Differences between PayPal and Venmo.

PayPal and Venmo, two online payment giants, offer ease and convenience in transactions. Even though they both have the same goal, namely facilitating payments, there are several striking differences that need to be noted.

First of all, PayPal is a more comprehensive platform than Venmo. In addition to the money transfer function, PayPal also provides other services such as merchant payment processing, billing, and financial management. This makes it a more versatile option for businesses and individuals looking for a one-stop payment solution.

Moving on to Venmo, this app focuses more on person-to-person money transfers. Designed for social payments, Venmo allows users to easily split bills, send gifts, or transfer money between friends. An intuitive interface and social media-style activity feed add to the fun experience.

Furthermore, PayPal has a wider network and larger user base than Venmo. This gives PayPal users a wider reach, allowing them to conduct transactions with more people and businesses. PayPal’s wider presence also translates into wider acceptance in physical stores and online shopping platforms.

However, Venmo offers lower transaction fees than PayPal for transfers between friends. This makes it a more attractive option for small value transactions and social payments. Venmo also relies more heavily on links to bank accounts or debit cards, while PayPal offers additional funding options such as credit cards.

Finally, in terms of security, PayPal and Venmo both implement industry security standards. Both use encryption and anti-fraud measures to protect transactions and prevent misuse. However, PayPal’s consumer protection policies are generally considered to be more comprehensive and can provide an additional layer of protection for its users.

In short, PayPal is a more comprehensive and widely accepted platform, while Venmo focuses on social money transfers and offers lower transaction fees. The right choice between the two depends on the user’s specific needs, whether it’s ease of social payments, breadth of reach, or added security.

How to send money from PayPal to Venmo (if possible).

PayPal and Venmo, two giants in the mobile payments industry, may seem similar at first glance, but beneath their similarities lie significant differences that can impact how you choose to transfer money. Let’s explore their main differences to help you make the right decision.

First of all, PayPal has been established in the market for a long time, being founded in 1998, while Venmo only entered this world in 2009. With more experience, PayPal has established itself as a reliable and trusted platform for online and international money transfers.

Furthermore, PayPal offers a variety of features that are not available on Venmo. In addition to the ability to send and receive money, PayPal also allows you to create invoices, manage subscriptions, and make recurring payments. These features make PayPal a more comprehensive choice if you’re looking for a payment service that offers more than just money transfers.

On the other hand, Venmo focuses more on transferring money between individuals. From the start, Venmo was designed as a social app that allowed users to split bills, pool money for group events, and even send money with cute notes or emojis. If you’re looking for a simple and easy-to-use platform to transfer money with friends and family, Venmo could be a great choice.

Additionally, Venmo has adopted a different fee model than PayPal. While PayPal charges fees for certain transactions, such as international transfers or credit card payments, Venmo is generally free to use for transfers between US users. However, if you transfer money from your bank balance, Venmo charges a flat fee of 1%.

Lastly, Venmo has a larger user reach in the United States than PayPal. The app has gained significant popularity among younger users, who appreciate its user-friendly interface and social features. However, if you need to transfer money globally or want to use a more established platform, PayPal may be a better choice.

So, when choosing between PayPal and Venmo for transferring money, consider the following factors:

Transfer purposes: PayPal is suitable for business, international, and full-featured money transfers, while Venmo focuses on money transfers between individuals.

Features: PayPal offers more comprehensive features, including invoicing and recurring payments, while Venmo is simpler in its offerings.

Fees: Venmo is generally free to use for transfers between US users, while PayPal charges fees for certain transactions.

User reach: Venmo has a larger user reach in the United States, especially among younger users.

Ultimately, the best decision depends on your personal needs and preferences. Both PayPal and Venmo offer strong payment services, each with their own advantages and disadvantages. By considering these differences, you can choose the platform that best suits your needs and ensure that your money transfers are smooth and convenient.

Alternatives to transferring funds between PayPal and Venmo.

When it comes to transferring funds digitally, PayPal and Venmo are the two top choices. Both offer easy and convenient ways to send and receive money, but there are some key differences you need to know before deciding which is best for your needs.

First, PayPal has been in business longer than Venmo, which gives it an edge in terms of reliability and security. PayPal has a strong buyer protection system that helps protect users from fraud, whereas Venmo relies more on the honor system. As a result, PayPal may be a better choice if you are concerned about the security of your transactions.

In contrast, Venmo outperforms PayPal in terms of ease of use. Venmo’s simple interface makes it quick and easy to send and receive money, even for those who aren’t as tech-savvy. Venmo also has social features that allow you to share transactions with friends and family, making it similar to social media platforms.

Additionally, there are differences in terms of costs. PayPal charges fees for some transactions, such as international transfers or withdrawals to bank accounts. In contrast, Venmo is generally free for most transactions. However, Venmo charges fees for certain transactions, such as instant transfers or topping up your balance using a debit card.

Finally, Venmo is better suited for small transactions between friends and family. This is because Venmo’s transfer limits are lower than PayPal’s. If you need to transfer larger amounts of money, PayPal may be a better choice.

In conclusion, PayPal and Venmo are both excellent options for transferring funds digitally. PayPal offers better security and reliability, while Venmo is easier to use and more social. Consider your needs and preferences carefully to decide which platform is right for you.

Can I send a payment through PayPal to Venmo?

Sending Payments via PayPal to Venmo: Is It Possible?

In this digital era, the use of online payment services is increasing. Two popular examples are PayPal and Venmo. PayPal is one of the earliest and largest online payment services, while Venmo is a peer-to-peer payment service that is popular among young people. But, the question is: can we send payments via PayPal to Venmo? Let’s find the answer.

What is PayPal?

PayPal is an online payment service that allows users to send and receive payments electronically. Founded in 1998, PayPal has become one of the world’s most popular online payment services, with more than 400 million active users worldwide. PayPal allows users to send payments to anyone with a PayPal account, without needing to know their bank account information.

What is Venmo?

Venmo is a peer-to-peer payment service owned by PayPal. Founded in 2009, Venmo allows users to send and receive money to and from friends, family, or business associates. Venmo also allows users to link their bank accounts or credit cards to send and receive payments. Venmo is popular among young people because of its ease of use and low fees.

Is it possible to send payments via PayPal to Venmo?

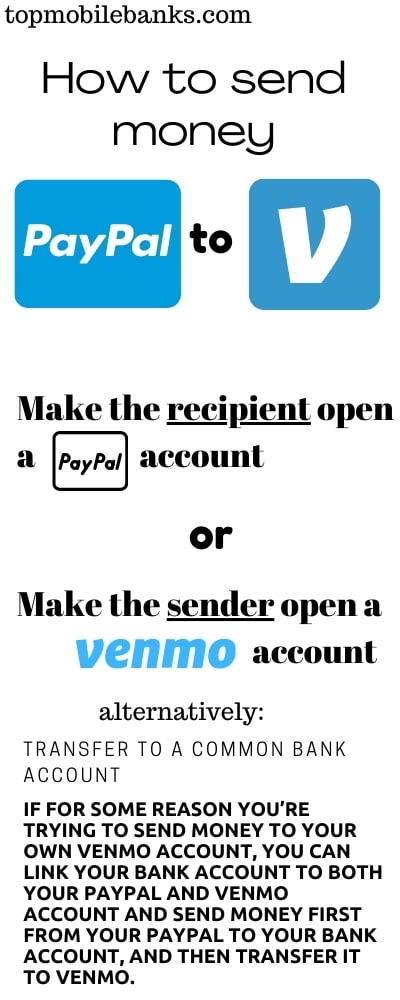

Of course, the answer is yes! PayPal and Venmo are both owned by the same company, so they integrate well. Users can send payments via PayPal to Venmo in several ways:

- Using the Venmo app : Users can download the Venmo app and connect their PayPal account with Venmo. After that, they can send payments to other people who have Venmo accounts using PayPal as the funding source.

- Using the PayPal website : Users can log in to the PayPal website and send payments to other people who have Venmo accounts. They will need to enter the recipient’s email address or phone number associated with their Venmo account.

- Using the PayPal application : Users can download the PayPal app and send payments to other people who have Venmo accounts. They will need to enter the recipient’s email address or phone number associated with their Venmo account.

Fees for sending payments via PayPal to Venmo

The cost of sending a payment via PayPal to Venmo varies depending on the payment method used. The following are some of the fees that may apply:

- Transfer fees : If users use a PayPal account to send payments to Venmo, a transfer fee of 2.9% + $0.30 per transaction will be charged.

- Currency conversion fees : If a user sends a payment in a currency different from the currency of the recipient’s Venmo account, a currency conversion fee will be charged.

- International payment fees : If a user sends a payment to a recipient in another country, international payment fees will be charged.

Security sends payments via PayPal to Venmo

Both PayPal and Venmo have good security systems to protect user transactions. Here are some of the security features they offer:

- Encryption : PayPal and Venmo use encryption to protect user and transaction data.

- Two-factor authentication : PayPal and Venmo offer two-factor authentication to increase user account security.

- Transaction restrictions : PayPal and Venmo have transaction restrictions to prevent fraud and other crimes.

Conclusion

Sending payments via PayPal to Venmo is an easy and secure process. Users can use the Venmo app, PayPal website, or PayPal app to send payments. However, please note that transfer and currency conversion fees may apply. Thus, users can choose the payment method that best suits their needs.