Using PayPal Debit Card for withdrawals

Imagine being able to access money from a PayPal account easily and comfortably, without having to go through a complicated withdrawal process. Well, the smart solution is at your fingertips: PayPal Debit Card!

This card links your PayPal account with your chosen bank account, so you can make withdrawals by simply swiping or inserting the card into an ATM. Plus, you can use this card at millions of physical and online stores, receive cash at the cashier or post office, and even make online purchases with ease.

The process of using a PayPal Debit Card is very simple. First, activate your card via the PayPal app or website. After that, simply insert the card into an ATM or use it at your favorite store. Funds will be immediately debited from your PayPal account, providing convenience and peace of mind.

The benefits of using a PayPal Debit Card are numerous. You no longer have to wait days for withdrawals, saving time and effort. You can also avoid withdrawal fees that are usually charged for traditional withdrawal methods. Plus, this card is widely accepted, so you have the flexibility to access your money anytime, anywhere.

What’s interesting, the PayPal Debit Card is also equipped with advanced security features to protect your finances. A chip and PIN system ensures secure transactions, while real-time notifications notify you of every card activity. A dedicated customer support team is also ready to help if you run into any problems.

In conclusion, PayPal Debit Card is the ideal solution to access PayPal funds easily and efficiently. From ATM withdrawals to online purchases, this card offers unmatched convenience, security and flexibility. If you’re looking for a practical way to manage your PayPal account, PayPal Debit Card is the answer.

Withdrawal limits and fees using the card

When using a PayPal Debit Card to withdraw cash, it is important to be aware of applicable withdrawal limits and fees. Daily and monthly withdrawal limits vary depending on your PayPal account level. To avoid unnecessary fees, check your withdrawal limits before visiting an ATM.

Fees associated with cash withdrawals using a PayPal Debit Card include ATM transaction fees, which are usually charged by the ATM operator, and foreign withdrawal fees, if the withdrawal is made in a country other than your home region. Fees may vary depending on the ATM location and service provider.

To use your PayPal Debit Card at an ATM, simply insert your card, enter your PIN, and determine the amount you want to withdraw. Be sure to check the ATM screen for any transaction fees that may apply.

If you are unsure of your withdrawal limits or need any other assistance with withdrawals using your PayPal Debit Card, contact PayPal customer service. They can provide clear information and help you complete the transaction smoothly.

Withdrawing cash using a PayPal Debit Card is an easy and convenient way to access your funds. By knowing the applicable withdrawal limits and fees, you can avoid unnecessary fees and ensure a smooth withdrawal experience. Always check your withdrawal limits before making a withdrawal and contact PayPal support if you have questions or need help.

Alternatives to withdrawing PayPal funds without linking a bank account

If you are looking for an alternative way to withdraw PayPal funds without needing to link a bank account, a PayPal Debit Card could be the perfect solution. Here’s how to use it and some of its advantages:

Let’s start with how to register for a PayPal Debit Card. All you need is a verified PayPal account and a qualifying residential address. The registration process is quick and easy, and once approved, the card will be sent to your address in approximately 7-10 business days.

Now that you have the card, you can use it to withdraw PayPal funds at any ATM that displays the MasterCard logo. Just insert the card, enter the PIN, and determine the amount you want to withdraw. Daily withdrawal limits and fees will vary depending on ATM policies and your PayPal account limits.

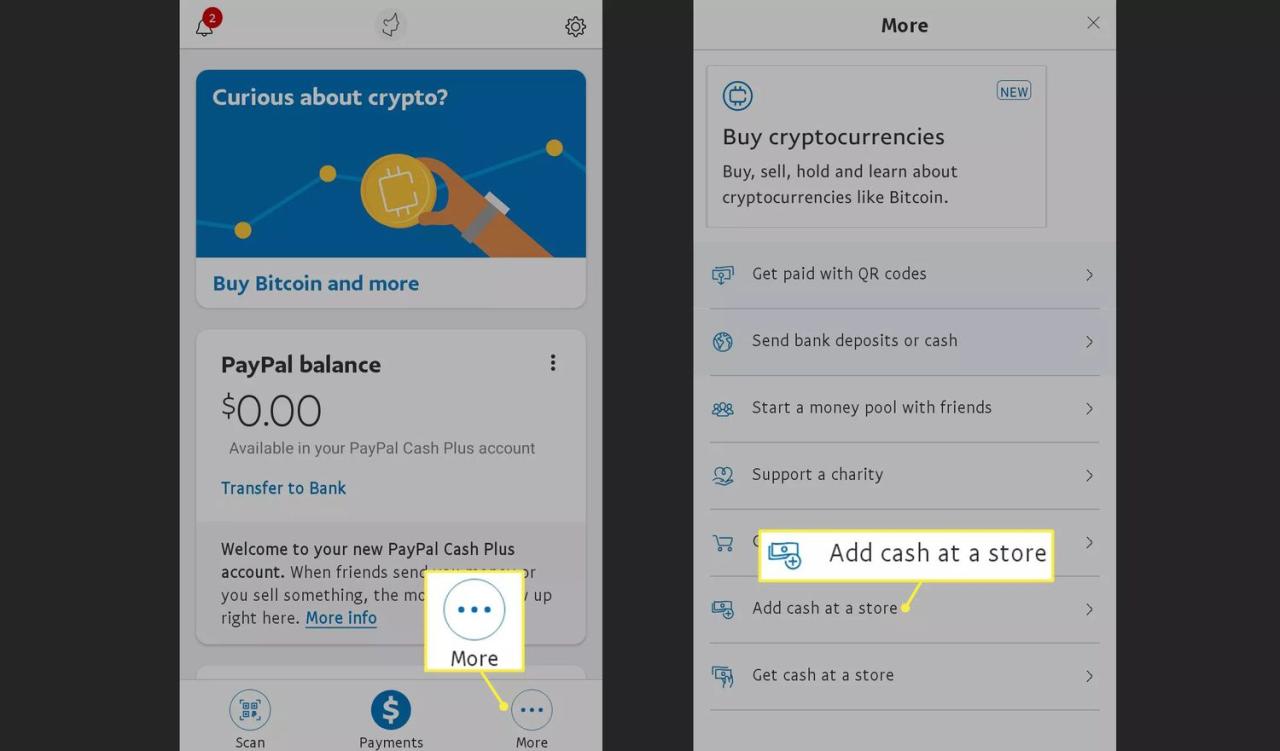

In addition to ATM withdrawals, you can also use your PayPal Debit Card to make purchases and get cash in stores. When making a purchase, the card is charged directly from your PayPal balance. And if you need cash while shopping, just ask if the store offers a “cash back” facility.

One of the main advantages of using a PayPal Debit Card is its flexibility. Because it’s not linked to a specific bank account, you can control the amount you want to withdraw at any time. Additionally, withdrawal fees are usually lower compared to transferring funds to a bank account.

However, it is important to remember that the PayPal Debit Card cannot be used at all ATMs or stores. Always check first whether the service provider accepts MasterCard. Apart from that, make sure you read the conditions and fees for using the card carefully to avoid unwanted surprises.

Overall, the PayPal Debit Card offers a fast, easy, and flexible way to withdraw PayPal funds without needing to link a bank account. So, if you are looking for a practical alternative, consider using a PayPal Debit Card and take advantage of its advantages.

Can I withdraw money from my PayPal account (not my linked bank account) using PayPal debit card directly?

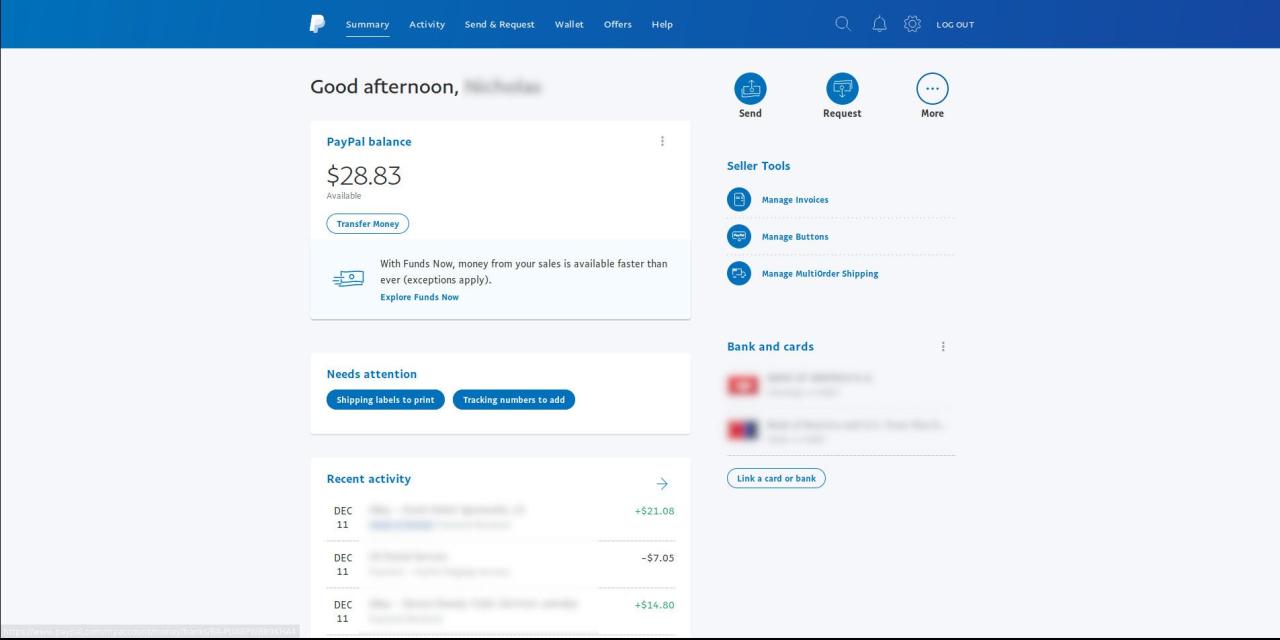

Using a PayPal Debit Card to Withdraw Money from a PayPal Account

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal offers various conveniences in carrying out online transactions. One of the most useful features of PayPal is the PayPal debit card. A PayPal debit card allows you to use your PayPal account balance to make purchases directly, both online and offline. But, can you withdraw money from your PayPal account directly using a PayPal debit card? Let’s discuss it further.

Get to know the PayPal Debit Card

A PayPal debit card is a card issued by PayPal to allow users to directly access their PayPal account balance. PayPal debit cards are similar to regular debit cards, but with some differences. A PayPal debit card has no connection to your bank account, so you don’t need to have a bank account to use a PayPal debit card.

The PayPal debit card can be used to make purchases online and offline, as well as to withdraw money from ATMs. However, there are some limitations and fees you need to know about before using a PayPal debit card.

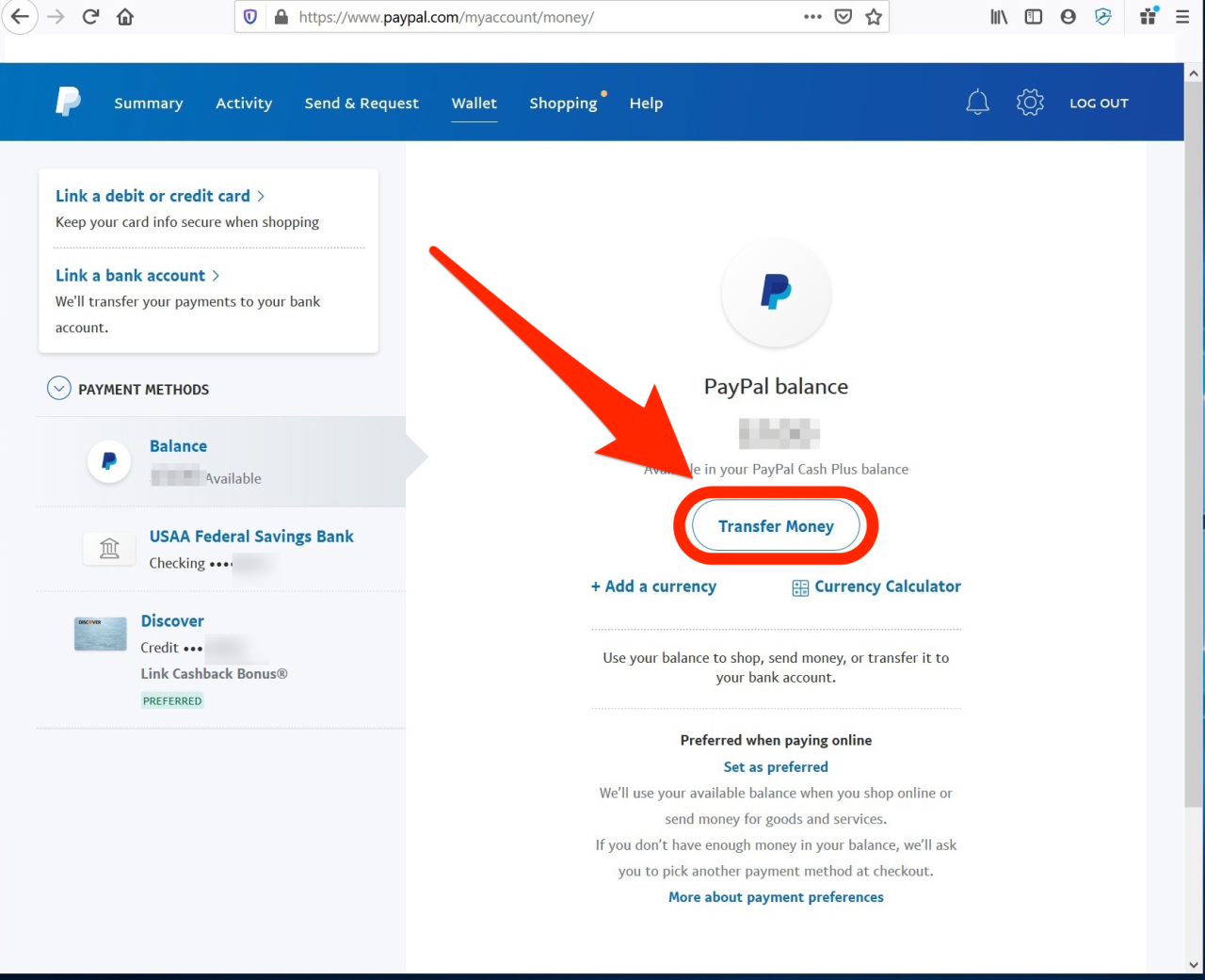

Withdraw Money from PayPal Account using PayPal Debit Card

Now, let’s address the main question: can you withdraw money from your PayPal account directly using a PayPal debit card? The answer is yes, but with some terms and conditions.

You can withdraw money from your PayPal account using a PayPal debit card at an ATM that accepts Visa or Mastercard cards. However, you need to ensure that you have sufficient balance in your PayPal account to make a withdrawal.

Here are the steps to withdraw money from your PayPal account using a PayPal debit card:

- Make sure you have an active PayPal debit card associated with your PayPal account.

- Look for an ATM that accepts Visa or Mastercard cards.

- Insert your PayPal debit card into the ATM and select the “Cash Withdrawal” option.

- Enter the amount of money you want to withdraw and confirm the transaction.

- Wait a few moments until the transaction is complete and your money comes out of the ATM.

Please note that there are some fees that will apply when you withdraw money from your PayPal account using a PayPal debit card. These fees can include withdrawal fees, currency conversion fees, and other fees.

Fees Charged when Withdrawing Money from a PayPal Account

Here are some fees you may incur when you withdraw money from your PayPal account using a PayPal debit card:

- Withdrawal fees: These fees are charged by PayPal for each withdrawal of money from your PayPal account. Withdrawal fees can range from 1.5% to 2% of the amount of money withdrawn.

- Currency conversion fees: If you withdraw money in a currency different from your PayPal account currency, then a currency conversion fee will be charged. Currency conversion fees can range from 2.5% to 4.5% of the amount withdrawn.

- ATM Fees: Some ATMs may charge a fee for each money withdrawal. ATM fees can range from 1% to 3% of the amount withdrawn.

Conclusion

Withdrawing money from your PayPal account using a PayPal debit card can be a convenient and easy option. However, keep in mind that there are some fees that may be charged when withdrawing money. Make sure you understand the fees charged before withdrawing money from your PayPal account using a PayPal debit card.

In conclusion, PayPal debit cards can be used to withdraw money from your PayPal account directly. However, make sure you understand the fees charged and some of the terms and conditions that apply. This way, you can use your PayPal debit card more effectively and efficiently.