Hello everyone, we will talk about the types of fees on PayPal. Just like other services, PayPal also has fees that are charged in certain situations. Come on, let’s discuss them one by one.

1. Processing Fee:

This is a fee charged when you receive payment from a customer. The amount depends on several factors, such as the sending country, transaction currency, and the type of PayPal account you have.

2. Withdrawal Fees:

When you withdraw funds from your PayPal account to your bank account, PayPal also charges a fee. These fees vary depending on the withdrawal method used and the currency withdrawn.

3. Foreign Exchange Fees:

If you receive or withdraw funds in a currency different from your PayPal account currency, PayPal will charge a currency exchange fee. This fee is usually a percentage of the amount transferred.

4. Cancellation and Refund Fees:

If you cancel the transaction or return funds to the customer, PayPal will charge a small fee. This is to cover processing and administration costs.

5. Subscription Fee:

If you subscribe to certain paid services on PayPal, such as PayPal Pro, you will be charged a monthly subscription fee. This fee provides access to additional features and services.

6. Additional Fees:

In some cases, PayPal may charge additional fees, such as payment denial fees, dispute fees, and inactive account fees. Be sure to check PayPal’s Terms of Service for more information.

So, those are the types of fees that you might encounter when using PayPal. It is important to consider these fees when estimating your total transaction costs. By understanding the applicable fees, you can make the right decisions and avoid unwanted surprises.

How to Calculate Goods and Services Costs

When you want to make transactions using PayPal, understanding the different types of fees is important to ensure you budget effectively. While PayPal offers a convenient service, there are some fees associated with using the platform. Let’s discuss the types of fees so you can calculate the total cost of the transaction.

The first is the processing fee. This is a percentage of the transaction amount that PayPal charges to facilitate the transfer of funds. These fees vary depending on your region and account type. For personal accounts, processing fees are usually around 2.9% plus a fixed fee based on currency. As for business accounts, the fees may be lower, depending on your transaction volume.

Next, there are withdrawal fees. If you want to transfer money from your PayPal account to a bank account or debit card, PayPal may charge a withdrawal fee. These fees also vary depending on the region and account type. Typically, withdrawal fees range from $0.50 to $4.99 per transaction.

If you receive payments in a currency different from your account’s base currency, you may be charged a currency conversion fee. PayPal converts currencies using specific exchange rates, which can differ slightly from market exchange rates. This difference is reflected in conversion costs. You can avoid these fees by opening a PayPal account in multiple currencies.

Apart from the costs mentioned above, there are also other costs that rarely occur. This includes refund fees, dispute fees, and inactive account fees. A refund fee is charged when you return the payment to the customer. Dispute fees arise if a customer disputes your transaction. An inactive account fee is charged if you do not use your PayPal account for a certain period of time.

By understanding the types of fees associated with PayPal, you can easily calculate the total cost of a transaction. This will help you budget effectively and avoid unwanted surprises when using the platform. Remember to consider your transaction volume, region, and account type when estimating your fees.

Tips for Reducing Transaction Fees on PayPal

PayPal is known as a reliable payment platform that makes transferring money online easy. However, like other financial services, PayPal charges certain fees that you need to be aware of. Understanding these types of fees is critical to managing your financial expenses and reducing transaction costs when using PayPal.

One of the main types of fees at PayPal is transaction fees. This fee is charged every time you make or receive a payment through the platform. Fees vary depending on the type of transaction and your location. For example, transaction fees for domestic payments are usually lower than for international payments.

An additional fee you may encounter with PayPal is a currency exchange fee. If you send or receive money in a currency different from your base currency, PayPal will charge a conversion fee. This fee is usually calculated as a percentage of the amount transferred.

PayPal also charges fees for withdrawing funds from your account. Withdrawal fees vary depending on the withdrawal method you choose. Typically, transferring funds to your bank account incurs lower fees than withdrawing funds via credit or debit card.

In addition to these fees, PayPal may also charge fees for additional features and services. For example, you may be charged for features such as recurring payments, seller protection, or dispute resolution services.

To reduce transaction costs when using PayPal, there are several tips you can consider. First, try to make transactions in your base currency as much as possible. This will help you avoid currency conversion fees.

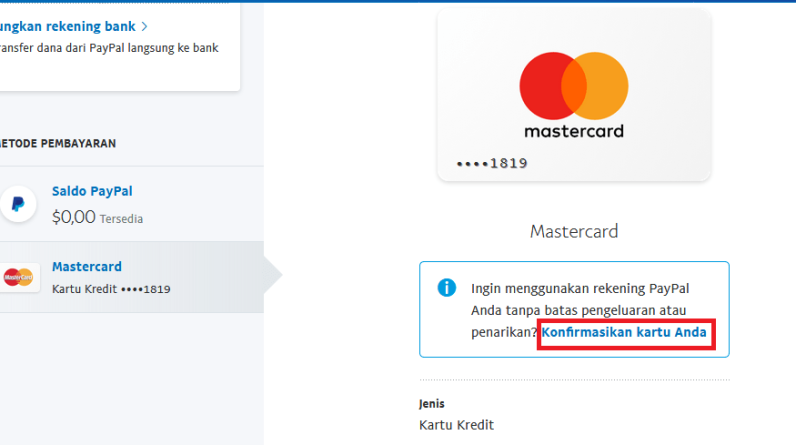

Second, if you frequently make large transactions, consider signing up for a PayPal Business account. This account offers lower transaction fees and access to additional features.

Third, find out about the promotions and discounts that PayPal offers. Sometimes, PayPal offers discounts on transaction fees for certain types of transactions or during promotional periods.

Finally, consider using an alternative payment method that does not require PayPal transaction fees. For example, you can use a credit or debit card that offers rewards or benefits when you use it for online transactions.

By understanding the types of fees on PayPal and implementing fee reduction tips, you can minimize transaction costs and maximize the benefits of using this payment platform.

Goods and Services Fees on PayPal: What You Need to Know

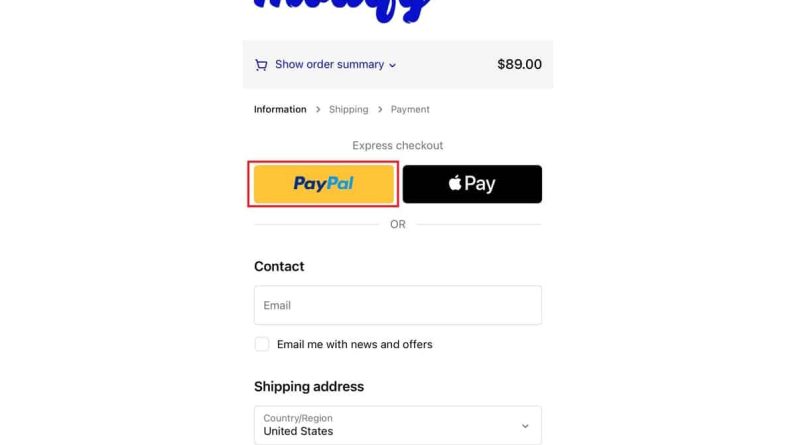

PayPal is one of the most popular online payment methods in the world. With more than 400 million active accounts, PayPal enables users to make payments and send money quickly and securely. However, as with all financial services, PayPal also charges fees for some types of transactions. One of the most common types of fees at PayPal is Goods and Services fees.

In this article, we’ll take a closer look at PayPal’s Goods and Services fees, including what they are, how to calculate them, and some tips for reducing them.

What is the Goods and Services Fee on PayPal?

Goods and Services Fees are fees charged by PayPal for transactions involving the purchase of goods or services. This fee is charged for transactions that meet several criteria, such as:

- Purchase goods or services from sellers who have a PayPal account

- Transactions made using payment methods supported by PayPal, such as credit cards or bank transfers

- Transactions that have significant value (usually above IDR 1,000,000)

Goods and Services fees at PayPal usually range between 2.9% + IDR 3,000 for domestic transactions and 4.4% + IDR 3,000 for international transactions. This fee is charged to the seller and will be deducted from the amount paid by the buyer.

How to Calculate Goods and Services Fees on PayPal?

Calculating Goods and Services fees on PayPal is quite simple. The following is the formula used:

Goods and Services Fees = (Number of Transactions x Fee Level) + Additional Fees

- Transaction Amount is the amount paid by the buyer

- Fee Rate is the percentage of fees charged by PayPal (usually 2.9% for domestic transactions and 4.4% for international transactions)

- Additional Fees are fees charged by PayPal for each transaction (usually IDR 3,000)

Example:

- Transaction Amount: IDR 100,000

- Fee Rate: 2.9% (domestic transactions)

- Additional Fee: IDR 3,000

Goods and Services Costs = (IDR 100,000 x 2.9%) + IDR 3,000 = IDR 2,900 + IDR 3,000 = IDR 5,900

How to Reduce Goods and Services Fees on PayPal

While Goods and Services fees on PayPal cannot be avoided completely, there are ways to reduce them. Here are some tips:

- Use the correct payment method : PayPal offers several payment methods that have varying fees. For example, bank transfers usually have lower fees than credit cards.

- Make bigger transactions : Goods and Services fees on PayPal are charged for each transaction. By making larger transactions, you can reduce the number of transactions and fees charged.

- Use the right PayPal account : PayPal has several types of accounts, such as Personal accounts and Business accounts. Business accounts have lower fees than Personal accounts.

- Check the fees charged : Before making a transaction, check the fees charged by PayPal. Make sure you understand what fees will be charged and how to calculate them.

Advantages and Disadvantages of Goods and Services Fees on PayPal

Here are some of the advantages and disadvantages of Goods and Services fees on PayPal:

Excess:

- Goods and Services fees on PayPal are relatively low compared to fees charged by other financial services.

- Goods and Services fees at PayPal are charged only for transactions that meet certain criteria.

- PayPal offers several payment methods that have varying fees.

Lack:

- Goods and Services fees on PayPal can add significant costs to large transactions.

- Goods and Services fees on PayPal are charged only to sellers, not buyers.

- Goods and Services fees on PayPal can vary depending on transaction type and location.

Conclusion

Goods and Services Fees on PayPal are fees charged for transactions involving the purchase of goods or services. This fee is charged for transactions that meet certain criteria and have significant value. While Goods and Services fees on PayPal cannot be avoided completely, there are ways to reduce them. By understanding how to calculate Goods and Services fees on PayPal and using the right tips, you can reduce the fees you incur and make more effective transactions.