Receiving payments in PayPal personal accounts.

Receive Payments in Personal PayPal Accounts

PayPal is one of the most convenient ways to accept online payments. Whether you’re a freelancer, a small business owner, or just want to receive money from friends and family, PayPal makes it easy to accept payments securely.

To start accepting payments, you must have a personal PayPal account. The manufacturing process is fast and easy. Just visit the PayPal website and follow the instructions. You must provide your name, email address and password.

Once you have an account, you can share your PayPal email address with people who want to send you money. When someone sends you a payment, you will receive a notification via email. You can then log in to your PayPal account to view and receive payments.

PayPal offers several ways to accept payments. You can receive payments via:

Your website: You can add a PayPal button to your website that allows customers to pay you online.

Invoices: You can create and send invoices to customers via PayPal. They can pay invoices using their credit card, debit card, or PayPal account.

Request money: You can request money from other people via PayPal. They will accept your request and may choose to send you money.

PayPal is safe and secure. Your financial information is encrypted and PayPal will never share it with anyone. Additionally, PayPal offers Buyer Protection which can help protect you from fraud.

However, keep in mind that PayPal charges a fee for accepting payments. These fees vary depending on the payment method used. For example, PayPal charges 2.9% + $0.30 for each transaction paid by credit card.

Overall, PayPal is an easy and safe way to accept online payments. If you’re looking for a way to receive money from customers or clients, PayPal is a great option.

PayPal fees and limits for personal accounts.

When you accept payments in your personal PayPal account, it is important to be aware of the fees and limitations that apply. While PayPal is a convenient platform for receiving money, there are some fees to consider.

The first fee to pay attention to is the transaction fee. Typically, PayPal charges 2.9% of the transaction value plus a flat fee that varies depending on the currency used. However, these fees may be reduced if you receive payments in your native currency or if you register for a PayPal Business account.

In addition to transaction fees, there are also limits on the amount of money you can receive. For personal PayPal accounts, the daily receiving limit is $10,000, while the monthly receiving limit is $20,000. These limits may vary depending on your location and account type. If you need to receive larger amounts, you may need to upgrade to a PayPal Business account.

Another consideration when accepting payments on PayPal is security. Even though PayPal has comprehensive security measures, it is still important to watch out for fraud. Always ensure that you only accept payments from trusted sources and report any suspicious activity to PayPal immediately.

To maximize your potential for receiving payments on PayPal, remember to continue following PayPal’s terms and conditions. This will help you avoid problems and ensure that you receive payments efficiently and securely.

In addition to understanding fees and limitations, there are some best practices you can follow when accepting payments on PayPal. First, make sure to provide a clear description of the product or service you provide for each transaction. This will help prevent disputes and ensure that you receive full payment.

Second, consider accepting payments via PayPal invoicing. This will allow you to send professional invoices to your customers and track payments easily. Finally, take advantage of PayPal’s security features, such as two-step verification, to protect your account from unauthorized access.

By following these tips, you can improve your experience receiving payments through PayPal and ensure that you receive payments efficiently and securely.

Upgrading your PayPal account for business transactions.

As your business grows and you start accepting payments online, a PayPal personal account may start to feel restrictive. Transaction limits, higher fees, and limited features can hinder your growth. It’s time to consider switching to a business PayPal account.

Upgrading your PayPal account to a business account is easy and only takes a few simple steps. First, visit the PayPal website and log in to your personal account. From there, click “Settings” and select “Upgrade To Business.” Follow the on-screen instructions and provide the required information, such as your business name and business type.

Once your business account is active, you’ll be able to accept larger payments, pay lower fees, and access advanced features like invoicing, expense tracking, and better fraud protection.

The benefits of upgrading to a business PayPal account are numerous. First, you will eliminate transaction limits that are often imposed on personal accounts. This allows you to accept payments of any size, without having to worry about getting stuck.

Second, you’ll pay lower fees when you receive payments. PayPal charges lower fees for business accounts compared to personal accounts, so you can save money in the long run.

Third, you will get access to advanced business features. This includes invoicing, which makes it easy for you to send and track invoices to customers. You’ll also get expense tracking, so you can monitor your transactions and identify areas of potential savings.

Lastly, you’ll get better fraud protection. PayPal has a sophisticated fraud system that protects business accounts from unauthorized transactions. This gives you peace of mind and helps you keep your business safe.

Upgrading to a business PayPal account is an important step for any business looking to grow. By removing limitations, reducing costs, and providing advanced features, it can help you accept payments easily, save money, and protect your business.

Can I receive payment through PayPal in a personal account?

Receiving Payments via PayPal in a Personal Account: Is It Possible?

PayPal is one of the largest online payment service providers in the world. With more than 400 million active users, PayPal makes it easy for users to carry out online transactions, including receiving payments. However, many people still wonder if they can receive payments via PayPal on a personal account. In this article, we will explore this possibility and discuss how to accept payments via PayPal in a personal account.

What is PayPal?

PayPal is an American company that operates in the field of online payments. Founded in 1998, PayPal allows users to make online transactions easily and securely. Using PayPal, users can make payments, receive payments, and manage their balance online.

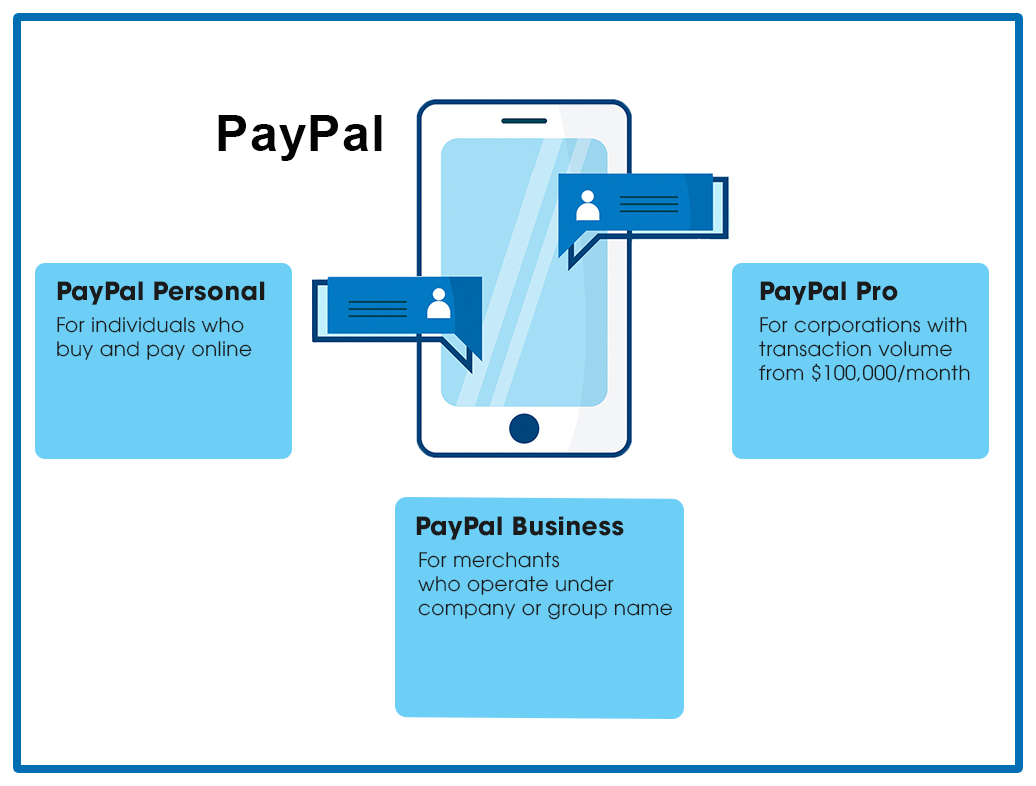

PayPal Account Type

PayPal has several different account types, including:

- Personal Account (Personal) : Personal accounts are the most common account type on PayPal. With a personal account, users can make payments, receive payments and manage their balance online.

- Business Account (Business) : A business account is a type of account designed for businesses and organizations. With a business account, users can make transactions more easily and get access to additional features.

- Primary Account (Premium) : A primary account is a type of account that offers additional features, such as the ability to accept payments directly and manage balances more easily.

Can I Accept Payments via PayPal in a Personal Account?

The short answer is yes, you can accept payments via PayPal on a personal account. However, there are some limitations and conditions that need to be understood.

With a personal account, you can accept payments from family, friends, or other people who use PayPal. However, there are some limits on the amount of payments you can receive each month. If you receive payments that exceed these limits, you may need to upgrade your account to a business account.

Payment Limitations in Personal Accounts

There are several payment limitations to understand when using a personal account on PayPal:

- Monthly Payment Limits : The monthly payment limit on a personal account is around IDR 10,000,000 per month. If you receive payments that exceed these limits, you may need to upgrade your account to a business account.

- Single Payment Limitation : The single payment limit on a personal account is around IDR 1,000,000 per transaction. If you receive payments that exceed these limits, you may need to upgrade your account to a business account.

- Limitations on Payments from Abroad : The limit for payments from abroad on a personal account is around IDR 5,000,000 per month. If you receive payments that exceed these limits, you may need to upgrade your account to a business account.

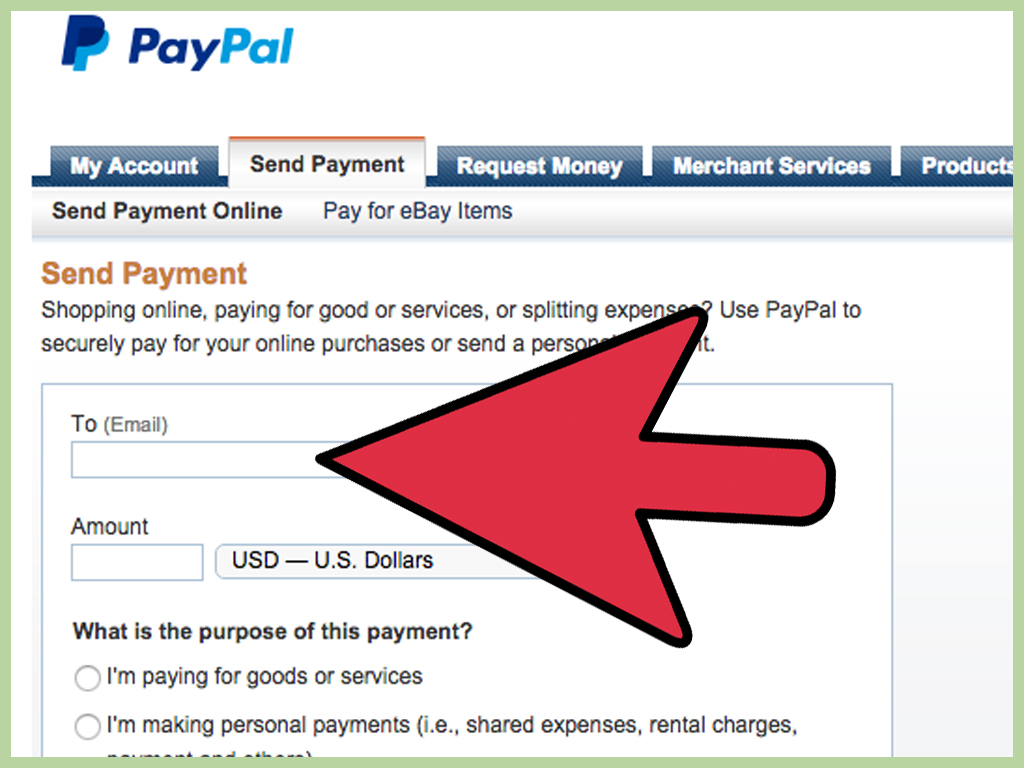

How to Receive Payments via PayPal in Personal Account

Here are the steps to receive payments via PayPal in a personal account:

- Create a PayPal Account : First of all, you need to create a PayPal account. You can create a PayPal account by visiting the PayPal website and following the instructions provided.

- Account Verification : After creating an account, you need to verify your account. You can verify your account by following the instructions provided by PayPal.

- Get a PayPal Email Address : Your PayPal email address is the email address you used to create your PayPal account. This email address will be used as the email address for receiving payments.

- Provide Payment Information : Provide payment information to parties who wish to make payments to you. This payment information includes your PayPal email address and the amount of payment you wish to make.

- Receive Payment : After the other party makes a payment, you will receive a notification from PayPal that the payment has been received. You can check your balance in your PayPal account to ensure that payment has been received.

Advantages of Accepting Payments via PayPal in Personal Accounts

Here are some of the advantages of receiving payments via PayPal on a personal account:

- Easy : Receiving payments via PayPal in a personal account is very easy. You only need to provide payment information to the party who wants to make a payment to you.

- Safe : Receiving payments via PayPal in a personal account is very safe. PayPal has a sophisticated security system to protect your transactions.

- Flexible : Accepting payments via PayPal in a personal account is very flexible. You can accept payments from multiple countries and currencies.

Conclusion

In this article, we have discussed the possibility of receiving payments via PayPal in a personal account. With a personal account, you can accept payments from family, friends, or other people who use PayPal. However, there are some limits on the amount of payments you can receive each month. If you receive payments that exceed these limits, you may need to upgrade your account to a business account. Thus, you can take advantage of the additional features offered by PayPal to make your transactions easier.