PayPal withdrawal methods in Singapore

Hello friends in Singapore! You must often use PayPal for online transactions, right? So, this time we will discuss ways to withdraw money from PayPal to a bank account in Singapore. Don’t worry, it’s easy.

Withdraw via Local Bank Account

The most common way is to withdraw money to your local bank account. The method:

1. Log in to your PayPal account.

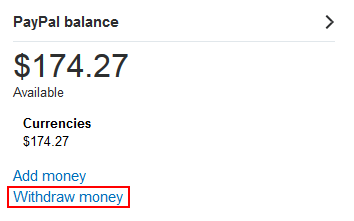

2. Click “Withdraw Funds” on the main menu.

3. Select “Withdraw to Your Bank Account.”

4. Enter the amount you want to withdraw and select the destination bank account.

5. Click “Withdraw Funds.”

The money will usually enter your bank account within 1-3 working days.

Withdraw via Instant Transfer (Instant Transfer)

If you need money quickly, you can use the Instant Transfer option. The method is almost the same as the method above, but with the addition of a more expensive service fee. The money will usually enter your bank account in a matter of minutes.

Withdraw via PayPal Cash Plus Card

For those of you who prefer to carry a debit card, you can use the PayPal Cash Plus Card. The method:

1. Apply for a PayPal Cash Plus card.

2. Once the card is approved, add balance to the card via your PayPal account.

3. You can withdraw money from the card at any ATM.

Withdraw Via Third Party Services

If you want more flexible options, you can use third-party services such as TransferWise or XE. These services usually charge lower service fees compared to direct PayPal.

Vital Records

Make sure the names on your PayPal account and bank account are the same.

There is a service fee charged for each withdrawal transaction.

Withdrawal times may vary depending on the method used.

So, those are the various ways to withdraw money from PayPal in Singapore. Choose the method that best suits your needs. If you have any questions, don’t hesitate to ask in the comments column. Good luck!

Local bank accounts for withdrawing PayPal funds

Well, now that you have earned a decent income through PayPal in Singapore, the next step is to withdraw those funds. The first option we will discuss is withdrawing money to your local bank account.

Withdrawing PayPal funds to a local bank account in Singapore is a relatively easy process. However, there are some details you need to know before starting.

First of all, not all banks in Singapore allow PayPal withdrawals. Some of the most commonly used banks for PayPal withdrawals in Singapore include DBS Bank, OCBC Bank, and United Overseas Bank (UOB).

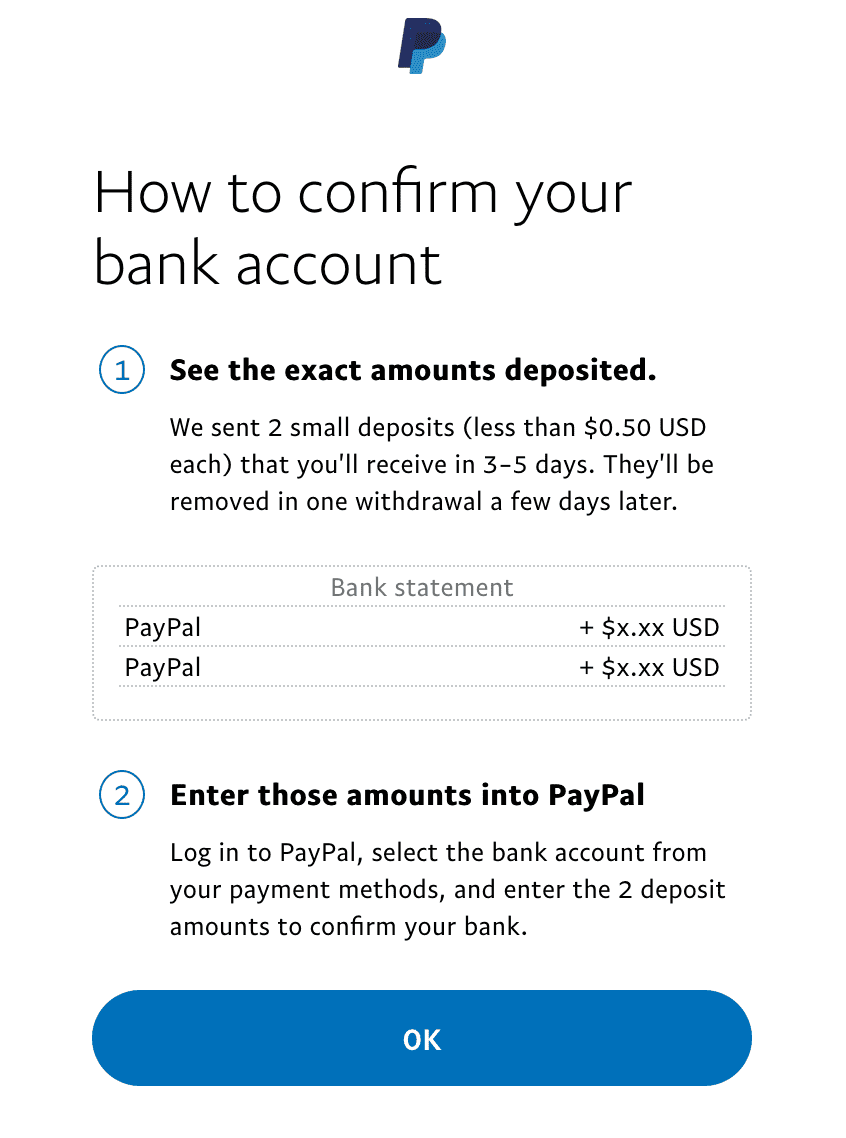

Once you’ve chosen a bank, the next step is to connect your bank account to PayPal. To do this, go to your PayPal account, click “Wallet,” then click “Connect Bank.” You will then be asked to provide your bank information, including account number and routing number.

Once your bank account is connected, you can withdraw your PayPal funds by following these steps:

1. Go to your PayPal account and click “Wallet”.

2. Click “Withdraw Funds”.

3. Select the bank account you want to withdraw funds from.

4. Enter the amount you want to withdraw.

5. Click “Continue”.

PayPal withdrawals are usually processed within 1-3 business days. Once the funds are processed, they will appear in your bank account.

It is important to note that PayPal charges a fee for withdrawals to local bank accounts in Singapore. Fees vary depending on the amount you withdraw. You can check the current fees on the PayPal website.

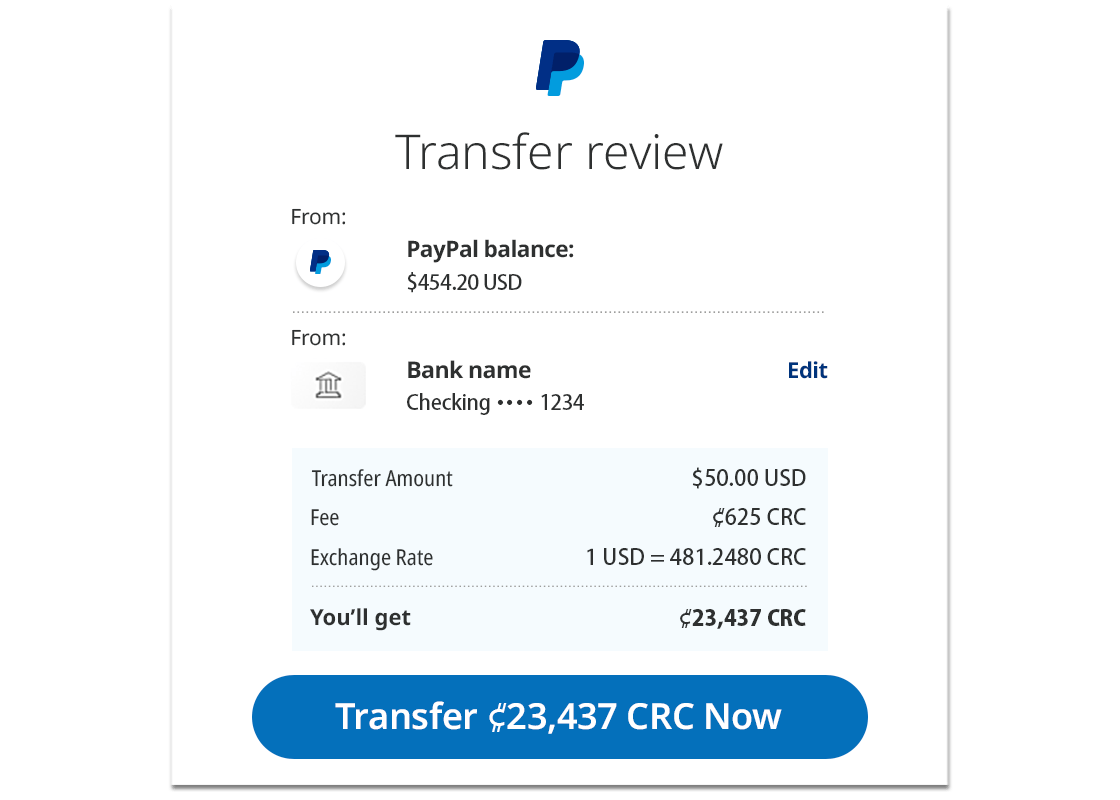

Apart from costs, you also have to consider the foreign exchange rate. If you withdraw your PayPal funds in a currency different from your bank account currency, PayPal will convert the funds using their own exchange rate. These exchange rates may not be in your favor, so it is important to check them before making a withdrawal.

Overall, withdrawing PayPal funds to a local bank account in Singapore is an easy process. However, there are some costs and details you need to know before getting started. By following the steps outlined above, you can ensure that your withdrawals are processed quickly and efficiently.

PayPal fees for withdrawing USD in Singapore

When withdrawing your funds from PayPal in Singapore, it is very important to be aware of the fees associated with the withdrawal method. This is because each withdrawal method comes with unique fees, which can affect the amount of money you receive.

One of the most common withdrawal methods is through a local bank. To withdraw your funds to a local bank account in Singapore, PayPal charges a flat fee of S$2.50, plus a currency conversion fee of 2.5%. For example, if you withdraw USD100, you will be charged S$2.50, plus a currency conversion fee of around S$1.25.

Another withdrawal method is via debit or credit card. PayPal charges a fee of 3.4% + S$0.50 for withdrawals using debit or credit cards. Thus, if you withdraw USD100, you will be charged around S$3.90.

For those who wish to withdraw their funds in foreign currency, PayPal also offers the option of withdrawing to an overseas bank account. However, it is important to note that the fees for this option may vary depending on the currency and destination country. For example, to withdraw funds to a USD bank account in the United States, PayPal charges a flat fee of USD5, plus a currency conversion fee of 2.5%.

In addition to withdrawal fees, PayPal may also charge foreign currency fees when you withdraw funds in a currency different from the currency of your PayPal account. These fees vary depending on the currency and may affect the amount of money you receive.

By understanding the withdrawal fees associated with each withdrawal method, you can make an informed decision on how best to withdraw your funds from PayPal in Singapore. This will allow you to maximize the amount of money you receive and avoid unnecessary fees.

Can one withdraw USD from PayPal in Singapore?

Is It Possible to Withdraw USD from PayPal in Singapore?

PayPal is one of the most popular online payment platforms in the world. With more than 440 million active users, PayPal allows you to make online transactions easily and securely. However, sometimes you may need access to your funds in cash, especially if you are abroad or have an urgent need.

In Singapore, PayPal is one of the most commonly used online payment methods. You can use PayPal to make online purchases, pay bills, and even send money to other people. However, the question is: is it possible to withdraw USD from PayPal in Singapore?

Security and Limitations

Before answering that question, keep in mind that PayPal has several security and limitations to protect users and prevent fraud. One such security is control over the withdrawal of funds. PayPal may limit withdrawals from your account if they suspect fraud or other suspicious activity.

Additionally, PayPal also has some limitations for withdrawing funds, depending on your account type and location. For example, if you have an unverified PayPal account, you may not be able to withdraw large amounts of funds.

Withdraw USD from PayPal in Singapore

Now, let’s answer the main question: is it possible to withdraw USD from PayPal in Singapore?

The answer is yes, but with some caveats. You can withdraw USD from PayPal in Singapore in several ways:

- Transfer to Local Bank Account : You can transfer USD from PayPal to your local bank account in Singapore. However, keep in mind that you may be charged transfer fees and foreign exchange commissions.

- Debit Cards : If you have a debit card issued by PayPal (such as the PayPal Debit Card), you can use the card to withdraw USD from ATMs in Singapore.

- Foreign Exchange Office : You can visit a foreign exchange office in Singapore to withdraw USD from PayPal. However, keep in mind that you may be charged foreign exchange fees and commissions.

How to Withdraw USD from PayPal in Singapore

Here are the steps to withdraw USD from PayPal in Singapore:

- Make sure your PayPal account is verified : Make sure your PayPal account is verified to ensure that you can withdraw funds without problems.

- Check Your Balance : Check your USD balance in your PayPal account to ensure that you have enough funds to withdraw.

- Select Withdrawal Method : Choose a withdrawal method that suits your needs, such as transfer to a local bank account, debit card, or foreign exchange office.

- Follow Instructions : Follow the instructions provided by PayPal or the withdrawal service provider to complete the withdrawal process.

Fees and Commissions

Please note that there are some fees and commissions associated with USD withdrawals from PayPal in Singapore. These fees and commissions may include:

- Transfer fees: Transfer fees charged by PayPal or withdrawal service providers.

- Foreign exchange commission: Foreign exchange commission charged by a bank or withdrawal service provider.

- ATM Fees: ATM fees charged by banks or withdrawal service providers.

Conclusion

Withdrawing USD from PayPal in Singapore is possible, but keep in mind that there are some security and limitations to consider. Make sure your PayPal account is verified, check your balance, and choose a withdrawal method that suits your needs. Additionally, keep in mind that there are some fees and commissions associated with USD withdrawals from PayPal in Singapore.

With these things in mind, you can withdraw USD from PayPal in Singapore easily and safely.