Receiving salary via PayPal

PayPal’s presence in the world of finance has revolutionized the way we receive our salaries. In this digital era, more and more companies are choosing to pay their employees via PayPal because of its convenience and convenience.

Receiving a paycheck via PayPal offers many benefits. First of all, it’s very easy. You just need to give your employer your PayPal email address, and they can make a secure transfer directly to your account. No more waiting for a physical check or worrying about writing errors.

Plus, PayPal is very fast. Payroll transfers are usually processed within minutes, ensuring you have immediate access to your funds. This is especially helpful if you have urgent expenses or bills that need to be paid immediately.

PayPal also provides security. Transactions are protected by advanced encryption technology, keeping your financial information safe from fraudsters and hackers. You can rest assured that your paycheck will be delivered securely and directly to your account.

Additionally, PayPal allows you to manage your finances more easily. You can track expenses, schedule payments, and send or receive money easily using PayPal’s features. This gives you more control over your finances and helps you make better financial decisions.

However, keep in mind that there are some potential drawbacks to receiving a paycheck via PayPal. One of them is the possibility of transaction fees. If your employer uses a PayPal Business account, they may charge a small fee for each paycheck transfer. Additionally, you may face withdrawal or spending restrictions if you do not fully verify your account.

Overall, receiving a salary via PayPal offers many benefits such as convenience, speed, security, and better financial management. While there are some potential fees or limitations to consider, PayPal’s convenience and security make it an attractive option for many professionals in the modern era.

Setting up PayPal for salary payments

Setting Up PayPal for Payroll

PayPal has become a popular platform for making online payments, including receiving salaries. Here is a step-by-step guide on how to set up your PayPal account for payroll:

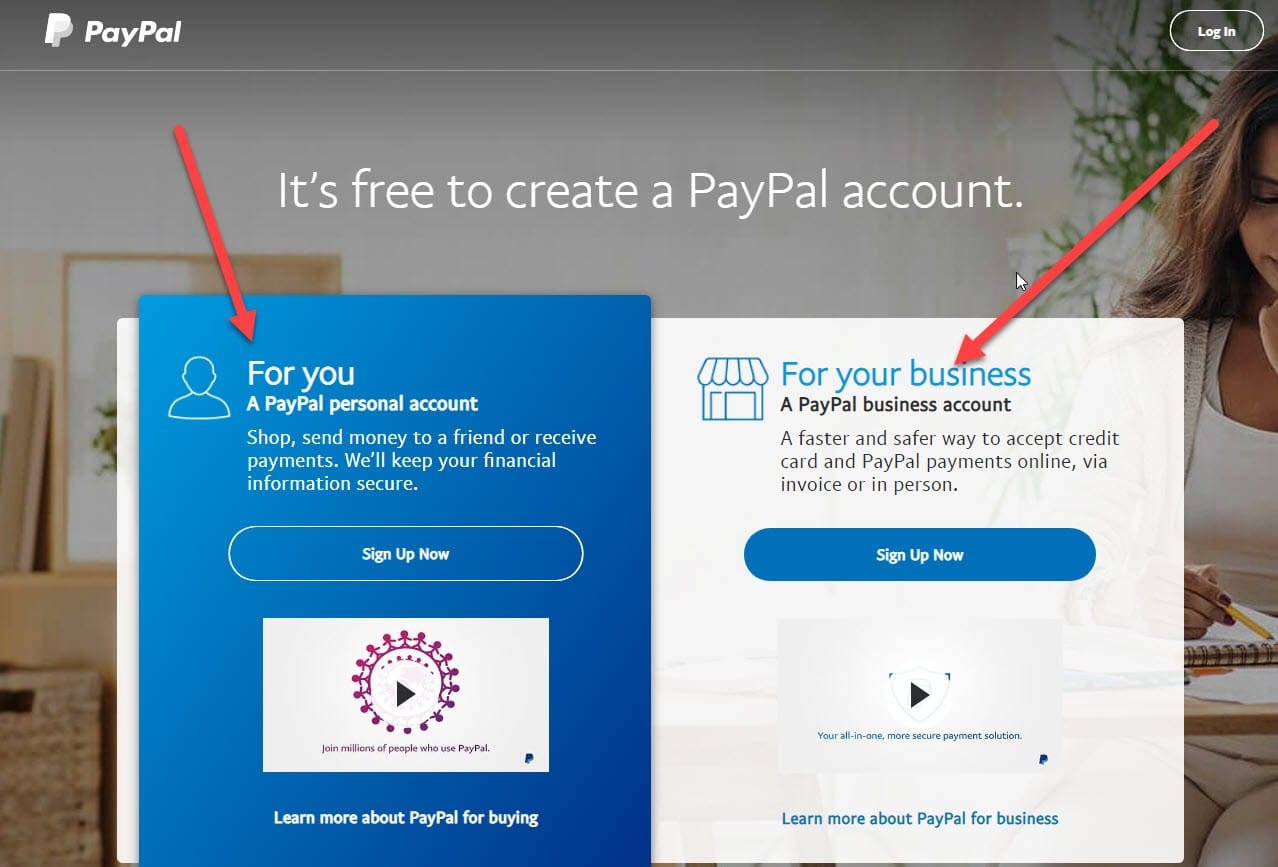

First, you need to create a PayPal Business account. It’s free and specifically designed for accepting business payments. Once you have an account, you need to link your bank account to PayPal. This will allow you to receive salary payments directly into your bank account.

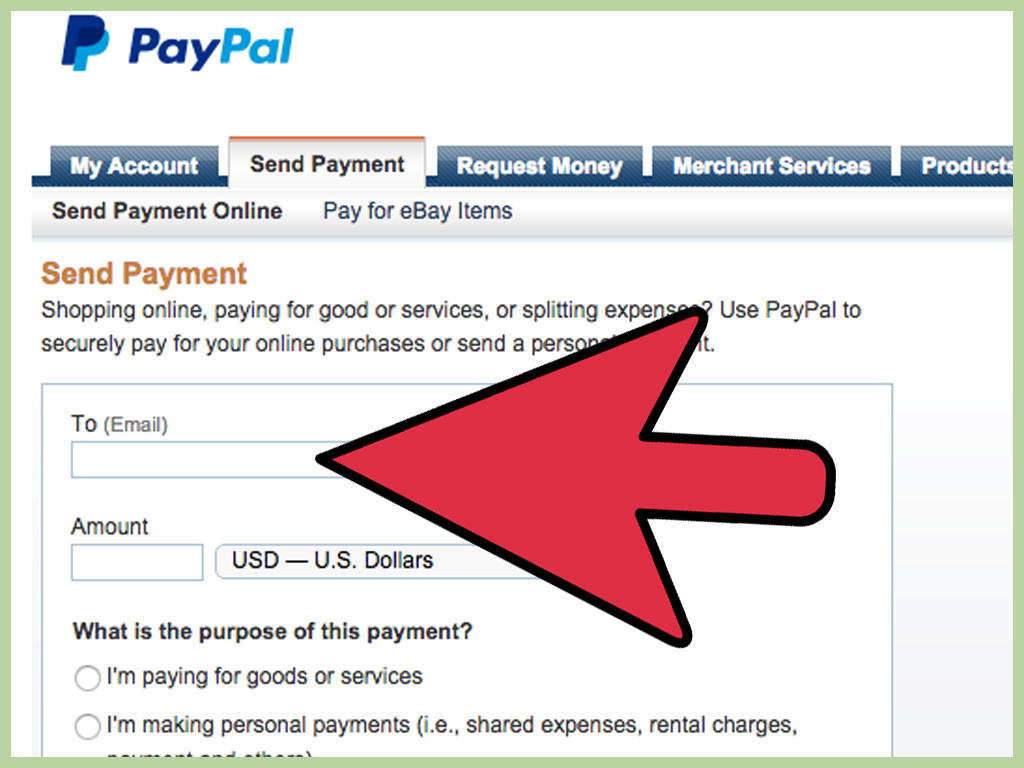

Next, you need to provide your business email address to your employer. This is the email address that will be used to send your salary payments. It is important to ensure that this email address is correct and active.

Once your employer has set up payroll in their system, you will receive an email notification from PayPal. This email will contain payment details, including the amount and expected payment date.

When the payment date arrives, the funds will be automatically transferred to your linked bank account. You will receive an email notification confirming the transfer.

Receiving pay via PayPal is a safe and convenient way. This eliminates the hassle of collecting checks or visiting the bank. Additionally, you can access your funds in real-time, which gives you more control over your finances.

If you’re having trouble setting up PayPal for payroll, you can contact PayPal customer support. They will be happy to help you with any questions or problems.

Additionally, PayPal offers a variety of additional features that can be beneficial for businesses. This includes invoicing, expense management, and tax reporting. By taking advantage of these features, you can save time and money while increasing the efficiency of your business.

Overall, setting up PayPal for payroll is a simple and straightforward process. It provides a safe and convenient way to receive your salary payments and manage your finances.

Employer compatibility with PayPal salary payments

Does your company allow salary payments via PayPal? If not, you may need to reconsider. PayPal offers many benefits to employers and employees, making it an attractive option for payroll.

One of the biggest advantages of PayPal is its ease of use. The platform is intuitive and easy to navigate, making it easy for you to manage payroll. You can also easily track payments and create reports, saving time and hassle.

PayPal is also very secure. The platform uses advanced encryption technology to protect your financial data, ensuring that your salary payments are safe and secure. Additionally, PayPal offers buyer protection, so you can be sure that you will receive the funds you expect.

Besides its ease of use and security, PayPal also offers several other features that make it a great choice for payroll. For example, PayPal can be integrated with your payroll system, automating processes and saving time. PayPal also allows you to make international payments, making it easy for you to pay employees abroad.

Of course, there are several things to consider before using PayPal for payroll. One consideration is cost. PayPal charges a small fee for each transaction, so it’s important to account for those fees in your budget. Additionally, PayPal may not be suitable for all employers. For example, if you have many employees, it may be more difficult to manage payroll via PayPal.

Overall, PayPal is a great option for payroll for many employers. The platform is easy to use, secure, and offers several useful features. If you’re considering using PayPal for payroll, be sure to research and consider the costs and challenges.

Can I use PayPal to receive salary?

Receiving Paycheck via PayPal: Is It Possible?

In recent years, financial technology (fintech) has developed rapidly and allows people to carry out financial transactions more easily and quickly. One popular example of fintech is PayPal, an online payment platform that allows users to send and receive money electronically.

However, the question that often arises is whether PayPal can be used to receive salaries? In this article, we will discuss the possibility of using PayPal to receive a salary, as well as some things to consider before using this service.

What is PayPal?

PayPal is a financial technology (fintech) company founded in 1998. Initially, PayPal was designed as an online payment platform that allowed users to send and receive money electronically. However, over time, PayPal has evolved into a broader platform that offers a variety of financial services, including online payments, money transfers, and financial management.

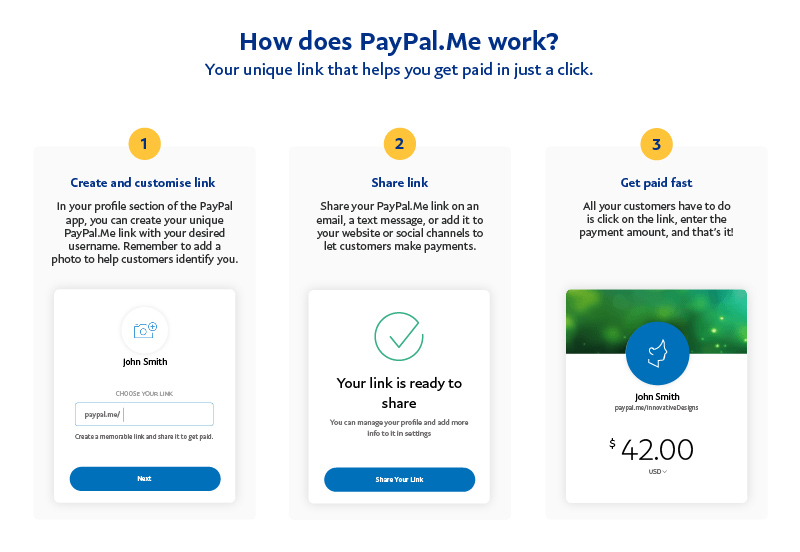

How to Receive Salary via PayPal?

Receiving a paycheck via PayPal is relatively easy. Here are some steps to follow:

- Create a PayPal Account : First of all, you need to create a PayPal account. You can create a PayPal account by visiting the PayPal website and filling out the registration form.

- Add Payment Information : After creating a PayPal account, you need to add payment information, such as email address and phone number.

- Email Confirmation : PayPal will send a confirmation email to the email address you specified. You need to confirm the email to activate your PayPal account.

- Add Payment Method : Next, you need to add a payment method, such as a credit card or bank account, to receive your paycheck via PayPal.

- Provide PayPal Information to Employers : After creating a PayPal account and adding a payment method, you will need to provide your employer with your PayPal information, including your PayPal email address and PayPal account number.

Advantages of Receiving Salary via PayPal

Receiving a salary via PayPal has several advantages, including:

- Convenience : Receiving a salary via PayPal is very easy and fast. You just need to create a PayPal account and provide your PayPal information to your employer.

- Flexibility : PayPal allows you to receive your salary flexibly. You can receive your salary via PayPal anytime and anywhere.

- Low Cost : Money transfer fees via PayPal are relatively low compared to other payment methods.

Disadvantages of Receiving a Paycheck via PayPal

However, receiving salaries via PayPal also has several disadvantages, including:

- Cost : Although money transfer fees via PayPal are relatively low, you still need to pay money transfer fees.

- Limitation : PayPal has limits on the amount of money that can be received through a PayPal account.

- Dependence : Receiving a salary via PayPal makes you dependent on the internet network and a stable connection.

Is PayPal Safe?

PayPal is a very secure online payment platform. PayPal has several advanced security features, such as:

- Encryption : PayPal uses advanced encryption to protect your payment information.

- Authentication : PayPal has a sophisticated authentication system to ensure that only you can access your PayPal account.

- Supervision : PayPal has a sophisticated monitoring system to detect and prevent unsafe transactions.

Conclusion

Receiving a salary via PayPal is an easy and flexible option. However, before using this service, you need to consider several things, such as money transfer fees, limits on the amount of money that can be received, and dependence on the internet network and a stable connection. By understanding the advantages and disadvantages of receiving a paycheck through PayPal, you can make the right decision for your finances.