Payment methods other than credit cards on PayPal

In addition to credit cards, PayPal offers a variety of flexible payment methods to meet diverse customer needs. Let’s explore these options:

PayPal Balance: Utilize the funds you have added to your PayPal account to make payments. This is a practical way to track expenses and avoid credit card fees.

Bank Transfer: Connect your bank account to PayPal to make direct fund transfers. This method is free and offers a safe and easy way to fund your purchases.

Pay with Cash: PayPal partners with retail outlets such as CVS and 7-Eleven. Customers can visit these stores, provide a PayPal-generated barcode, and pay in cash.

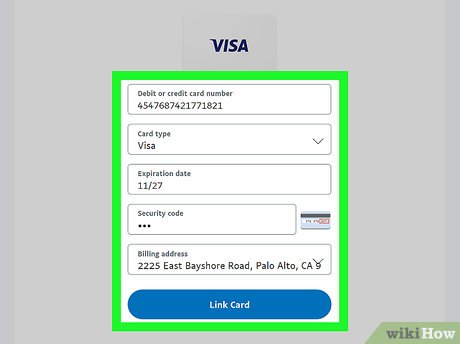

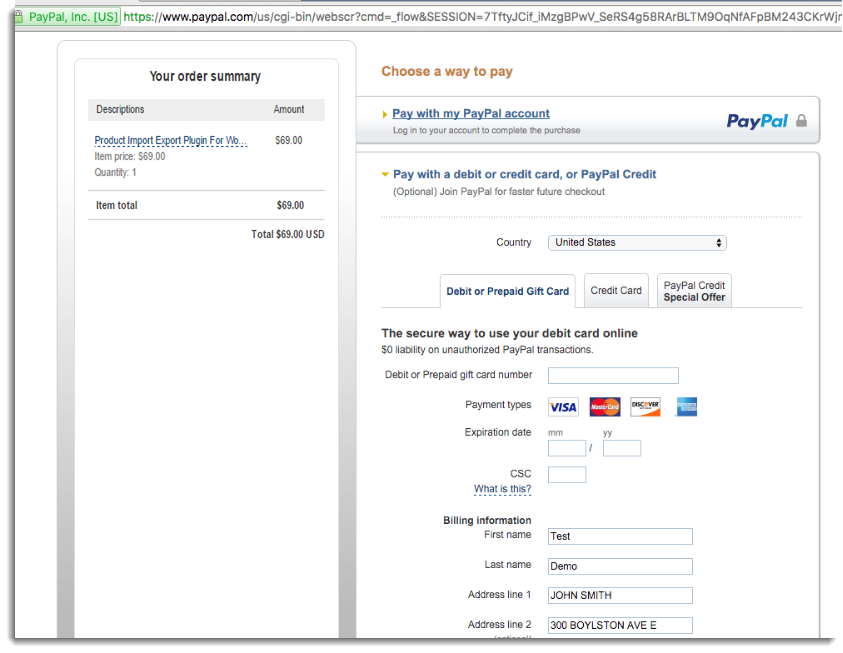

Debit Cards: PayPal accepts Visa, Mastercard, and American Express debit cards. This is a convenient option for those who want to use their debit card to make online purchases.

Venmo: If you have a Venmo account, you can link it to PayPal to make payments using your Venmo balance. This is ideal for transactions between friends and family.

Klarna: Klarna is a buy now, pay later service that allows customers to split their purchases into multiple interest-free payments. PayPal has partnered with Klarna to offer this option to qualified buyers.

Accepting Payments: In addition to offering payment methods for customers, PayPal also allows businesses to accept payments through various channels. This includes online invoicing, a PayPal button, and website integration.

Choose the Right Payment Method:

Choosing the best payment method will depend on your personal preferences and circumstances. If you want convenience, PayPal Balance and Bank Transfer are very convenient. If you prefer to use a card, Debit Card and Klarna could be a good choice. And if you want to pay in cash, the Pay by Cash option is very convenient.

With so many payment methods available on PayPal, making online transactions has never been easier. Whether you’re a customer or a business, PayPal provides the flexibility and security you need to manage your finances with confidence.

Using linked bank accounts or PayPal balance

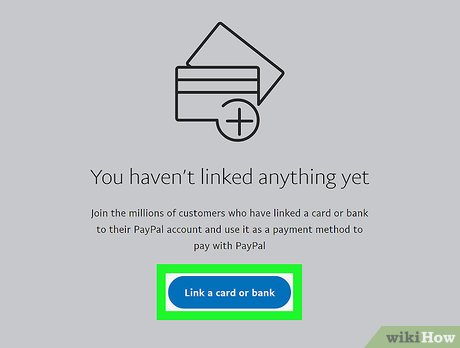

Besides credit cards, PayPal also offers alternative payment methods that are just as convenient. One practical option is to use a linked bank account. Just link your bank account to your PayPal account, and you can make payments directly from your bank account balance. This method saves you the hassle of manually entering credit card information, while keeping your financial data secure.

Additionally, PayPal also allows you to use your PayPal balance to make payments. PayPal balance is the funds you receive through transactions accepted or transferred to your account. When making a payment using your PayPal balance, funds will be automatically deducted from the available amount. This is ideal if you want to avoid using a bank account or credit card.

The main advantage of using a linked bank account or PayPal balance is the convenience and security. You don’t have to enter credit card information every time you make a payment, and your financial data remains protected by PayPal’s advanced security system. Additionally, there are no additional fees for using this payment method, thereby saving on transaction costs.

However, please note that some limitations may apply when using a linked bank account or PayPal balance. Your number of daily or monthly transactions may be limited, depending on your PayPal account type. Additionally, some merchants may not accept payments via linked bank accounts or PayPal balances.

Overall, using a linked bank account or PayPal balance is a safe and convenient payment method on PayPal. This saves you the hassle of entering credit card information, keeps your financial data safe, and doesn’t incur additional fees. With these advantages, this alternative payment method is a worthy option to consider when making online transactions.

Limitations of non-credit card purchases on PayPal

Payment Methods on PayPal Other Than Credit Cards: Limitations on Non-Credit Card Purchases

PayPal users enjoy the convenience of making online transactions with a variety of payment methods, including credit cards. However, there are some limitations to consider when using payment methods other than credit cards.

Debit cards are linked directly to your bank account and can be used for online payments. Although easy to use, non-credit card purchases with debit cards on PayPal have limitations. You may have daily or monthly limits on purchases and withdrawals, which may limit the amount you can spend or the amount of funds you can withdraw.

Bank transfer is another option, allowing you to fund your PayPal account directly from your bank account. However, this process can take several business days, which may slow down your transactions. Additionally, some banks charge fees for bank transfers, which can add additional fees.

PayPal Balance is a convenient payment method that allows you to use existing funds in your PayPal account. However, this can only be used if you have sufficient funds in your account. If your balance is insufficient, you will not be able to complete the transaction.

Additionally, certain non-credit card payment methods may not be accepted by all merchants. Some merchants may only accept credit cards as a form of payment, which may limit your shopping options.

Finally, it’s important to remember that non-credit card purchases on PayPal may not qualify for the same buyer protections offered for credit card transactions. Credit card buyer protection can provide compensation if you do not receive the goods you ordered or if the goods are damaged or do not match the description.

Overall, although PayPal offers a variety of payment methods, there are some limitations to consider when using non-credit card methods. Transaction limits, processing times, additional fees, and merchant eligibility may impact your shopping experience. Therefore, it is important to understand these limitations and plan ahead so that your transactions run smoothly and safely.

Can I use PayPal to buy things without a credit card?

Using PayPal to Buy Stuff Without a Credit Card: Is It Possible?

PayPal has become one of the most popular online payment methods in the world. With more than 440 million active users, this platform allows you to carry out transactions online easily and safely. However, many people still wonder if they can use PayPal to buy things without having a credit card.

In this article, we will discuss in detail PayPal’s ability to carry out transactions without a credit card. We’ll also explain other ways you can top up your PayPal balance if you don’t have a credit card.

What is PayPal?

PayPal is an online payment service that allows you to make transactions electronically. With PayPal, you can make payments for a variety of products and services, including online shopping, money transfers, and bill payments. PayPal also offers advanced security services to protect your information and prevent fraud.

Using PayPal Without a Credit Card

Yes, you can use PayPal to buy things without having a credit card. Here are some ways to do it:

- Using a Bank Account : You can connect your bank account with PayPal. This way, you can make payments using your bank account balance.

- Using Bank Debit : If you have a debit card, you can use it to make payments via PayPal.

- Using Cash : In some countries, you can make payments using cash at certain stores that work with PayPal.

- Using Other Fund Sources : PayPal also allows you to use other sources of funds, such as a checking or investment account, to make payments.

How to Top Up PayPal Balance Without a Credit Card

If you don’t have a credit card, there are several ways to top up your PayPal balance:

- Bank Transfer : You can make a bank transfer from your bank account to your PayPal account.

- Bank Debit : You can use a debit card to make payments to your PayPal account.

- Cash : In some countries, you can make payments using cash at certain stores that work with PayPal.

- Other Funding Sources : You can also use other sources of funds, such as a checking or investment account, to top up your PayPal balance.

Benefits of Using PayPal Without a Credit Card

Using PayPal without a credit card has several advantages, including:

- Security : PayPal offers advanced security services to protect your information and prevent fraud.

- Comfort : PayPal allows you to make transactions online easily and quickly.

- Flexibility : You can use PayPal to make payments in various countries and for various products and services.

- Control : With PayPal, you can exercise control over your balance and better manage your transactions.

Conclusion

In conclusion, you can use PayPal to purchase items without having a credit card. By using another source of funds, such as a bank account, bank debit, or cash, you can make payments via PayPal. Apart from that, PayPal also offers sophisticated security services and convenience in carrying out online transactions. Thus, PayPal can be an ideal choice for those of you who want to make transactions online without having to have a credit card.