Withdrawing USD to INR in India

If you have traveled abroad or received payments in US Dollars (USD), you may be wondering how to withdraw Indian Rupees (INR) in India. This process is quite easy and can be done through various channels.

One of the easiest ways to withdraw USD is through a bank. Most banks in India offer this service, and you can usually withdraw cash in INR directly from your account. However, keep in mind that banks may charge a fee for this service.

You can also withdraw USD through a foreign exchange provider. These providers usually offer better exchange rates than banks, so you may be able to get more INR for your USD. However, it is important to research these providers carefully to ensure that they are legitimate and trustworthy.

Another way to withdraw USD is to use an online currency exchange website or app. This website allows you to exchange USD for INR online and then withdraw your funds to your bank account. This process is usually easy and convenient, but you must ensure that the website is secure and reputable.

If you don’t have a bank account in India, you can still withdraw USD by converting it into INR at a currency exchange. This currency exchange can usually be found at airports, hotels and shopping centers. However, it is important to compare exchange rates in different places to get the best deal.

Tips to Withdraw USD to INR:

Bring your passport or official ID card.

Notify your bank of your plans to withdraw USD.

Compare the exchange rates offered by different providers.

Check any fees that may apply.

Always count your money before leaving a currency exchange.

The process of withdrawing USD to INR is relatively easy and convenient. By following the tips above, you can ensure that you get the best exchange rate and that your funds are safe.

PayPal withdrawal methods and limitations in India

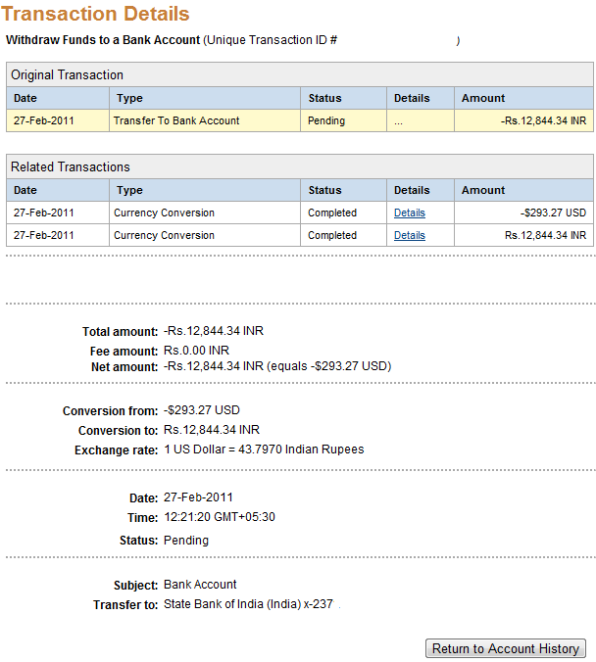

Well, let’s discuss how to withdraw USD to INR in India using PayPal. As one of the main withdrawal methods available, this is a relatively easy process. However, there are some limitations and requirements you need to know before getting started.

First, you need to have a verified PayPal account linked to your Indian bank account. Once your account is ready, you can withdraw your USD funds by following these steps:

1. Log in to your PayPal account.

2. Click “Balance” at the top of the screen.

3. Click “Withdraw” in the “Your Balance” section.

4. Select the amount you want to withdraw in USD.

5. Select “INR” as the currency you want to receive.

6. Click “Continue” to process the withdrawal.

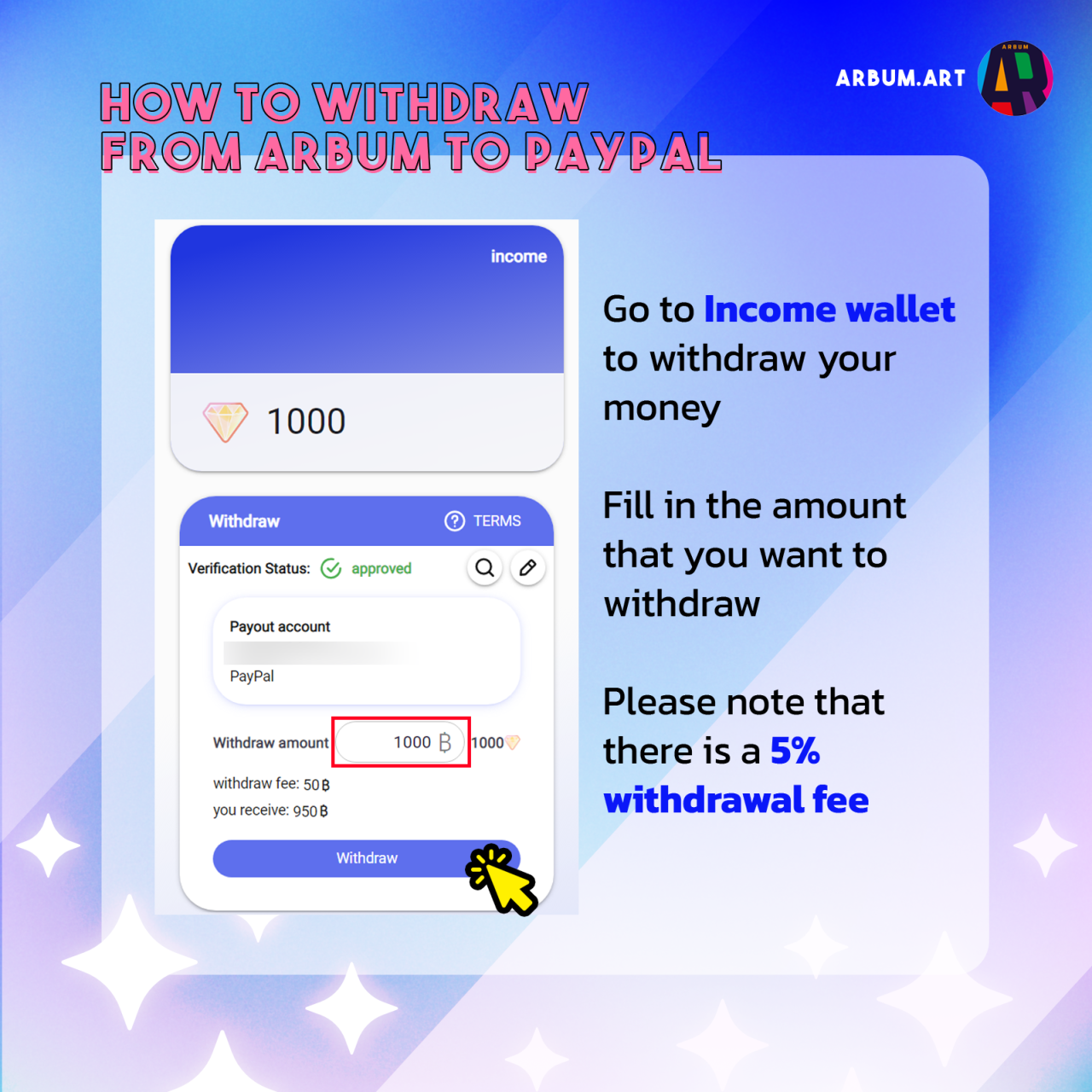

The withdrawal process usually takes 2-3 business days to complete. Once the funds arrive in your bank account, you can access them as usual. However, keep in mind that PayPal charges a 5% international withdrawal fee, so make sure you take that into account when determining the amount you want to withdraw.

Additionally, there are some withdrawal restrictions to be aware of. The maximum amount you can withdraw in a day is 10,000 USD, and the maximum amount you can withdraw in a month is 25,000 USD. If you need to withdraw a larger amount, you may need to contact PayPal customer support for assistance.

Overall, withdrawing USD to INR in India using PayPal is a relatively easy and safe process. Make sure you meet the requirements and understand the limitations before starting. By following the steps mentioned above, you can quickly and easily access your funds in your local currency.

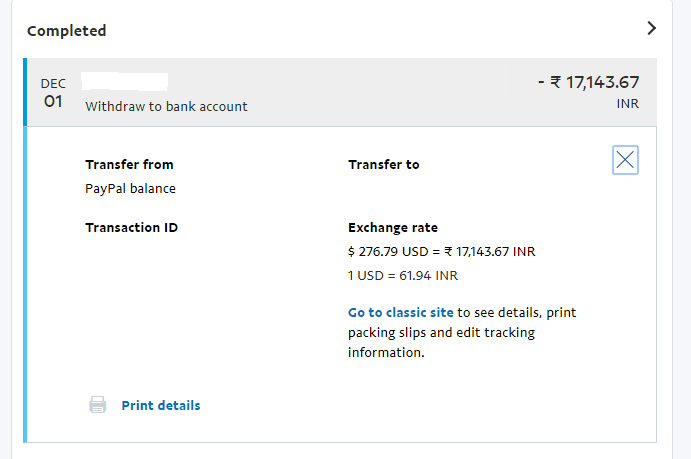

Currency conversion rates for PayPal withdrawals in India

Currency Exchange Rate Conversion for PayPal Withdrawals in India

Making a withdrawal from PayPal to INR can be an uncomplicated process, but understanding currency exchange rates is essential to ensure a profitable transaction. Exchange rates may vary depending on global financial markets and fees charged by PayPal.

When you initiate a withdrawal, PayPal will automatically convert USD to INR based on the applicable exchange rate. However, this exchange rate may differ from the average market rate. Therefore, it is recommended to check the latest exchange rates before completing a transaction.

You can find updated exchange rates on the PayPal website or via the mobile app. These exchange rates are updated regularly to reflect market fluctuations. When making a withdrawal, be sure to confirm the exchange rate PayPal uses to avoid any unwanted surprises.

Additionally, PayPal charges a small transaction fee for withdrawals of INR. These fees typically range from $0.25 to $3.00, depending on your withdrawal amount. Once exchange rates and fees are considered, you will receive an INR amount equivalent to your USD amount.

To maximize exchange rates, it is recommended to avoid withdrawals during periods of market volatility. If the USD value is higher against INR, your withdrawal will result in more INR. On the other hand, if the INR value is higher, your withdrawal will result in less INR.

By monitoring exchange rates and considering transaction fees, you can ensure that you are getting the best value for your PayPal withdrawals. Additionally, you can always contact PayPal support if you have questions or problems regarding currency conversion.

Can I withdraw USD from PayPal in India?

Can Withdraw USD from PayPal in India?

PayPal is one of the world’s largest electronic payment services, allowing users to make online transactions easily and securely. In India, PayPal is very popular among business people and individuals who want to make international transactions. However, there are some frequently asked questions by PayPal users in India, such as “Can I withdraw USD from PayPal in India?” or “How to withdraw USD from PayPal in India?” In this article, we will discuss the possibility of withdrawing USD from PayPal in India and the process required.

PayPal Policy on Withdrawals

PayPal has a strict policy regarding withdrawing funds from PayPal accounts. In India, PayPal only allows withdrawals in Indian Rupees (INR) and does not allow withdrawals in other foreign currencies, including USD. This is because PayPal has partnered with local banks in India to provide safe and efficient withdrawal services.

Reasons Why USD Withdrawals Are Not Allowed

There are several reasons why PayPal does not allow USD withdrawals in India. Here are some of the main reasons:

- Indian Government Policy : The Indian government has a strict policy regarding foreign currency transactions, including withdrawal of funds in USD. PayPal must comply with this policy to avoid legal issues.

- Transaction Risk : Withdrawing USD can increase transaction risk, because there is a possibility that funds cannot be withdrawn or funds are deducted by the bank.

- Transaction Fees : USD withdrawals may result in higher transaction fees, as there is the possibility of higher currency conversion fees.

How to Withdraw USD from PayPal in India

However, there are several ways to withdraw USD from PayPal in India, although not directly. Here are some ways you can do this:

- Using an International Debit or Credit Card : You can use any international debit or credit card accepted by banks in India to withdraw USD from PayPal. However, make sure the card has no withdrawal limits and has low transaction fees.

- Using Foreign Currency Transaction Services : There are several foreign currency transaction services that can help you withdraw USD from PayPal in India. However, make sure the service is trusted and has low transaction fees.

- Using a Local Bank : You can contact local banks in India to see if they can help you withdraw USD from PayPal. However, make sure the bank has a clear policy regarding withdrawing funds in USD.

Tips and Warnings

Here are some tips and warnings to consider when withdrawing USD from PayPal in India:

- Make Sure You Understand PayPal Policies : Make sure you understand PayPal’s policies regarding withdrawals and associated transaction fees.

- Choose a Trusted Transaction Service : Make sure you choose a transaction service that is trusted and has low transaction fees.

- Check Transaction Fees : Make sure you check transaction fees before withdrawing funds.

- Do Not Share Account Information : Never share your PayPal account information with others to avoid misuse.

Conclusion

In this article, we have discussed the possibility of withdrawing USD from PayPal in India and the process required. Although PayPal does not allow withdrawals in USD, there are several ways you can withdraw USD from PayPal in India. However, make sure you understand PayPal’s policies, choose a trusted transaction service, and check transaction fees before withdrawing funds.