PayPal Credit is a line of credit that can be used to make purchases on websites and stores that accept PayPal. That’s different from PayPal, which is a payment service that lets you transfer money to and from your bank account. In contrast, PayPal Credit is a credit mechanism that you can use to finance purchases.

PayPal Credit is similar to a credit card. When you make a purchase, you will have the option to use PayPal Credit as your payment method. You will then have a grace period of approximately 21 days to pay your purchase in full before interest is charged. If you do not pay off your purchase in full, you will be charged interest on your outstanding balance.

The interest rate for PayPal Credit varies depending on your credit history. However, it generally ranges from 19.99% to 26.99%. There is also a $29 late fee if you do not make your payment on time.

To use PayPal Credit, you must register for an account. You can do this on the PayPal website. Once you register, you will be given a certain credit limit. This credit limit is the maximum amount you can spend using PayPal Credit.

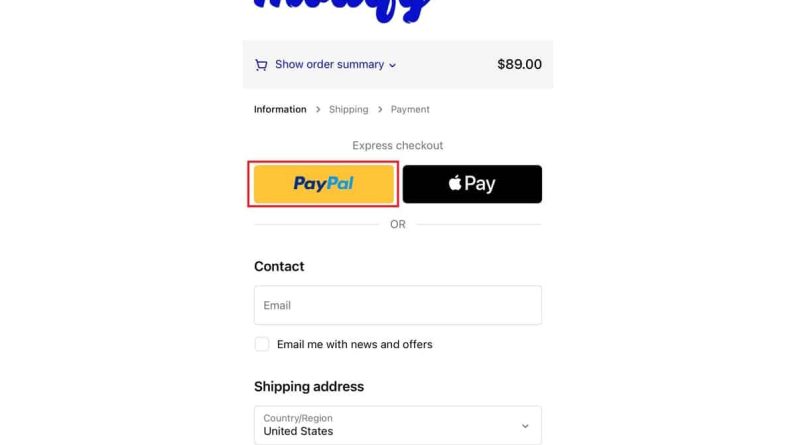

You can use PayPal Credit to make purchases anywhere that accepts PayPal. When you make a purchase, you will have the option to select PayPal Credit as your payment method. You will then be asked to enter your PayPal login information. Once you enter your login information, your purchase will be processed.

PayPal Credit is an easy and convenient way to finance your purchases. However, it is important to remember that PayPal Credit is a credit mechanism. As with any credit card, it’s important to use PayPal Credit responsibly. If you don’t pay off your purchase in full each month, you may be charged interest and fees.

What is PayPal Credit?

So, you’re curious about PayPal Credit? Let’s discuss the details.

PayPal Credit, previously known as Bill Me Later, is a credit service that allows you to make online purchases and pay them over a certain amount of time without interest. It’s like having a credit card, but without the physical plastic.

To use PayPal Credit, you must create an account first. It’s an easy process and only takes a few minutes. Once you are approved, you will receive a credit limit that you can use for purchases on websites that accept PayPal.

One of the main advantages of PayPal Credit is the interest-free period. If you pay off your balance in full within the specified time period, you will not be charged any interest. However, if you don’t pay off your balance on time, you will start to accrue interest.

Apart from that, PayPal Credit also offers several convenient features. For example, you can use the PayPal app to track your balance, view transaction history, and make payments. You can also set up automatic payments, so you don’t have to worry about forgetting to pay.

However, please note that PayPal Credit does have several disadvantages. For starters, interest rates can be quite high if you don’t pay off your balance on time. Additionally, you may not qualify for PayPal Credit if you have poor credit.

Additionally, PayPal Credit can only be used on websites that accept PayPal. This means you can’t use it in physical stores or for other purchases that weren’t made online.

Now that you know the basics of PayPal Credit, here are some tips for using it effectively:

Always pay off your balance in full within the specified time period to avoid interest.

Use the PayPal app to track your balance and payments.

Set up automatic payments to ensure you never miss a payment.

Only use PayPal Credit for purchases you can actually afford.

Be wary of interest rates if you don’t pay off your balance on time.

Overall, PayPal Credit can be a useful tool for making online purchases. However, it is important to understand the terms of service and use them responsibly.

PayPal Credit: Affordable Loans for Online Payments

In recent years, digital financial technology has developed rapidly, making it easy for consumers to carry out online transactions. One example of this innovation is PayPal Credit, a loan service that allows users to make online payments in an easier and more flexible way. This article will discuss PayPal Credit, how it works, its benefits, as well as some tips you need to know before using this service.

What is PayPal Credit?

PayPal Credit is a loan service managed by PayPal, the world’s largest digital financial technology company. This service allows users to make online payments without having to pay in cash. With PayPal Credit, you can purchase products or services online from sellers who accept PayPal as a payment method, even if you don’t have a balance in your PayPal account.

How PayPal Credit Works

The way PayPal Credit works is relatively simple. Here are the basic steps:

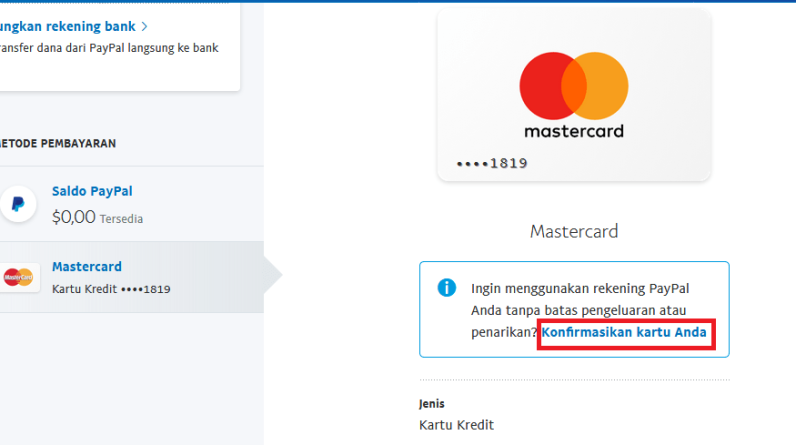

- Register : First, you must register to use PayPal Credit. You can do this by visiting the PayPal website and following the easy registration process.

- Activate : Once you register, you must activate PayPal Credit in your PayPal account. You can do this by clicking the “Activate” button on the PayPal Credit page.

- Set Credit Limits : Once you activate PayPal Credit, you must set your credit limit. This credit limit will determine the maximum amount you can borrow.

- Creating Transactions : When you want to make an online payment, you can choose PayPal Credit as the payment method. You will be asked to enter the amount you want to pay and your credit limit will be checked to ensure that you have sufficient balance.

- Repay : After you make a transaction, you must pay back the amount you borrowed, along with any interest incurred. You can make payments periodically or in cash.

Benefits of PayPal Credit

PayPal Credit has several significant benefits, including:

- Ease of Payment : PayPal Credit allows you to make online payments in an easier and more flexible way.

- No Admin Fees : PayPal Credit has no admin fees, so you don’t have to pay additional fees.

- Low Interest : PayPal Credit interest is relatively low compared to other credit cards.

- Purchase Protection : PayPal Credit offers purchase protection that allows you to cancel a transaction if the product or service you purchased is not what you expected.

- Ease of Management : PayPal Credit allows you to easily manage your account, including monitoring balance and transaction history.

Tips for Using PayPal Credit

Here are some tips you need to know before using PayPal Credit:

- Set Credit Limits : Make sure you set your credit limit carefully to avoid overspending.

- Read the Terms and Conditions : Make sure you read the PayPal Credit terms and conditions before using this service.

- Make Payments on Time : Make sure you make payments on time to avoid additional interest.

- Managing Your Account : Make sure you manage your account carefully to avoid transaction errors.

- Using PayPal Credit Wisely : Make sure you use PayPal Credit wisely and not too often, because the interest that occurs can add to your financial burden.

Conclusion

PayPal Credit is a loan service that allows you to make online payments in an easier and more flexible way. With significant benefits, such as ease of payment, no admin fees, low interest, purchase protection, and ease of management, PayPal Credit could be the right choice for you. However, make sure you use this service wisely and not too often, and manage your account carefully. Thus, you can enjoy the benefits of PayPal Credit without having to worry about financial burdens.

Benefits and Terms of Use of PayPal Credit

So, you’ve heard about PayPal Credit and are curious to find out more? Well, you’re in luck! PayPal Credit is a special line of credit that allows you to make purchases on any website that accepts PayPal, even if you don’t have enough funds in your PayPal account. It works similarly to a credit card, but is specifically designed for PayPal users.

One of the main advantages of PayPal Credit is that you can take advantage of sign-up bonuses if you qualify. This bonus usually takes the form of a certain percentage of your purchase back in the form of a statement credit. Additionally, you can often get offers of 0% APR on purchases for a certain period of time, which can be especially helpful if you’re making a large purchase. For example, you may qualify for 0% APR for 6 months when making a new furniture purchase.

Of course, there are also some terms of use to keep in mind when using PayPal Credit. Just like a credit card, you must make a minimum payment every month. If you miss a payment or do not pay your balance in full, you may be subject to fines or late fees. Additionally, PayPal Credit’s standard APR rate is higher than traditional credit cards, so it’s important to pay off your balance as quickly as possible.

In addition to the terms of use, it is also important to remember that PayPal Credit is only available to customers who have a good PayPal account. If your account has ever been limited or suspended, you may not be eligible for PayPal Credit. If you’re not sure whether you qualify, you can always check by contacting PayPal customer service.

If you decide that PayPal Credit is right for you, it’s easy to sign up. You simply log into your PayPal account and click on the “Credit” tab. From there, you will be asked to provide some basic information, such as your Social Security number and date of birth. Once your application is approved, you can immediately start using PayPal Credit to make purchases.

Overall, PayPal Credit is a useful tool that can help you manage your expenses and make large purchases. However, it is important to understand its benefits and terms of use before signing up. By using PayPal Credit responsibly, you can take advantage of its bonuses and offers while building your credit history.