Set up automatic transfers from your bank

In this fast-paced era, managing our finances can be quite a tiring task. Luckily, many banks now offer a handy feature that can help automate repetitive financial tasks—automatic transfers.

By setting up automatic transfers, you can schedule your money to move between your accounts at specified times and amounts. Whether it’s transferring funds to your savings account, paying bills, or saving for a specific goal, this automated process will save you time and effort.

Setting up automatic transfers is very easy. Start by logging into your online banking account. There, you will find the option to set up a new transfer. Select the type of transfer you want, such as one-time, recurring, or temporary.

Next, determine the source account, namely the account from which the money will be withdrawn. You can then select the destination account, namely the account where the money will be transferred. Specify the transfer amount, and if this is a recurring transfer, specify the date and frequency of the transfer.

Once you have entered all the required information, review the details carefully. Make sure the source and destination accounts are correct and the transfer amount is accurate. You can also add memos or notes to help you track transfer destinations.

Once you are sure of the details, confirm the transfer. Your bank will process your request and automate the transfer according to your instructions. You can monitor the transfer status in your online banking account or via email notifications sent by the bank.

Automatic transfers offer many benefits. By setting up transfers to your savings account, you can develop an automatic savings habit. You can also schedule bill payments to ensure you never miss a payment. If you have specific financial goals, you can create custom automatic transfers to the goal savings account.

Overall, automatic transfers are an effective tool for managing your finances efficiently. By automating repetitive financial tasks, you can save time, reduce stress, and stay in control of your financial situation. So, why not take advantage of this handy feature and make managing your finances easier today?

How automatic transfers work with PayPal

PayPal makes it easy for you to set up automatic transfers from your bank. With this feature, you can automate payments to your PayPal account so you never have to worry about missing an important payment or being charged late fees again.

The automatic transfer setup process is simple and secure. First, connect your bank account to PayPal. Then, go to the “Automatic Transfer” page and follow the step-by-step instructions. You can choose the transfer frequency, amount transferred, and start date. PayPal will handle the rest, automatically transferring funds from your bank account to your PayPal account according to the schedule you set.

Automatic transfers are helpful for individuals and businesses looking to simplify their finances. For example, if you’re a freelancer, you can set up automatic transfers to set aside a portion of your earnings each month to your PayPal account to save on taxes or emergency funds. Businesses can use automatic transfers to fund their PayPal accounts for use in vendor payments or order processing.

PayPal offers flexibility in setting up automatic transfers. You can change the amount transferred, frequency, or start date at any time. You can also cancel automatic transfers at any time. This provides peace of mind, knowing that you can control the transactions from your account.

Automatic transfers set up through PayPal are safe and secure. PayPal uses high-level encryption to protect your financial information and adheres to industry security standards to ensure the security of your transactions.

If you’re looking for an easy and convenient way to fund your PayPal account, don’t hesitate to set up automatic transfers. This feature can save you time, energy and worry, so you can focus on more important things.

Managing and disabling automatic transfers from PayPal

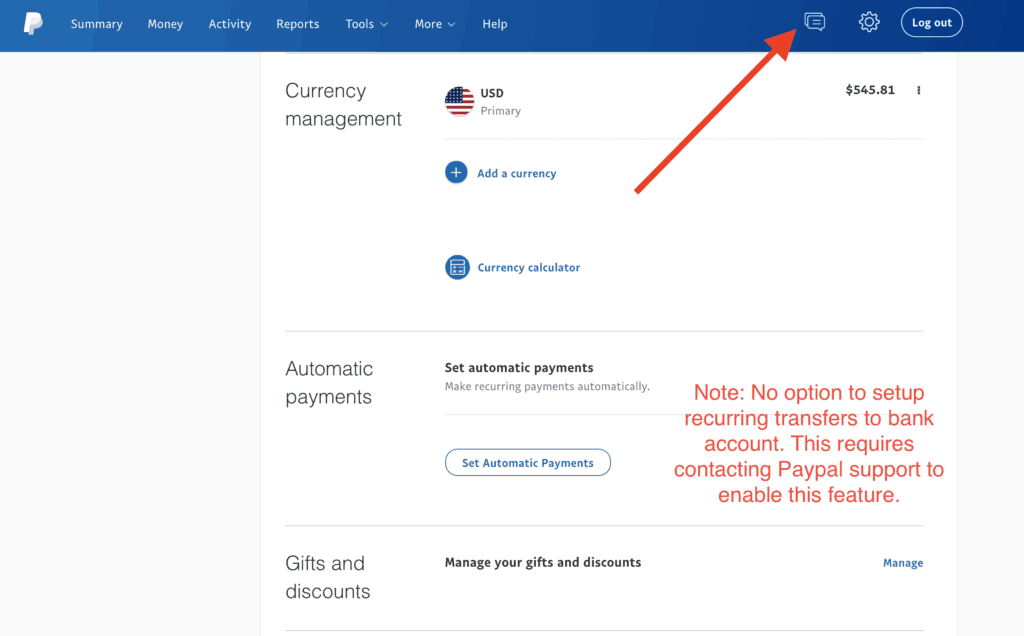

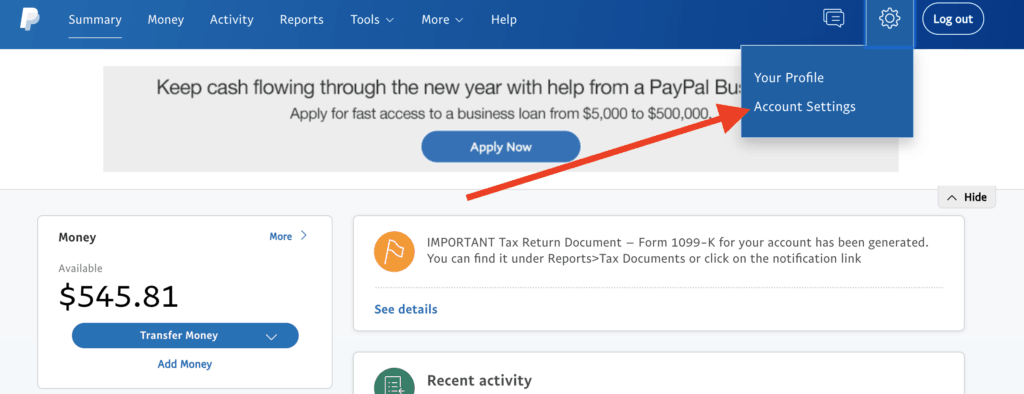

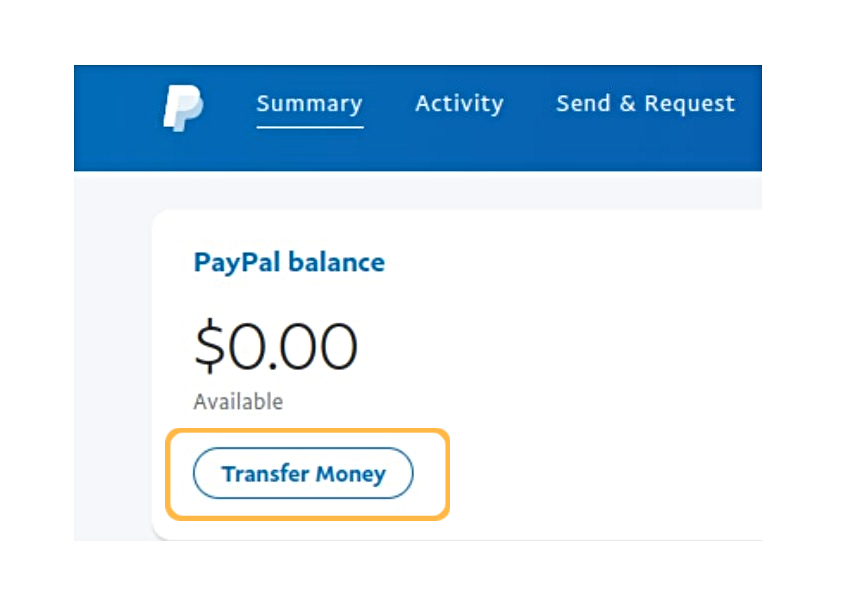

So, are you ready to set up automatic transfers from your bank? It’s very easy to do! First of all, you need to log in to your PayPal account. Once there, look for the “Wallet” tab and click on the “Money Transfer” section.

On the next page, you will see the option to set up automatic transfers. Click on that option and follow the instructions. You must provide PayPal with your bank account number, the name of your bank, and the amount you want to transfer.

After you set up automatic transfers, the transfers will be carried out periodically according to the schedule you have specified. This is a great way to ensure that you always have enough funds in your PayPal account to make purchases or send money to other people.

However, if you decide that you no longer want to set up automatic transfers, you can also easily disable them. Just log in to your PayPal account, find the “Wallet” tab, and click the “Money Transfer” section. On the next page, you will see a list of automatic transfers that you have set.

To disable automatic transfers, click the trash icon next to the transfer you want to delete. You will be asked to confirm the deletion. Once you confirm, automatic transfers will be deactivated and will no longer be carried out.

You can also disable all automatic transfers at once by clicking the “Disable All Automatic Transfers” button at the bottom of the page. This is a great way to turn off all automatic transfers if you no longer need them.

Once you disable automatic transfers, they will no longer be made from your bank account. If you want to reset automatic transfers, you will have to do it manually via the “Money Transfers” page.

Can PayPal transfer money automatically from my bank account if I link it in PayPal?

Why Can PayPal Send Money Automatically from Your Bank Account?

PayPal is one of the most popular online payment platforms in the world. With PayPal, you can make online transactions easily and safely, whether for online shopping, paying bills, or even sending money to friends or family. However, how can PayPal send money automatically from your bank account if you link the bank account to your PayPal account? Let’s discuss it further.

Linking Bank Account with PayPal

To be able to use PayPal, you need to link your bank account with your PayPal account. The process of connecting a bank account with PayPal is relatively easy and only takes a few steps. Here’s how to connect a bank account with PayPal:

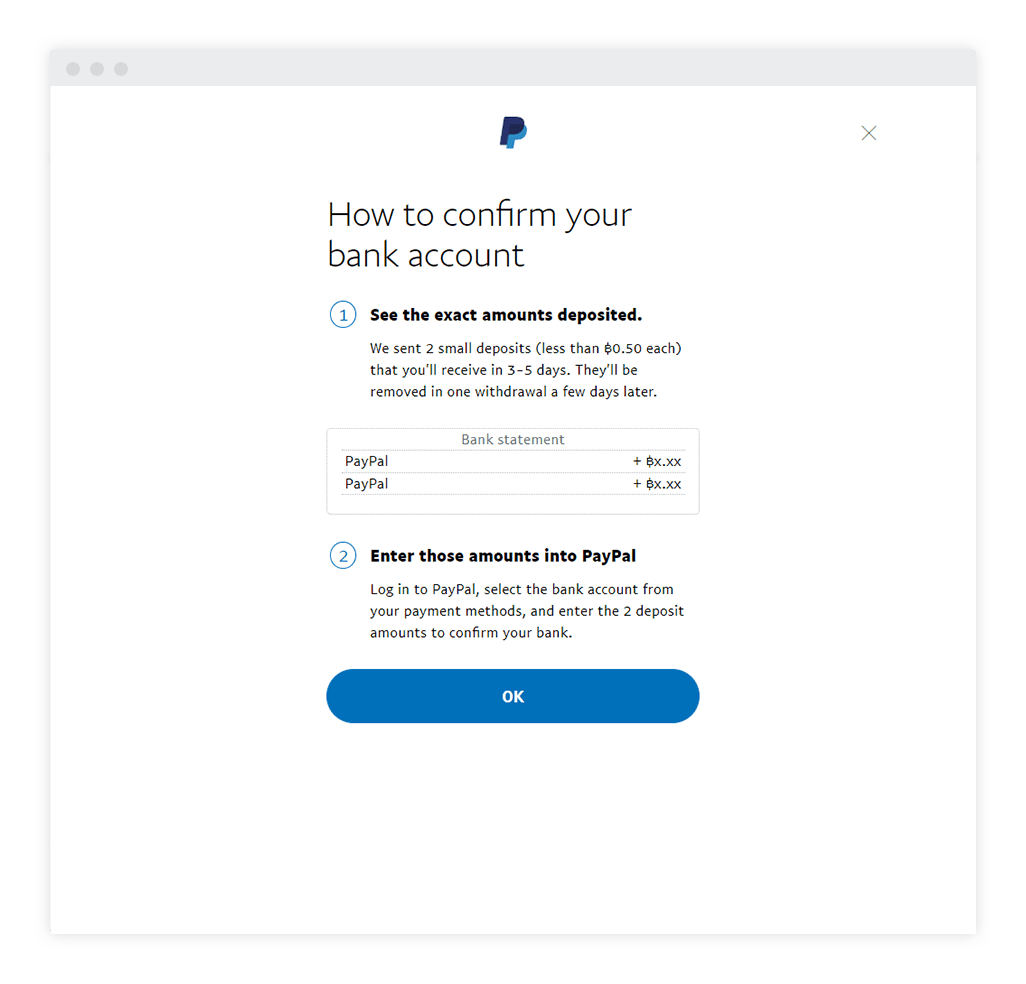

- Log in to your PayPal account and select the “Add Bank Account” or “Add Bank Account” option in the “Finance” or “Payment” menu.

- Select the type of bank account you want to connect, such as a savings account or checking account.

- Enter your bank account information, including bank name, account number, and branch code.

- PayPal will send a confirmation code to your bank account, which you need to enter into your PayPal account to activate the connection between your PayPal account and your bank account.

How PayPal Sends Money Automatically

If you have linked a bank account with your PayPal account, PayPal can send money automatically from your bank account using the “Automatic Withdrawal” method. Here’s how PayPal sends money automatically:

- When you make a transaction with PayPal, the PayPal system checks whether you have sufficient balance in your PayPal account to make the transaction.

- If your PayPal account balance is insufficient, PayPal will send an automatic withdrawal request to your bank account to top up your PayPal account balance.

- Once the automatic withdrawal request is processed, PayPal will send the money from your bank account to your PayPal account.

- Once the money is received, PayPal will use the money to carry out the transactions you make.

Security and Protection

PayPal uses advanced security technology to protect your bank account information and conduct transactions securely. PayPal also has a strict customer protection policy to protect you from erroneous withdrawals or unauthorized transactions.

Benefits of Using PayPal

Using PayPal has several benefits, including:

- Convenience : PayPal allows you to make online transactions easily and quickly.

- Security : PayPal uses advanced security technology to protect your bank account information.

- Flexibility : PayPal can be used to make transactions on various websites and online applications.

- Protection : PayPal has a strict customer protection policy to protect you from erroneous withdrawals or unauthorized transactions.

Conclusion

In conclusion, PayPal can send money automatically from your bank account if you link the bank account with your PayPal account. This process allows you to make online transactions easily and quickly, and provides strict safeguards to protect you from erroneous withdrawals or unauthorized transactions. By using PayPal, you can make online transactions more easily and safely.

However, please remember that you should always be alert and careful when making online transactions, as well as ensure that you have set up the security of your PayPal account correctly. Thus, you can use PayPal more conveniently and safely.

In recent years, PayPal has become one of the most popular online payment platforms in the world. With more than 300 million users worldwide, PayPal has helped people make online transactions more easily and securely.

But, what makes PayPal so popular? Here are some reasons that make PayPal one of the most popular online payment platforms in the world:

- Convenience : PayPal allows you to make online transactions easily and quickly. With a few clicks, you can make payments or send money to other people.

- Security : PayPal uses advanced security technology to protect your bank account information. This way, you can carry out online transactions more safely.

- Flexibility : PayPal can be used to make transactions on various websites and online applications. Thus, you can use PayPal to make online transactions more easily.

In recent years, PayPal has made several significant changes to improve security and user convenience. Here are some examples of changes that PayPal has made:

- Security Improvements : PayPal has increased the security of user accounts by using more advanced security technology. Thus, users can carry out online transactions more safely.

- Application Development : PayPal has developed a mobile application that allows users to make online transactions more easily and quickly.

- Improving Service Quality : PayPal has improved the quality of customer service by offering better and faster support.

In conclusion, PayPal has become one of the most popular online payment platforms in the world due to its convenience, security, and flexibility. By making several significant changes, PayPal has improved security and user convenience. Thus, PayPal can continue to grow and become one of the most popular online payment platforms in the world.

However, keep in mind that PayPal is not the only online payment platform in the world. There are several other online payment platforms that also offer the same or even better convenience, security and flexibility. Here are some examples of other online payment platforms:

- Stripe : Stripe is an online payment platform that allows users to make online transactions easily and securely.

- Square : Square is an online payment platform that allows users to make online transactions easily and safely.

- AmazonPay : Amazon Pay is an online payment platform that allows users to make online transactions easily and safely.

In conclusion, PayPal is one of the most popular online payment platforms in the world due to its convenience, security, and flexibility. However, keep in mind that there are several other online payment platforms that also offer the same or even better convenience, security and flexibility. Thus, users can choose an online payment platform that suits their needs.