How to send money from India to USA

Hi everybody! Do you guys want to know how to send money from India to US? No need to worry, because I will guide you with easy steps.

First of all, you need to choose a money transfer service provider. There are many options available, such as banks, brokerage companies, and online money transfer services. Each provider has its own advantages and disadvantages, so do your research to find the provider that best suits your needs.

Once you choose a provider, you need to provide personal information, such as name, address, and telephone number. You will also need to provide recipient information, such as their name and address in the US.

Next, you need to determine the amount of money you want to send. The provider will inform you of the fees and exchange rates applicable at that time. Make sure to double check the amount before confirming the transaction.

Once all the details are checked, you can choose the payment method. Generally, you can pay by bank transfer, debit card or credit card. Each provider has different payment options, so be sure to ask for details.

Once the transaction is processed, the provider will provide you with a tracking reference number. Use this number to track your transfer status. Delivery times may vary depending on the provider and quantity sent.

Now, let’s talk about the required documents. Usually, you need to provide proof of identity, such as an identity card or passport. Some providers also require proof of address, such as a utility bill or bank statement.

Additionally, it is important to consider the costs of sending money. Some providers charge a flat fee, while others charge a percentage of the amount transferred. Be sure to compare costs before choosing a provider.

Lastly, don’t forget to save your receipt or transaction records. This will be useful if you need to carry out an investigation or have questions at a later date.

By following these steps, you can send money from India to the US easily and quickly. Remember to choose a trusted provider and double check all details before confirming the transaction. Happy sending money!

PayPal fees and exchange rates for India-USA transactions

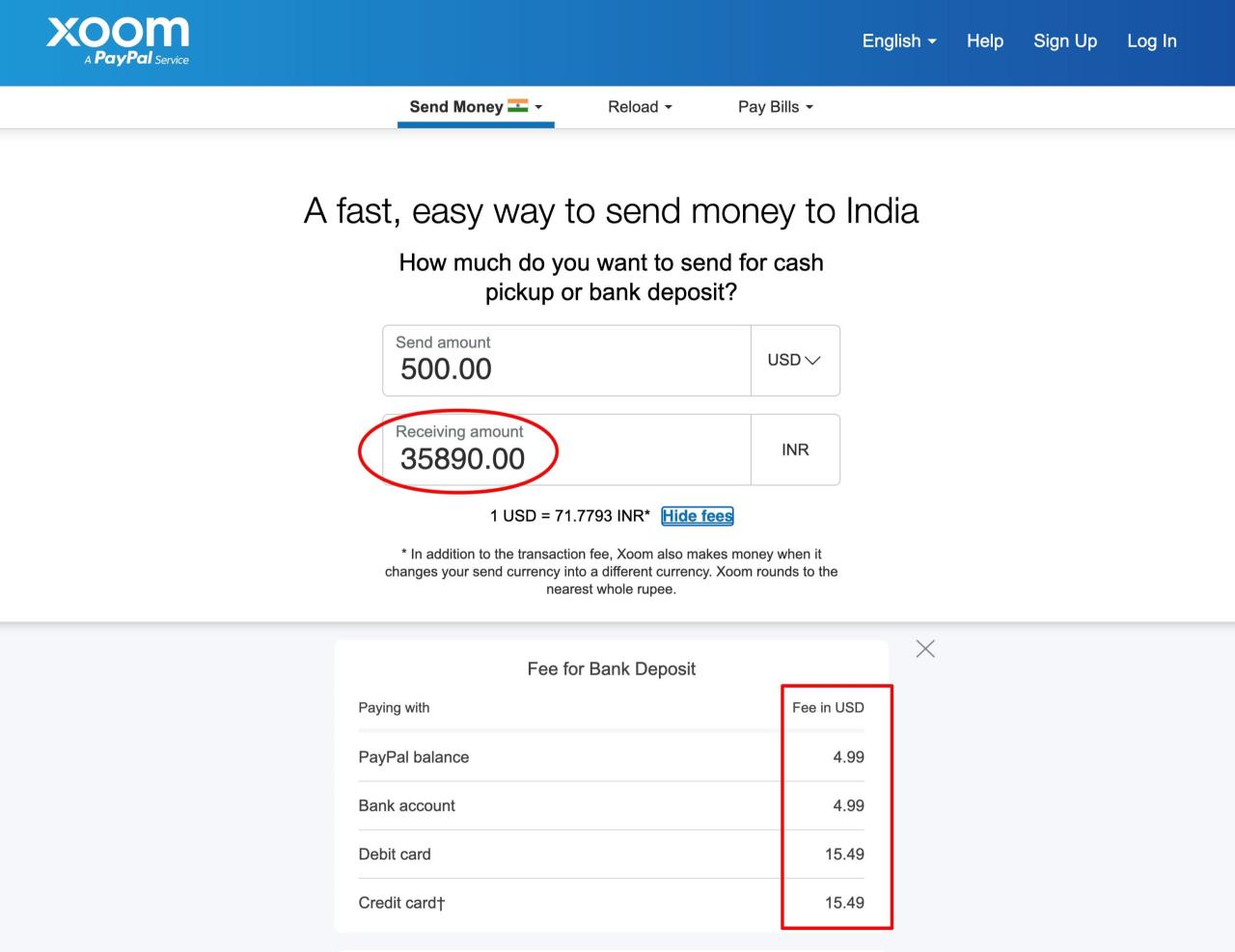

After determining the appropriate shipping method, let’s discuss the fees and exchange rates associated with PayPal transactions from India to the US. Knowing these numbers is crucial to predicting the amount the receiver will receive on the other end.

PayPal charges a flat fee for each transaction, plus a certain percentage of the amount sent. Fixed fees vary depending on the sending and receiving countries, as well as the type of transaction. For transfers from India to the US, the flat fee is around 50 Indian rupees.

In addition to the flat fee, PayPal also charges a percentage fee, which ranges from 4.5% to 5.7%, depending on the amount sent. So, if you send 10,000 Indian rupees, you may be charged a commission of around 450 to 570 Indian rupees. This fee is charged at the time of transaction and will be deducted from the amount you send.

The exchange rate PayPal uses to convert Indian rupees to US dollars will also affect the amount the recipient receives. These exchange rates are determined by the foreign exchange market and may fluctuate from time to time. You can check the current exchange rates on the PayPal website before making a transaction.

To minimize costs and maximize the amount your recipient receives, there are several things you can do. First, try to send larger amounts at one time, as PayPal’s percentage fee decreases as the amount sent increases. Second, avoid making transactions on weekends or holidays, as exchange rates are often less favorable during these periods.

Knowing the fees and exchange rates associated with PayPal transactions from India to the US is essential for making informed decisions about money transfer methods. By considering these factors, you can ensure that the recipient gets the most possible amount from your transfer.

Common issues with international PayPal transfers from India

One of the common problems faced while transferring money from India to the US via PayPal is transaction delays. This can be very frustrating, especially if you need to transfer funds urgently. There are several reasons why PayPal transactions can be delayed:

Account Verification: PayPal may place a hold on transactions to verify your or the recipient’s identity. This can happen if you are a new user or if you have not provided the required identity documents.

Unusual Activity: If PayPal detects unusual activity on your account, such as a large transfer amount or a transfer to a different account, the transaction may be held for review.

Terms and Conditions: PayPal has terms and conditions that users must follow. If a transaction violates any of these conditions, the transaction may be suspended.

Technical Issues: Sometimes, transaction delays can be caused by technical issues on PayPal’s part. This could be a problem with the server or a problem with payment processing.

If you experience transaction delays, there are several things you can do:

Contact PayPal: Contact PayPal customer service to find out the reason for the delay and what steps you need to take to resolve the problem.

Complete Verification: If you have not yet verified your account, complete the verification process as soon as possible. This usually involves providing identity documents and proof of address.

Review Activity: Review your transaction history to identify any activity that PayPal may consider unusual. If you find a suspicious transaction, report it to PayPal immediately.

Wait Patiently: If the delay is caused by a technical issue, be patient and wait for the issue to be resolved. PayPal will usually notify you of the status of your transaction via email or app notification.

Remember that PayPal has a strong buyer protection system to ensure your transactions are safe. However, it is important to follow PayPal’s terms and conditions to avoid delays or other issues. By following the tips above, you can help ensure your international PayPal transfers run smoothly and efficiently.

Can I use PayPal to send money from India to the USA?

Using PayPal to Send Money from India to US: Complete Guide

In today’s digital era, sending money abroad has become increasingly easier. One of the most popular ways is to use PayPal, an online payment service that is famous throughout the world. However, there are some restrictions and requirements that need to be met before you can use PayPal to send money from India to the US. In this article, we will discuss the possibility of using PayPal to send money from India to the US, as well as the requirements and fees involved.

Why PayPal?

PayPal is one of the most popular online payment services in the world. Founded in 1998, PayPal has become one of the easiest and safest ways to make online transactions. Using PayPal, you can make payments, send money, and receive payments from people all over the world.

Requirements to Send Money from India to USA via PayPal

To use PayPal to send money from India to the US, you need to meet the following requirements:

- PayPal Account : You need to have an active and verified PayPal account. If you don’t have a PayPal account yet, you can create one for free on the official PayPal website.

- Account Verification : You need to verify your PayPal account by providing correct information about yourself, including email address, telephone number, and physical address.

- Source of funds : You need to have a valid source of funds, such as a bank account, credit card, or debit card, to make transactions through PayPal.

- Transaction Limits : PayPal has transaction limits that apply to users in India. These limits may vary depending on your account type and transaction history.

Cost of Sending Money from India to US via PayPal

The cost of sending money from India to the US via PayPal may vary depending on several factors, such as:

- Transaction Fees : PayPal charges a transaction fee of 2.9% + IDR 3,000 (or the equivalent in the currency used) for international transactions.

- Currency Conversion Fees : If you send money in a currency different from your US currency, PayPal will charge a currency conversion fee of 2.5% to 4.5% of the transaction amount.

- Withdrawal Fees : If the recipient of the money wishes to withdraw money to a bank account or credit card, they may be charged a withdrawal fee by their bank or financial institution.

Steps to Send Money from India to US via PayPal

Here are the steps to send money from India to US via PayPal:

- Log in to your PayPal Account : Log in to your PayPal account using your email address and password.

- Select Transaction Destination : Select the destination of your transaction (US) and the currency used (USD).

- Enter the Transaction Amount : Enter the transaction amount you want to send.

- Select Fund Source : Select the source of funds you want to use to make transactions.

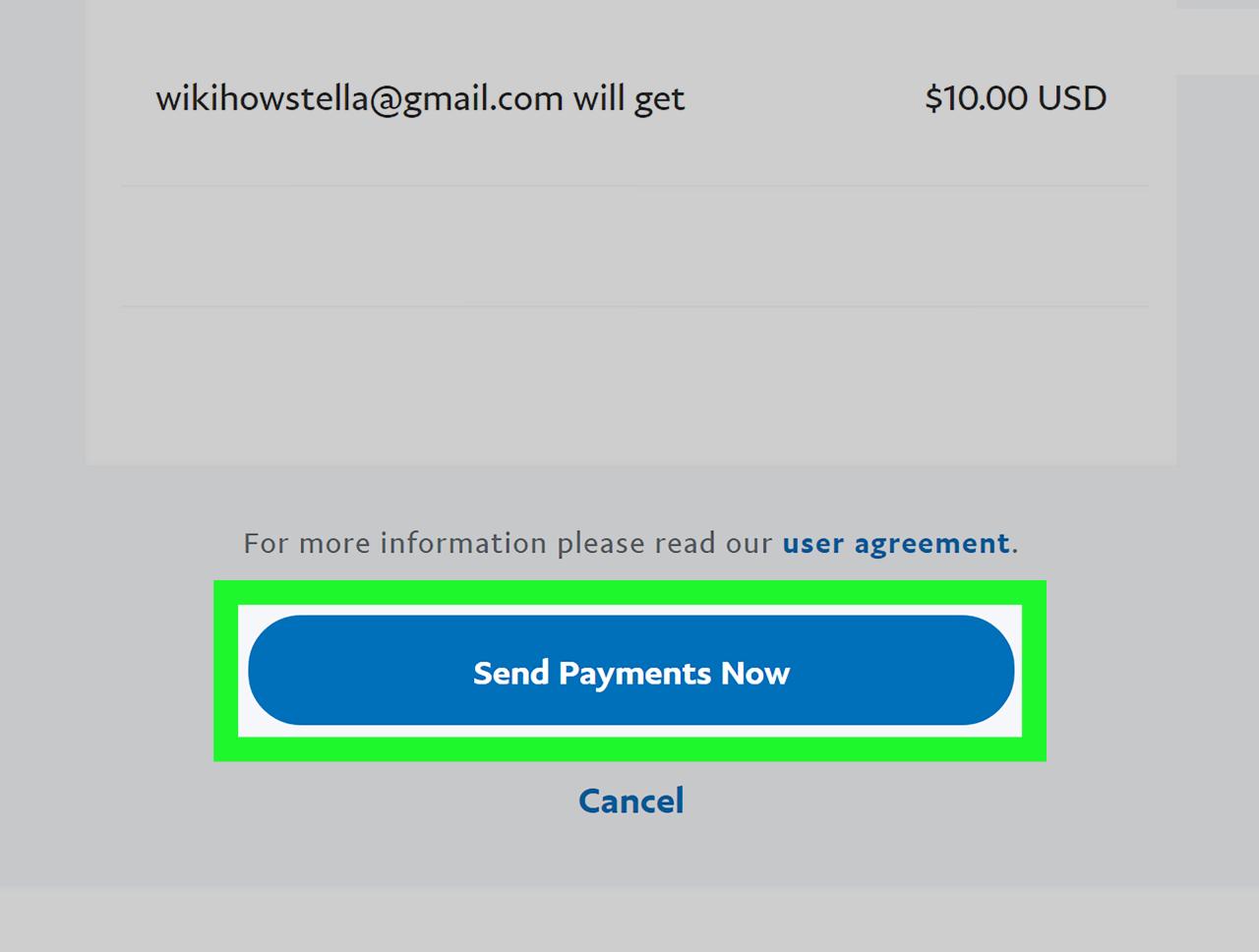

- Transaction Confirmation : Confirm your transaction and ensure that all information provided is correct and correct.

- Wait for the Transaction Process : Wait for the transaction process to complete. PayPal will send an email notification to you and the recipient of the money when the transaction is complete.

Advantages and Disadvantages of Using PayPal to Send Money from India to the US

Pros of using PayPal to send money from India to US:

- Easy and Safe : PayPal is a trusted and safe online payment service.

- Fast : The transaction process via PayPal is fast and effective.

- Flexible : PayPal can be used to send money to many countries, including the US.

Disadvantages of using PayPal to send money from India to US:

- High Transaction Fees : Transaction fees through PayPal can be higher than other payment services.

- Transaction Limits : PayPal has transaction limits that apply to users in India.

- Currency Conversion Fees : Currency conversion fees may be higher if you send money in a currency different from US currency.

Conclusion

Using PayPal to send money from India to US is easy and safe. However, keep in mind that there are several requirements and fees that need to be met. By understanding the terms and fees involved, you can use PayPal to send money to the US effectively. Make sure you always check the official PayPal website for the latest information on the services and fees offered.