Steps for transferring money from India

So, you need to transfer money from India to abroad? Don’t worry, here’s a step-by-step guide to make the process easier:

Step 1: Select Transfer Method

There are several ways to transfer money internationally, such as through banks, money transfer companies, or e-wallets. Compare costs and processing times to find a method that suits your needs.

Step 2: Gather Information

You need the recipient’s basic information, such as name, address, and account number. If you are transferring via bank, you will also need to know the recipient bank’s SWIFT code.

Step 3: Complete the Form

Once you have selected your transfer method, complete the required online form or application. Make sure you provide accurate and complete details.

Step 4: Prepare Documents

In some cases, you may need to provide supporting documents, such as proof of identity or proof of address. This varies depending on the transfer method and amount of money.

Step 5: Verify Details

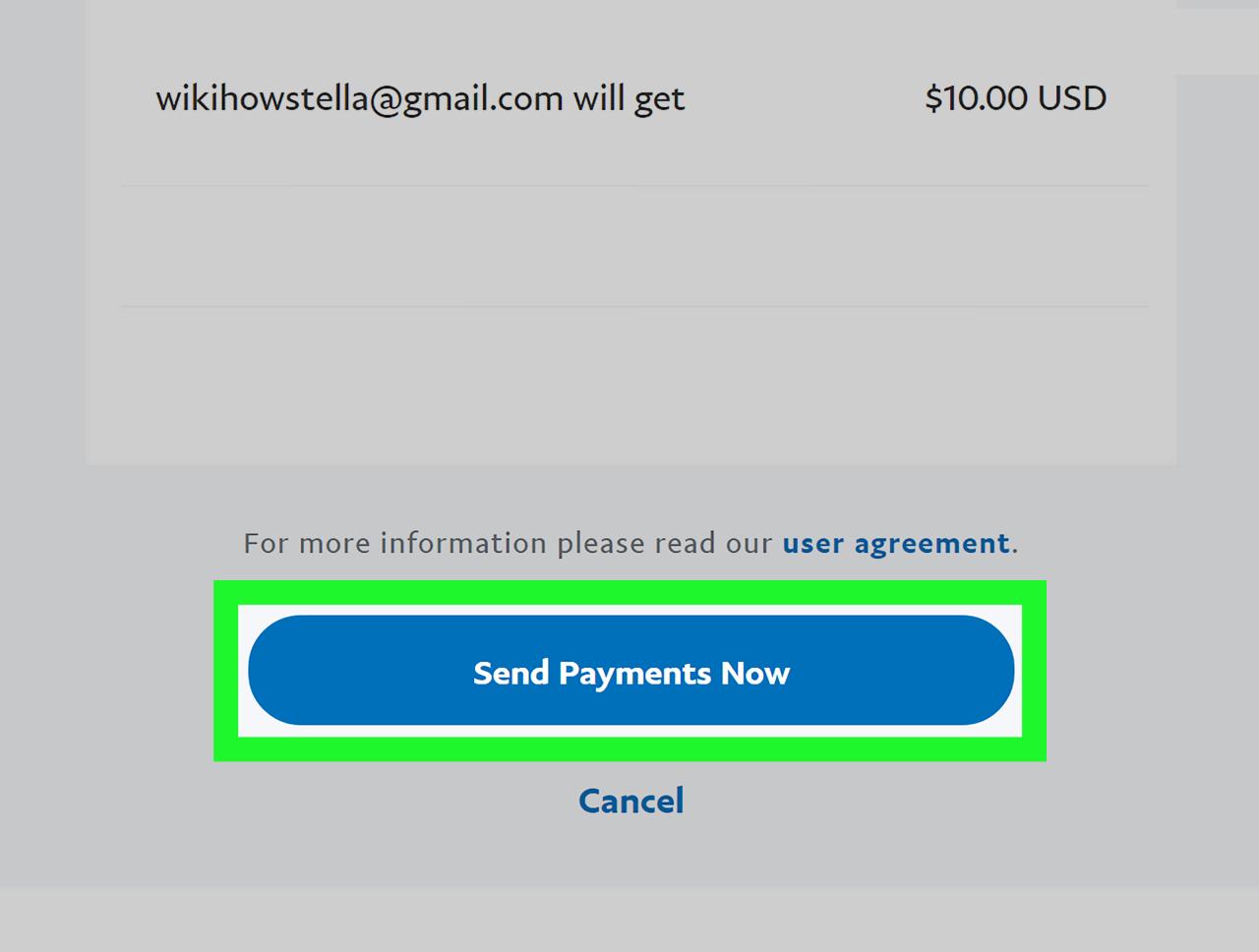

Double check your transfer details carefully before confirming. Make sure the amount, recipient details and transfer fees are correct.

Step 6: Send Money

Once everything is verified, complete the transfer process. Depending on the method you choose, money can be sent electronically or as a bank deposit.

Step 7: Track Transfer

Some money transfer providers allow you to track transfer status online. Use this feature to monitor the progress of your transactions.

Additional Tips:

Compare exchange rates from different providers to get the best price.

Consider transfer fees and processing time.

Verify the recipient’s identity to avoid fraud.

Keep a record of your transactions for future reference.

By following these steps, you can transfer money from India to abroad easily and safely. Remember to provide accurate information, verify details, and compare fees for a smooth transfer experience.

PayPal fees for international transfers

When looking to send money from India abroad using PayPal, it is important to understand the fees associated with international transfers. These fees vary depending on several factors, including the currency sent, the amount, and the payment method.

First of all, PayPal charges a flat fee for every international transaction. These fees vary depending on the destination country. For example, to send money to the United States, the flat fee is 4%.

Additionally, PayPal also charges a percentage fee for all transactions. This fee usually ranges from 1.5% to 2.5%, depending on the currency and amount sent. For example, if you send $100 to the United States, the percentage fee will be $1.50.

If you send a larger amount, the percentage fee may decrease. For example, if you send $1,000 to the United States, the percentage fee will be $15, or 1.5% of the amount sent.

It’s also important to consider the payment method you use. If you fund your transfer using a credit or debit card, you may incur additional fees. For example, PayPal charges a 2.9% fee for all transactions funded using a credit card.

To avoid additional fees, we recommend that you fund your transfer using your PayPal balance or bank account. This way, you will only be charged the fixed fees and percentages explained above.

In conclusion, PayPal transfer fees for international transfers vary depending on several factors. However, by understanding these fees and choosing the right payment method, you can save money when sending money abroad. This way, you can ensure that the person you send the money to gets the amount you expect.

Legal regulations on international transfers from India

When sending money from India abroad, understanding the legal regulations is very important. The Indian government has put in place a framework to ensure smooth and secure international transactions.

The first step is to ensure your transfer destination is permitted by the Reserve Bank of India (RBI). The RBI allows individuals to send money abroad for certain purposes, such as studies, medical treatment, maintenance of family members, and investments.

Next, you must comply with the transfer value limits. RBI has set a monthly limit of USD 250,000 for personal transfers. For higher amounts, you need special approval from RBI.

The most common way to transfer money from India is through banks. Just visit a bank branch or use their internet banking service. You must provide recipient details, transfer destination and the amount you want to send.

Another quick and easy way is through a money transfer company. These service providers specialize in international money transfers and often offer favorable exchange rates. To use their services, you need to register for an account and provide your personal information.

Another option is to use a bank draft. This involves making a payment request to the bank, which then issues a draft that can be redeemed by the recipient in the destination country.

Before making a transfer, be sure to check the fees charged by the bank or money transfer company. These fees may vary depending on the transfer method, amount transferred, and destination country.

Additionally, you may need to provide proof of the purpose of the transfer. This can be documents such as school fee receipts, medical invoices, or proof of property purchase.

By following these legal regulations, you can ensure that your international money transfers from India are carried out safely and efficiently. Remember to do your research, compare costs, and provide the necessary documentation for a smooth transaction.

Can I transfer money abroad from India via PayPal?

Transfer Money Abroad from India Via PayPal: Is It Possible?

In recent years, PayPal has become one of the most popular online payment platforms in the world. However, some countries have strict regulations regarding international money transfers, including India. So, can you transfer money abroad from India via PayPal? Let’s find the answer.

RBI Regulations on International Money Transfers

The Reserve Bank of India (RBI) is India’s central bank responsible for regulating financial activities in the country, including international money transfers. The RBI has strict regulations on international money transfers, especially if the funds are used for unauthorized or unlawful activities.

According to RBI regulations, Indian individuals can transfer money abroad through the Liberalized Remittance Scheme (LRS) scheme for legitimate purposes such as:

- Education

- Treatment

- Journey

- Property purchase

- Investment

However, there are limits to the amount of money transfers that can be made through the LRS scheme. These limits apply to all types of international money transfers, including transfers via PayPal.

PayPal in India: Do’s and Don’ts

PayPal allows Indian users to transfer money internationally, but there are some restrictions and regulations to follow. Here are some things you need to know:

- International money transfer : PayPal allows Indian users to transfer money internationally to certain countries, but only for legitimate purposes like education, treatment, travel, etc.

- Transfer amount limits : PayPal has limits on the amount of money transfers that can be made through an Indian PayPal account. These limits vary depending on the type of PayPal account you have.

- Transfer fees : PayPal charges a transfer fee for every international transaction. These fees may vary depending on the type of transfer and the amount transferred.

- Currency conversion : PayPal will convert Indian currency to destination currency, but there may be unfavorable exchange rate differences.

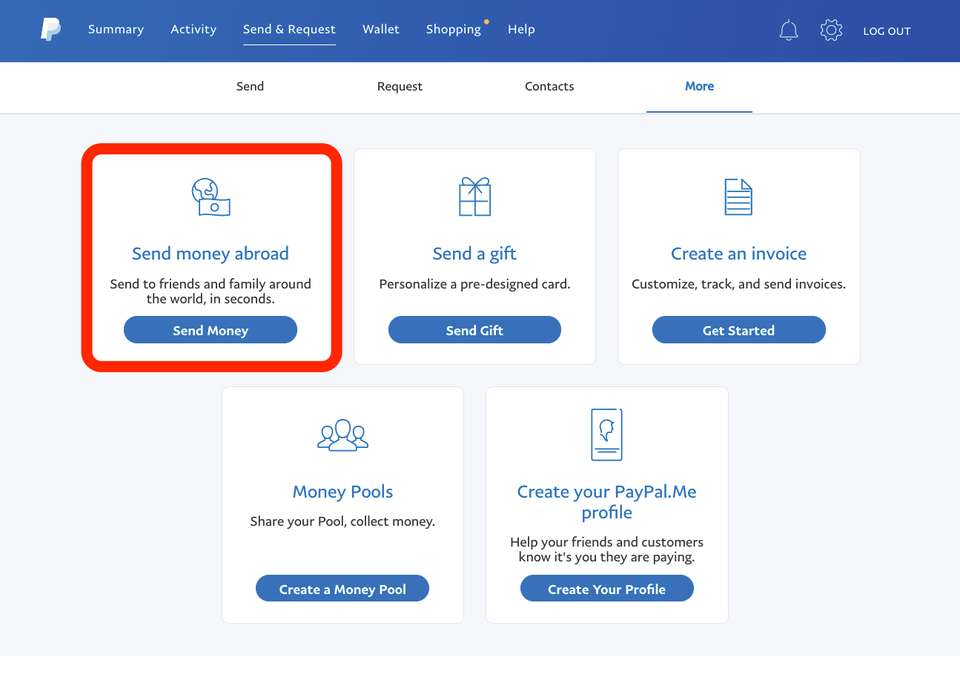

How to Transfer Money Abroad from India Via PayPal

If you want to transfer money overseas from India via PayPal, here are the steps you need to take:

- Open an Indian PayPal account : If you don’t have an India PayPal account, open one first.

- Add funding sources : Add a funding source such as a credit, debit card, or bank account to your PayPal account.

- Select the transfer type : Select the type of transfer you want to make, such as transfer to a bank account or transfer to another PayPal user.

- Enter recipient information : Enter recipient information, such as name, address, and bank account number.

- Confirm transfer : Confirm the transfer and fees that will be charged.

Tips and Warnings

Before transferring money abroad from India via PayPal, you need to know the following things:

- Check RBI regulations : Make sure you understand RBI regulations on international money transfers and comply with them.

- Choose the right transfer type : Select the transfer type that best suits your needs, such as transfer to a bank account or transfer to another PayPal user.

- Check transfer fees : Make sure you understand the transfer fees that will be charged and prepare to pay these fees.

- Keep your account secure : Keep your PayPal account secure by using a strong password and monitoring your transactions regularly.

Conclusion

Transferring money abroad from India via PayPal is possible, but there are some restrictions and regulations to follow. Make sure you understand the RBI regulations on international money transfers and comply with them. Additionally, choose the right transfer type, check transfer fees, and keep your account secure. Thus, you can transfer money abroad from India via PayPal safely and easily.