Steps to link a credit card to PayPal

Linking a credit card to PayPal is an easy and practical process that can increase the ease of use and security of your online transactions. Here are the simple steps to do so:

First, log in to your PayPal account with your email and password. Once logged in, you will see your main dashboard. At the top of the page, click the “Wallet” tab, which will display various financial management options.

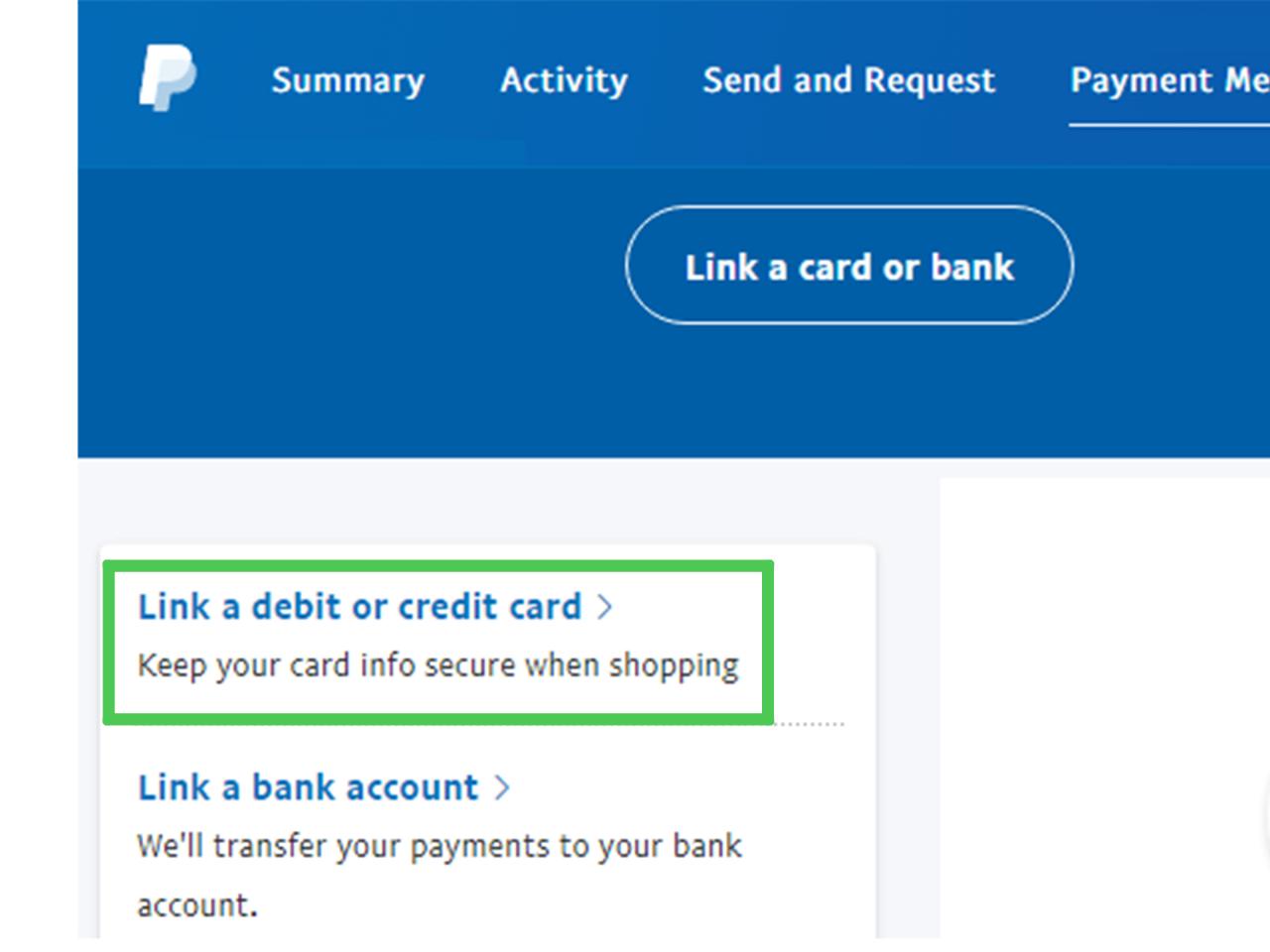

Next, find the “Cards and Bank” section. There, you will see an “Add Credit or Debit Card” button. Click that button to start the linking process.

The next step is to fill in your credit card information. Enter the card number, expiration date and security code. Make sure to include accurate information to avoid errors or rejections.

Once you have entered your credit card details, click the “Save” button. PayPal will process your information and link your card to your account. You will receive a confirmation notification once the process is complete.

To verify your card, PayPal may make a small transaction to your account. This transaction will incur a nominal fee, which will be returned to your balance after successful verification.

Once your card is verified, you can immediately start using it to make online payments. When making a payment, simply select the linked credit card from the payment options. PayPal will process payments safely and conveniently.

Linking a credit card to PayPal has several advantages. This allows you to make payments quickly and easily without having to enter your credit card information each time. Additionally, PayPal offers additional protection against fraud and identity theft, giving you peace of mind when shopping online.

So, if you haven’t linked your credit card to PayPal, take a few minutes to complete this process. This is an easy and safe way to simplify your online transactions and increase your overall financial security.

Credit card transfer limitations

When it comes to PayPal credit card transfers, there are some limitations to be aware of. First of all, keep in mind that not all credit cards are eligible to be linked to PayPal. Therefore, it is important to check with your credit card provider to ensure that your card qualifies.

Additionally, there are limits to the amount you can transfer to PayPal from your credit card. The amount allowed varies depending on the specific credit card and PayPal policies. For more detailed information, check with your credit card provider and PayPal directly.

Lastly, please note that credit card transfers to PayPal generally incur transaction fees. This fee is charged by PayPal and may vary depending on the amount transferred. Again, it is important to check with PayPal regarding specific fees associated with credit card transfers to ensure that you are fully aware of the fees that will be charged.

While there are some limitations to consider, linking a credit card to PayPal is still a convenient and safe way to transfer money. By following the simple steps outlined previously, you can easily set up your PayPal account and start transferring money from your credit card today. Remember to check the limitations and fees associated with credit card transfers so you can maximize your PayPal experience.

Alternatives to transferring credit card funds to PayPal

Apart from transferring credit card funds to PayPal via a bank account, there are other ways that may be more convenient and efficient. Let’s discuss how to connect a credit card to PayPal.

Step 1: Log in to your PayPal account

The first step is to log in to your PayPal account using your registered email address and password. After logging in, you will be redirected to the main page of your account.

Step 2: Go to your “Wallet”.

At the top of the main page, find the “Wallet” tab. Click the tab to access your Wallet page, which displays your credit card details, bank account and existing PayPal balance.

Step 3: Add a New Credit Card

On the Wallet page, click the “Add Credit Card” button. A pop-up window will appear, asking you to enter your credit card information, including card number, expiration date, and CVV code.

Step 4: Verify Your Credit Card

After entering your credit card information, PayPal will verify your card by sending a small amount to your account. This amount will appear on your statement within a few days. Enter the amount into the “Verification Code” field in the PayPal pop-up window to complete the verification process.

Step 5: Confirm and Save

Once your credit card is verified, click the “Save” button to save the card to your PayPal account. The card will now appear in the “Credit Cards” section of your Wallet page.

Benefits of Linking a Credit Card to PayPal

By connecting your credit card to PayPal, you get several benefits, such as:

Easier payments: You can use your credit card to make online payments without having to constantly enter the card information.

Additional protection: PayPal offers buyer protection, which can help you in cases of disputes or other problems with transactions made with your credit card through PayPal.

Shopping limit increases: PayPal can increase your shopping limit based on your credit card eligibility, so you can make larger purchases.

Linking a credit card to PayPal is a quick and easy process. By following these steps, you can take advantage of the convenience and benefits offered by this payment method.

Can I transfer funds from a credit card to a PayPal account?

Can You Transfer Funds from a Credit Card to a PayPal Account?

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal has become one of the most convenient and secure ways to conduct online transactions. However, some people may wonder if they can transfer funds from a credit card to a PayPal account. This article will discuss the possibilities and ways of transferring funds from a credit card to a PayPal account.

Why You Might Want to Transfer Funds from Credit Card to PayPal

There are several reasons why you might want to transfer funds from a credit card to a PayPal account. Here are some examples:

- Security : PayPal is known as one of the most secure online payment services. By using PayPal, you don’t have to provide credit or debit card information to sellers or other buyers. This makes your online transactions safer and more secure.

- Comfort : PayPal makes it easy to carry out online transactions. You no longer need to enter credit or debit card information every time you make a transaction. Just use your PayPal account and your transaction will be completed in no time.

- Flexibility : PayPal can be used for various types of transactions, from online purchases to transferring funds between accounts. By using PayPal, you can make online transactions more flexibly and easily.

How to Transfer Funds from Credit Card to PayPal

To transfer funds from a credit card to a PayPal account, you can do the following steps:

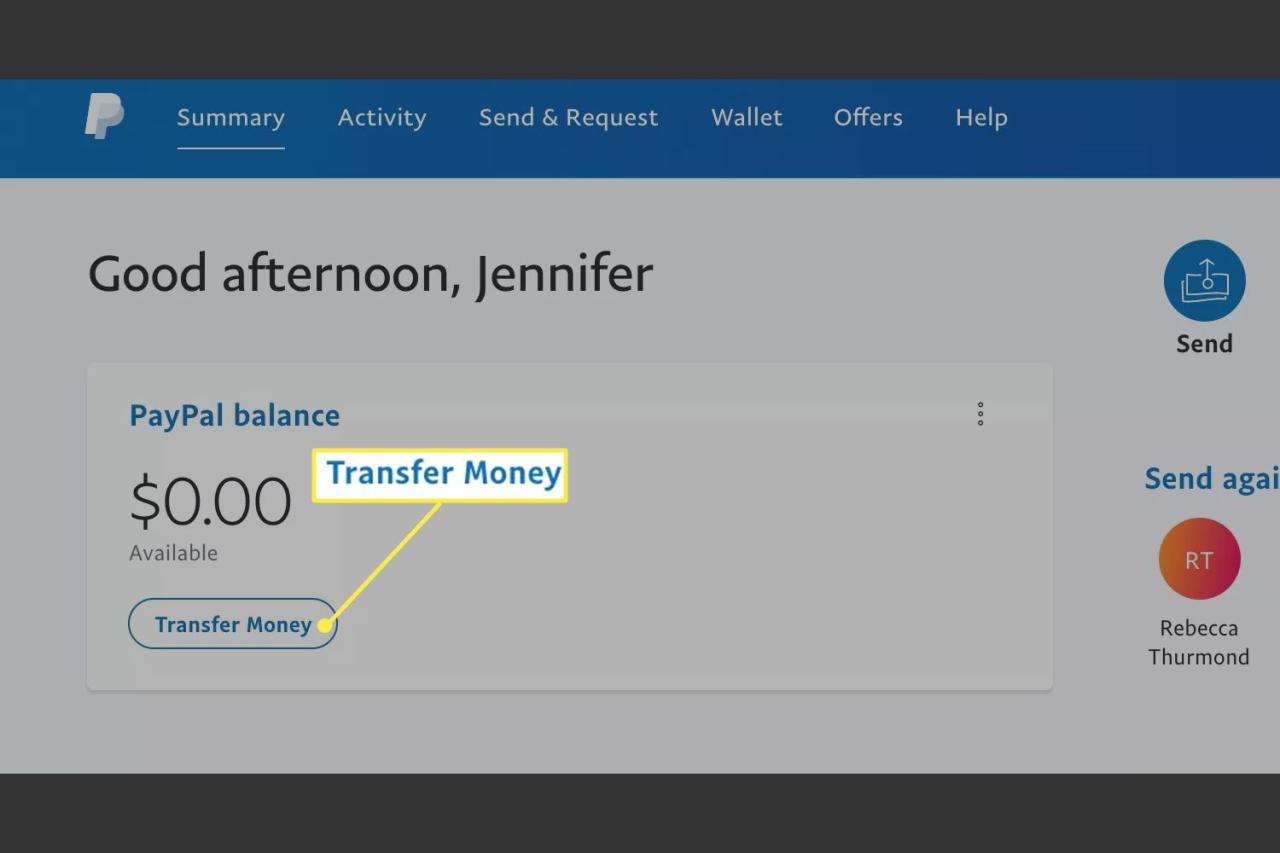

- Log in to your PayPal account : First, log in to your PayPal account using the email and password you have registered.

- Select “Add Funding Source” : Once logged in, select “Add Funding Source” at the top of the page.

- Select “Credit Card” : Select “Credit Card” as the source of funds you want to add.

- Enter Credit Card Information : Enter your credit card information, including card number, cardholder name, and expiration date.

- Credit Card Verification : After entering your credit card information, PayPal will verify your credit card. You may be asked to enter a verification code sent via SMS or email.

- Add Credit Card : Once your credit card is verified, you can add the credit card as a source of funds in your PayPal account.

- Fund Transfer : Once your credit card has been added as a funding source, you can transfer funds from your credit card to your PayPal account.

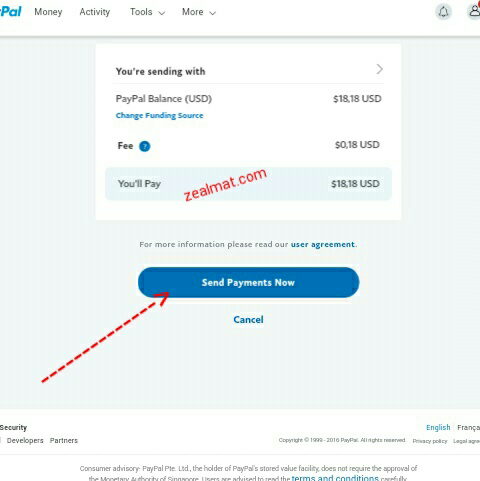

Fund Transfer Fees from Credit Card to PayPal

Please note that transferring funds from a credit card to PayPal may incur a fee. Fund transfer fees may vary depending on your credit card type and location. Here are some of the funds transfer fees you may face:

- Fee for transferring funds from credit card to PayPal: 2.9% + $0.30 per transaction

- Fees for transferring funds from international credit cards to PayPal: 4.4% + $0.30 per transaction

Limitations on Transferring Funds from Credit Card to PayPal

Keep in mind that transferring funds from a credit card to PayPal may have limitations. Here are some limitations you may face:

- Fund transfer limits: PayPal may have a limit on the funds transfers you can make in one day.

- Fund transfer time: Fund transfers from credit cards to PayPal may take several days to process.

- Credit card type limitations: PayPal may not support all credit card types. Make sure your credit card is supported by PayPal before transferring funds.

Conclusion

Thus, the answer to the question “Can I transfer funds from a credit card to a PayPal account?” is yes. You can transfer funds from your credit card to PayPal by taking a few simple steps. However, keep in mind that transferring funds from a credit card to PayPal may incur fees and has limitations. Make sure you understand these fees and limitations before transferring funds.