Options for receiving funds without a bank account linked.

In today’s fast-paced world, having access to funds immediately is critical. However, not everyone has a connected bank account. Don’t worry, there are several practical ways to receive funds without a bank account.

One of the most convenient options is through a money transfer service. Companies like Western Union and MoneyGram allow you to send and receive money simply by providing the recipient’s name and address. You can visit their local agent or use their online platform to make transactions.

Another option worth considering is an e-wallet, such as PayPal, Venmo, or Cash App. This wallet allows you to create an account and store funds digitally. You can receive money from others by sharing your email address or phone number associated with an account. Once you receive the funds, you can withdraw them to a prepaid card or transfer them to another e-wallet.

For those who prefer a more traditional approach, money orders are still a viable option. You can buy a money order at a post office, bank, or licensed sales agent. Give the money order to the recipient, who can then cash it at a bank or post office.

If you are dealing with international businesses or individuals, a wire transfer may be the best option. These transfers are made through the bank network and allow you to send funds to the recipient’s bank account abroad. Although it may incur higher fees compared to other methods, wire transfers offer security and convenience.

In addition to the options above, there are also prepaid cards, such as prepaid Visa or Mastercard. These cards can be loaded using cash or checks and can be used to make purchases or withdraw funds at ATMs.

Finally, if you only need to receive small amounts of money, you might consider peer-to-peer apps like Zelle or Google Pay. This app allows you to send and receive money directly from your bank account to someone else’s account, even if they don’t have the same app.

Now that you know the different ways to receive funds without a bank account, you can choose the option that best suits your needs. Whether you receive a money order, use an e-wallet, or make a wire transfer, you can access your funds quickly and easily.

How to withdraw PayPal funds if bank number is linked.

Good news for those of you who want to access PayPal funds without having to link a bank account! Here are some options that you can explore to withdraw money easily.

One of the most common ways is to use a PayPal Cash Plus card. This card can be loaded with your PayPal balance and used like a regular debit card, allowing you to make purchases, withdraw cash at ATMs, and make online payments. Alternatively, you can also sign up for a service like Venmo or Cash App, which allows you to transfer PayPal funds to other users and then withdraw money from their digital wallets.

If you prefer the traditional option, you may consider issuing a check drawn on your PayPal account. Just ask for a check on the PayPal site, which will then be sent to your address. Once received, you can cash the check at a check cashing place or deposit it into someone else’s bank account.

For those looking for a more technologically advanced approach, prepaid cards like NetSpend or Green Dot can be a good choice. You can load your PayPal balance onto these cards and use them just like a debit card. Additionally, some gift card issuing companies allow you to purchase gift cards with your PayPal balance, which can be exchanged for cash at certain stores.

Lastly, if you have a cryptocurrency wallet, you can transfer your PayPal funds to it and then sell the cryptocurrency for cash. This option may require some technical knowledge, but can be an efficient way to access your funds if you are comfortable with cryptocurrencies.

Not having a connected bank account doesn’t have to be a barrier to accessing your PayPal funds. By exploring this option, you can easily withdraw money and enjoy the convenience of managing your finances through PayPal.

Alternatives for receiving payments without linking a bank account.

In this digital era, having access to funds without having to link a bank account can be invaluable. Here are some options you can consider for receiving money without a bank account:

Mobile Wallet App

Mobile wallet apps like PayPal, Venmo, and Google Pay allow you to receive money from friends, family, or clients without needing a bank account. You simply create an account and provide your payment details. The money received will be deposited in your account and can be spent online or withdrawn via prepaid card.

Prepaid Card

Prepaid cards are another popular option for receiving funds. You can buy a prepaid card at a convenience store or online and add money to it via wire transfer or check. Once the funds are credited, you can use the card to shop online or in physical stores.

Cash

The most direct way to receive funds without a bank account is through cash. You can ask clients or employers to pay you in cash, or you can withdraw cash from an ATM terminal using a debit or prepaid card linked to your unbanked account. However, please note that carrying large amounts of cash can be risky.

Wire Transfer

Wire transfers are an alternative method for receiving funds directly into your unbanked account. You can provide your account details and routing number to the sender, and they can transfer funds to your account using a wire transfer service. Please note that wire transfers usually incur a fee.

Check Cashing Services

If you receive a check, you can cash it at a check cashing service. These businesses will cash the check for you for a fee, and you will receive cash in return. Be sure to bring valid identification and the original check.

When choosing the best option for receiving funds without a bank account, consider factors such as convenience, cost, and security. If you frequently receive payments from different sources, a mobile wallet app or prepaid card may be a good choice. If you only receive funds occasionally, other options such as cash or wire transfer may be more suitable.

Can I receive payment if I do not link my bank account to PayPal?

Can I Receive Payments If I Don’t Link a Bank Account to PayPal?

PayPal is one of the most popular online payment services used today. With PayPal, you can make online transactions more safely and easily. However, sometimes you may have questions about how PayPal works and how to accept payments through this service.

One frequently asked question is whether you can accept payments if you don’t link a bank account to PayPal. In this article, we will discuss in more detail how PayPal works and how to accept payments without connecting a bank account.

How PayPal Works

PayPal is an online payment service that allows you to make transactions using your email and password. When you want to make a payment or receive a payment via PayPal, you must have an active PayPal account.

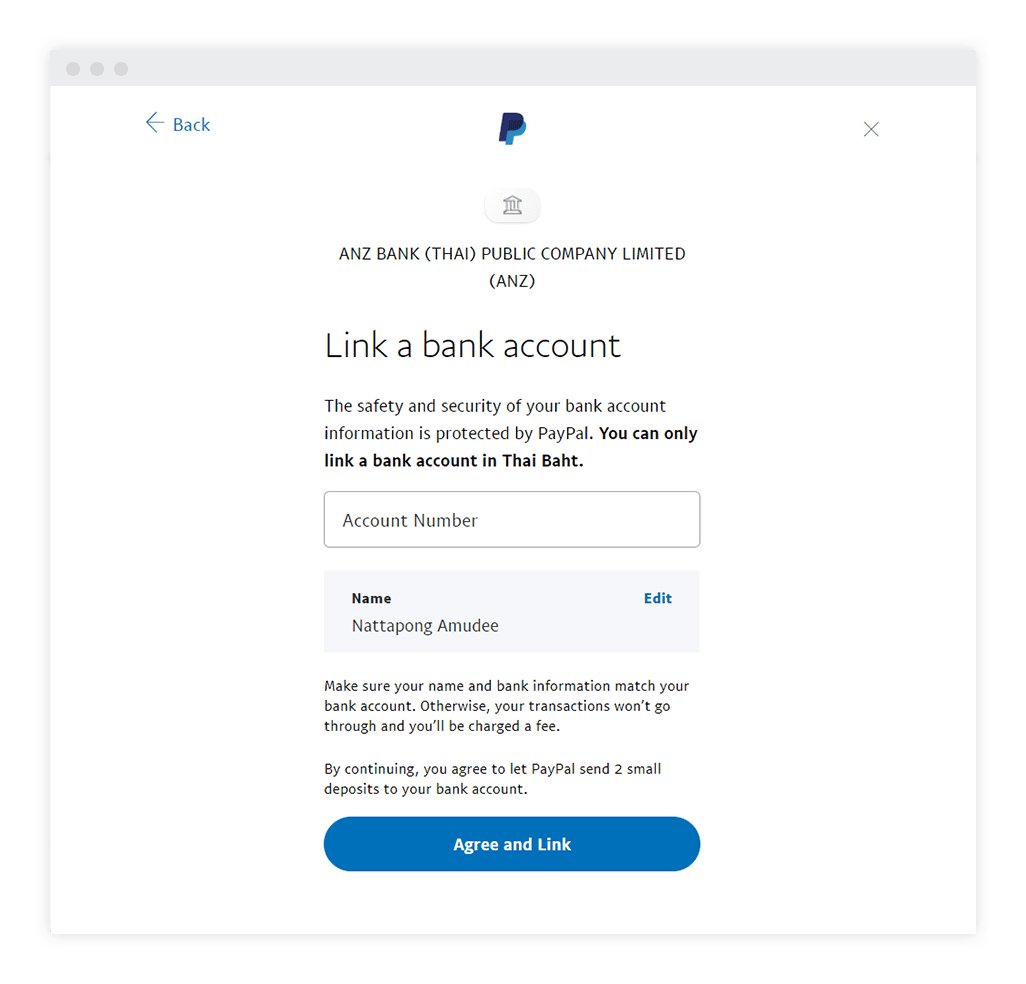

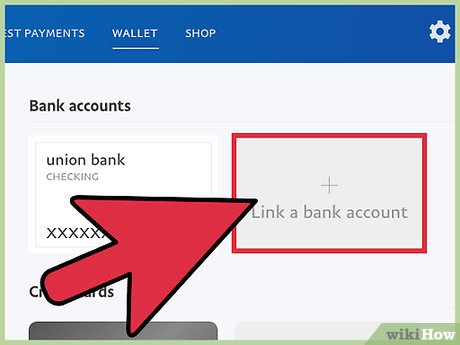

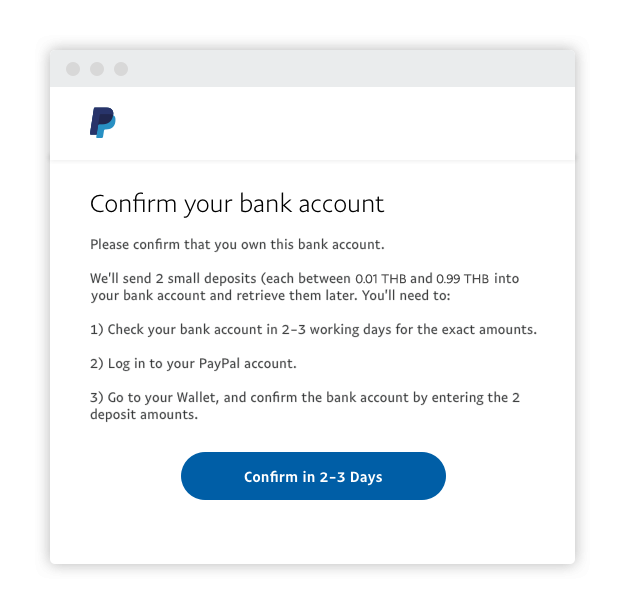

Once you have a PayPal account, you can add payment methods such as credit, debit cards, or bank accounts to your PayPal account. By adding a payment method, you can make online transactions more easily and safely.

Accepting Payments with PayPal

Accepting payments with PayPal is very easy. When someone wants to pay you via PayPal, they just need to enter your email address and the amount they want to pay. Then, PayPal will send a notification to your PayPal account to approve the transaction.

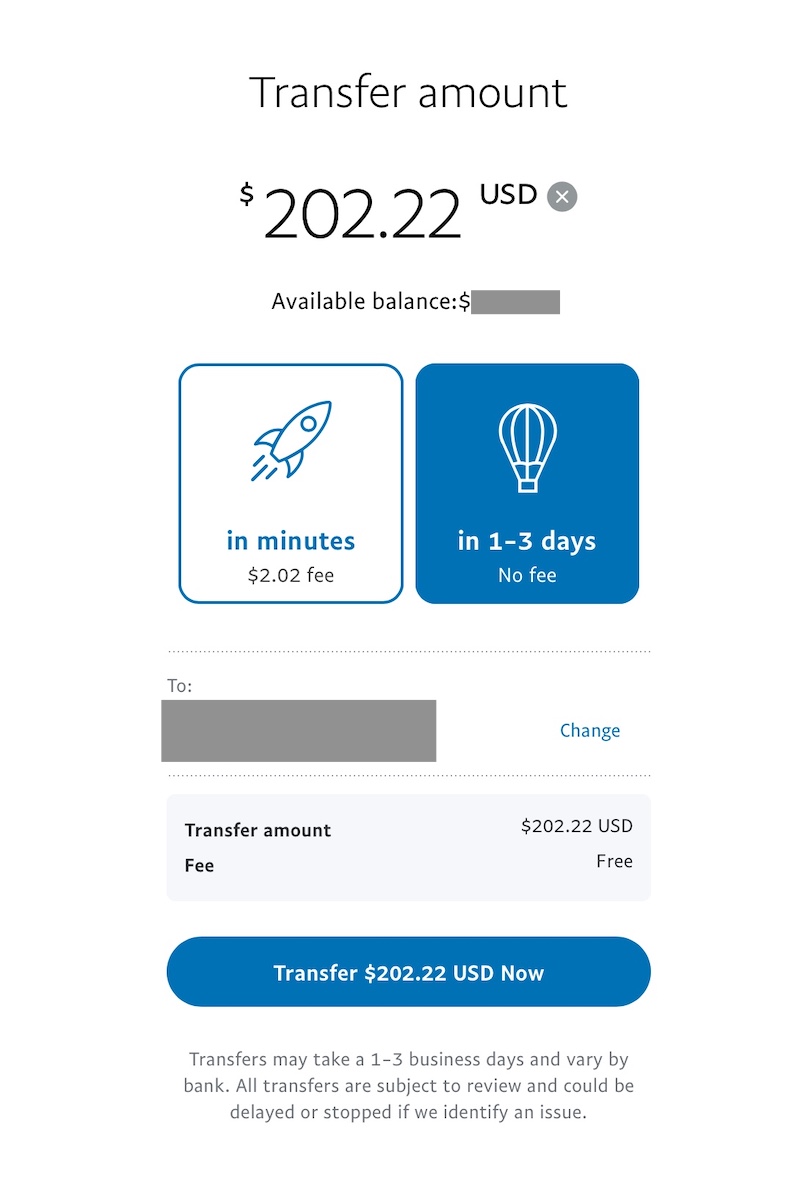

If you have a balance in your PayPal account, you can withdraw it to your bank account. However, if you don’t have a balance, you can use the credit or debit card associated with your PayPal account to make the payment.

Can I Receive Payments If I Don’t Link a Bank Account to PayPal?

Now, let’s answer the main question. Can you accept payments if you don’t link your bank account to PayPal? The answer is yes, you can accept payments via PayPal without connecting a bank account.

However, there are some limitations you should be aware of. Here are some things you should pay attention to:

- Unable to withdraw balance : If you do not connect your bank account to PayPal, you cannot withdraw the balance in your PayPal account to your bank account.

- Cannot make payment with balance : If you do not connect your bank account to PayPal, you cannot make payments with the balance in your PayPal account.

- Can only accept small payments : If you don’t connect a bank account to PayPal, you can only accept small payments (usually under $100).

- Fees may apply : If you don’t connect a bank account to PayPal, fees may apply to receive payments.

So, while you can accept payments via PayPal without connecting a bank account, there are some limitations you should be aware of.

How to Accept Payments with PayPal Without Linking a Bank Account

If you don’t want to connect your bank account to PayPal, but want to accept payments via PayPal, here are some ways you can do it:

- Use a credit card : You can use the credit card associated with your PayPal account to make payments.

- Use a debit card : You can use the debit card associated with your PayPal account to make payments.

- Receive payment in the form of PayPal Balance : You can receive payments in the form of a balance in your PayPal account, but you cannot withdraw them to your bank account.

Conclusion

Accepting payments with PayPal is very easy and safe. Even if you don’t connect a bank account to PayPal, you can still receive payments through PayPal. However, there are some limitations you should be aware of.

If you want to accept payments through PayPal without connecting a bank account, make sure you understand how PayPal works and some of its limitations. This way, you can carry out online transactions more safely and easily.

FAQs

Here are some frequently asked questions about accepting payments with PayPal without connecting a bank account:

- Q: Can I accept payments with PayPal without linking a bank account?

A: Yes, you can accept payments with PayPal without connecting a bank account. - Q: Are there any restrictions on accepting payments with PayPal without linking a bank account?

A: Yes, there are some limitations such as not being able to withdraw the balance, not being able to make payments with the balance, and only being able to accept small payments. - Q: Can I use a credit card to make payments with PayPal?

A: Yes, you can use the credit card associated with your PayPal account to make payments.

We hope this article helps you understand how PayPal works and how to accept payments without connecting a bank account.