PayPal’s bill payment services

Hey, finance fans! Let’s dig into a cool feature of PayPal that you might not know about: bill payment services.

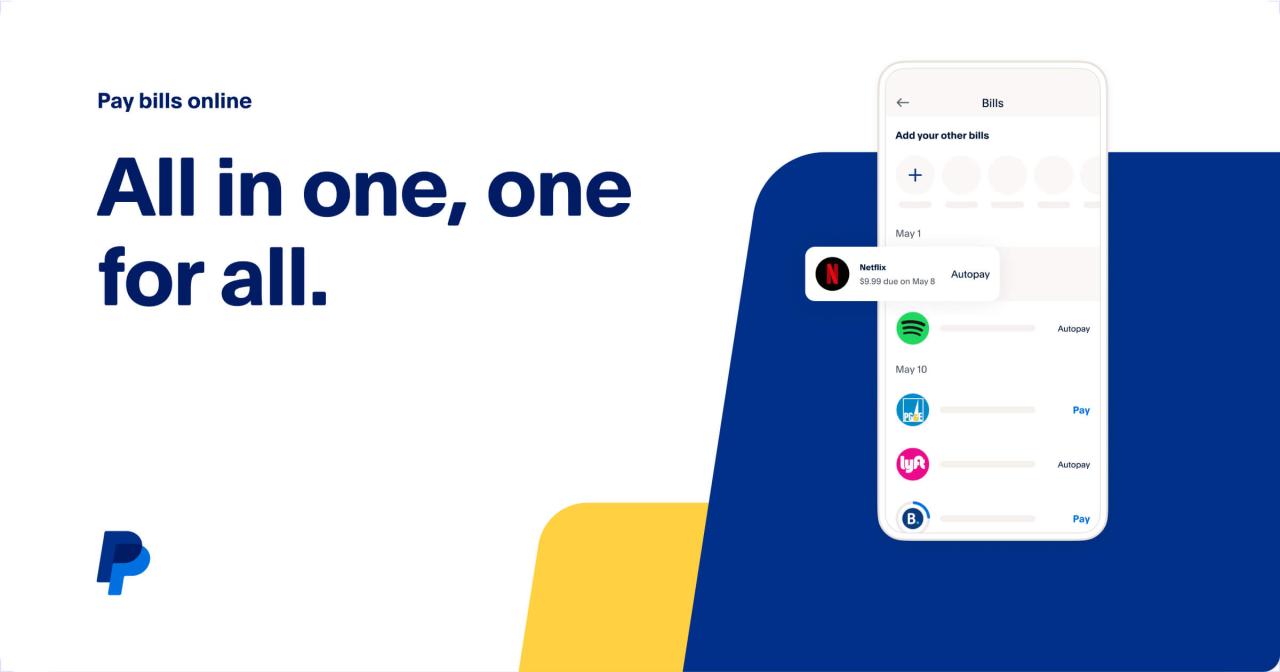

PayPal has been talked about for easy online payments, but it turns out it can also help you organize your bills. With a bill pay service, you can easily automate payments for all your bills, including utilities, credit cards, and even rent.

Here’s how it works: Simply add your payee and billing information to your PayPal account. Then, you can set up recurring or one-time payments for the due dates you specify. PayPal will handle the rest, sending your payment on time and avoiding annoying late fees.

The benefits don’t stop there. PayPal’s bill payment service also gives you a clear picture of all your expenses in one place. You can track payments you’ve made, view your billing history, and set reminders for future bills. This is very helpful in managing your budget and ensuring you don’t miss a single payment.

In addition to convenience and organization, PayPal’s bill payment service is also very secure. PayPal uses advanced encryption and fraud protection technology to ensure your financial information remains safe. So, you can breathe easy knowing that your bills are paid on time and your money is protected.

PayPal’s bill payment service is the perfect solution for anyone looking for an easy and efficient way to manage their bills. This saves you time, hassle and money in the long run. So, why wait? Visit the PayPal website today and start automating your bill payments now.

Remember, with PayPal bill payment services, you can say goodbye to piles of unpaid bills and late fees. Instead, you’ll get the peace of mind that comes from knowing that all your bills are under control and taken care of.

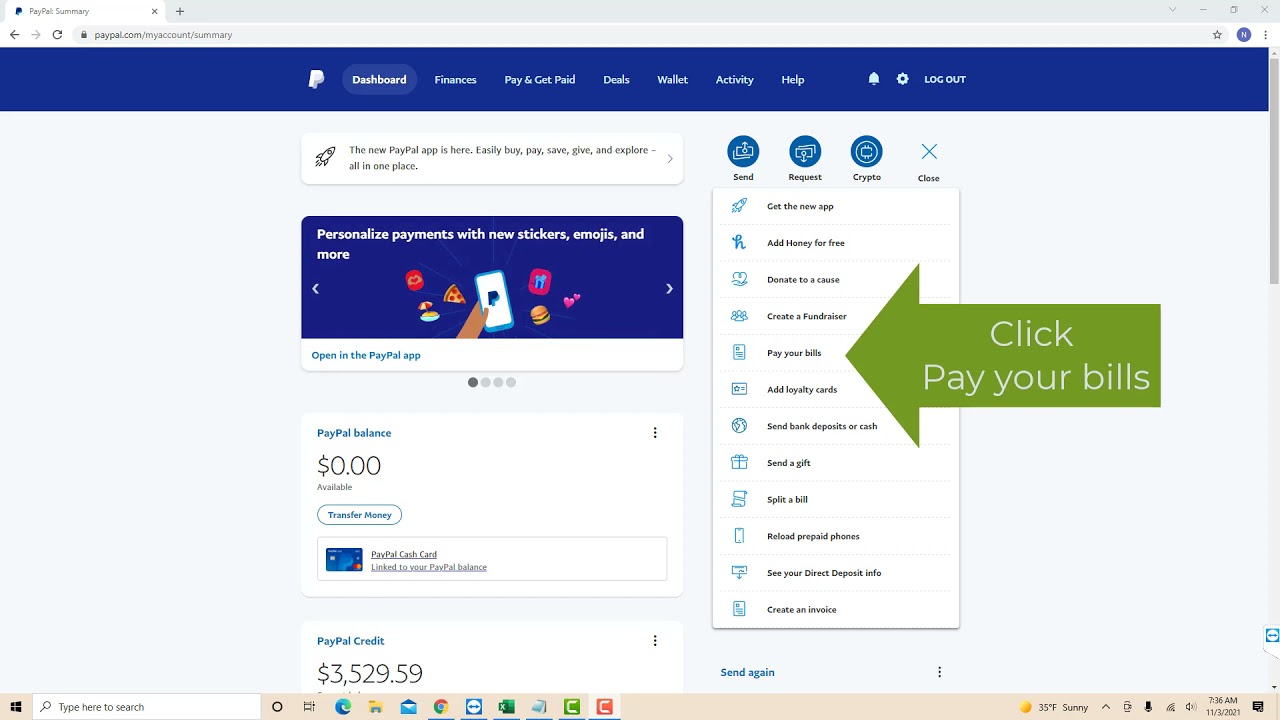

How to set up automatic bill payments

If you’re often late paying bills, or just want to make financial management easier, PayPal’s bill payment service can be a lifesaver. With this service, you can automate your monthly bills and pay them off on time, without any hassle. So how do I set up automatic bill payments via PayPal?

First of all, log in to your PayPal account and click the “Wallet” tab. Then, select “Payments & Subscriptions”. Here, you will see a list of all the recurring payments you have set up. To set up a new automatic bill payment, click the “Add Recurring Payment” button.

Next, you need to enter information about the bill you want to automate. This includes the name of the billing company, account number, and bill amount. You can also choose the payment frequency, whether monthly, quarterly, or annually.

Once you have entered all the required information, click the “Next” button. PayPal will review the information and verify your account. If everything is fine, you will receive a confirmation email.

To ensure automatic bill payments go as planned, you must ensure that there are sufficient funds in your PayPal account on the due date. You can set the funding source from a linked bank account or credit card.

PayPal bill payment service offers many benefits. Firstly, it saves time and effort. You no longer need to remember all the due dates and write checks manually. Second, it helps you avoid late fees and fines. Third, it can improve your credit score by showing that you are a reliable payer.

However, there are a few things to keep in mind. First, make sure you only automate bills that are a constant amount. If the billing amount varies, you may need to make manual adjustments occasionally. Second, monitor your PayPal account regularly to ensure there are no errors or fraud.

Overall, PayPal bill payment service is a convenient and safe way to manage your monthly bills. By automating payments, you can save time, money, and peace of mind.

Paying bills online with PayPal in different countries

Imagine the convenience of paying your monthly bills with a few clicks from the comfort of your home. PayPal, the online payments giant, has revolutionized the way we handle our financial affairs, and its bill payment service is no exception.

In the United States, PayPal has partnered with various service providers to enable customers to pay their bills online. Whether it’s a utility bill, rent, or credit card, PayPal provides a secure and easy-to-access platform to manage your payments. To get started, users simply link their bank account or credit card to PayPal and add bill recipients. PayPal’s automated system will track due dates and send timely reminders, ensuring you never miss a payment again.

Outside the US, PayPal has also expanded its bill payment services to cover other countries. In the UK, PayPal has partnered with Barclaycard, allowing users to easily pay their credit card bills and installments. In Canada, PayPal works with a number of major banks to provide safe and convenient bill payment services for customers.

Apart from convenience and timeliness, PayPal also offers a number of additional benefits. Users can schedule payments in advance to avoid late fees, track their payment history, and receive instant payment confirmation. Additionally, PayPal offers buyer protection, giving customers peace of mind that their transactions are secure.

If you’re tired of the hassle of paying bills by post or phone, then PayPal’s bill payment service is definitely worth considering. With an automated system, timely reminders, and added benefits, PayPal simplifies your financial affairs and saves valuable time and energy.

So, next time you have to pay a bill, don’t hesitate to take advantage of PayPal’s bill payment service. From the comfort of your home, you can tackle these everyday tasks with just a few clicks.

Can PayPal be used to pay bills?

Can PayPal be Used to Pay Bills?

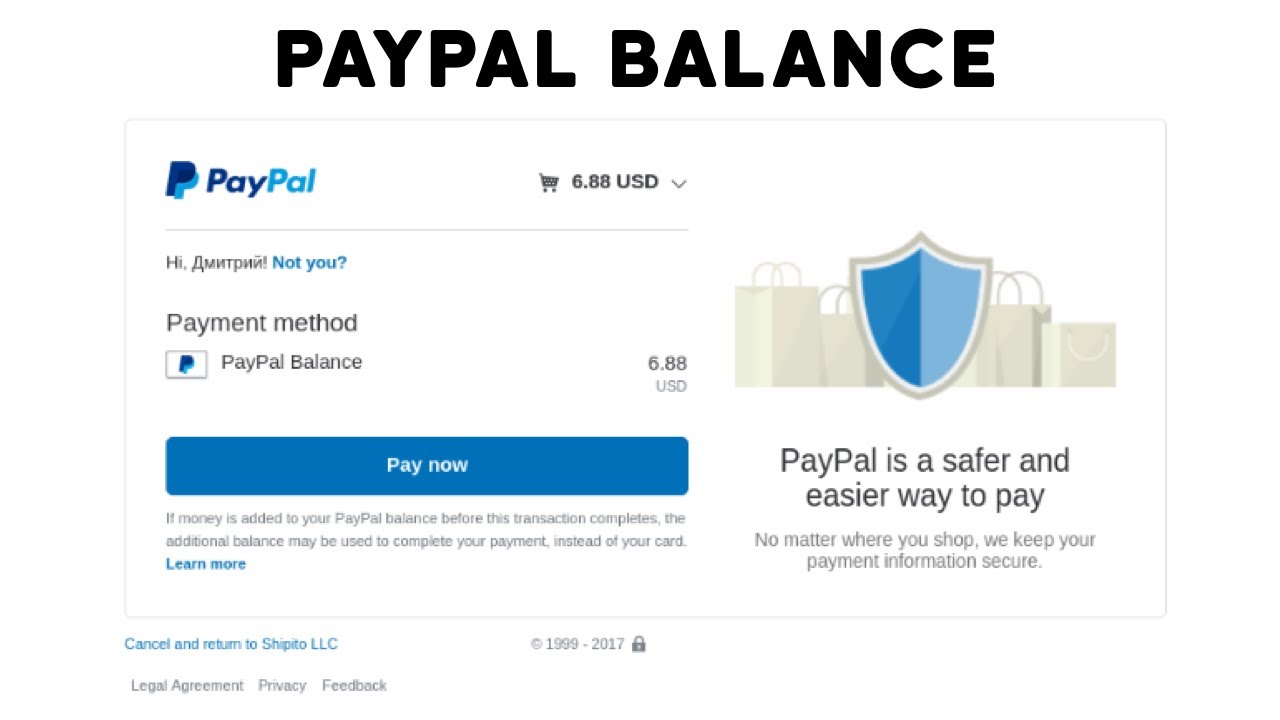

PayPal is one of the most popular online payment services in the world. Using PayPal, you can make payments and send money to other people online. However, can PayPal be used to pay bills?

What is PayPal?

PayPal is an online payment service that allows you to make payments and send money to other people online. PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, PayPal was used as a payment service for eBay, but over time, it developed into an independent payment service.

How PayPal Works?

PayPal works by linking your credit card or bank account with your PayPal account. When you make a payment using PayPal, the money is transferred from your PayPal account to the recipient’s account. This process takes place instantly and safely.

Can PayPal be Used to Pay Bills?

Yes, PayPal can be used to pay bills. PayPal lets you make bill payments online, without having to bother with cash or credit cards. Here are some ways to pay bills using PayPal:

- Pay Bills Online : Many companies and businesses accept bill payments via PayPal. You can pay bills online using your PayPal account.

- Paying Bills Via Mobile : You can also pay bills via the PayPal app on your phone.

- Pay Bills with Auto-Payment : You can set auto-payment to pay bills automatically every month.

Benefits of Paying Bills with PayPal

Paying bills with PayPal has several advantages, including:

- Comfort : Paying bills with PayPal is very easy and convenient. You don’t need to bother with cash or credit cards.

- Security : Payment with PayPal is very safe. PayPal uses advanced security technology to protect your account.

- Flexibility : PayPal allows you to make bill payments online or via mobile.

- Cost Savings : Paying bills with PayPal can save money. You don’t have to pay any transfer fees or other fees.

Disadvantages of Paying Bills with PayPal

Although paying bills with PayPal has several advantages, there are also several disadvantages, including:

- Cost : Paying bills with PayPal may incur fees. These fees can be in the form of transfer fees or other fees.

- Limits : PayPal has a limit for making bill payments. This limit may vary depending on your account type.

- Limitations : Paying bills with PayPal can only be done by companies or businesses that accept PayPal payments.

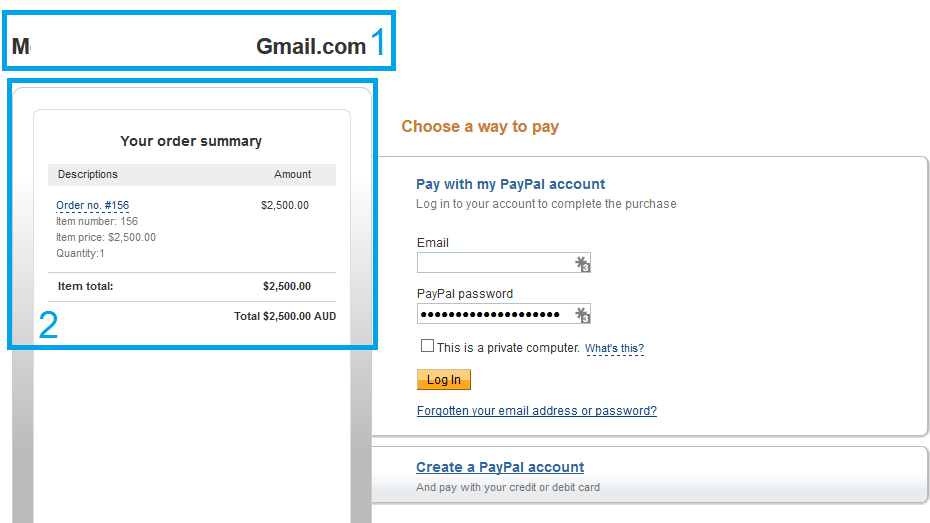

How to Pay Bills with PayPal

Here’s how to pay bills with PayPal:

- Open a PayPal Account : Open your PayPal account and log into the account.

- Select Payment Method : Select the payment method you want, for example credit card or bank account.

- Enter Payment Information : Enter payment information, such as payment amount and due date.

- Payment Confirmation : Confirm payment and wait until the payment process is complete.

Conclusion

Paying bills with PayPal is very easy and convenient. PayPal allows you to make bill payments online or via mobile. While there are some drawbacks, the benefits of paying bills with PayPal are much greater. By using PayPal, you can save costs, make secure payments, and have flexibility in making payments. Therefore, if you haven’t tried paying bills with PayPal, now is a good time to do so.