Introduction to PayPal Adaptive Payments

Imagine you are a business owner who has just completed a large transaction. However, you need to split those payments across different parties, such as suppliers, partners, and affiliates. In the past, this could be a complicated and time-consuming process.

Fortunately, in this digital era, there is a solution that can make things easier: PayPal Adaptive Payments. This intuitive service allows you to send one payment to multiple recipients efficiently and securely.

PayPal Adaptive Payments works in a similar way to GPS routing. You specify the amount to send, the recipient, and how you want the payment to be distributed (percentage or fixed amount). PayPal then handles payment processing, breaking down the total into specified amounts and crediting each recipient according to your instructions.

A great feature of PayPal Adaptive Payments is its flexibility. You can set up serial payments, split payments automatically, and even customize the payment experience to suit your specific needs. Additionally, the service can be integrated with your websites and applications, simplifying the payment process and improving the user experience.

One of the main advantages of using PayPal Adaptive Payments is security. PayPal’s encrypted and secure platform ensures that your financial information is protected. Recipients also get peace of mind knowing that they will receive their payments on time and without hassle.

Additionally, PayPal Adaptive Payments is cost-effective. Service fees for each transaction are usually lower compared to traditional payment processing methods. These savings can add up over time, especially if you make frequent bulk payments.

For business owners looking to streamline and simplify their payment processes, PayPal Adaptive Payments is an excellent choice. The service offers great functionality, reliable security, and profitable cost savings. With PayPal Adaptive Payments, you can focus on running your business with confidence, knowing that your payments will be handled easily and efficiently.

How to implement Adaptive Payments in marketplace apps

Imagine you are running a marketplace application where buyers and sellers come together to transact. Managing payments is usually a complicated and time-consuming part, especially when multiple parties are involved. PayPal Adaptive Payments comes to your rescue, offering a seamless and efficient solution for multi-party transactions.

PayPal Adaptive Payments allows you to split payments between multiple recipients in a single transaction. This is especially useful in situations like markets, where you have buyers, sellers, and possibly a commission involved. By leveraging PayPal’s Adaptive Payments API, you can automate this process, creating a better experience for all users.

Let’s see how it works. When a buyer makes a purchase in your marketplace app, PayPal Adaptive Payments creates a single transaction that is split among the recipients. First, payment is received by your PayPal account. From there, you can use the Adaptive Payments API to distribute funds to the seller’s PayPal account and your own account for commission fees.

The benefits of Adaptive Payments are clear. First and foremost, it simplifies the payment process, reducing complexity and the risk of errors. Plus, it saves time and costs, as you don’t have to process each payment separately. Users also benefit because they can complete transactions smoothly and safely in one place.

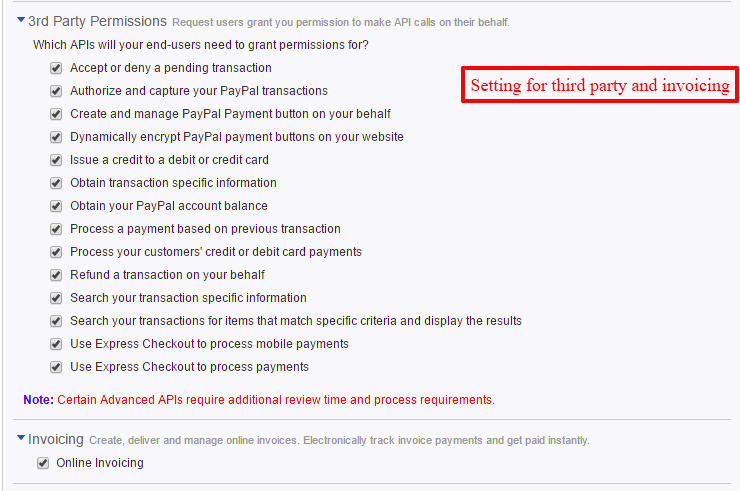

Implementing Adaptive Payments in your marketplace app is easy. All you need to do is integrate the PayPal Adaptive Payments SDK or API with your platform. PayPal provides comprehensive documentation and resources to help you get started. With a little effort, you can enjoy the benefits of Adaptive Payments and provide a better transaction experience to your users.

So, if you run a marketplace application and are looking for a flexible and efficient payment solution, consider PayPal Adaptive Payments. It provides an easy and secure way to process payments between parties, automating the process, and creating a better transaction experience. By integrating PayPal Adaptive Payments, you can take your marketplace app to the next level and provide more value to your users.

Alternative PayPal solutions for marketplaces

Explore PayPal Alternative solutions for Marketplaces: An Introduction to PayPal Adaptive Payments

PayPal Adaptive Payments offers innovative solutions for businesses running marketplaces or multi-vendor platforms. Unlike traditional payment methods PayPal, Adaptive Payments allows you to facilitate payments between buyers, sellers, and other third parties in one seamless transaction.

The flexibility of Adaptive Payments is an added value for the marketplace. You can customize payment flows to suit your business needs, allowing buyers to make payments to multiple vendors at once, whether it’s commissions, shipping costs, or tax payments. Additionally, you can set a percentage or fixed amount to be paid to third parties, such as affiliates or payment processors.

PayPal Adaptive Payments key features include:

Parallel Payments: Facilitate payments to multiple recipients in one transaction.

Sequential Payments: Set a defined payment sequence so that sellers receive funds only after certain conditions are met.

Discontinue Payments: Securely stop payments if necessary, safeguarding your funds in the event of a dispute or cancellation.

The benefits of using PayPal Adaptive Payments for marketplaces include:

Seamless Shopping Experience: Provide an efficient and secure checkout experience for your customers.

Transaction Flexibility: Customize payment flows to fit your unique business model.

Efficient Vendor Management: Easily manage vendor, payment, and affiliate data in one place.

Security and Protection: Take advantage of PayPal’s advanced security measures to protect your transactions.

Implementing PayPal Adaptive Payments into your marketplace platform is easy. With a comprehensive API and extensive documentation, you can quickly integrate this feature into your system.

In conclusion, PayPal Adaptive Payments is a powerful solution for businesses that operate marketplaces or multi-vendor platforms. Its flexibility and innovative functionality allow you to customize the payment experience, increase efficiency and provide an exceptional shopping experience to your customers. If you’re looking for a payment solution that can enhance your platform, PayPal Adaptive Payments is worth considering.

Can I use Paypal Adaptive Payments to build a marketplace-like application?

Using PayPal Adaptive Payments to Build Marketplace Apps

In recent years, marketplace apps have become increasingly popular, allowing users to buy and sell products and services online. However, building a successful marketplace app requires more than just an elegant online platform. You also need to consider a secure and efficient payment system to manage transactions between sellers and buyers.

One option available for marketplace apps is to use PayPal Adaptive Payments. In this article, we’ll talk about what PayPal Adaptive Payments is, how it works, and whether it’s suitable for building marketplace apps.

What is PayPal Adaptive Payments?

PayPal Adaptive Payments is an online payment service that allows marketplace applications to manage transactions between sellers and buyers. This service allows sellers to accept payments from buyers without having to have a PayPal account. Apart from that, PayPal Adaptive Payments also offers other features such as order management, product delivery, and refunds.

How PayPal Adaptive Payments Works

PayPal Adaptive Payments works in the following way:

- The seller creates a PayPal account and enables Adaptive Payments.

- Sellers create marketplace applications that can accept payments from buyers.

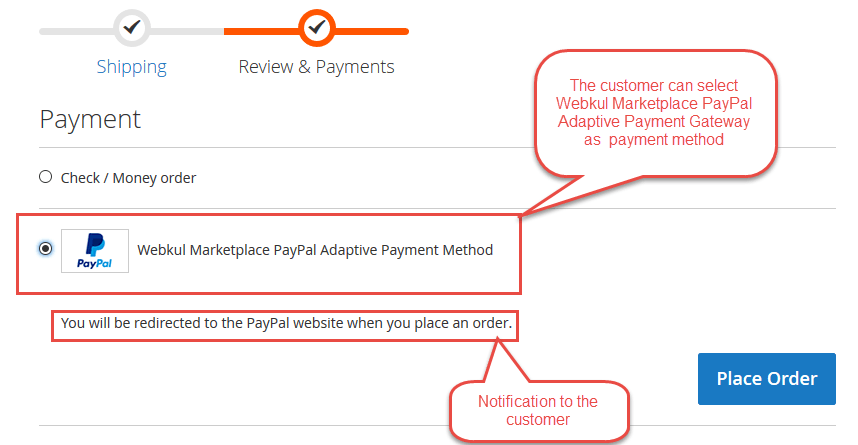

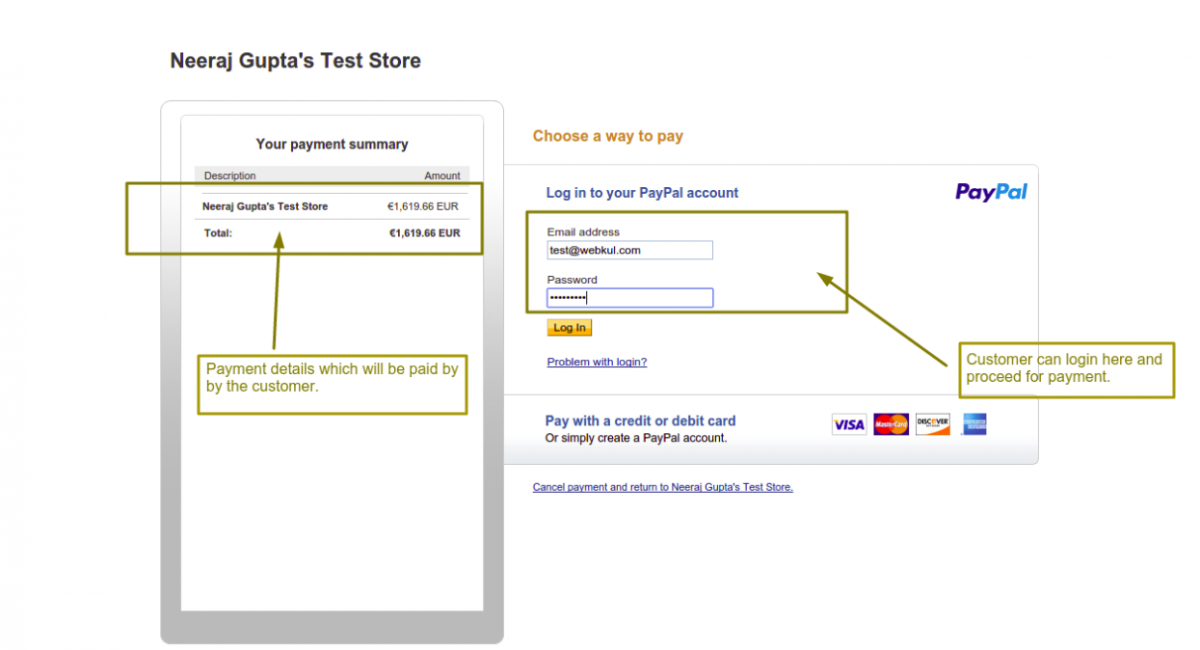

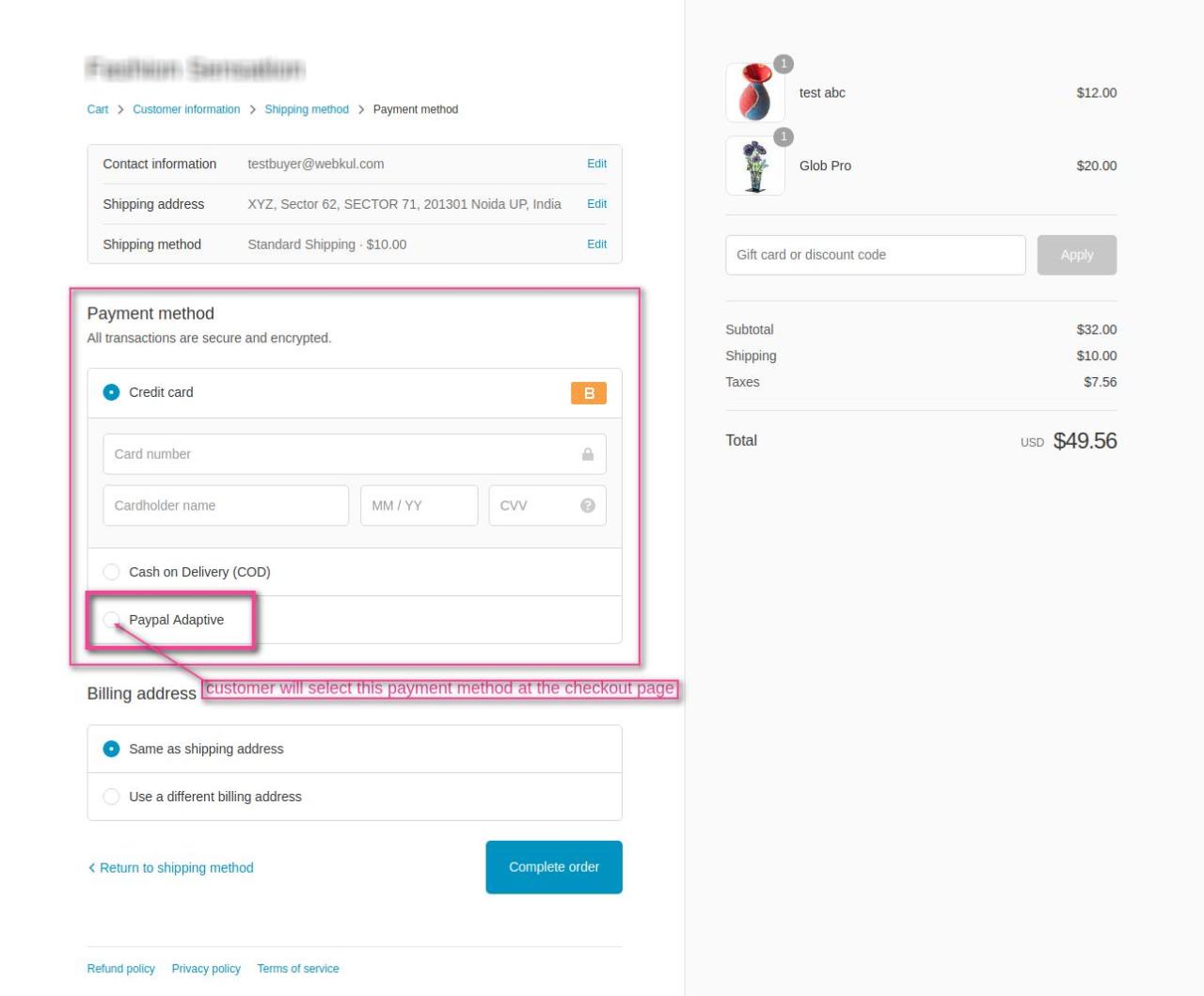

- When a buyer makes a payment, the marketplace app sends a payment request to PayPal.

- PayPal then directs buyers to a checkout page to enter payment information.

- After successful payment, PayPal sends a notification to the marketplace application.

- The marketplace application then processes the order and delivers the product or service to the buyer.

Advantages of Using PayPal Adaptive Payments

Using PayPal Adaptive Payments has several advantages, including:

- Secure Payment System : PayPal Adaptive Payments offers a safe and reliable payment system, so sellers and buyers can carry out transactions with confidence.

- Easy to use : PayPal Adaptive Payments is easy to use and integrates with marketplace applications.

- Low Cost : PayPal Adaptive Payments fees are lower compared to other payment services.

- Worldwide Support : PayPal Adaptive Payments can be used worldwide, so sellers and buyers can make transactions from anywhere.

Disadvantages of Using PayPal Adaptive Payments

Although PayPal Adaptive Payments has several advantages, it also has several disadvantages, including:

- Cost : Although PayPal Adaptive Payments fees are lower compared to other payment services, there are still fees to pay.

- Feature Limitations : PayPal Adaptive Payments has limited features compared to other payment services.

- Dependence on PayPal : The marketplace application must depend on PayPal to carry out transactions, so if PayPal experiences problems, the marketplace application will also be disrupted.

Is PayPal Adaptive Payments Suitable for Building Marketplace Apps?

PayPal Adaptive Payments can be a good choice for building a marketplace app, especially if you want to build a marketplace app that is simple and has low costs. However, if you want to build a marketplace application that is more complex and has more advanced features, then you may need to consider other payment services.

Conclusion

PayPal Adaptive Payments is an online payment service that can be used to build marketplace applications. This service offers a safe and reliable payment system, and has low fees. However, PayPal Adaptive Payments also has some drawbacks, such as accrued fees and feature limitations. Therefore, it is necessary to consider the advantages and disadvantages of PayPal Adaptive Payments before deciding to use it.

Recommendation

If you want to build a marketplace application that is simple and has low costs, then PayPal Adaptive Payments could be a good choice. However, if you want to build a marketplace application that is more complex and has more advanced features, then you may need to consider other payment services such as Stripe or Braintree.

Questions

Q: Can PayPal Adaptive Payments be used worldwide?

A: Yes, PayPal Adaptive Payments can be used worldwide.

Q: How do I activate PayPal Adaptive Payments?

A: Sellers can enable PayPal Adaptive Payments by creating a PayPal account and enabling Adaptive Payments.

Q: Does PayPal Adaptive Payments have fees?

A: Yes, PayPal Adaptive Payments has fees to pay.

Q: Can PayPal Adaptive Payments be used to build complex marketplace applications?

A: Yes, PayPal Adaptive Payments can be used to build complex marketplace applications, but you may need to consider other payment services.