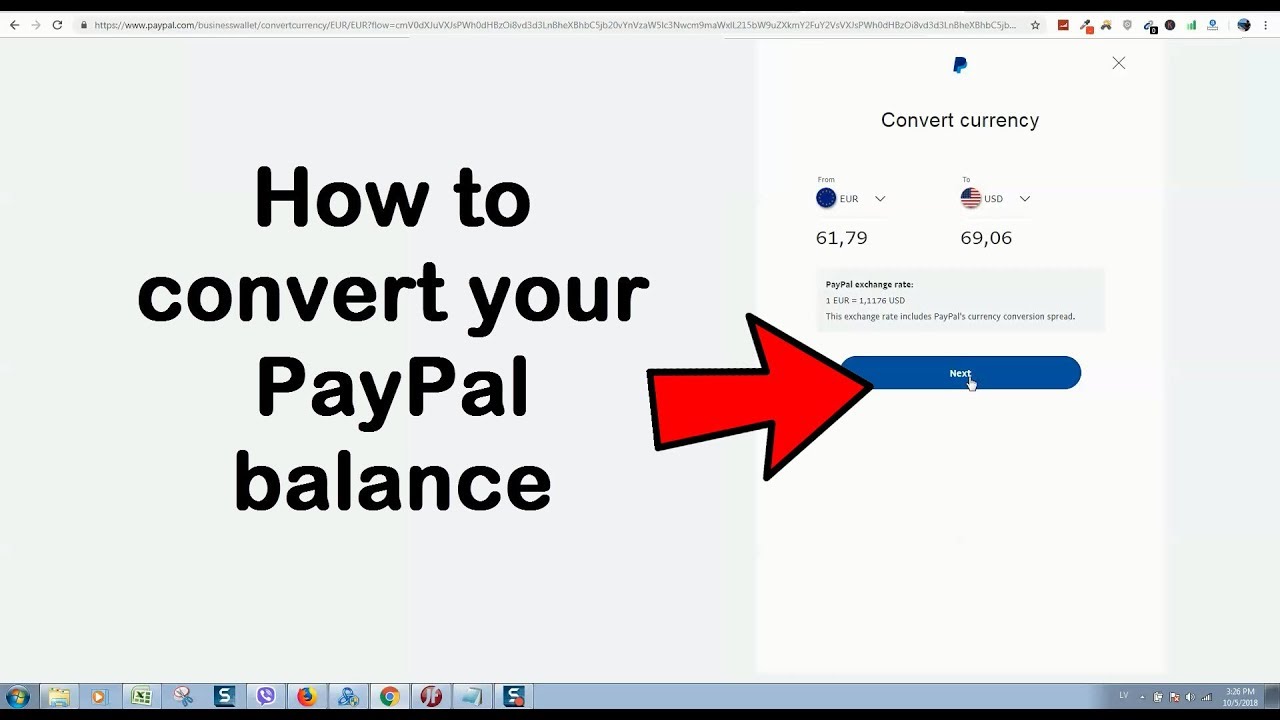

How to convert PayPal funds to a different currency

Friends, have you ever wanted to use PayPal to make transactions in different currencies? Maybe you’re a freelancer who works with clients from all over the world, or maybe you’re an adventure seeker planning to travel to a country that uses a different currency. Whatever the reason, you’ll be happy to know that converting PayPal funds to another currency is a very easy process.

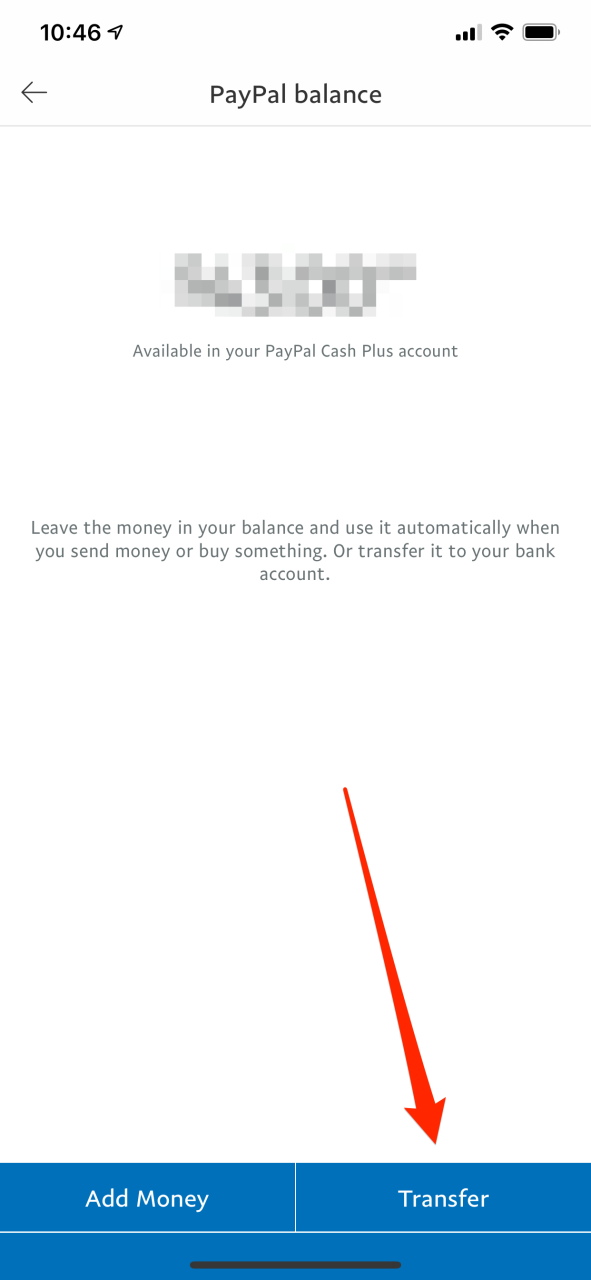

Let’s start with the first step. Log in to your PayPal account and click “Balance” in the top left corner of the screen. On the next page, you will see a list of your balances in various currencies. Click the currency you want to convert.

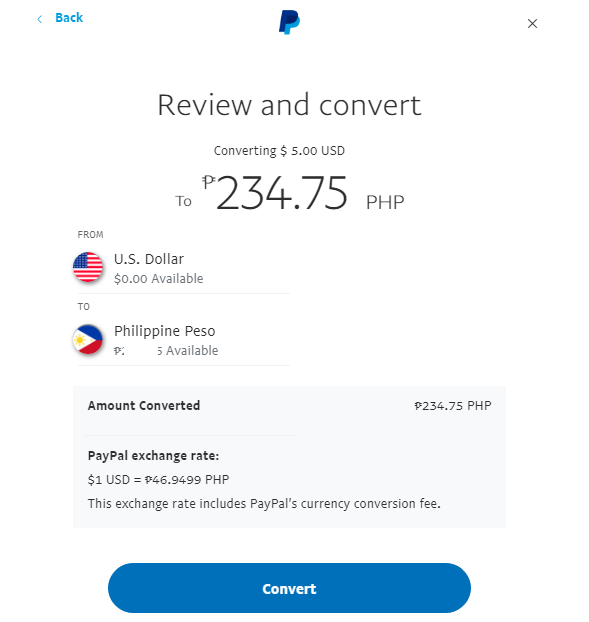

After you select the currency you want to convert, you will be taken to the “Currency Conversion” page. Here, you can enter the amount you want to convert, as well as select the currency you want to exchange. PayPal will automatically display the applicable exchange rate.

If you are satisfied with the exchange rate and amount, just click “Convert Now”. Your funds will be converted instantly, and you will see your new balance on the “Balance” page.

This entire process usually only takes a few minutes. However, it is important to remember that PayPal charges a small fee for conversion transactions. These fees will vary depending on the amount converted and the currency involved.

So, friends, now you know how to convert PayPal funds to different currencies. So, next time you need to transact in another currency, don’t hesitate to use this feature. This is an easy and convenient way to ensure that you always have the currency you need.

Currency exchange fees on PayPal

When you transact on PayPal in a different currency, you will be charged a currency exchange fee. These fees may vary depending on the currency involved and the amount transacted. Understanding how these fees work is critical to managing your finances effectively at PayPal.

PayPal uses mid-market exchange rates to calculate currency exchange fees. This is the average exchange rate determined by the financial markets at a particular time. Additionally, PayPal adds margin to these exchange rates to make a profit. This margin varies depending on the currency being converted, usually around 3-4%.

For example, if you want to convert $100 USD to Euros, PayPal will use the mid-market exchange rate and add the margin. If the mid-market exchange rate is 1 EUR = $1.10, PayPal will use an exchange rate of 1 EUR = $1.13 (with a 3% margin). Thus, you will receive approximately €88.50 after conversion, minus PayPal fees.

It is important to note that PayPal currency exchange fees may differ from banks or other currency exchange services. Always compare exchange rates and fees from different providers before converting. If you plan to exchange a large amount, a small difference in the exchange rate can save you a lot of money.

In addition to currency exchange fees, PayPal also charges a flat fee for certain currency conversions. For example, there is a flat fee of $0.30 USD to convert to Mexican Pesos. This fee does not depend on the amount transacted.

To avoid PayPal currency conversion fees, you may consider opening a PayPal account in the currency you need. This will allow you to receive and send funds in that currency without incurring conversion fees. However, if you have different currencies in your PayPal account, conversion fees may be unavoidable.

In conclusion, understanding currency exchange fees on PayPal is essential to managing your finances effectively. By comparing exchange rates and fees from different providers, you can save money when exchanging currencies. If possible, considering opening a PayPal account in the currency you need can help avoid conversion fees altogether.

Limitations when transferring funds to a different currency

However, there are some important limitations to keep in mind when transferring funds to a different currency. First of all, PayPal charges a conversion fee for every transaction. The amount of this fee varies depending on the currency involved and the amount transferred. Additionally, the exchange rate PayPal uses may differ from the current market exchange rate, which may affect the amount you ultimately receive.

Another limitation is that you may not be able to transfer funds from all currencies to all currencies. PayPal only supports certain currencies, and certain currencies may only be available in certain countries. If you can’t find the currency you’re looking for, you may need to contact PayPal customer service for help.

Lastly, there are limits to the amount you can transfer to different currencies. These limits may vary depending on your account status and the country where you live. If you need to transfer a larger amount, you may need to contact PayPal for approval.

Despite these limitations, transferring funds to a different currency using PayPal is generally an easy and convenient process. By following the step-by-step instructions provided above, you can quickly and easily convert your funds and send them to the recipient of your choice.

Can PayPal be transferred to a different currency account?

Can or Not? PayPal Transfer Process to Different Currency Accounts

In today’s digital era, international financial transactions have become easier and faster thanks to online payment platforms such as PayPal. However, what if you want to make a transfer from your PayPal account to a local bank account in a different currency? Is this possible? The following is the information needed to answer this question.

What is PayPal?

Before we discuss transfers to accounts in different currencies, let’s get to know better what PayPal is. PayPal is an online payment platform that allows users to carry out international financial transactions easily and safely. With PayPal, you can make online payments, accept payments from other people, and even make transfers to local bank accounts.

Transfer from PayPal to a Different Currency Account

Now, let’s answer the main question: is it possible or not to transfer from PayPal to a different currency account? The answer is, yes, PayPal allows transfers to local bank accounts in different currencies. However, there are several things you need to know before making a transfer.

How to Transfer from PayPal to a Different Currency Account

Here are the steps you need to take to make a transfer from PayPal to a local bank account in a different currency:

- Make sure you have an active PayPal account : Before making a transfer, make sure you have an active and verified PayPal account.

- Add a local bank account : Add a local bank account with a different currency to your PayPal account.

- Select the transfer option : Select the transfer option to a local bank account from within your PayPal account.

- Enter the transfer amount : Enter the transfer amount you want to make.

- Select currency : Select the currency you want to use for the transfer.

- Confirm transfer : Confirm your transfer and wait for the transfer process to complete.

Transfer Fees

Transfer fees from PayPal to local bank accounts in different currencies can vary depending on several factors, such as:

- PayPal transfer fees : PayPal charges a transfer fee of 0.5% to 2% of the transfer amount.

- Currency conversion fees : If you make a transfer to a local bank account in a different currency, you will be charged a currency conversion fee of 2.5% to 4.5% of the transfer amount.

- Bank fees : The recipient’s bank may also charge a fee for accepting the transfer.

Transfer Security

PayPal prioritizes the security of your transactions. Here are some of the security steps taken by PayPal to protect your transactions:

- Data encryption : PayPal uses data encryption to protect your information.

- Two-factor verification : PayPal offers two-factor verification to increase the security of your account.

- Transaction monitoring : PayPal monitors your transactions in real-time to detect potential fraud.

Conclusion

In conclusion, transfers from PayPal to different currency accounts can be done easily and safely. However, keep in mind that there are some transfer fees to consider. Therefore, make sure you understand the transfer fees and transaction security before making a transfer. With PayPal, you can make international financial transactions easily and safely.

FAQs

Here are some frequently asked questions about transferring from PayPal to a different currency account:

- How long does a transfer from PayPal to a local bank account take?

Transfer times may vary depending on several factors, such as the type of transfer and the speed of the recipient’s bank. - Is a transfer from PayPal to a different currency account safe?

Yes, PayPal prioritizes the security of your transactions by using data encryption, two-factor verification, and real-time transaction monitoring. - How much does it cost to transfer from PayPal to a different currency account?

Transfer fees can vary depending on several factors, such as the type of transfer and currency conversion fees.

With the information provided above, you can make transfers from PayPal to different currency accounts easily and safely. Make sure you understand the transfer fees and transaction security before making a transfer.