How to transfer funds from PayPal to Cash App.

Hi everyone, have you ever wanted to know how to easily transfer money from PayPal to Cash App? Well, what a coincidence, I will guide you step by step to get it done quickly and safely.

The first step is to make sure you have the Cash App application on your cellphone. If not, download it from the App Store or Google Play. Once you have it, open the application and log in to your account.

Then, go back to PayPal and log in to your account there. Click on the “Send & Request” tab and select “Send to Bank Account.” Here, you have to add the bank account associated with your Cash App.

To find bank account details, open the Cash App app and tap the profile icon in the bottom right corner. Under the “Balance” section, you will see the option “Bank.” Tap that and you’ll see the account number and routing number you need.

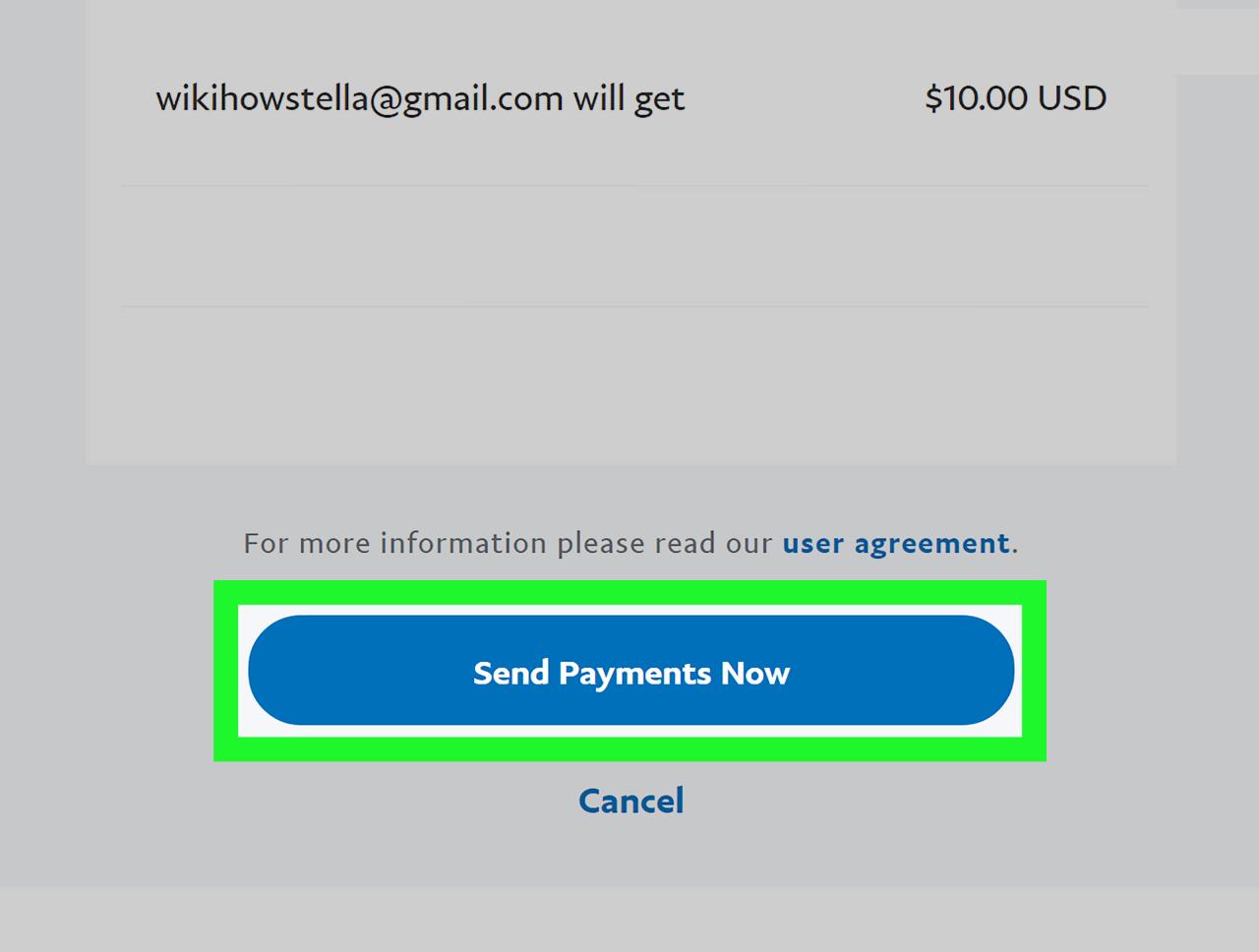

Go back to PayPal and enter your Cash App account number and routing number. Enter the amount of money you want to transfer and make sure all the details are correct. Then, click “Submit.”

The transfer process usually takes 1-3 working days. You can monitor the transfer status in your PayPal or Cash App application. Once the money arrives in your Cash App, you can use it to send, spend, or withdraw cash easily.

Congratulations, you now know how to transfer funds from PayPal to Cash App. Remember to always check your bank account information carefully to ensure the transfer goes smoothly. If you have any further questions, feel free to ask in the comments below.

Steps to link PayPal and Cash App for money transfers.

Connecting PayPal and Cash App is an important step before transferring funds. To do this, open the Cash App app and tap the profile icon in the top left corner. Select “Linked Banks” and follow the instructions to link your PayPal account.

Once your account is connected, you can transfer funds from PayPal to Cash App easily. In the Cash App app, tap the “Balance” option. Then, tap “Add Cash” and select “From Paypal.” Enter the amount you want to transfer and confirm the transaction. Funds will be added to your Cash App balance within minutes.

To transfer funds from Cash App to PayPal, open the Cash App app and tap “Balance” again. This time, select “Cash Out” and select “To Paypal.” Enter your PayPal email address and the amount you want to transfer. Review the transfer details and confirm to complete the process. Funds will be available in your PayPal account within one to three business days.

Fund transfers between PayPal and Cash App may incur fees, so it’s important to check these before making a transaction. Fees usually range from 1% to 3% of the amount transferred. However, there are ways to avoid these fees, such as using your Cash App balance to make purchases or waiting until the funds are available in your PayPal account before transferring them.

Overall, transferring funds between PayPal and Cash App is easy and safe. By following the steps outlined above, you can make transactions quickly and efficiently. However, always check the fees before making a transfer to avoid unwanted surprises.

Possible fees for transferring funds between PayPal and Cash App.

Once you connect your PayPal and Cash App accounts, transferring funds is easy. However, it is important to be aware of the possible fees associated with this transfer.

Instant transactions are subject to a flat fee of 1% of the transfer amount, with a minimum of $0.25 and a maximum of $10. This is the fastest option, allowing funds to hit your Cash App account in minutes.

To avoid these fees, you can choose the standard transfer option, which takes 1-3 business days. However, Cash App charges a flat fee of 2.5% of the transfer amount, with a minimum of $0.25 and a maximum of $25.

Additionally, PayPal may charge a currency conversion fee if you transfer funds between currencies. These fees vary depending on the type of currency and current exchange rates.

Before making a transfer, make sure you have considered all potential fees. If the amount transferred is relatively small, standard fees may be a more cost-effective option. However, if you need to transfer funds immediately, instant transactions may be more suitable.

Some users reported problems transferring funds from PayPal to Cash App. If you experience this, try checking your account information again and make sure both accounts are verified. You can also contact customer support of both platforms for assistance.

Transferring funds between PayPal and Cash App can be an easy and convenient way to manage your finances. However, by understanding the possible costs involved, you can make an informed decision to maximize your transfer.

Can I send my PayPal money to my cash app?

Sending Money from PayPal to Cash App: Is It Possible?

PayPal and Cash App are two of the most popular digital financial services in the world. Both allow users to send and receive money electronically, as well as carry out online transactions easily. However, can you send money from PayPal to Cash App? This article will discuss the possibilities and ways to send money from PayPal to Cash App.

Can PayPal and Cash App be linked?

PayPal and Cash App are two different digital financial services, but they can be connected in several ways. You can connect your bank account with PayPal and Cash App, so you can transfer money from one account to another. However, there are some limitations you need to be aware of before sending money from PayPal to Cash App.

How to send money from PayPal to Cash App

Here are some ways you can send money from PayPal to Cash App:

- Using a connected bank account : If you have connected your bank account with PayPal and Cash App, you can transfer money from PayPal to your bank account, then from your bank account to Cash App. This may take a few days to process, depending on the type of transaction and the bank you use.

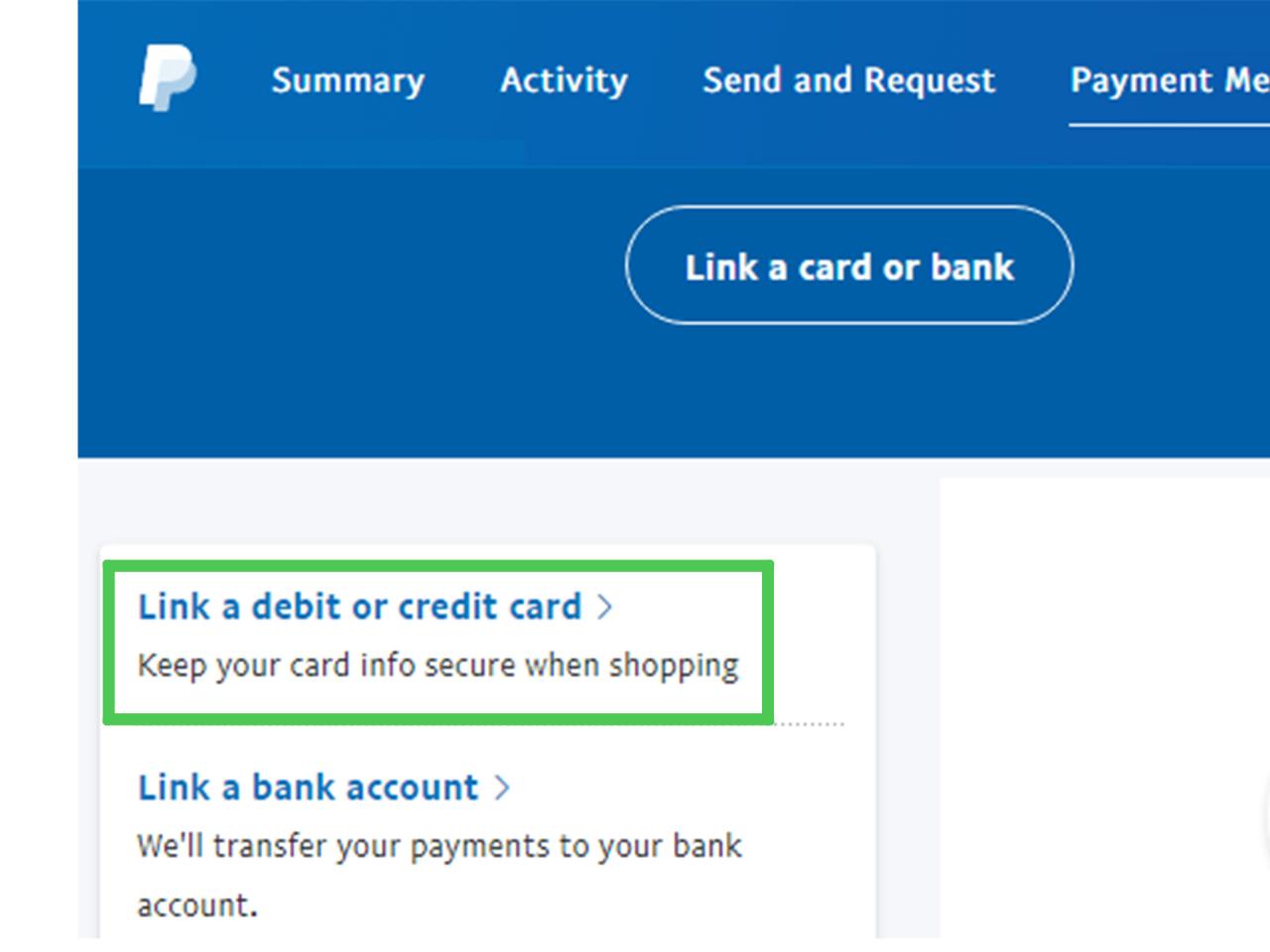

- Use a debit or credit card : If you have a debit or credit card linked to PayPal and Cash App, you can use it to transfer money from PayPal to Cash App. You can use your debit or credit card to pay for transactions in Cash App, and the money will be deducted from your PayPal balance.

- Using third party services : There are several third-party services that allow you to send money from PayPal to Cash App, such as Xoom, WorldRemit, or Skrill. However, keep in mind that these services may have additional fees and different delivery times.

Cost and delivery time

Fees and shipping times for sending money from PayPal to Cash App can vary depending on the method you choose. Here are some examples of shipping costs and times you may experience:

- Using a connected bank account : Bank transfer fees may apply, and delivery time may take several days (usually 2-5 days).

- Use a debit or credit card : Transfer fees may apply, and delivery times are usually faster than bank transfers (usually a few minutes to a few hours).

- Using third party services : Transfer fees may apply, and delivery time may take several days (usually 1-3 days).

Security and privacy

Security and privacy are very important when making online transactions. PayPal and Cash App have strict security policies to protect their users, but you also need to be careful when making transactions.

- Identity verification : Make sure you have verified your identity on PayPal and Cash App before making a transaction.

- Use a strong password : Make sure you use strong and unique passwords for your PayPal and Cash App accounts.

- Check transactions regularly : Make sure you check your transactions regularly to ensure that there are no unauthorized transactions.

Conclusion

Sending money from PayPal to Cash App can be done in several ways, but keep in mind that there are some restrictions and fees that may apply. Make sure you understand the security and privacy policies of both services before making a transaction. By being careful and choosing the right method, you can easily send money from PayPal to Cash App.

FAQs

Q: Can I send money from PayPal to Cash App directly?

A: No, PayPal and Cash App do not have direct integration, so you cannot send money directly from one account to another.

Q: How much does it cost to transfer from PayPal to Cash App?

A: Transfer fees may vary depending on the method you choose. Make sure you check the fee policies of PayPal and Cash App before making a transaction.

Q: What is the delivery time from PayPal to Cash App?

A: Delivery times may vary depending on the method you choose. Make sure you check the shipping time policies of PayPal and Cash App before making a transaction.

Q: Can I use a debit or credit card to send money from PayPal to Cash App?

A: Yes, you can use a debit or credit card to send money from PayPal to Cash App, but make sure you check the fee policy and sending times before making a transaction.