PayPal’s verification process and PAN card requirements in India.

Hello everyone, today we will discuss PayPal and PAN card verification requirements in India. I know this can be a confusing process, so I’m here to help guide you through it.

First of all, why does PayPal require a PAN card? This is a requirement of the Indian government to prevent money laundering and other illegal activities. The Indian government requires all citizens using PayPal to provide their PAN card to verify their identity.

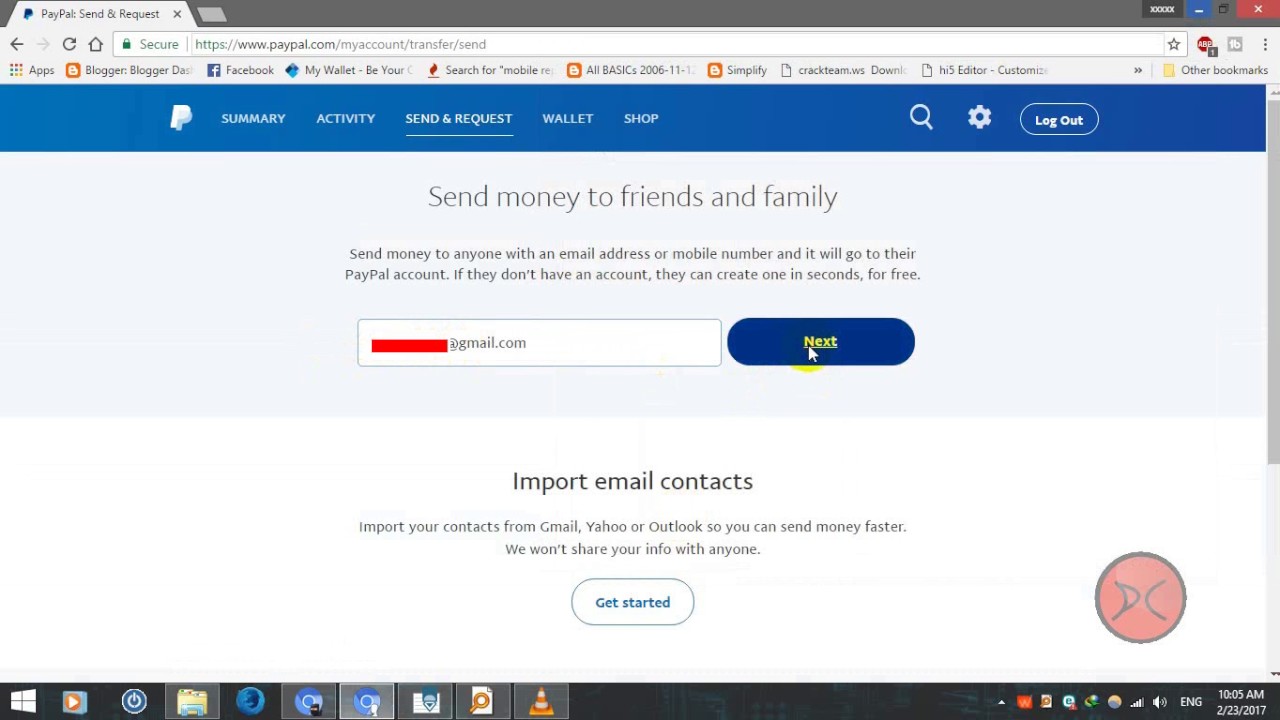

So, how to verify your PayPal account? The process is quite easy. You just need to upload a photo of your PAN card and fill in some personal information. PayPal will review your documents and will usually verify your account within a few days.

But there are several things to pay attention to. Your PAN card must be valid and not expired. You should also ensure that the photos you upload are clear and easy to read. If PayPal cannot verify your PAN card, you may not be able to use your account.

Apart from the PAN card, PayPal also requires you to verify your email address and phone number. This is done to ensure that you are the legal owner of the account. You can verify this information by following the instructions on the PayPal website.

The entire verification process usually takes no more than a week. However, in some cases, PayPal may take longer to review your documents. If your account is not verified within three weeks, you should contact PayPal customer service for assistance.

So, that’s a brief overview of PayPal and PAN card verification requirements in India. If you have any further questions, don’t hesitate to ask. Thanks for reading!

How to receive funds with partial or incomplete verification.

How to Receive Funds with Partial or Incomplete Verification on PayPal Using PAN Card in India

If you are based in India and want to receive funds in your PayPal account, verifying your account is very important. However, sometimes we may miss some steps or be unable to complete the verification process. Well, don’t worry! This article will guide you on how to receive funds on PayPal even with partial or incomplete verification.

PAN Card: Important Requirements

PAN Card (Permanent Account Number) is an important identification document in India that is required to fully verify your PayPal account. Without a PAN card, you can only receive funds up to INR 25,000 per year.

Partial Verification and Receipt of Funds

If you have completed basic PayPal verification by confirming your email address and linking a bank card, but have not linked a PAN card, you can receive funds up to INR 25,000. However, you will not be able to withdraw the funds until you complete full verification.

Incomplete Verification Process

If you have started the PAN verification process but have not completed it, you can receive funds up to INR 100,000 per year. However, to withdraw these funds, you have to complete PAN verification within 30 days.

How to Complete PAN Verification

To complete PAN verification, log in to your PayPal account and navigate to “Resolution Center”. There, you will find the option to upload a copy of your PAN card. Once you upload them, PayPal will review and verify your documents within 2-3 business days.

Transition Phrase: So, if you’re dealing with incomplete PayPal verification, don’t let that stop you from receiving funds.

Conclusion

By following these steps, you can receive funds in your PayPal account even if your verification is partial or incomplete. Remember to complete PAN verification within the specified time to unlock all features of your PayPal account. By doing so, you can maximize the potential of your online business in India.

Alternative verification methods for PayPal accounts.

PayPal has become a popular choice for individuals and businesses who want to conduct online transactions safely and conveniently. However, some users in India may face issues in verifying their PayPal account due to the company’s requirement for a PAN (Permanent Account Number) card. This article will outline the PayPal verification process and explore alternative verification methods available to users in India.

Before we discuss alternative methods, let’s understand the basic requirements to verify PayPal account using PAN card:

1. Indian citizens above 18 years of age.

2. Bank account in India linked to a valid PAN card.

3. PAN Card issued by the Indian Revenue Department.

If you meet the above requirements, you can verify your PayPal account by uploading a copy of your PAN card. However, if you don’t have a PAN card or want to explore other options, PayPal offers several alternative verification methods:

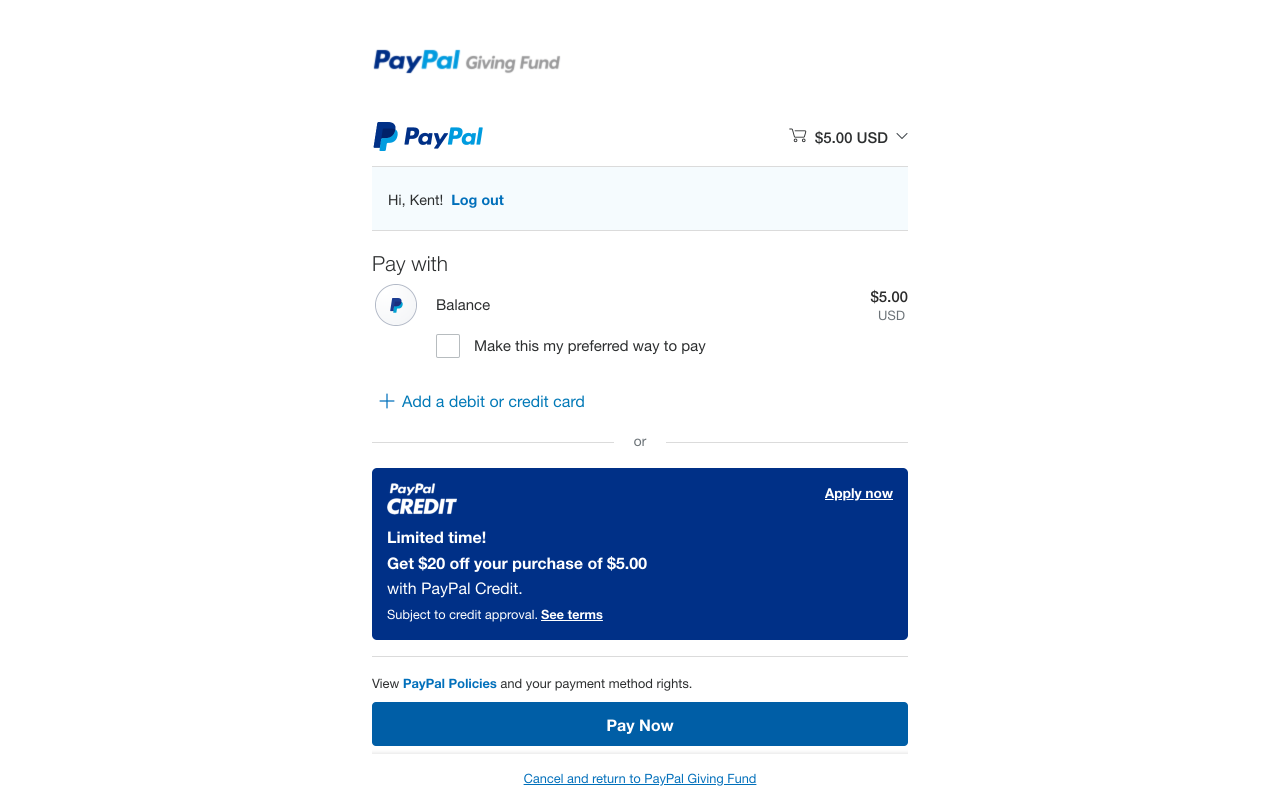

1. Credit/Debit Card Provider: You can link a credit or debit card issued by a bank in India to your PayPal account. PayPal will perform a small authorization (usually less than $1) on your card as part of the verification process.

2. Bank Account: You can also verify your PayPal account by connecting it to a bank account in India. PayPal will make two small deposits (less than $0.50 each) to your account, and you will have to enter the amounts manually to complete verification.

3. Bank Transfer: This method involves making a small bank transfer (around $2) from your bank account to your PayPal account. PayPal will provide instructions regarding the exact amount and transaction reference to be used.

After successfully completing one of the alternative verification methods, your PayPal account will be fully verified. Verification is very important because it allows you to send and receive money, make online transactions, and access the entire set of features offered by PayPal.

It is important to note that alternative verification methods may require longer processing time compared to the use of PAN card. However, they provide an easy and convenient way for users in India to verify their PayPal account without having to have a PAN card.

In conclusion, PayPal offers a variety of verification methods for users in India, including alternative methods such as credit/debit cards, bank accounts, and bank transfers. By following the steps outlined above, you can easily verify your PayPal account and start enjoying the convenience of safe and fast online transactions.

Can I receive money on PayPal without a pancard?

Receiving Money on PayPal without PAN Card: Is It Possible?

PayPal is one of the most popular online payment services in the world. With PayPal, you can make transactions safely and easily, whether it’s making payments or receiving money from other people. However, there are several conditions that must be met before you can use PayPal to its full potential, one of which is the PAN Card provisions.

PAN Card is a tax identity card issued by the Indian government to Indian citizens. This card contains a unique tax number that is used for tax purposes. In India, a PAN Card is usually required to carry out financial transactions, including receiving money on PayPal.

What is PAN Card?

PAN Card is a tax identity card issued by the Directorate General of Taxes, Ministry of Finance, Government of India. This card contains a unique tax number that is used for tax purposes. A PAN Card is needed to carry out financial transactions, such as opening a bank account, making tax payments, etc.

Why is PAN Card required to receive money on PayPal?

PayPal requires a PAN Card for several reasons:

- Government of India provisions : The Government of India requires all Indian citizens who carry out financial transactions to have a PAN Card.

- Identity Verification : PAN Card is used as proof of identity to carry out online financial transactions.

- Fraud Prevention : PAN Card helps PayPal to prevent fraud and illegal transactions.

Is it possible to receive money on PayPal without PAN Card?

Of course, it is possible to receive money on PayPal without a PAN Card, but there are some conditions that must be met:

- Non-Resident India : If you are not an Indian citizen, then you do not need a PAN Card to receive money on PayPal.

- PayPal users outside India : If you are using PayPal outside India, then you do not need a PAN Card.

- Amount of money received : If the amount of money you received on PayPal is less than Rs. 49,999, then you don’t need a PAN Card.

- Verified PayPal user : If you have been verified by PayPal and have sufficient balance, then you can receive money on PayPal without PAN Card.

How to receive money on PayPal without PAN Card?

If you do not have a PAN Card, then you can receive money on PayPal in the following ways:

- Perform PayPal verification : Make sure you have been verified by PayPal and have sufficient balance.

- Use another bank account : You can use another bank account that is associated with PayPal to receive money.

- Ask someone else to receive the money : You can ask someone else who has a PAN Card to receive money in PayPal on your behalf.

Conclusion

Receiving money on PayPal without a PAN Card is possible, but there are some conditions that must be met. If you don’t have a PAN Card, then you can receive money on PayPal by verifying PayPal, using another bank account, or asking someone else to receive the money on your behalf. However, keep in mind that PAN Card is very important for carrying out financial transactions safely and easily in India.

Frequently Asked Questions

- Q: Is PAN Card mandatory to receive money on PayPal?

A: No, PAN Card is not mandatory to receive money on PayPal, but there are some conditions that must be met. - Q: How to receive money on PayPal without PAN Card?

A: You can receive money on PayPal without a PAN Card by verifying PayPal, using another bank account, or asking someone else to receive the money on your behalf. - Q: Is PAN Card required to make payment on PayPal?

A: No, PAN Card is not required to make payments on PayPal, but there are some conditions that must be met.