PayPal’s account cancellation policies

PayPal’s account cancellation policy is designed to protect users and keep the platform safe. However, understanding complex policies can be difficult. Let’s discuss the ins and outs of canceling a PayPal account.

First, you should differentiate between account restrictions and account cancellation. Account restrictions are temporary and PayPal blocks certain transactions while you resolve the issue. Account cancellation, on the other hand, is permanent and closes your account completely.

There are several reasons why PayPal might cancel your account. This includes violation of the user agreement, unauthorized activity, fraud, and unfair use. If PayPal believes your account has violated its policies, they can cancel it without notice.

Before canceling your account, PayPal will usually provide a warning or restrict your account. If you receive such a notification, it is important to respond promptly and resolve any issues raised. Failure to respond may result in account cancellation.

Once your account is cancelled, you may not be able to access your balance or use any PayPal services. However, you may still be entitled to withdraw any remaining funds in your account. PayPal usually provides instructions on how to do this in the cancellation notice.

It is important to note that account cancellation is a serious action that can have a significant impact on your ability to conduct online transactions. If you are considering canceling your account, please read PayPal’s policies carefully and contact customer service if you have any questions.

If you cancel your account due to security concerns, PayPal recommends immediately closing all cards or bank accounts linked to the account. This will help prevent unauthorized use.

Keep in mind that PayPal account cancellation policies may change over time. It is always recommended to check the latest version of the policy on the PayPal website before taking any action. By understanding these policies, you can avoid unexpected account cancellations and better protect your account.

Link between inactive accounts and PayPal limits

PayPal is famous for its fast and easy online payment services. However, many users may not be aware of account cancellation policies that may limit their transactions.

One common trigger for account cancellation policies is an inactive account. If your account is not used for a certain period of time, PayPal reserves the right to freeze or cancel your account. This is done to protect users from fraud and other unauthorized activities.

The period of account inactivity that is considered reasonable varies depending on the type of account. For personal accounts, PayPal usually disables accounts that have not been used for 12 months. Business accounts, on the other hand, may require a shorter period of inactivity before being subject to cancellation.

When an account is cancelled, PayPal will limit the funds you have. You will not be able to access or transfer those funds until your account is restored. This can be a hassle if you rely on PayPal to accept payments or pay for goods and services.

To avoid account cancellation, it is important to carry out regular account activities. This could be sending or receiving a payment, updating your account information, or changing your password. Performing any activity on your account will reset the inactivity timer and prevent your account from being cancelled.

If your account has been cancelled, you can contact PayPal customer service to request reinstatement. The account recovery process may require verifying your identity and updating your account information. Once your account is restored, you will be able to access your funds and continue using PayPal as usual.

In conclusion, PayPal’s account cancellation policy is designed to protect users from fraudulent activity. By understanding these policies and maintaining regular account activity, you can avoid unwanted account cancellations and ensure continued access to your funds. If your account is ever cancelled, don’t panic. Contact PayPal customer service to begin the account recovery process and get access to your funds again.

Steps to avoid account suspension or cancellation

Steps to Avoid PayPal Account Suspension or Cancellation

PayPal, one of the world’s largest online payment services, has a strict account cancellation policy to protect its users from fraud and other illegal activities. If your account is suspended or cancelled, it can be very inconvenient and put your financial activities at risk. To avoid this, it is important to understand PayPal’s policies and take steps to comply with them.

Verify Your Identity

An important first step is to verify your identity with PayPal. This helps them ensure that you are the person authorized to use the account. You can do this by providing personal information, such as your name, address, and Social Security number. The verification process may involve providing supporting documents, such as a copy of an identity card or utility invoice.

Use Your Account Responsibly

One of the best ways to avoid suspension or cancellation is to use your account responsibly. Avoid engaging in activities that violate PayPal policies, such as sending or receiving payments for illegal goods or services, money laundering, or terrorism financing. Make sure your transactions are valid and comply with PayPal’s terms of service.

Monitor Account Activity

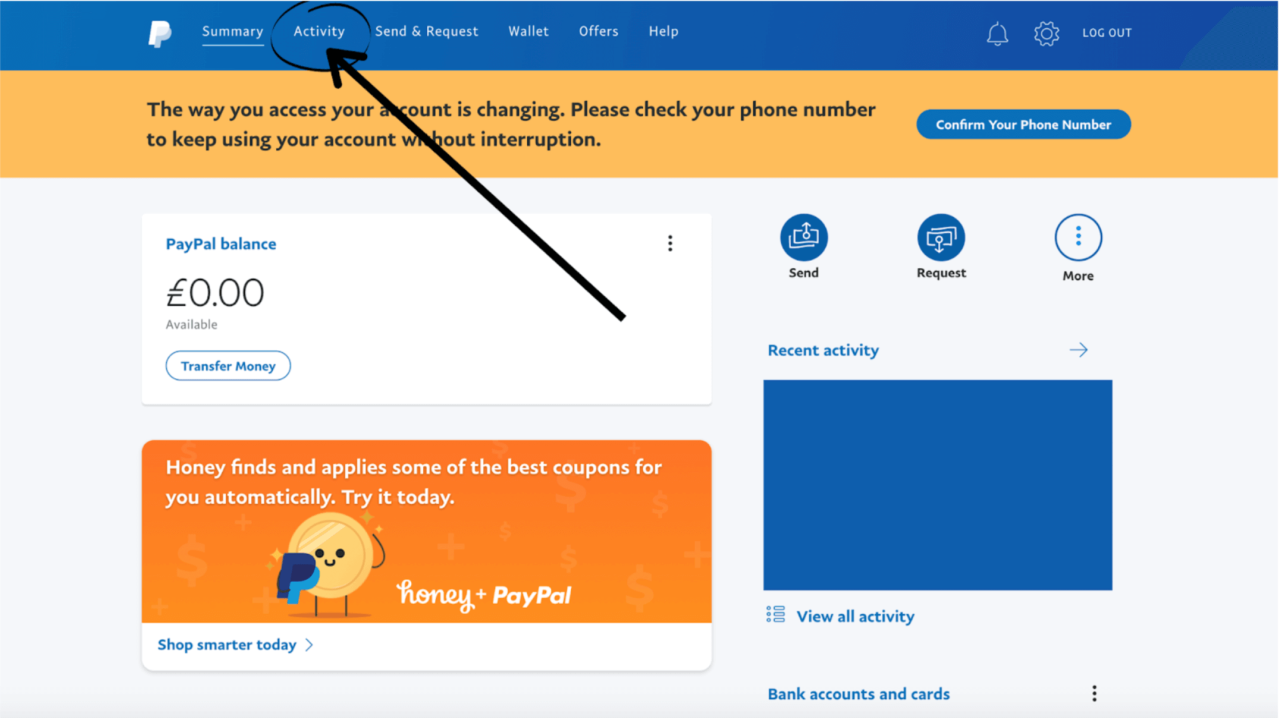

Stay alert to your account activity and report any suspicious activity to PayPal immediately. If you see unauthorized transactions or signs of unauthorized access, act quickly to protect your account and funds. The sooner you report a problem, the sooner PayPal can take action.

Communicate with PayPal

If you receive notification of account suspension or cancellation, it is important to communicate with PayPal. Explain your situation and provide any evidence that can support your case. PayPal may be willing to review their actions and reactivate your account if they believe you have not violated any policies.

Protect Your Personal Information

One of the best ways to prevent unauthorized access to your PayPal account is to protect your personal information. Use a strong, unique password for your PayPal account, and never share it with anyone. Avoid accessing your account from public computers or networks, and always be alert to phishing emails that may try to steal your information.

By following these steps, you can significantly reduce the risk of your PayPal account being suspended or cancelled. Complying with PayPal policies and using the platform responsibly will help you keep your account and funds safe.

Can PayPal cancel your bank account if it is linked to your PayPal account and you become inactive or are permanently limited on PayPal?

Can PayPal Cancel Your Bank Account If It’s Linked to Your PayPal Account and It Becomes Inactive or Permanently Restricted?

PayPal is one of the world’s most popular online payment services, allowing users to carry out financial transactions easily and safely. However, some users may be concerned about what will happen if they become inactive or permanently restricted on their PayPal account. One of the most common questions is: can PayPal cancel your bank account if it is linked to your PayPal account and it becomes inactive or permanently restricted?

In this article, we’ll talk about what can happen if you become inactive or permanently restricted on your PayPal account, and how that affects your bank account connected to your PayPal account.

What Happens If You Become Inactive on Your PayPal Account?

If you become inactive on your PayPal account, it means you no longer use your PayPal account to make transactions or log into your account. In some cases, PayPal may deactivate your account if you do not use your account for a long time.

If your PayPal account is disabled, you will not be able to make transactions or access your account. However, this does not directly affect your bank account linked to your PayPal account. Your bank account is still active and can be used to make other transactions.

What Happens If You Are Permanently Restricted on Your PayPal Account?

If you are permanently restricted to your PayPal account, it means you can no longer use your PayPal account to make transactions or access your account. Permanent restrictions are usually imposed if you violate PayPal policies or commit unethical actions.

If you are permanently restricted on your PayPal account, PayPal may require you to remove the credit card or bank account associated with your PayPal account. However, this does not directly affect your bank account. Your bank account is still active and can be used to make other transactions.

Can PayPal Cancel Your Bank Account?

PayPal cannot directly cancel your bank account. Your bank account is an account owned by your bank, and only your bank can cancel or close your bank account.

However, if you become inactive or permanently restricted on your PayPal account, PayPal may require you to delete the credit card or bank account associated with your PayPal account. If you do not delete the bank account associated with your PayPal account, PayPal may send a request to your bank to delete the bank account.

If your bank receives a request from PayPal, they may send you a notification before deleting your bank account. However, this is not the same as PayPal canceling your bank account directly.

What Do You Need to Do If You Are Permanently Restricted on Your PayPal Account?

If you are permanently restricted on your PayPal account, there are a few things you need to do:

- Delete the credit card or bank account linked to your PayPal account : PayPal may ask you to delete the credit card or bank account connected to your PayPal account. Make sure you do this to avoid further problems.

- Look for other alternatives to make transactions : If you are permanently restricted to your PayPal account, you can no longer use your PayPal account to make transactions. Look for other alternatives such as credit cards, debit cards, or other online payment services.

- Contact your bank : If you are concerned about your bank account being linked to your PayPal account, contact your bank for more information.

Conclusion

PayPal cannot directly cancel your bank account if you become inactive or permanently restricted on your PayPal account. However, if you are permanently restricted on your PayPal account, PayPal may require you to remove the credit card or bank account associated with your PayPal account.

If you are concerned about your bank account being connected to your PayPal account, make sure you do the necessary things such as deleting the credit card or bank account connected to your PayPal account, looking for other alternatives to make transactions, and contacting your bank to request more information carry on.