Linking PayPal to TransferWise (now Wise).

Hey, everyone! Have you ever had trouble transferring money internationally? Well, I have the perfect solution: link your PayPal account to TransferWise (now known as Wise)!

Wise is a money transfer platform that allows you to send and receive money abroad at much lower costs compared to traditional banks. By linking your PayPal account to Wise, you can take advantage of Wise’s fantastic rates without having to leave the comfort of your PayPal account.

The process is very easy. First, log in to your PayPal account and click “Wallet”. Then, select “Link card or bank” and follow the instructions. You will need your Wise bank account information to complete the link.

Once your accounts are linked, you can start transferring funds internationally via PayPal. Simply select Wise as your payment method when sending money, and Wise will automatically convert the currency at a favorable rate.

In addition to lower fees, linking PayPal to Wise also offers several other benefits. For example, you can track your transfers in real-time via the Wise application. You can also store multiple currencies in your Wise account, so you can make conversions at any time without having to wait for funds to arrive.

If you frequently transfer money internationally, linking PayPal to Wise is a highly recommended option. This will save you a lot of money and make the transfer process more convenient and efficient.

So, what are you waiting for? Visit the Wise website or download the app today and start enjoying the benefits of transferring money internationally at lower fees. Good luck!

How to transfer funds from PayPal to TransferWise.

Transferring funds from PayPal to a Wise (formerly TransferWise) account can be a bit confusing, especially if you’ve never done it before. But don’t worry, we will guide you step by step to make the process easier.

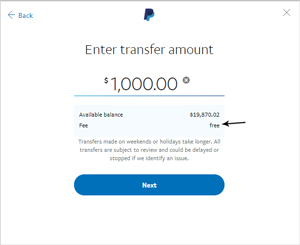

First of all, of course you need to have a PayPal and Wise account. Once you have it, log in to your PayPal account. On the main homepage, look for the “Wallet” or “Money” section and click there. Then, click the “Withdraw Funds” button.

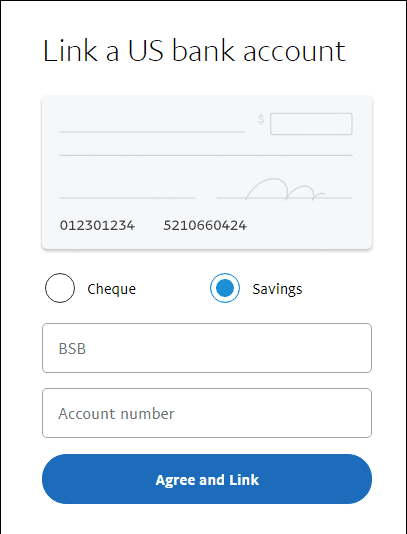

On the withdrawal funds page, you will see the option to withdraw funds to a bank account. There are two options: the bank account you previously linked and the option to add a new bank account. Select the option to “Add a new bank account” and enter your Wise bank account details.

Make sure to enter all details accurately, including bank name, account number, and SWIFT/BIC code. Once everything is filled in, click the “Add” button. PayPal will verify your bank account by sending two small deposits. Note this amount.

Now log in to your Wise account. Go to the “Balance” tab and click the “Add money” button. There, you will see the “PayPal” option. Click that option and enter the PayPal email address associated with your account.

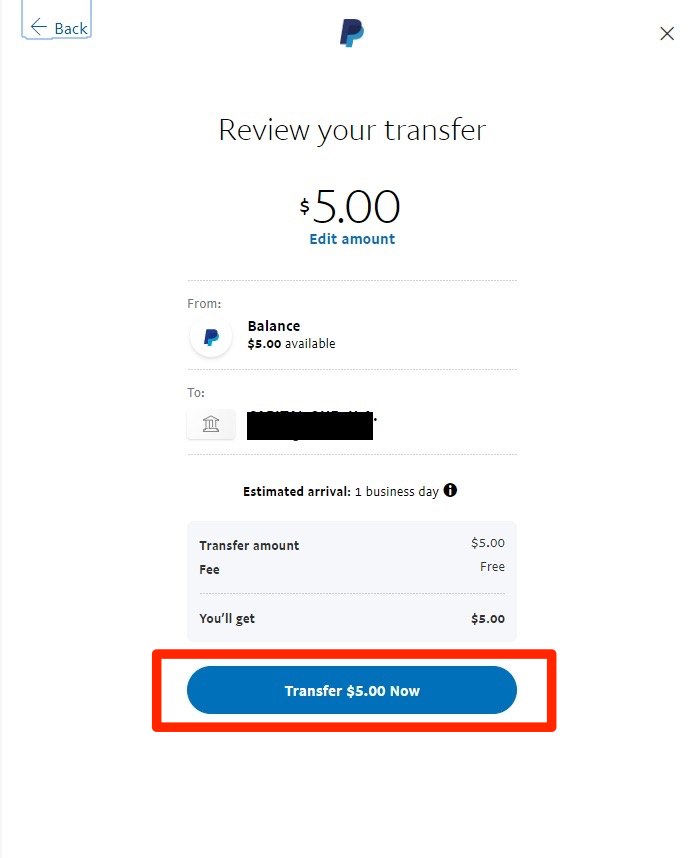

You will be directed to the PayPal page to log in and confirm the withdrawal. Enter the amount you want to withdraw, as well as the two small deposit amounts that PayPal sent to your Wise bank account. Once everything is double checked, click the “Withdraw Funds” button.

Transfers will usually be processed within 1-2 business days. You can monitor the transfer status in your Wise account.

Keep in mind that PayPal charges a small fee for each withdrawal. These fees vary depending on your location and currency. Wise may also charge a fee for receiving money, depending on the currency.

These are the steps to transfer funds from PayPal to Wise. If you experience any problems or have questions, don’t hesitate to contact the PayPal or Wise customer support team.

PayPal-to-Wise transfer fees and timings.

Connecting PayPal to TransferWise (now known as Wise) can be an efficient way to save on fees when making international transfers. Before connecting your account, it is important to understand the costs and time associated with this process.

PayPal to Wise Transfer Fees

The fees you pay to transfer funds from PayPal to Wise vary depending on the payment method, currency, and country of origin and destination. In general, you can expect to pay a flat fee and a small percentage of the amount transferred.

PayPal charges a flat fee for all transfers, which varies depending on the currency used. In addition to flat fees, PayPal also charges a percentage fee, which usually ranges from 3.5% to 4.5%.

Wise, on the other hand, is known for its low transfer fees. Their fees usually include a fixed fee and a lower percentage fee, generally around 0.35% to 1.5%.

By connecting PayPal to Wise, you can save money by taking advantage of the lower transfer fees offered by Wise.

PayPal to Wise Transfer Times

The time it takes to transfer funds from PayPal to Wise varies depending on the country of origin and destination. However, most transfers are completed within minutes or hours.

If you make a transfer on a weekend or holiday, it may take longer for the funds to reach your Wise account. It is important to note that transfer times can also be affected by verification and security checks.

How to Connect PayPal to Wise

To connect PayPal to Wise, you must register for a Wise account. Once your account is verified, you can follow these steps:

1. Click “Balance” on your Wise Dashboard.

2. Select “Add money”.

3. Select PayPal as your payment method.

4. Log in to your PayPal account.

5. Confirm the amount you want to transfer.

Once you confirm the transfer, the funds will be withdrawn from your PayPal account and credited to your Wise account.

Conclusion

Connecting PayPal to Wise can be a cost-effective and convenient way to send money internationally. By understanding the costs and time associated with this process, you can plan your transfer and maximize your savings.

Can I receive payment from PayPal to my TransferWise account?

Accepting Payments from PayPal to TransferWise: Complete Guide

As an active internet user, you may have had questions about how to receive payments from PayPal to your local bank account. One popular option is to use the TransferWise service, which is known as a cheaper and more effective alternative to sending money compared to traditional bank transfers. However, is it really possible to accept payments from PayPal to TransferWise? This article will discuss in detail the possibilities, processes, and costs involved.

What is TransferWise?

TransferWise is a money transfer service that allows you to send and receive money to and from all over the world with lower fees compared to traditional bank transfers. The service was founded in 2011 by Kristo Käärmann and Taavet Hinrikus, and now has more than 5 million users worldwide. TransferWise uses peer-to-peer technology to connect users who want to send money with users who want to receive money, eliminating high transfer fees.

What is PayPal?

PayPal is an online payment service that allows you to make payments and receive money from other people around the world. The service was founded in 1998 by Peter Thiel and Max Levchin, and now has more than 300 million users worldwide. PayPal allows you to make payments using a credit, debit card, or bank account.

Can I accept payments from PayPal to TransferWise?

Yes, you can accept payments from PayPal to TransferWise. However, there are several things you need to know before carrying out this process. Here are some steps you need to take:

- Make sure you have a TransferWise account : You must have a verified TransferWise account before you can receive payments from PayPal.

- Add a TransferWise account to PayPal : You must add a TransferWise account to PayPal as a payment method. You can do this by logging into your PayPal account, then going to “Wallet” or “Settings”, and selecting “Add payment method”.

- Confirm TransferWise account : After you add a TransferWise account to PayPal, you must confirm the account by entering the verification code sent by TransferWise to your email address.

- Receive payments from PayPal : Once your TransferWise account is confirmed, you can receive payments from PayPal to your TransferWise account.

Associated costs

There are some fees associated with accepting payments from PayPal to TransferWise. Here are some costs you need to know:

- PayPal transfer fees : PayPal will charge a transfer fee that ranges from 0.5% to 2% of the transfer amount, depending on your account type and location.

- TransferWise Fees : TransferWise will charge a transfer fee that ranges from 0.3% to 2% of the transfer amount, depending on your account type and location.

- Currency conversion fees : If you receive payment in a currency different from the currency of your TransferWise account, you will be charged a currency conversion fee that ranges from 0.5% to 2% of the transfer amount.

The advantages of accepting payments from PayPal to TransferWise

There are several advantages to receiving payments from PayPal to TransferWise, including:

- Lower costs : Transfer fees with TransferWise are lower compared to traditional bank transfers.

- Faster transfer times : Transfers with TransferWise can be processed in a faster time compared to traditional bank transfers.

- Ease of account management : TransferWise has an easy-to-use interface and allows you to manage your accounts more effectively.

Conclusion

Accepting payments from PayPal to TransferWise can be an effective option for you, especially if you want to save on transfer fees and time. However, there are several things you need to know before undertaking this process, such as the costs involved and the steps you need to take. By understanding this information, you can make better decisions about how to accept payments from PayPal to TransferWise.