Sending money without linking a bank or credit card.

In an increasingly digital financial landscape, the ability to send money without having to link a bank account or credit card has become a necessity. Thanks to services like Zelle, Venmo, and PayPal, sending money is now easier and more convenient than ever.

One of the main advantages of this money transfer service is the anonymity it provides. Unlike traditional bank transfer transactions, which require providing sensitive account information, this service allows users to send money without disclosing their financial information. This is ideal for people who want to maintain their privacy or for situations where confidentiality is required.

Apart from its convenience and anonymity, this money transfer service also offers various features that make it easy to send and receive money. For example, Zelle allows users to send money with just the recipient’s mobile phone number or email address. PayPal, on the other hand, provides buyer protection for eligible transactions, providing peace of mind when making online transactions.

However, it is important to note that this service is not completely free of charge. Zelle charges a $0.25 fee for each transaction, while Venmo charges a 3% fee for transactions using credit cards. PayPal charges various fees depending on the type of transaction. Therefore, it is always important to review the fees before using these services.

Additionally, this money transfer service has limits on the amount of money that can be sent and received. Zelle allows a daily limit of $1,000, while Venmo has a weekly limit of $4,999.99. PayPal has higher limits, but the amounts vary depending on the account type.

Despite these limitations and small fees, money transfer services without a bank or credit card link have revolutionized the way people send and receive money. They provide convenience, anonymity, and security, making them an attractive option for anyone who wants to make financial transactions easily and comfortably.

Alternative funding methods for PayPal transactions.

In the ever-evolving world of digital transactions, PayPal has become the go-to platform for sending and receiving money. However, for those who don’t have a linked bank account or credit card, this can be an obstacle. Don’t worry, because there is a clever way to solve this problem.

One popular alternative method is to use a Prepaid card. These cards function like bank accounts, but don’t require you to open a new account or provide sensitive financial information. Just top up your card with cash or transfer, and you can use it to make PayPal transactions easily.

Another innovative alternative is a digital wallet like Venmo or Cash App. The app lets you connect your bank account or add funds via debit or credit card. Once your funds are available, you can transfer money to PayPal instantly. All you need to do is enter the recipient’s email address or phone number.

If you prefer a more direct method, you can also make a Western Union transfer. With this service, you can visit a Western Union branch and fill out a transfer form. You will be given an MTCN code, which you can then use to complete the PayPal transaction.

Additionally, some large retail stores such as Walmart and 7-Eleven offer PayPal reload services. Just visit a store, bring cash, and tell the cashier you want to top up your PayPal account. You will be given a code that you can enter into your PayPal account to add funds.

With these alternative methods, sending money via PayPal without linking a bank account or credit card is no longer a problem. You can choose the method that best suits your needs, whether it’s the convenience of a Prepaid card, the convenience of a digital wallet, or the accessibility of Western Union transfers or retail top-ups.

No matter which method you choose, all of these options give you flexibility and security in managing your finances. So, the next time you need to send money via PayPal, don’t let the lack of a bank account or credit card get in the way. Use this alternative method and enjoy the convenience of unlimited transactions.

PayPal limitations when no bank or credit card is linked.

Sending money without linking a bank or credit card may seem challenging, but with PayPal, you can do it easily. While PayPal is known for its ease of use, there are some limitations to be aware of if you don’t link a traditional payment method.

Without linking a bank or credit card, you can send money to other PayPal users for free. However, the amount you can send is limited to $500 per transaction and $2,500 per month. These limits are in place to protect users from fraud and money laundering.

Additionally, you can only send money to individuals who have a verified PayPal account. This is also to prevent fraud and ensure that your funds are sent to legitimate recipients.

If you need to send a larger amount or want to transfer money to someone who doesn’t have a PayPal account, you can use the PayPal Guest Checkout service. This option allows you to pay using a debit or credit card without having to create an account. However, keep in mind that PayPal charges a 2.9% processing fee for Guest Checkout transactions.

Despite certain limitations, sending money via PayPal without linking a bank or credit card remains a convenient and safe option. By following the instructions above, you can easily transfer funds to your friends, family, or business, even without traditional payment methods.

Can I send money with PayPal without a bank or credit card?

Send Money with PayPal Without a Bank Account or Credit Card: Is It Possible?

PayPal is one of the most popular and widely used online payment services worldwide. Many people use PayPal to make online transactions, whether to buy goods, pay for services, or send money to other people. However, a frequently asked question is: “Can I send money with PayPal without having a bank account or credit card?”

In this article, we’ll explore the answer to that question and discuss several ways you can send money with PayPal without having a bank account or credit card.

What is PayPal?

Before we discuss how to send money with PayPal without a bank account or credit card, let’s first understand what PayPal is. PayPal is an online payment service that allows you to make transactions safely and easily. With PayPal, you can send money, pay for services, and make other transactions online.

How to Send Money with PayPal

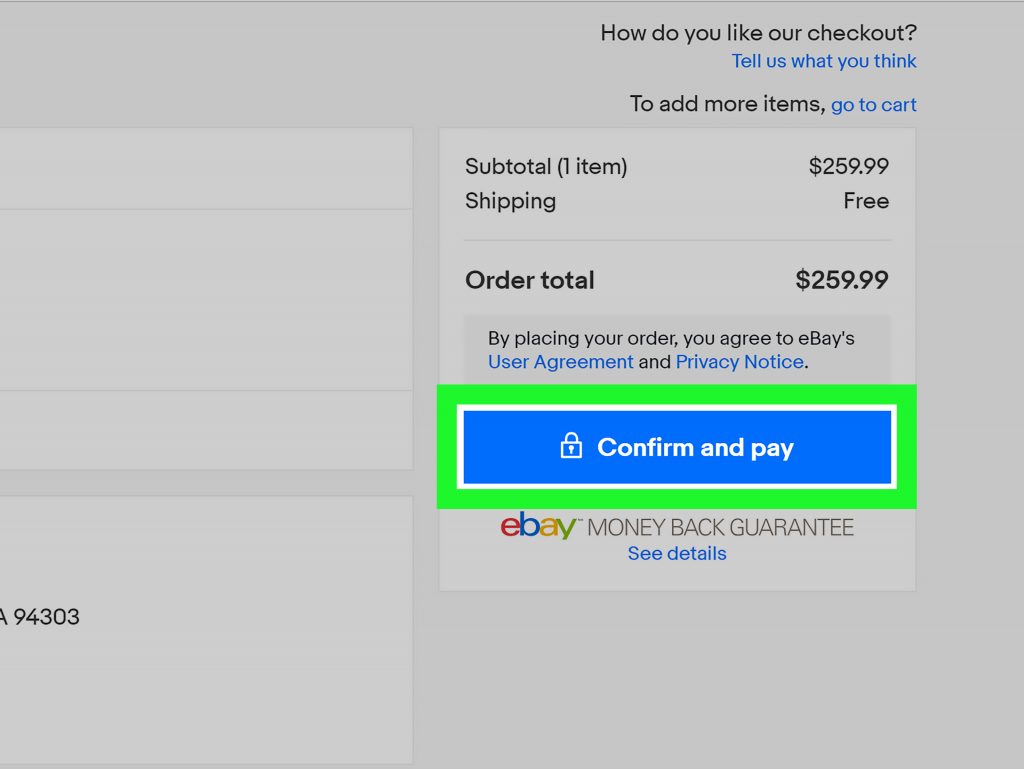

To send money with PayPal, you usually need a bank account or credit card linked to your PayPal account. However, there are several other ways you can send money with PayPal without having a bank account or credit card.

1. Using PayPal Cash

PayPal Cash is a service that allows you to send money with PayPal without having a bank account or credit card. With PayPal Cash, you can send money using your PayPal balance. You can top up your PayPal balance using other payment methods, such as TransferWise or Skrill.

To use PayPal Cash, you need to have an active PayPal account and sufficient balance to make transactions. You can send money with PayPal Cash to someone else’s PayPal account or to the recipient’s bank account.

2. Using PayPal Prepaid Card

PayPal Prepaid Card is a prepaid card that can be used to make online and offline transactions. With PayPal Prepaid Card, you can send money with PayPal without having a bank account or credit card. You can top up your card balance using other payment methods, such as TransferWise or Skrill.

To use a PayPal Prepaid Card, you need to have an active PayPal account and a PayPal Prepaid card linked to your account. You can send money with a PayPal Prepaid Card to someone else’s PayPal account or to the recipient’s bank account.

3. Using Google Pay or Apple Pay

Google Pay and Apple Pay are digital payment services that can be used to make online and offline transactions. With Google Pay or Apple Pay, you can send money with PayPal without having a bank account or credit card. You can top up your PayPal account balance using Google Pay or Apple Pay.

To use Google Pay or Apple Pay, you need to have an active PayPal account and a Google Pay or Apple Pay app connected to your account. You can send money with Google Pay or Apple Pay to someone else’s PayPal account or to the recipient’s bank account.

4. Using TransferWise or Skrill

TransferWise and Skrill are online payment services that can be used to make international transactions. With TransferWise or Skrill, you can send money with PayPal without having a bank account or credit card. You can top up your PayPal account balance by using TransferWise or Skrill.

To use TransferWise or Skrill, you need to have an active TransferWise or Skrill account and a PayPal account connected to your account. You can send money with TransferWise or Skrill to someone else’s PayPal account or to the recipient’s bank account.

Security and Privacy Policy

PayPal has strict security and privacy policies to protect your personal information and transactions. PayPal uses encryption technology to protect your personal information and has a dedicated security team to prevent fraud and online crime.

However, keep in mind that security and privacy policies also depend on you. Make sure you use a strong password and do not reveal your personal information to others.

Conclusion

In this article, we’ve discussed several ways you can send money with PayPal without having a bank account or credit card. Using PayPal Cash, PayPal Prepaid Card, Google Pay or Apple Pay, TransferWise or Skrill, you can send money with PayPal without having a bank account or credit card.

However, keep in mind that you must use a secure payment method and have sufficient balance to make transactions. Make sure you read and understand PayPal’s privacy and security policies before making a transaction.

With PayPal, you can make online transactions safely and easily. So, what are you waiting for? Start using PayPal today!