PayPal’s payment receiving capabilities without linked accounts.

PayPal is undoubtedly a big player in the world of online payments, offering unmatched convenience and reliability. However, did you know that you can receive payments via PayPal without even linking a bank account? This is made possible through PayPal’s innovative card feature.

A PayPal card is a virtual or physical debit card linked to your PayPal balance. This allows you to accept payments without linking any traditional bank account. This is very useful in various situations, such as:

When traveling abroad: PayPal Card allows you to access your PayPal funds at ATMs or stores abroad that accept MasterCard. This eliminates the need to exchange currency or carry large amounts of cash.

For added security: If you’re concerned about the security of your bank account, linking a PayPal card to your balance can provide an additional layer of protection. This separates your funds from personal bank accounts, reducing the risk of theft or fraud.

As an alternative to a bank account: For those who don’t have a traditional bank account, a PayPal card can serve as a convenient alternative for receiving and managing money. You can load the card with your PayPal balance and use it to make purchases or withdraw cash.

To accept business payments: If you run a business and would rather not share your banking information, a PayPal card can provide a professional and secure way to accept payments. You can provide PayPal card details to your clients, allowing them to make payments without knowing your bank account details.

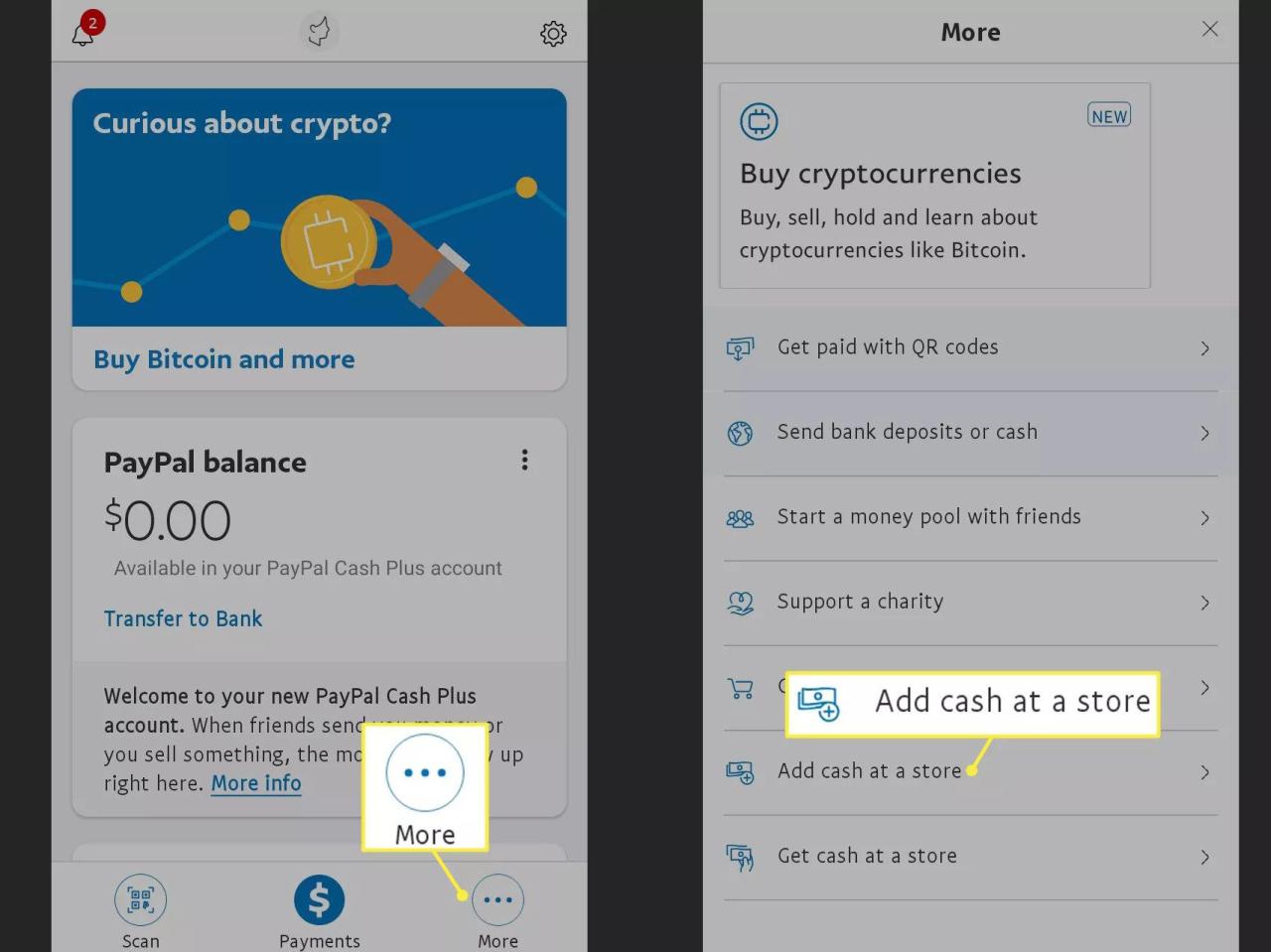

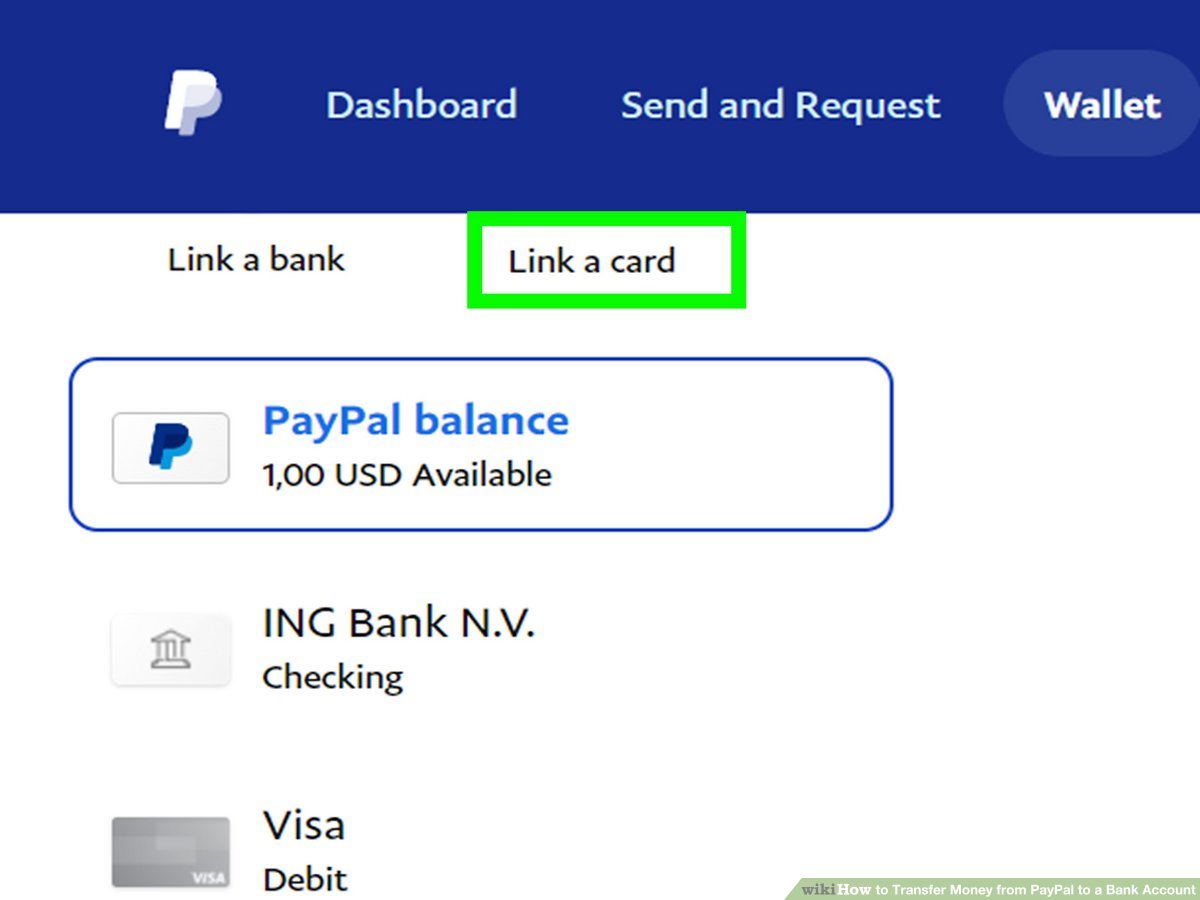

Setting up a PayPal card is very easy. Just log in to your PayPal account, navigate to “Wallet”, and click “Add card”. Select “PayPal Card” and follow the instructions. Once your card is issued, you can start receiving payments directly to your card balance.

It should be noted that there are some fees associated with using a PayPal card. There is a small initial issuance fee, and there is a cash withdrawal fee at an ATM. However, these fees are usually outweighed by the convenience and security the card offers.

Overall, PayPal’s card feature is a powerful and flexible solution for accepting online payments without linking a bank account. This provides added security, convenience when traveling, and a bank account alternative for those who want it. If you haven’t used this feature yet, consider taking advantage of it to manage your money more efficiently and securely.

How to withdraw money with no linked account.

Have you ever struggled with accepting payments without linking an account? PayPal offers a practical solution to this problem. With its ability to accept payments without a linked account, you can easily receive money from others without the hassle of managing multiple accounts.

Interestingly, the process is very easy. All you need to do is provide a unique link to the sender. This link can be shared via email, text message, or social media platforms. The sender can then use this link to send payment using their credit or debit card, without having to create a PayPal account.

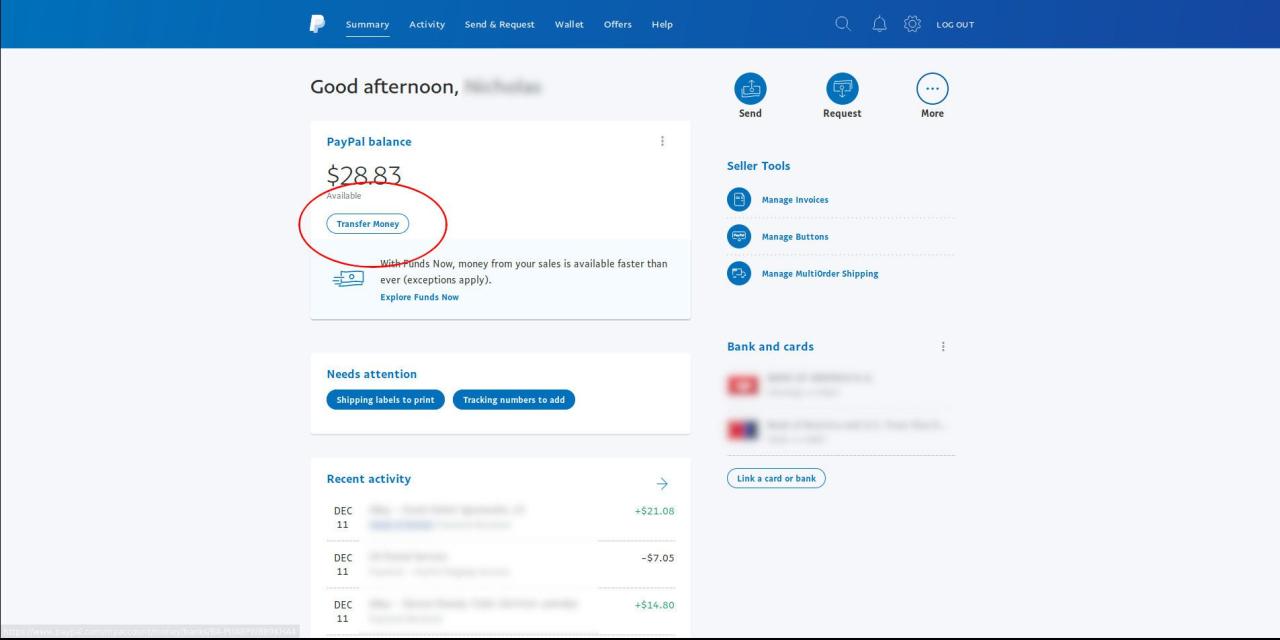

Once payment is received, you will be notified via email or text message. You can then withdraw funds from your PayPal account to your chosen bank account or prepaid card. This process usually takes several business days, depending on the withdrawal method you choose.

The ability to accept payments without a linked account offers several significant advantages. First, it eliminates the need to create and manage multiple PayPal accounts, which can save a lot of time and effort. Additionally, it provides greater privacy, as you don’t have to share sensitive financial information with third parties.

However, it is important to note that there are some limits on the amount of money you can receive without a linked account. These limits vary depending on your country and currency, so it’s best to check PayPal’s support page for specific details. Additionally, you may be charged a small service fee for each transaction.

Overall, the ability to accept payments without a linked account offered by PayPal is a convenient and safe solution for receiving money from other people. Whether you’re a freelancer, a small business owner, or just want to accept payments from friends and family, the process is easy and efficient.

Limitations of unlinked PayPal accounts.

In today’s fast-paced digital world, PayPal has become much more than just a payment processor. The platform has grown into a comprehensive financial hub, offering a wide range of financial services, including the ability to accept payments without a linked account.

However, despite its convenience, accepting payments via PayPal without a linked account has some limitations. First of all, users will be limited to the maximum amount they can receive. This amount varies depending on region and account settings.

Additionally, users with unlinked PayPal accounts may be subject to withdrawal restrictions. They may not be able to withdraw funds directly to their bank account or may be charged additional fees for such withdrawals. These limits are designed to protect PayPal and its users from fraud and suspicious activity.

Another limitation of unlinked PayPal accounts is the lack of features and protection. Users may not be eligible for buyer protection programs, extended customer service, or other financial management features. Linked accounts offer a higher level of security and convenience, making them the preferred choice for many users.

Lastly, accepting payments without a linked account can limit a user’s flexibility in managing their funds. Users may not be able to easily transfer funds between PayPal accounts or purchase goods and services online. They may also experience problems when trying to integrate their PayPal account with other financial platforms or services.

Despite these limitations, accepting payments via PayPal without a linked account remains a viable option in certain situations. For example, businesses or individuals who wish to receive occasional payments or small amounts of money will find this method beneficial. However, users should be aware of existing limitations and take necessary steps to minimize their impact.

Can I receive money on PayPal without linking a bank account or card?

Can I Receive Money on PayPal Without Linking a Bank Account or Card?

PayPal is one of the most popular and widely used online payment services worldwide. With PayPal, you can send and receive money easily and securely. However, many people wonder if they can receive money on PayPal without linking a bank account or card. Below is the complete answer.

Why You Need to Link a Bank Account or Card in PayPal

Before we talk about whether you can receive money on PayPal without connecting a bank account or card, let’s see why you need to connect a bank account or card on PayPal. Here are some of the main reasons:

- Account Verification : Linking a bank account or card on PayPal helps verify your identity and improves the security of your account.

- Withdrawal of Funds : If you want to withdraw funds from your PayPal balance, you need to link a bank account or card to receive the money.

- Online Payment : When you make an online purchase using PayPal, you need to link a bank account or card to make the payment.

Can I Receive Money on PayPal Without Linking a Bank Account or Card?

Now, let’s answer your main question. Yes, you can receive money on PayPal without linking a bank account or card. However, there are some limitations and conditions that you need to know:

- Balance Limitations : If you don’t link a bank account or card, your PayPal balance has a maximum limit of $2,500.

- Direct Payment : You can only accept direct payments from other PayPal users who have sufficient PayPal balance to make the payment.

- Unable to withdraw funds : If you don’t link a bank account or card, you can’t withdraw funds from your PayPal balance.

- Unable to Make Online Payments : If you don’t link a bank account or card, you can’t make online payments using PayPal.

How to Receive Money on PayPal Without Linking a Bank Account or Card

If you want to receive money on PayPal without linking a bank account or card, here are the steps you need to take:

- Create a PayPal Account : If you don’t have a PayPal account, create a new account on the PayPal website.

- Verify Email Address : Verify your email address used to register for a PayPal account.

- Request Payment from Other Users : Request payment from other PayPal users who have sufficient PayPal balance to make the payment.

- Receive Payment : Once the payment is made, you will receive a notification from PayPal that you have received the money.

Security and Privacy

PayPal cares deeply about user security and privacy. If you don’t link a bank account or card, PayPal will still protect your account by:

- encryption : Your data will be encrypted to prevent unauthorized access.

- Verification : PayPal will verify every transaction to prevent fraud.

- Supervision : PayPal has a monitoring team ready 24/7 to address security issues.

Conclusion

In this article, we have discussed whether you can receive money on PayPal without linking a bank account or card. Yes, you can receive money on PayPal without linking a bank account or card, but there are some limitations and conditions you need to be aware of. Make sure you understand the terms and conditions before making a transaction on PayPal.