct information to ensure that your bank account is not frozen again.

- Complete KYC requirements : Make sure you have met the KYC requirements set by PayPal. This will help ensure that your bank account is not frozen due to KYC failure.

- Set transaction limits : Set transaction limits on your bank account to prevent unusual transactions or large withdrawals.

- Use a valid email address : Make sure the email address you use for your PayPal account is valid and reachable. This will help ensure that you receive an email from PayPal about freezing your bank account.

Conclusion

PayPal may freeze your bank account for several reasons, including suspicious activity, inaccurate information, KYC failure, violation of PayPal policies, and involvement in fraud. However, by understanding the reasons for freezing bank accounts and taking appropriate steps, you can prevent or restore frozen bank accounts.

Make sure you keep accurate information up to date, meet KYC requirements, and follow PayPal policies. If your bank account has been frozen, contact the PayPal support team for clarification and the steps you need to take to restore your bank account. By doing this, you can minimize the risk of bank account freezes and ensure that your bank account functions smoothly.