When using PayPal for online transactions, it is important to be aware of the various fees that may be charged. By understanding these types of costs, you can take steps to avoid unnecessary ones and save money.

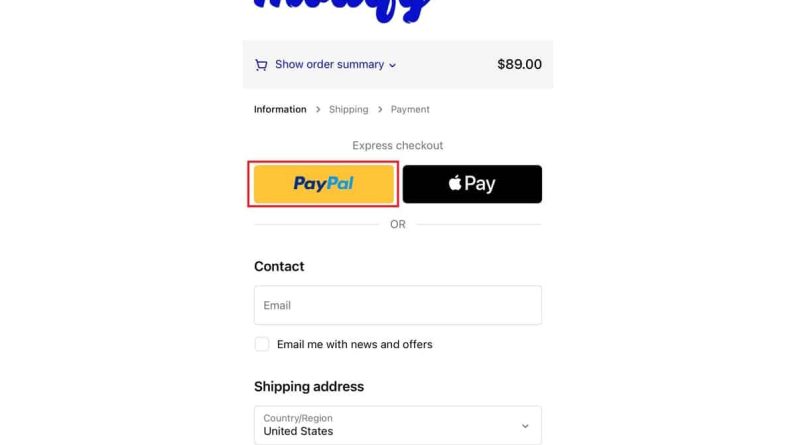

One of the most common types of PayPal fees is transaction fees, which are charged every time you send or receive money. The fee amount varies depending on the payment method used and transaction currency. For example, the fees for transferring funds from a bank account to a PayPal account are lower than the fees for using a credit card.

Another type of fee is a withdrawal fee, which is charged when you withdraw money from your PayPal account to your bank account. The amount of this fee also varies depending on the withdrawal method used. Withdrawals via bank transfer usually have lower fees than withdrawals via debit or credit card.

In addition to transaction and withdrawal fees, PayPal also charges currency conversion fees when you send or receive money in a currency different from your account currency. These fees may vary based on current exchange rates and the currencies involved.

To avoid unnecessary costs, consider the following tips:

Use low-cost payment methods: Send money from your bank account to your PayPal account or use a payment method that offers lower fees.

Withdraw large amounts: Avoid withdrawing small amounts repeatedly, as each transaction incurs a fee.

Personal currency conversion: If possible, convert your own currency before sending or receiving money via PayPal to avoid PayPal currency conversion fees.

Find out applicable fees: Check applicable fees before sending or receiving money to avoid unpleasant surprises.

By understanding the types of PayPal fees and taking steps to avoid unnecessary ones, you can save money and get the most out of this service. Remember, a little planning and preparation can make a big difference in the long run.

Types of PayPal Fees

Let’s discuss the various fees associated with using PayPal:

Processing Fee:

Every time you receive a payment via PayPal, you will be charged a processing fee. These fees vary depending on the type of transaction and your country. For domestic sales, the fees usually range from 2.9% to 3.9% plus fixed costs.

Withdrawal Fees:

When you want to withdraw funds from your PayPal account to your bank account, you will also be charged a withdrawal fee. This fee also varies depending on the country, and usually ranges from 1% to 3.5%.

Currency Conversion Fees:

If you receive payment in a currency different from your account’s base currency, PayPal will charge a currency conversion fee. This fee is generally around 2.5% per transaction.

Subscription Fee:

PayPal offers a variety of subscription plans for businesses. This plan includes additional features, such as batch processing, bulk invoicing, and dedicated support. The costs vary depending on the package chosen.

Additional cost:

In addition to the main fees above, PayPal also charges some additional fees in certain situations. For example, you may be charged a fee to return a payment, charge back, or decline a disputed transaction.

Understanding Costs:

Understanding the various fees involved when using PayPal is important. By understanding these fees, you can plan your expenses and ensure that you maximize the profits from your transactions.

You can find detailed information about PayPal fees on their official website. If you have any questions or concerns, don’t hesitate to contact the PayPal support team.

PayPal Fees: What You Need to Know

PayPal is one of the most popular online payment methods in the world, with more than 400 million active users worldwide. However, as with other financial services, PayPal also has fees that you have to pay when making transactions. In this article, we will discuss PayPal fees and what you should know.

What are PayPal Fees?

PayPal fees are fees charged by PayPal to users when making transactions. This fee is usually charged in the form of a percentage of the transaction amount. PayPal fees may vary depending on the type of transaction, user location, and type of PayPal account used.

How Much Are PayPal Fees?

PayPal fees may vary depending on the type of transaction and user location. The following are examples of PayPal fees for several types of transactions:

- Domestic Payments : 3.4% of the transaction amount + IDR 1,500 (for Indonesian PayPal accounts)

- International Payments : 4.4% of the transaction amount + IDR 1,500 (for Indonesian PayPal accounts)

- Receipt of Money : 4.4% of the transaction amount (for Indonesian PayPal accounts)

- Money Transfer : Rp. 16,500 (for Indonesian PayPal accounts)

Types of PayPal Fee Fees

PayPal has several types of fees, including:

- Transaction Fees : fees charged when making transactions, such as payments or sending money.

- Currency Conversion Fee : fees charged when making international transactions and currency must be converted.

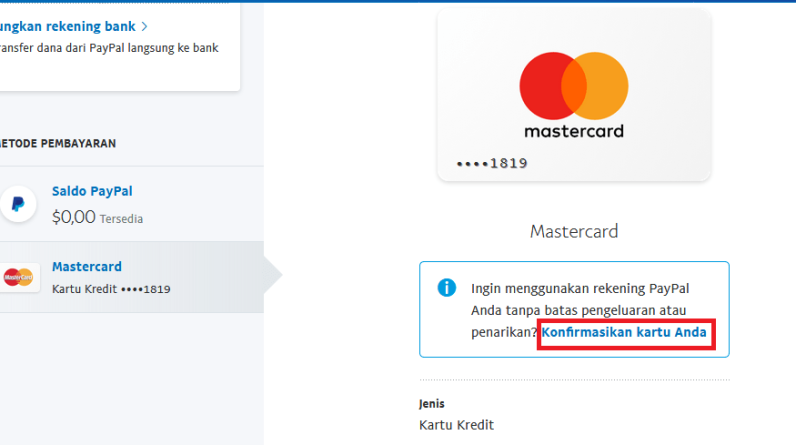

- Withdrawal Fee Fee : fee charged when withdrawing money from a PayPal account to a bank account or credit card.

How to Save on PayPal Fees?

The following are several ways to save on PayPal fees:

- Use a Business PayPal Account : business PayPal accounts have lower fees compared to personal PayPal accounts.

- Perform Domestic Transactions : domestic transactions have lower fees compared to international transactions.

- Use PayPal Balance : using PayPal balance can save transaction fees.

- Avoid Using Credit Cards : using a credit card can increase transaction fees.

Advantages and Disadvantages of PayPal Fees

The following are the advantages and disadvantages of PayPal fees:

Excess:

- Easy to use : PayPal fees are easy to understand and calculate.

- Flexible : PayPal fees can be adjusted to the type of transaction and user location.

- Safe : PayPal fees provide protection to users from unauthorized transactions.

Lack:

- High Fees : PayPal fees can be quite high, especially for international transactions.

- Not all countries can use PayPal : some countries cannot use PayPal, so PayPal fees cannot be used in these countries.

- Need to Have a PayPal Account : to use PayPal fees, users must have a PayPal account.

Conclusion

PayPal fees are fees charged by PayPal to users when making transactions. PayPal fees may vary depending on the type of transaction, user location, and type of PayPal account used. By understanding PayPal fees, users can carry out transactions more efficiently and save costs. As a PayPal user, it is important to understand PayPal fees to avoid unwanted fees.

FAQs

Q: What are PayPal fees?

A: PayPal fees are fees charged by PayPal to users when making transactions.

Q: How much is the PayPal fee?

A: PayPal fees may vary depending on the type of transaction, user location, and type of PayPal account used.

Q: How can I save on PayPal fees?

A: Some ways to save on PayPal fees are to use a business PayPal account, make domestic transactions, use a PayPal balance, and avoid using credit cards.

Q: What are the advantages and disadvantages of PayPal fees?

A: The advantage of PayPal fees is that they are easy to use, flexible and safe. The disadvantages of PayPal fees are high fees, not all countries can use PayPal, and you need to have a PayPal account.

Fee Payments and Benefits for Users

PayPal, a leading payment platform, offers various types of fees to facilitate financial transactions. Understanding these fees is critical to maximizing use of PayPal services and managing expenses.

The first type of fee to pay attention to is the basic transaction fee. It is charged every time you use PayPal to make a payment or receive money. The amount of this fee varies depending on the type of transaction, the country where the transaction is made, and the currency used. For example, in the United States, the standard transaction fee for online payments is 2.9% plus $0.30.

In addition to basic transaction fees, PayPal also charges additional fees for certain services. For example, withdrawal fees are charged when you withdraw money from your PayPal account to your bank account. This ranges from $0.50 to $4.00 per withdrawal. Currency conversion fees also apply when you convert funds from one currency to another, charging a flat fee plus a percentage of the converted amount.

For businesses, PayPal offers a variety of custom fees tailored to their needs. A monthly subscription fee gives access to additional features, such as PayPal Business Debit Mastercard and priority customer support. Additionally, businesses are charged payment processing fees that vary depending on transaction volume and account type.

While PayPal fees can be a burden for users, it is important to consider the convenience and security they provide. PayPal allows users to make payments safely and easily, avoiding the exchange of cash or checks. Additionally, PayPal offers buyer protection, which helps resolve disputes between buyers and sellers.

By understanding the different types of PayPal fees, you can make informed decisions about when and how to use the service. By considering basic transaction fees, additional fees, and business costs, you can optimize your use of PayPal and take advantage of its benefits while minimizing expenses.