Linking a Credit Card to a PayPal Account

Linking a credit card to a PayPal account is an easy and safe way to make online purchases. By linking your card, you can use PayPal to pay for purchases without having to enter your credit card details every time.

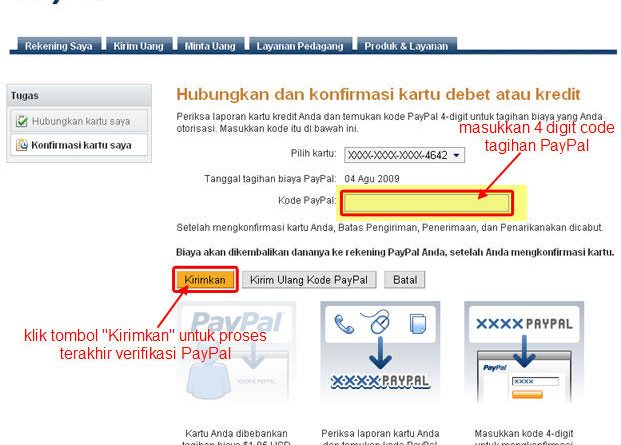

The first step to connecting your credit card is to log in to your PayPal account. Once you’re logged in, hover over the “Wallet” tab and then click “Add Card.” You will be asked to provide your credit card number, expiration date, and CVV code.

Once you have entered this information, click the “Save” button. Your credit card will now be linked to your PayPal account. You can use it to make purchases by clicking the “Pay with PayPal” button at checkout.

You can link multiple credit cards to your PayPal account. This makes it easy for you to use different cards for different purchases. For example, you can use one card for personal purchases and another card for business purchases.

In addition to linking a credit card, you can also link a bank account to your PayPal account. This gives you another option to fund your purchase. To connect a bank account, click the “Wallet” tab and then click “Add Bank.” You will be asked to provide your account number and routing number.

Both credit cards and bank accounts linked to your PayPal account are safe. PayPal uses encryption technology to protect your financial information. Additionally, PayPal never shares your information with third parties.

Linking a credit card to a PayPal account is an easy and safe way to make online purchases. This also gives you the option to use different cards for different purchases. If you haven’t linked a credit card to your PayPal account, do so today. This is a great way to make your online purchases easier and safer.

How to Make Payments by Credit Card

When you link a credit card to your PayPal account, you open up a new world of easy payments. Whether you’re shopping online, sending money to friends, or conducting business, your credit card can give you the flexibility and security you need.

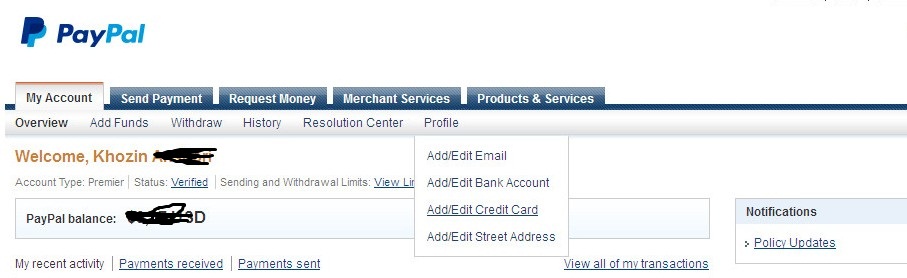

The process is fast and easy. First, log in to your PayPal account and click “Wallet”. On the “Wallet” page, click “Add Credit or Debit Card.” Enter your credit card number, expiration date, and security code. PayPal will verify your information and add your card to your account.

Once your card is connected, you can use it to make payments on any website that accepts PayPal. You can also use it to send money to friends and family, or to withdraw money from your PayPal account.

The process of adding a credit card to PayPal has several key benefits. First, it provides an extra layer of security for your online transactions. PayPal acts as an intermediary between you and the seller, protecting your financial information. Second, it makes it easy to track your expenses. All your transactions will be recorded in your PayPal account history. Lastly, it’s comfortable. You don’t need to enter your credit card information every time you shop online.

However, there are also some potential drawbacks to consider. First, connecting your credit card to PayPal can make it easier to spend more money than you have. Second, if your PayPal account is hacked, the hacker may have access to your credit card information. Although PayPal takes measures to protect your information, there is no guarantee of its security.

Overall, connecting a credit card to a PayPal account can be an easy and safe way to make online payments. However, it is important to consider the potential advantages and disadvantages before making a decision.

How to Use PayPal with a Credit Card: Complete Guide

PayPal is one of the most popular online payment platforms in the world. By using PayPal, you can make online payments easily and safely. One way to use PayPal is to link your credit card. In this article, we will discuss how to use PayPal with a credit card and provide a complete guide to the login process and using PayPal with a credit card.

Advantages of Using PayPal with a Credit Card

Using PayPal with a credit card has several advantages, including:

- Convenience : Using PayPal with a credit card is very easy and fast. You just need to link your credit card with your PayPal account, then you can make online payments easily.

- Security : PayPal offers excellent security features to protect your transactions. By using PayPal, you don’t have to worry about the security of your credit card.

- Flexibility : Using PayPal, you can make online payments on various websites that accept PayPal.

- Rewards : Some credit cards offer rewards and cashback for transactions made through PayPal.

How to Link a Credit Card with PayPal

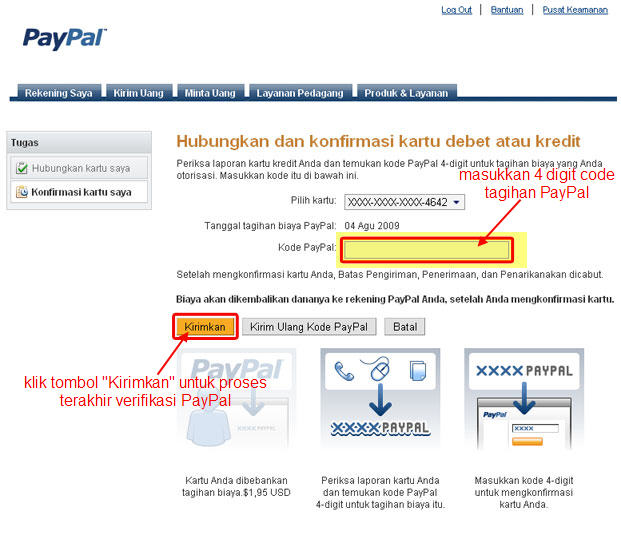

To connect a credit card with PayPal, you need to do the following steps:

- Open your PayPal account : Open your PayPal account and log in to your profile.

- Click the “Add Credit Card” button : Click the “Add Credit Card” button located at the top of your profile page.

- Enter credit card information : Enter your credit card information, including credit card number, expiration date, and security code.

- Click the “Save” button : Click the “Save” button to save your credit card information.

How to Login to PayPal with a Credit Card

To login to PayPal with a credit card, you need to do the following steps:

- Go to the PayPal website : Go to the PayPal website and click the “Login” button.

- Enter your email address and password : Enter your email address and password.

- Select a payment method : Select the payment method “Credit Card” from the list of available payment methods.

- Select a credit card : Select the credit card you want to use to make payment.

- Click the “Login” button : Click the “Login” button to log in to your PayPal account.

How to Use PayPal with a Credit Card

To use PayPal with a credit card, you need to do the following steps:

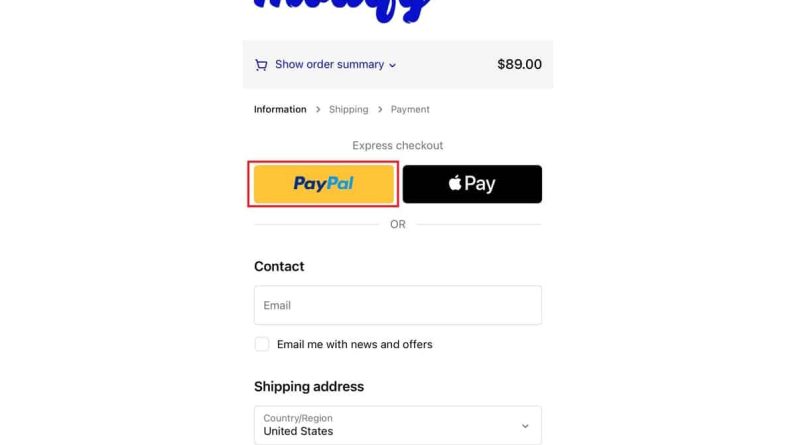

- Select a product or service : Select the product or service you want to purchase from a website that accepts PayPal.

- Click the “Pay” button : Click the “Pay” button to start the payment process.

- Select a payment method : Select the payment method “PayPal” from the list of available payment methods.

- Login to your PayPal account : Login to your PayPal account using the linked credit card.

- Confirm payment : Confirm your payment by clicking the “Pay Now” button.

Tips and Tricks for Using PayPal with a Credit Card

Here are some tips and tricks for using PayPal with a credit card:

- Make sure your credit card is active : Make sure your credit card is active and has sufficient balance to make the payment.

- Check payment limits : Check the payment limits applied by your credit card to avoid payment errors.

- Use a strong password : Use a strong and unique password for your PayPal account.

- Check your transactions : Check your transactions regularly to ensure that there are no unwanted transactions.

Conclusion

Using PayPal with a credit card is an easy and safe way to make online payments. By following the steps explained above, you can use PayPal with a credit card easily. Make sure you use the tips and tricks that have been presented to optimize the use of PayPal with credit cards.

Benefits and Restrictions of Using a Credit Card on PayPal

Benefits and Restrictions of Using a Credit Card on PayPal

Linking a credit card to a PayPal account comes with a number of benefits, making this payment method popular among online users. One of the main advantages is its ease of use. With a linked credit card, shoppers don’t have to enter their card details every time they make a purchase. PayPal automatically withdraws funds from the linked card, speeding up and simplifying the checkout process.

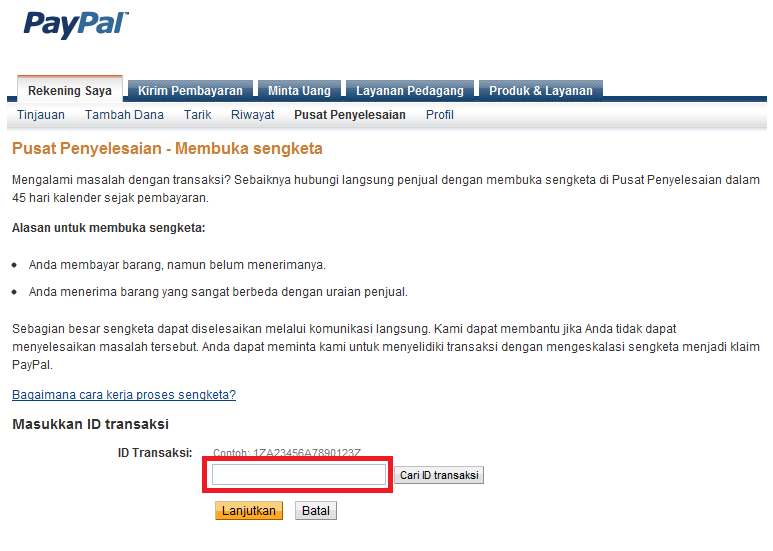

In addition to its convenience, using a credit card on PayPal also offers an additional layer of protection for buyers. When you use a credit card through PayPal, your financial information is not shared with the merchant. This reduces the risk of fraud and identity theft, giving you peace of mind when shopping online.

However, there are also some limitations to consider when using credit cards on PayPal. One limitation is the fees charged for certain transactions. PayPal charges a flat fee for withdrawals and fund transfers, which may vary depending on currency and country. These fees are important to pay attention to, especially if you frequently make small transactions.

In addition to fees, using a credit card on PayPal can also affect your credit score. If you don’t pay off your PayPal balance on time, it can have a negative impact on your credit score, which can make it difficult for you to get new loans or credit cards with favorable interest rates in the future.

It is also important to note that not all merchants accept PayPal as a payment method. If you shop at a website or store that does not accept PayPal, you may need to use your credit card directly or find an alternative payment method.

Overall, connecting a credit card to a PayPal account has its advantages and disadvantages. If you’re looking for a convenient and secure payment method with an added layer of protection, PayPal might be a good choice for you. However, it is important to consider the costs involved and the potential impact on your credit score before making a decision.