Despite facing stiff competition, PayPal continues to innovate and expand its offerings. The company recently launched PayPal Here, a mobile payment terminal that allows businesses to accept credit and debit card payments. PayPal also continues to expand its geographic reach, with plans to enter new markets around the world.

With its extensive global reach, comprehensive product offering, and large user base, PayPal appears to be in a strong position to maintain its dominance in the online payments market for years to come.

History and Founder of PayPal

PayPal, one of the world’s leading financial technology companies, has a rich history and a visionary founder. Let’s explore the origins and key figures behind PayPal’s success.

PayPal’s origins began in 1998 with the founding of Confinity, a software development company led by Max Levchin and Peter Thiel. The following year, Confinity merged with X.com, an online banking company founded by Elon Musk.

After this merger, X.com introduced a money transfer service which eventually became PayPal. In 2001, the company name was changed to PayPal, and the company spun off from X.com.

The establishment of PayPal cannot be separated from the role of the visionaries behind it. Max Levchin, a computer scientist, focuses on the platform’s core technology and develops innovative features. Peter Thiel, an investor and entrepreneur, provided strategic direction and helped shape the company’s vision.

Elon Musk, while no longer actively involved in PayPal’s day-to-day operations, plays an important role in shaping the company’s culture and driving innovation. Musk’s vision of the future of financial technology provided the foundation for PayPal’s growth and success in the years to come.

In addition to its famous founder, PayPal is backed by a talented team of engineers and executives who continue to push the boundaries of financial technology. Thanks to the innovative vision and support of its founders, PayPal has grown into a global leader in online payments and financial services.

The company continues to expand its offerings, including mobile payments, loans, and money management services. With its commitment to innovation and customer experience, PayPal aims to continue shaping the world of digital finance for years to come.

PayPal: The World’s Largest Online Payment Company

PayPal is one of the largest online payment companies in the world. Founded in 1998, PayPal has become one of the most recognized and trusted brands in the digital payments industry. In this article, we’ll discuss news and developments related to PayPal, as well as how the company continues to evolve to meet customer needs.

History of PayPal

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially, the company was called Confinity, and focused on payments via PalmPilot devices. However, in 2000, Confinity merged with X.com, a company founded by Elon Musk. In 2001, the company changed its name to PayPal, and expanded its online payment services to various platforms.

PayPal Development

In 2002, PayPal was acquired by eBay, the world’s largest online auction company. This acquisition helped PayPal increase its usage, and the company became one of the most popular payment methods on eBay. In 2015, PayPal was separated from eBay, and became an independent company.

PayPal Services

PayPal offers a variety of online payment services, including:

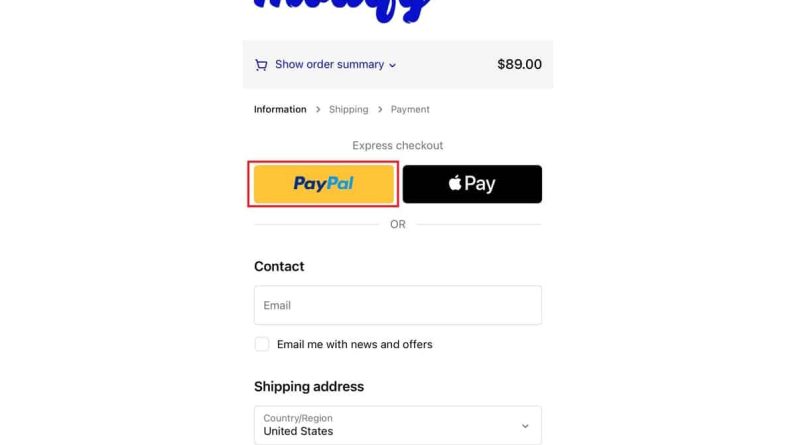

- Online Payment : PayPal allows users to make online payments to merchants that accept PayPal.

- Fund Transfer : PayPal allows users to send and receive funds to and from bank accounts or credit cards.

- PayPal Card : PayPal offers a debit card that can be used to shop at online and offline stores.

- PayPal Credit : PayPal offers a credit service that allows users to make payments in installments.

PayPal News

In recent years, PayPal has announced several important news, including:

- iZettle Acquisition : In 2018, PayPal acquired iZettle, a mobile payments company based in Sweden. This acquisition helps PayPal increase its presence in Europe.

- Digital Payment Services : In 2019, PayPal launched a digital payment service that allows users to make payments via a mobile application.

- Collaboration with Google : In 2019, PayPal announced a partnership with Google to enable users to make payments through Google Pay.

Technological development

PayPal continues to invest in technology to improve service and user experience. Some examples of technological developments carried out by PayPal are:

- Artificial Intelligence (AI) : PayPal uses AI to improve security and fraud detection.

- Blockchain : PayPal has been experimenting with blockchain technology to increase payment security and transparency.

- Mobile Payments : PayPal continues to improve its mobile payment services to enable users to make payments more easily and quickly.

Conclusion

PayPal is the world’s largest online payments company and continues to grow to meet customer needs. With its wide range of online payment services, PayPal has become one of the most recognized and trusted brands in the digital payments industry. In recent years, PayPal has announced several important news, including the acquisition of iZettle and digital payment services. The company continues to invest in technology to improve services and user experience.

Benefits of Using PayPal

Here are some benefits of using PayPal:

- Security : PayPal uses advanced security technology to protect user transactions.

- Comfort : PayPal allows users to make online payments easily and quickly.

- Flexibility : PayPal offers a variety of online payment services, including funds transfers and debit cards.

Tips for Using PayPal

Here are some tips for using PayPal:

- Use a strong password : Make sure you use a strong and unique password for your PayPal account.

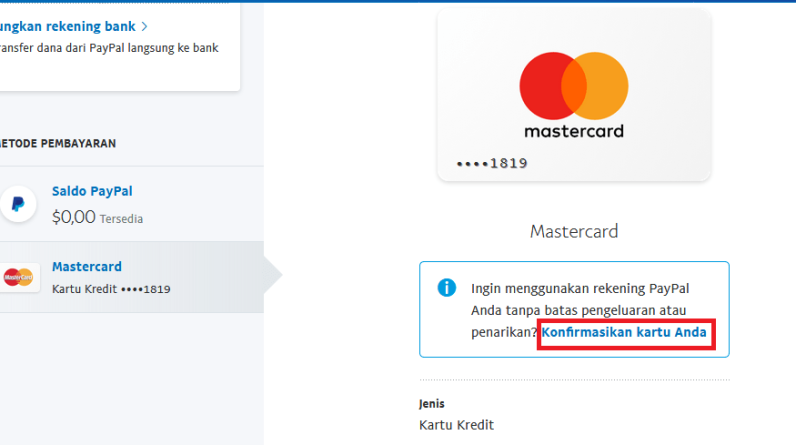

- Account verification : Verify your PayPal account for increased security and flexibility.

- Use the mobile app : Use the PayPal mobile application to make payments more easily and quickly.

Common Mistakes Made by PayPal Users

Here are some common mistakes made by PayPal users:

- Using weak passwords : Using a weak password can make your PayPal account vulnerable to fraud.

- Not verifying account : Not verifying your PayPal account may result in you losing access to your account.

- Using unofficial applications : Using unofficial apps can make you vulnerable to fraud.

By understanding PayPal-related news and developments, you can improve your experience and security when using this online payment service.

PayPal’s Advantages in the World of Online Payments

PayPal’s journey to glory in the world of online payments is rooted in its rich history and the extraordinary vision of its founders. Originally founded in 1998 as Confinity, a security software company, PayPal underwent an important transformation in 2000 when it merged with X.com, an online bank founded by Elon Musk. This merger marks the beginning of PayPal’s focus on digital payments.

Peter Thiel, one of PayPal’s founders, played a key role in forming the company. As CEO, Thiel brings extensive experience in cybersecurity and a clear vision for the future of online payments. Under his leadership, PayPal grew rapidly, introducing innovative services such as money transfers between users and payments on merchant websites.

In 2002, PayPal became part of eBay, the e-commerce giant. This acquisition gave PayPal access to a huge customer base and accelerated its growth. However, PayPal isn’t just resting on its laurels. The company continues to innovate, introducing new features such as PayPal Here for in-store transactions and PayPal Me for easily sending and receiving money.

Over time, PayPal developed into a giant in the field of online payments. Its platform is used by millions of businesses and consumers around the world. PayPal’s success is driven by its commitment to security, convenience, and innovation. The company has invested heavily in its security infrastructure to protect its users’ data. Additionally, PayPal is very easy to use, with a user-friendly interface and a variety of payment options.

In addition to its core services, PayPal also offers a range of additional products and services such as small business loans, fraud protection, and payment solutions for online marketplaces. This allows PayPal to provide comprehensive payment solutions to its customers, meeting the needs of any business.

PayPal’s prominence in the world of online payments can also be attributed to its continued adoption of the technology. The company has pioneered the use of artificial intelligence and machine learning to improve customer experience, detect fraud and automate processes. PayPal has also formed strategic partnerships with leading companies such as Visa, Mastercard, and UnionPay, expanding its reach globally.

In conclusion, PayPal’s history and founders have shaped the company’s identity as a leader in the world of online payments. With a clear vision, continuous innovation, and commitment to security and convenience, PayPal has revolutionized the way people and businesses conduct transactions. The company’s success reflects the determination of its founders and its ability to adapt and thrive in the ever-changing payments landscape.