Linking Direct Express to PayPal

As a Direct Express beneficiary, you have the convenient option of linking your card to a PayPal account. This is an easy and convenient process that allows you to access your funds in a more flexible and secure way.

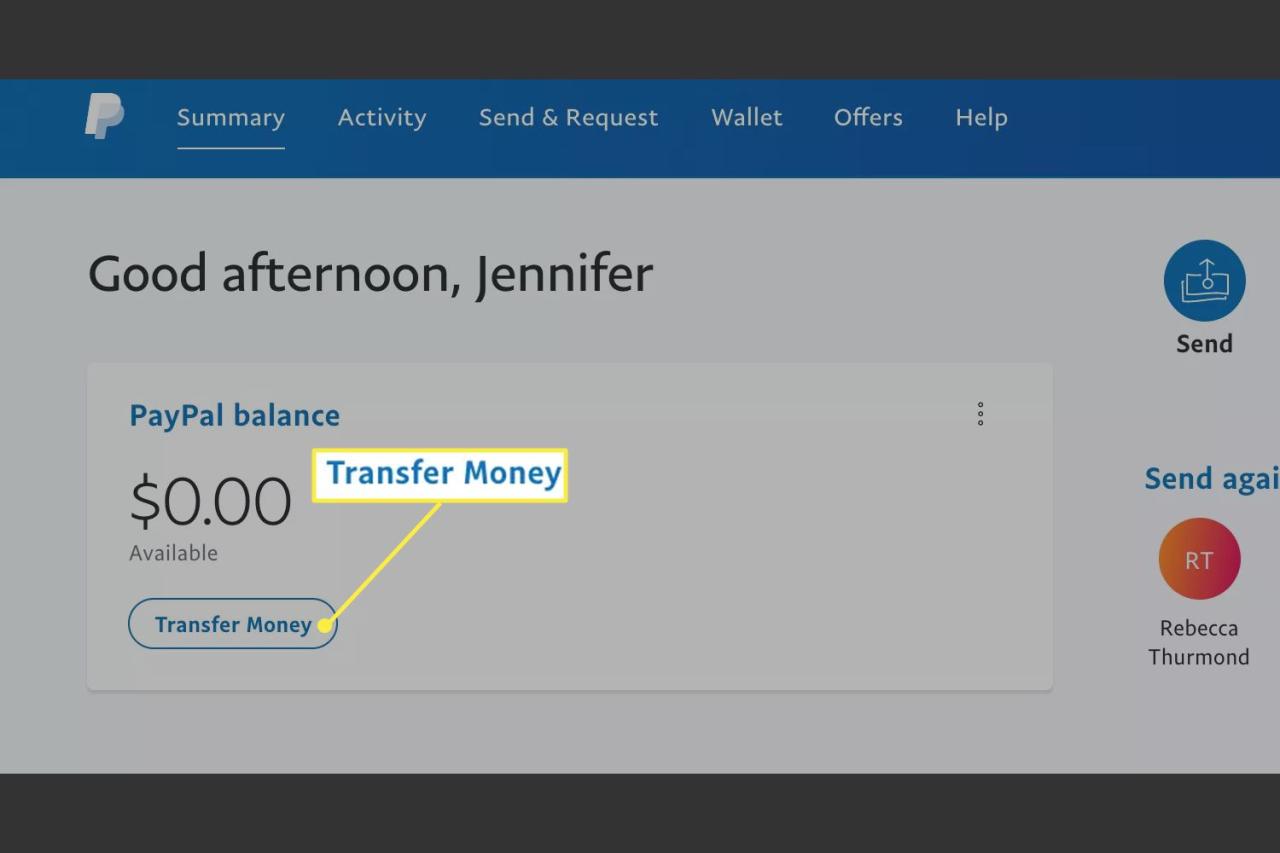

The first step is to log in to your PayPal account or create a new account if you don’t have one. Once logged in, navigate to the “Link and Confirm” section under the “Wallet” option. There, you will find the option to “Add Bank Card”.

Select that option and enter your Direct Express card information, including card number, expiration date, and security code. Make sure all the information entered is correct to avoid errors. Once you click “Link Bank Card,” PayPal will send you two small deposits to your Direct Express account.

These deposits usually take a few business days to appear, but you can speed up the process by verifying the deposit manually. To do this, log into your Direct Express account and record the amounts of both deposits. Go back to your PayPal account and enter the amount into the field provided.

Once the deposit is verified, your Direct Express card will be linked to your PayPal account. You can now use PayPal to make online payments, transfer funds, and withdraw cash from your linked bank account.

In addition to convenience, linking Direct Express to PayPal also offers increased security. You no longer need to enter your card details directly when making online transactions. PayPal acts as an intermediary, protecting your financial information from hackers and fraud.

To ensure your transaction is secure, always double-check payment details before confirming. Verify your recipient’s name, amount, and card information to make sure everything is correct. If you have any questions or concerns, feel free to contact PayPal customer service or visit their official website for help.

By linking Direct Express to PayPal, you can access your funds more easily and securely. Enjoy the convenience of online transactions, fast transfers, and enhanced protection offered by this integration.

Transfer method and steps

As a Direct Express card holder, you have the right to access various transfer methods, one of which is linking to a PayPal account. By connecting Direct Express to PayPal, you can easily transfer funds to your bank account or use it to make online payments and shop.

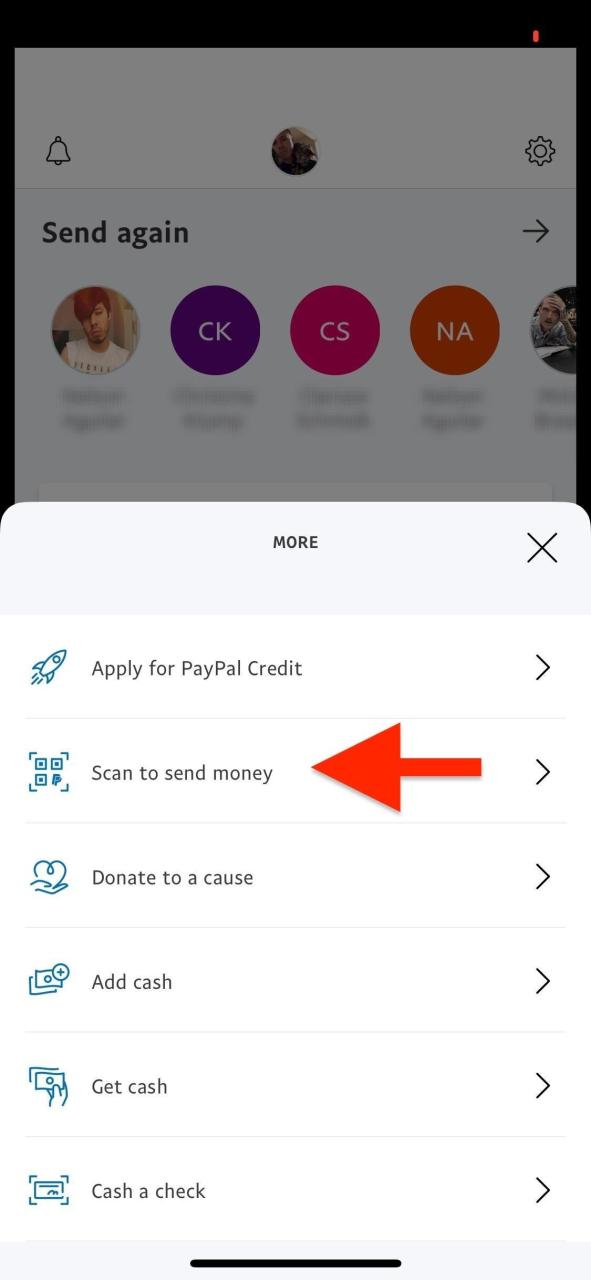

The process of linking Direct Express to PayPal is quite simple and can be completed in a few easy steps. The first step is to log in to your PayPal account and navigate to the “Wallet” section. From there, click the “Link Bank Account” option and select “US Bank Account.”

In the next step, you will be asked to enter your Direct Express account number and routing number. You can find this information on your Direct Express card or by contacting customer service. After entering account details, click “Link Account” and follow the on-screen instructions.

Once your Direct Express account is linked to PayPal, you can easily transfer funds at any time. Simply log into your PayPal account, select the “Transfer Funds” option, and enter the amount you want to transfer. Funds are usually credited to your bank account within 1-2 business days.

In addition to transferring funds, linking Direct Express to PayPal also allows you to use funds to make online payments and shop. At checkout, simply select PayPal as the payment method and complete the purchase. Funds will be debited automatically from your Direct Express account.

By connecting Direct Express to PayPal, you get flexibility and ease in managing your finances. You can easily access funds, make payments, and shop online without any hassle. So, if you want to maximize the potential of your Direct Express card, don’t hesitate to link it to your PayPal account today.

Restrictions or limitations on Direct Express transfers

When you use Direct Express to manage your finances, connecting it to your PayPal account can really help make your financial transactions easier. However, it is important to know the restrictions and limitations associated with Direct Express to PayPal transfers.

First of all, Direct Express limits the amount of money you can transfer to PayPal in one day. Daily limits typically range from $2,500 to $10,000, depending on your account type. These limits are established to help prevent fraud and suspicious activity.

In addition to daily limits, Direct Express also imposes weekly limits on PayPal transfers. Weekly limits typically range from $5,000 to $25,000, again varying depending on your account type. These limits are intended to protect you from overspending or losing money due to fraud.

In addition to transfer limitations, it is also important to pay attention to the fees associated with Direct Express transfers to PayPal. Direct Express charges $1.50 for each transfer to PayPal. This fee will be deducted from the amount transferred.

Finally, keep in mind that Direct Express to PayPal transfers cannot be reversed once initiated. This means that if you transfer money incorrectly or change your mind, you cannot cancel the transaction and get your money back. Therefore, it is important to double-check your transaction details before completing the transfer.

Overall, connecting your Direct Express to PayPal can provide convenience and convenience, but it is important to comply with the restrictions and limitations associated with such transfers. By understanding and complying with these rules, you can ensure that you use your Direct Express account safely and efficiently.

Can I transfer money from Direct Express to PayPal?

Sending Money from Direct Express to PayPal: Complete Guide

If you use a Direct Express card to receive government payments, you may be wondering whether you can send money from the card to your PayPal account. In this article, we’ll explain whether it’s possible to send money from Direct Express to PayPal, how to do it, and some other considerations you need to know.

What is Direct Express?

Direct Express is a debit card payment program administered by the United States Department of the Treasury. This program is designed to help individuals who receive government payments, such as pensions, social benefits, and food assistance, to manage their money more easily.

What is PayPal?

PayPal is an online payment service that allows you to send and receive electronic money. You can use PayPal to make online purchases, pay bills, and send money to friends and family.

Can You Send Money from Direct Express to PayPal?

Yes, you can send money from a Direct Express card to a PayPal account. However, there are some restrictions and requirements that you need to know about before making a transfer.

How to Send Money from Direct Express to PayPal:

Here are the steps to send money from a Direct Express card to a PayPal account:

- Create a PayPal Account : If you don’t have a PayPal account, create one first. You can do this by visiting the PayPal website and following the registration steps.

- Add Direct Express Card to PayPal Account : Once you have a PayPal account, add a Direct Express card to your account. You can do this by following these steps:

- Log in to your PayPal account

- Click on “Add Card” at the top of the page

- Select “Debit Card” as the card type

- Enter your Direct Express card information, including card number, expiration date, and security code

- Verify Your Card : Once you add a Direct Express card, PayPal will send a small amount to your card to verify that the card is Valid. You will need to enter the received verification code into your PayPal account to complete the verification process.

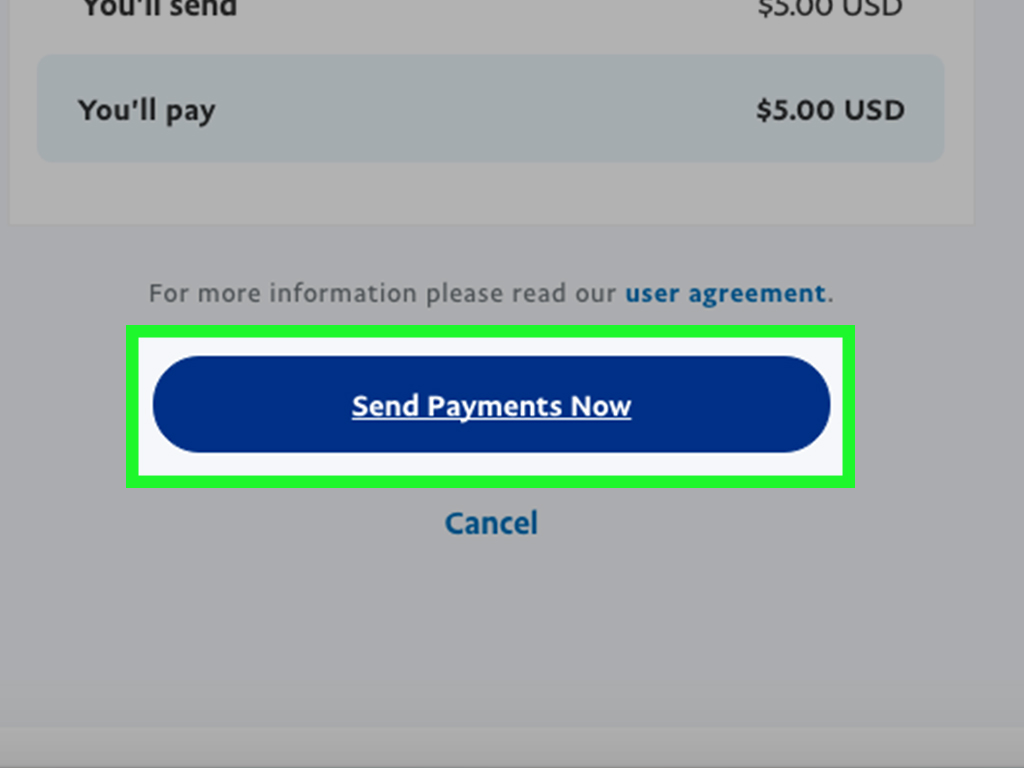

- Sending Money from Direct Express Card to PayPal : Once your card is verified, you can send money from your Direct Express card to your PayPal account. You can do this by following these steps:

- Log in to your PayPal account

- Click on “Balance” at the top of the page

- Select “Add Balance” and then select “Debit Card” as the source of funds

- Enter the amount of money you want to transfer and confirm the transaction

Transfer Limits and Fees

Keep in mind that there are some transfer restrictions and fees associated with sending money from a Direct Express card to a PayPal account. Here are some things you need to know:

- Transfer Limitations : PayPal has transfer limits for debit cards, including Direct Express cards. These transfer limits are typically around $10,000 per transaction.

- Transfer Fees : PayPal does not charge a transfer fee to send money from a debit card to a PayPal account. However, your Direct Express card may charge a fee for this transaction.

- Transfer Processing Time : Transfers from a Direct Express card to a PayPal account usually take a few minutes to a few hours to process.

Other Considerations

Before sending money from your Direct Express card to your PayPal account, you need to consider the following things:

- Security : Make sure you have a PayPal account that is secure and not used by anyone else. Also, make sure you do not give your Direct Express card information to anyone else.

- Other Fees : Keep in mind that there are some other fees associated with using a Direct Express card and a PayPal account, such as cash advance fees and international fees.

- Provision : Make sure you understand the terms and conditions associated with using a Direct Express card and PayPal account.

Conclusion

Sending money from a Direct Express card to a PayPal account is a relatively easy process. However, you need to understand some of the restrictions and transfer fees associated with these transactions. Make sure you have a PayPal account that is secure and not used by anyone else, and understand the terms and conditions associated with using a Direct Express card and PayPal account. With these things in mind, you can use a Direct Express card and a PayPal account to manage your money more easily.