Setting up automatic bank charges on PayPal

Setting up automatic bank billing in PayPal is an easy and convenient process that can save you time and energy. Here is a step by step guide on how to do it:

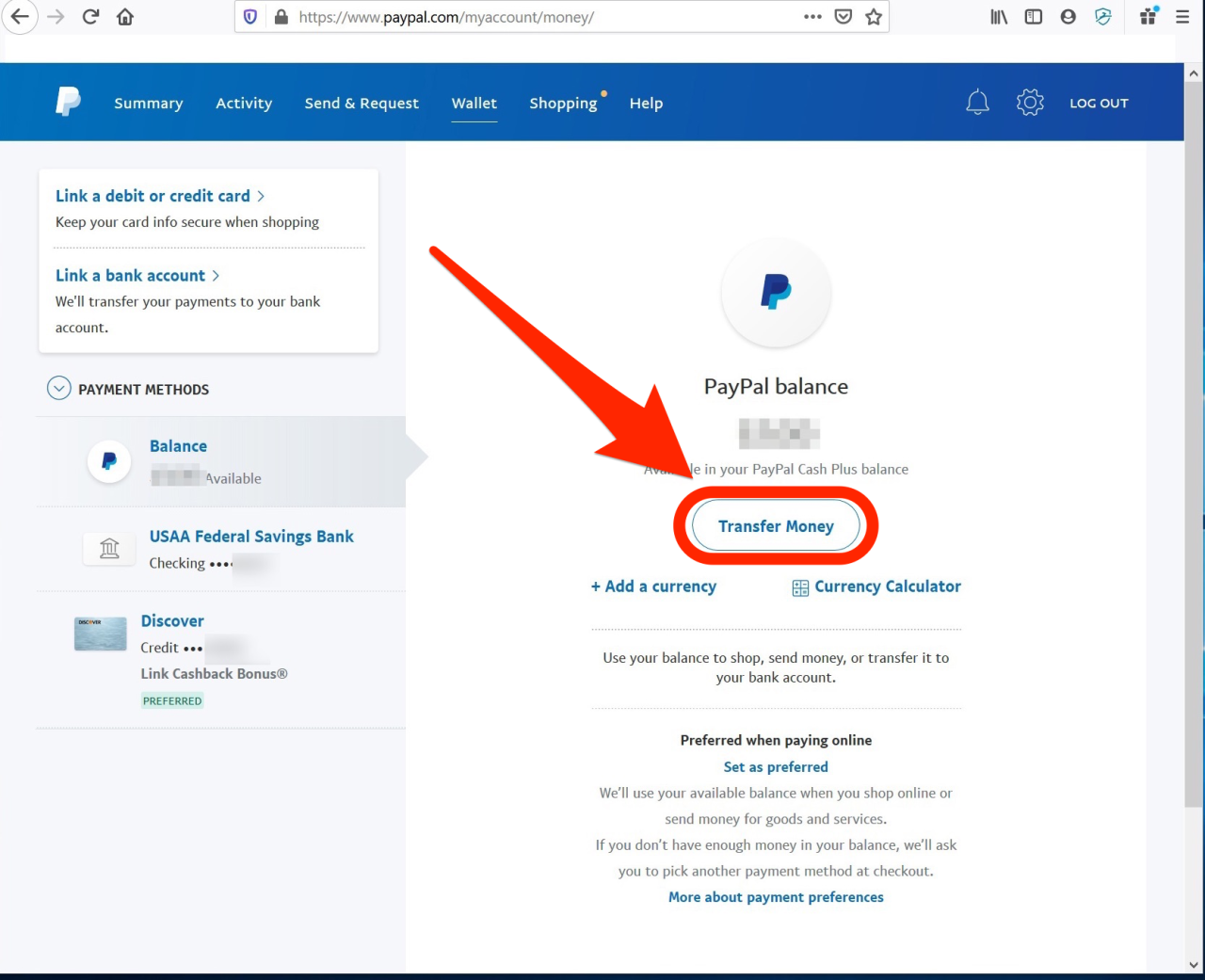

First, log in to your PayPal account and click the “Wallet” tab at the top of the page. Then, select “Add Bank” and enter your bank account information. Once your bank is connected, you can set up automatic billing by clicking “Set Up Automatic Billing.”

On the next page, select the type of service you want to charge automatically, such as a subscription or recurring payment. Enter the required information, such as the amount to be charged and the due date. You can also choose a billing frequency, such as monthly or annually.

Once you have entered this information, review the details carefully and click “Set Up Automatic Billing.” PayPal will process your request and send you a confirmation via email. You have now successfully set up automatic bank billing for the selected services.

It is important to note that automatic bank billing will be processed on the date you specify. Make sure you have sufficient funds in your bank account to cover such charges in due time. If there are insufficient funds, PayPal will try to charge your account again within a few days.

If you need to manage or cancel automatic billing, return to the “Wallet” tab in your PayPal account. Under the “Automatic Billing” section, you can view and manage all the billing you have set up. You can update billing details, cancel billing, or even add new billing from this page.

Setting up automatic bank billing on PayPal is an easy way to automate your payments and save time. By following the steps outlined in this article, you can set up automatic billing quickly and easily, ensuring that your payments are always made on time and accurately.

How PayPal auto-debits payments

Set up Bank Autofill on PayPal

PayPal offers a handy feature that lets you set up automatic top-ups from your bank account for recurring payments. This feature is especially convenient if you frequently make recurring payments, such as utility bills, rent, or subscriptions.

To set up bank autofill on PayPal, you need to link your bank account to your PayPal account. After that, you can create payment profiles for each merchant you want to pay automatically.

When creating a payment profile, you must specify the payment amount, due date, and payment frequency. You can also choose to allow PayPal to automatically convert currency if your merchant uses a different currency than your bank account.

Once your payment profile is set up, PayPal will automatically debit your bank account on the specified due date. You will receive an email notification before each deposit to give you an opportunity to review the transaction.

If you need to cancel automatic payments, you can do so at any time by editing the payments profile in your PayPal account. You can also contact PayPal customer service for help canceling automatic payments.

Bank autofill in PayPal is an easy and convenient way to manage your recurring payments. This saves time and hassle because you don’t have to remember to make payments on time or enter payment information manually.

By setting up bank autofill, you can ensure that your bills are paid on time, thereby avoiding late fees or service outages. It also provides peace of mind knowing that your payments will be made even when you are absent or forget.

Managing and canceling automatic charges on PayPal

Setting Up Automatic Payments in PayPal

PayPal offers a handy feature to set up automatic payments, saving you time and effort. Here’s how it works:

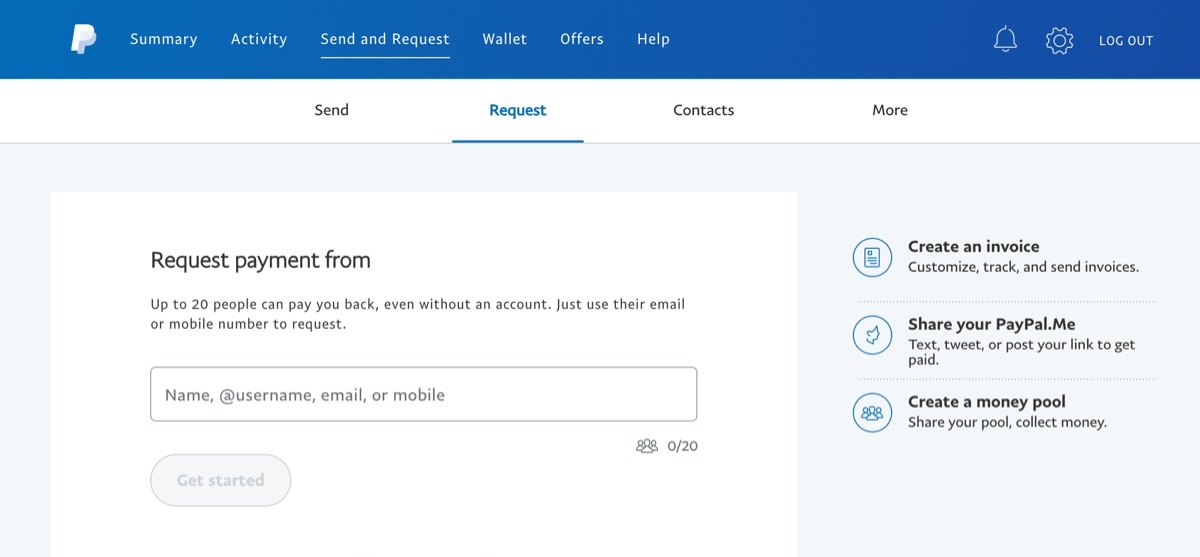

First, make sure you have a PayPal account associated with your bank account. Then, look for the “Automatic Payments” option in the “My Account” menu.

From there, you can add businesses or individuals you want to pay automatically. Enter their information and the amount you want to pay. You can also choose the payment frequency, such as monthly or yearly.

PayPal will make an agreement with the person receiving the payment, so that they can withdraw funds from your bank account automatically on a specified date. You will receive an email notification before each payment is made.

Benefits of Automatic Payments

Setting up automatic payments has many benefits. Firstly, it saves you time, because you don’t have to manually remember payments every month. Second, it helps avoid late fees, as PayPal will ensure your payment is sent on time. Lastly, it can help you manage your money better, as you can set a budget for your recurring payments.

Canceling Automatic Payments

If you want to cancel automatic payments, you can do so by following these steps:

1. Log in to your PayPal account.

2. Go to the “Automatic Payments” section in the “My Account” menu.

3. Find the automatic payment you want to cancel.

4. Click the “Cancel” option.

5. PayPal will confirm your cancellation.

It is important to note that you must cancel automatic payments before your next payment date to avoid paying fees.

Conclusion

Setting up automatic payments in PayPal is an easy and convenient way to simplify your recurring payments. By saving you time and effort, it can help you manage your finances more effectively.

Can PayPal automatically charge my bank account?

Can PayPal automatically charge my bank account?

PayPal is one of the most popular online payment systems in the world. With more than 400 million active users, PayPal offers convenience and security for users to carry out online transactions. However, some users may have questions about how PayPal works and whether the system can automatically charge fees to their bank accounts. In this article, we’ll talk about how PayPal works and whether the system can automatically charge fees to your bank account.

How PayPal works

PayPal is an online payment system that allows users to make transactions easily and safely. Here’s how PayPal works:

- Create an account : Users must create a PayPal account by entering personal information and email address.

- Added payment method : Users can add payment methods such as bank accounts, credit cards, or debit cards to their PayPal account.

- Create transactions : Users can make transactions using the existing balance in their PayPal account or by using a payment method that has been added.

- Transaction verification : PayPal will verify the transaction and ensure that the balance in the user’s account is sufficient to carry out the transaction.

What happens if I don’t have enough balance in my PayPal account?

If you do not have sufficient balance in your PayPal account to make a transaction, PayPal will automatically charge a fee to the payment method you added to your account. However, this will only happen if you have allowed PayPal to carry out transactions automatically.

How to set up automatic payment methods on PayPal

To set up an automatic payment method on PayPal, you can follow these steps:

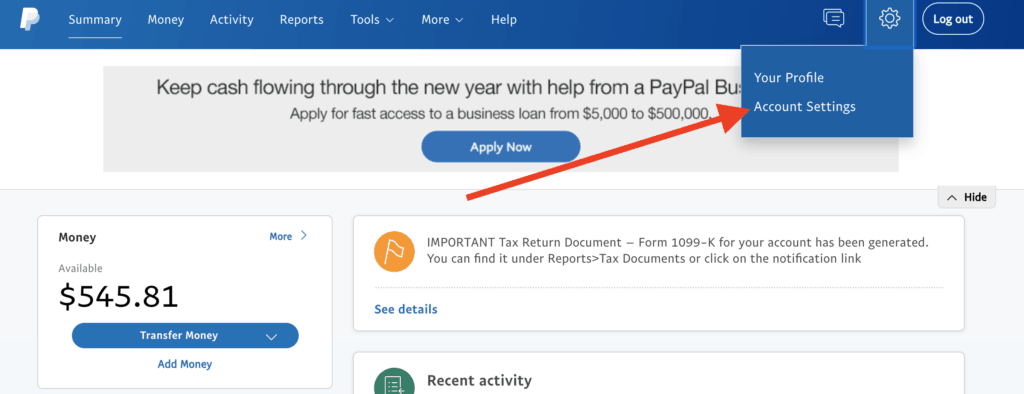

- Log in to your PayPal account : Log in to your PayPal account using your email address and password.

- Click on “Settings” : Click on the “Settings” button located at the top of the page.

- Click on “Payment” : Click on the “Payment” option located in the “Settings” menu.

- Click on “Payment methods” : Click on the “Payment method” option located at the top of the page.

- Select a payment method : Select the payment method you want to use to make transactions automatically.

- Check the “Use as primary payment method” box : Check the “Use as primary payment method” box to enable the automatic payment method.

What happens if I don’t set up an automatic payment method in PayPal

If you do not set up an automatic payment method in PayPal, your transaction will fail if there is not enough balance in your PayPal account. In this case, you will receive a notification from PayPal to top up your balance or set up an automatic payment method.

Security and privacy

PayPal has a very strict security system to protect users’ transactions and personal information. Following are some of the security features offered by PayPal:

- SSL Encryption : PayPal uses SSL encryption to protect transactions and user personal information.

- Identity verification : PayPal has a strict identity verification system to ensure that users are real people.

- Transaction monitoring : PayPal has a very strict transaction monitoring system to prevent fraud and abuse.

Conclusion

In this article, we’ve talked about how PayPal works and whether the system can automatically charge fees to your bank account. PayPal is a very useful and safe online payment system for making transactions. By setting up an automatic payment method in PayPal, you can make transactions more easily and quickly. However, keep in mind that you must always monitor the balance in your PayPal account to avoid failed transactions.

Tips for using PayPal safely

Here are some tips for using PayPal safely:

- Use a strong password : Use a strong and unique password for your PayPal account.

- Enable two-factor authentication : Enable two-factor authentication to increase the security of your PayPal account.

- Monitor balance : Monitor the balance in your PayPal account regularly to avoid failed transactions.

- Only use trusted payment methods : Only use trusted and safe payment methods to make transactions.

By following the tips above, you can use PayPal safely and comfortably.