Sending international payments with PayPal from India.

When you want to send money abroad quickly and easily from India, PayPal is here to help. Their international money transfer service gives you a safe and convenient way to send money to over 200 countries and territories.

Before you start, you must have a verified PayPal account. Once your account is set up, follow these steps:

1. Log in to your PayPal account.

2. Click “Send & Request” then “Send Money”.

3. Select the destination country and enter the amount you want to send.

4. Select your payment method (for example, debit card or bank account).

5. Review your transaction details and click “Submit.”

PayPal will automatically convert your currency to the recipient country’s currency at a competitive exchange rate. You can track the status of your transfer online or via the PayPal mobile app.

Here are some of the key benefits of sending international payments with PayPal from India:

Fast and convenient: Transfers are usually completed within minutes.

Secure: PayPal uses the latest encryption technology to protect your financial information.

Convenient: You can send money from anywhere with an internet connection.

Affordable: PayPal offers competitive exchange rates and low transfer fees.

Additionally, PayPal also offers a number of useful features:

Multi-currency support: You can send and receive money in more than 25 currencies.

Automatic currency conversion: PayPal will automatically convert your currency to the recipient’s currency.

Bulk payments: You can send money to multiple recipients at once.

24/7 customer service: If you need help, PayPal customer service is ready to help you.

If you’re looking for a fast, easy, and secure way to send money abroad from India, PayPal is a great choice. With its extensive global network and advanced features, PayPal will ensure that your money reaches its destination quickly and safely.

PayPal’s fees and exchange rates for international transfers.

When you need to send money abroad from India, PayPal is one of the popular choices. With its extensive global reach and easy-to-use platform, PayPal makes it easy to transfer funds overseas. However, before you start using PayPal for international payments, it’s important to understand its fees and the exchange rates offered.

PayPal fees for international transfers vary depending on several factors, such as the destination country, the amount sent, and the payment method used. Generally, PayPal charges a flat fee plus a percentage of the amount sent. These fees can vary slightly depending on the type of PayPal account you have.

For example, to send money from India to the United States using a personal PayPal account, PayPal charges a flat fee of $4.99 plus 5.4% of the amount sent. So, if you send $100, the total fee will be $9.94.

In addition to fixed fees, PayPal also uses exchange rates to convert currencies when you send international payments. The exchange rate PayPal uses is the mid-market exchange rate, plus PayPal’s own profit margin. This margin is usually small, but can vary depending on the currency involved.

To get a clear idea of the exchange rates PayPal offers, you can use the currency calculator on the PayPal website. This calculator lets you type in the amount you want to send and the destination currency, and will show the amount the recipient will receive once converted using PayPal’s exchange rate.

If you frequently make international payments, it may be beneficial to consider a Business PayPal account. Business Accounts offer lower fees for international transfers and also allow you to set a locked exchange rate to lock in a favorable exchange rate.

Overall, PayPal is a reliable choice for sending international payments from India. Fees and exchange rates are transparent, and the platform is easy to use. By understanding the fees and exchange rates offered, you can ensure that you get the best value for your money when sending international payments via PayPal.

Legal and tax considerations when sending money abroad.

When sending international payments with PayPal from India, there are several legal and tax considerations to keep in mind. Firstly, please note that PayPal in India is regulated by the Reserve Bank of India (RBI), which sets certain limits and requirements for cross-border transactions.

For private transactions, the maximum amount that can be sent per year is USD 250,000. For business payments, the limits vary depending on the purpose and nature of the payment. Additionally, RBI requires KYC (Know Your Customer) verification for transactions above INR 50,000. This means you must provide proof of identity and address to PayPal.

Apart from the RBI guidelines, it is also important to understand the tax implications. In India, overseas remittances may be subject to Tax Deduction at Source (TDS). TDS is a tax that is deducted from the amount transferred and paid to the government. TDS rates vary depending on the type of transaction and recipient status.

For example, TDS of 5% is charged on transfers to non-resident accounts, while TDS of 20% is charged on payments to overseas service providers. It is your responsibility to deduct and deposit TDS before making the transfer. Failure to do this may result in fines and penalties.

To ensure compliance, it is highly recommended to consult a financial advisor or tax professional before making any international transfers. They can help you understand the relevant regulations and suggest ways to avoid or minimize your tax liability.

In addition to the legal and tax implications, it’s worth considering transaction costs. PayPal charges a service fee for international transfers, which varies depending on the currency sent and the destination. Make sure you understand these fees before making a transfer to avoid unwanted surprises.

By understanding the legal guidelines, tax implications, and fees associated with sending international payments with PayPal from India, you can ensure compliance and minimize potential problems. It is important to exercise caution to protect your financial and legal interests when conducting cross-border transactions.

Can I send money from India to other countries via PayPal?

Sending Money from India to Abroad Via PayPal: Methods and Conditions

In this digital era, sending money abroad is no longer difficult. One of the most popular ways is to use PayPal, an online payment platform that is used by millions of people around the world. However, for those of you in India, keep in mind that there are some conditions and restrictions to be aware of when sending money abroad via PayPal. In this article, we will discuss how to send money from India to abroad via PayPal, as well as the conditions and limitations to be aware of.

What is PayPal?

PayPal is an online payment platform that allows users to send and receive money electronically. Founded in 1998, PayPal has become one of the world’s largest online payment platforms, with more than 400 million active users in more than 200 countries. PayPal allows users to send and receive money in a variety of currencies, including US dollars, euros, Japanese yen, and more.

Send Money from India to Abroad Via PayPal

To send money from India to abroad via PayPal, you need to have an active and verified PayPal account. Here are the steps you need to do:

- Create a PayPal account : If you don’t have a PayPal account, you need to create one first. You can create a PayPal account by visiting the official PayPal website and following the instructions provided.

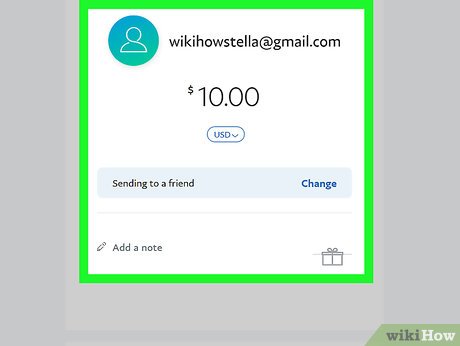

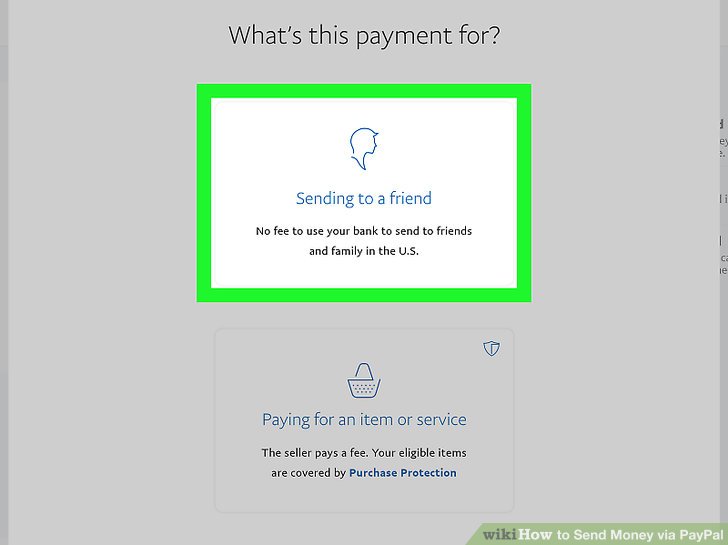

- Determine the transfer destination : Once you have a PayPal account, you need to determine the transfer destination. You can enter the recipient’s email address or PayPal username, as well as the amount of money you want to send.

- Select a payment method : You need to select the payment method you want to use. You can use your own credit card, debit card, or PayPal balance.

- Confirm transfer : Once you choose a payment method, you need to confirm the transfer. PayPal will send a transfer confirmation to your email address.

Terms and Restrictions for Sending Money from India to Abroad Via PayPal

Although PayPal allows you to send money abroad, there are some conditions and limitations to be aware of. Here are some conditions and limitations that you need to pay attention to:

- Transfer amount limits : PayPal has a limit on the number of transfers you can make per day. These limits may vary depending on the country you are transferring to and the payment method you use.

- Transfer fees : PayPal will charge transfer fees that vary depending on the country you are transferring to and the payment method you use.

- Currency exchange rate : PayPal will use the currency exchange rate in effect at the time of transfer to convert your money to the transfer currency.

- Taxes and other fees : You need to pay attention to taxes and other fees that may be imposed by the Indian government and the transfer destination country.

- Banking provisions : PayPal may have different banking terms depending on the country of transfer destination.

Tips and Advice for Sending Money from India to Abroad Via PayPal

Here are some tips and suggestions that can help you send money from India abroad via PayPal more effectively:

- Make sure you have sufficient PayPal balance : Before making a transfer, make sure you have sufficient PayPal balance to make the transfer.

- Choose the right payment method : Choose the most effective and efficient payment method for you.

- Check transfer fees : Check the transfer fees that PayPal will charge before making a transfer.

- Use the applicable currency exchange rate : PayPal will use the currency exchange rate in effect at the time of transfer to convert your money to the transfer currency.

- Save the transfer confirmation : Save the transfer confirmation you receive from PayPal as proof of transfer.

Conclusion

Sending money from India to abroad via PayPal can be an effective and efficient way. However, keep in mind that there are several conditions and limitations that need to be taken into account. By paying attention to the tips and suggestions mentioned above, you can send money from India abroad via PayPal more effectively and efficiently.