How PayPal uses your bank account for payments

When you choose PayPal as a payment method, most of us assume that the money will be taken directly from our PayPal balance. However, in some cases, PayPal may use a linked bank account to process your transactions. This can be confusing, so let’s dig deeper into how this process works.

In general, PayPal prefers to use your PayPal balance first before switching to your bank account. This makes sense because PayPal makes a profit from transaction fees associated with using a bank account. However, there are some situations where PayPal cannot use your PayPal balance, such as:

Insufficient PayPal balance: If your PayPal balance is insufficient to cover the transaction amount, PayPal will automatically use your linked bank account to pay off the balance.

Foreign currency transactions: If you make transactions in a currency other than your PayPal base currency, PayPal may need to use your bank account to facilitate the currency conversion.

Transactions requiring additional verification: In some cases, PayPal may require additional verification before processing a transaction. If you haven’t verified your bank account, PayPal may use it to verify your identity.

Now that we understand when PayPal can use your bank account, let’s take a look at how the process works. First, PayPal will try to debit your PayPal balance. If it’s not enough, PayPal will switch to your linked bank account and initiate an ACH (Automated Clearing House) withdrawal. This is an electronic process that transfers money from your bank account to your PayPal account to cover the transaction.

Once the ACH withdrawal is complete, PayPal will complete the transaction. It is important to note that this process may take several business days, depending on your bank.

While PayPal may use your bank account to process transactions, it’s important to remember that those transactions are still protected by PayPal buyer protection. This means that if you experience problems with a transaction, you can contact PayPal for assistance.

In conclusion, PayPal uses your bank account to process transactions in certain situations, such as when your PayPal balance is insufficient or when the transaction requires additional verification. This process is usually safe and convenient, and your transactions remain protected by PayPal buyer protection.

Linking a bank account for PayPal purchases

When you link a bank account to your PayPal account, you open up a world of ease and security in transactions. Let’s explore how PayPal leverages your bank account for seamless payments.

First of all, connecting your bank account with PayPal requires a simple verification process. PayPal sends a small amount of money to your account, and you must confirm the amount to complete the link. This step ensures legal ownership of the bank account.

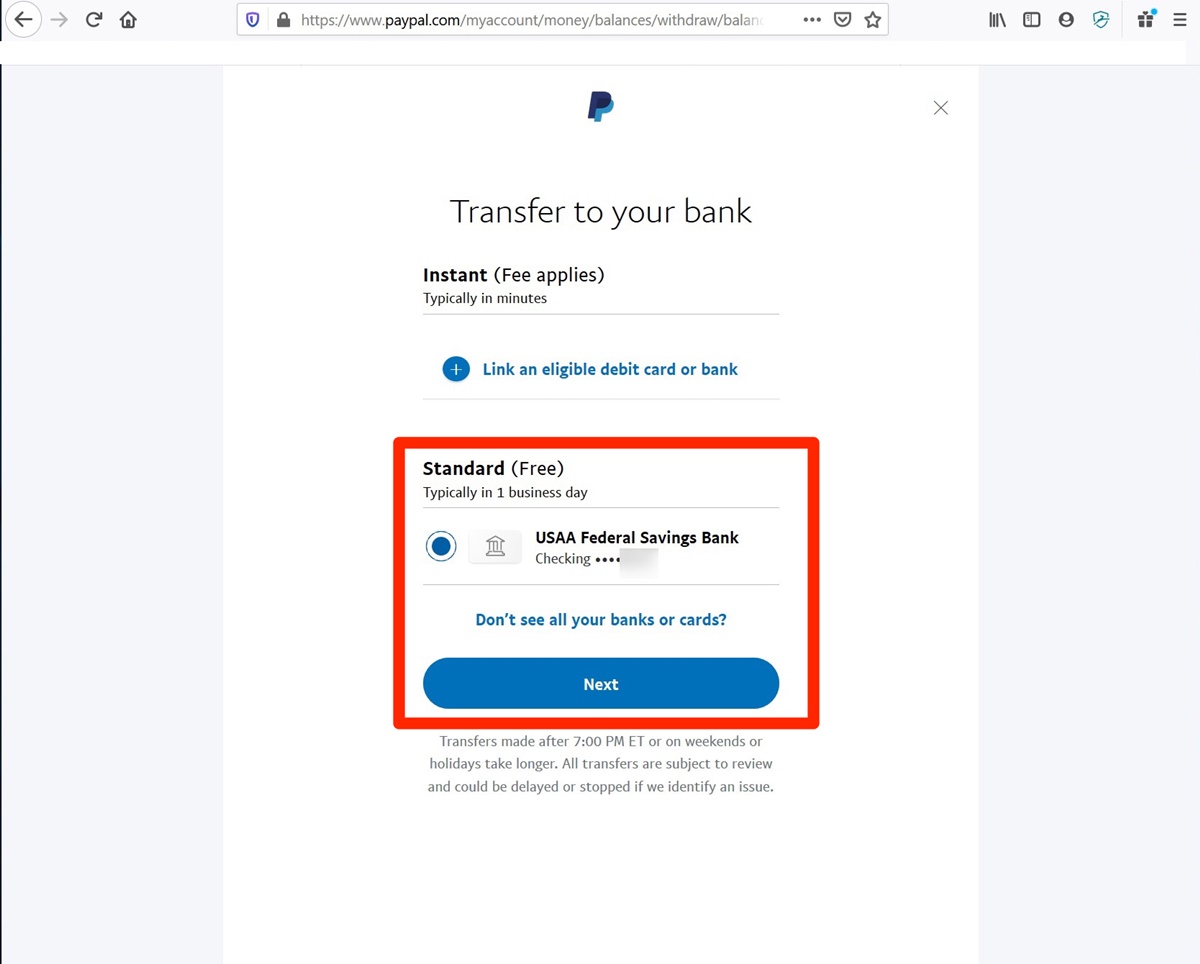

Once linked, your bank account becomes a convenient payment option. When you make a purchase using PayPal, you can choose to withdraw funds directly from your bank account. These transactions are usually completed within a few business days, giving you peace of mind that payments will be processed securely.

The main advantage of using a bank account for PayPal payments lies in its convenience. You don’t need to enter credit or debit card details every time you make a transaction. You just need to click the “PayPal” button on the payment page, and your bank account will be charged automatically.

Additionally, PayPal employs advanced security measures to protect your bank account information. Encryption technology ensures that your data remains secure, reducing the risk of fraud and identity theft.

For sellers, accepting payments via PayPal linked to a bank account brings the same benefits. Customers can make payments from their bank accounts easily, avoiding higher credit card processing fees. Additionally, PayPal offers seller protection, providing peace of mind in the event of disputes or unauthorized transactions.

Therefore, linking your bank account to your PayPal account is an easy and safe way to make online payments. Whether you are a buyer or seller, you will enjoy the convenience, security, and peace of mind that comes with every transaction.

PayPal charges and how to manage them

PayPal is a convenient payment service that allows you to send and receive money quickly and easily. However, as with other payment methods, PayPal charges a small fee for some transactions. Understanding these costs is critical to managing your budget and avoiding unexpected surprises.

One way PayPal processes payments is by using your bank account. When you connect your bank account to PayPal, you authorize PayPal to debit funds from that account to cover your transactions. This process usually happens automatically in the background, so you don’t have to worry about transferring funds manually.

PayPal charges a flat fee of $0.30 plus a certain percentage of the transaction amount when you use your bank account to fund purchases. This percentage varies depending on the currency and country where you transact. For example, in the United States, the fee is 2.9%. So, if you buy $100 worth of items, you will be charged an additional $3.20.

In addition to transaction fees, PayPal may also charge fees for certain services, such as:

Withdrawing funds to your bank account: These fees vary depending on the withdrawal method you use.

Receiving funds in foreign currency: PayPal charges a currency conversion fee for these transactions.

Making payments to certain countries: Some countries charge additional fees for receiving payments from PayPal.

Understanding these fees is critical to getting the most out of PayPal. If you plan to make large or frequent transactions, consider using another payment method that may offer lower fees. PayPal offers a variety of funding options, including credit cards, debit cards, and PayPal balance, so explore your options to find the most cost-effective option for your needs.

By understanding PayPal fees and how to manage them, you can optimize your use of the service and avoid unwanted financial surprises. Remember to always review PayPal’s terms and conditions before making a transaction for the most up-to-date information on applicable fees.

Can PayPal charge from my bank account?

Can PayPal Recharge from Your Bank Account?

PayPal is one of the most popular online payment methods in the world. With a number of users reaching hundreds of millions, PayPal has become the main choice for many people to carry out online transactions. However, many still don’t understand how PayPal works and whether they can top up their balance from a bank account.

What is PayPal and How Does It Work?

PayPal is an online payments company founded in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was designed as an online payment system that allowed users to send and receive money via email. However, over time, PayPal evolved into a more comprehensive payment platform, allowing users to make online transactions more easily and securely.

PayPal works by linking a user’s bank account or credit card to their PayPal account. When users make online transactions using PayPal, they can choose to use their PayPal balance or link their bank account or credit card to make payments.

Can PayPal Recharge from Bank Account?

Yes, PayPal can recharge from your bank account. When you make online transactions using PayPal, you can choose to use your PayPal balance or link your bank account to make payments. If you choose to use a bank account, PayPal will send a payment request to your bank account and top up your PayPal balance.

However, keep in mind that not all bank accounts can be connected to PayPal. PayPal has several requirements that a bank account must meet before it can be linked to a PayPal account. Here are some requirements that must be met:

- Bank account must be active : Your bank account must be active and have sufficient balance to carry out transactions.

- The bank account must be yours : The bank account must be yours and cannot be linked to someone else’s PayPal account.

- The bank account must have a valid account number : Your bank account must have a valid account number that can be accepted by PayPal.

- Bank accounts must be accessible online : Your bank account must be accessible online and have features for conducting online transactions.

How to Link a Bank Account to PayPal?

Linking a bank account to PayPal is quite easy. Here are the steps you have to do:

- Log in to your PayPal account : Log in to your PayPal account and click on the “Wallet” button.

- Click on the “Add Bank” button : Click on the “Add Bank” button and select your bank account type.

- Enter bank account information : Enter your bank account information, including account number, date of birth, and address.

- Confirm bank account information : Confirm your bank account information and click on the “Save” button.

- Wait for confirmation from PayPal : Wait for confirmation from PayPal that your bank account has been successfully linked to your PayPal account.

What Happens if Your Bank Account Can’t Be Linked to PayPal?

If your bank account cannot be connected to PayPal, you may receive an error message from PayPal. Here are some possible reasons why your bank account can’t be connected to PayPal:

- Invalid bank account information : Your bank account information may be invalid or incomplete.

- Your bank account is inactive : Your bank account may be inactive or has been closed.

- Your bank account cannot be accessed online : Your bank account may not be accessible online or may not have features for conducting online transactions.

- PayPal can’t find your bank account : PayPal may not be able to find your bank account or may not be able to connect to your bank account.

If you have difficulty connecting your bank account to PayPal, you can contact PayPal customer service for assistance.

Conclusion

PayPal can top up from your bank account, but there are several requirements that must be met before it can be linked to a PayPal account. Linking a bank account to PayPal is easy, but you need to make sure that your bank account is active, belongs to you, and can be accessed online. If you have difficulty connecting your bank account to PayPal, you can contact PayPal customer service for assistance.