Limits on receiving funds with an unverified PayPal account.

So, you’ve created a PayPal account and are excited to start accepting payments. However, there is a slight hurdle: unverified accounts. Relax, you are not alone! Many new PayPal users experience this. Let’s discuss the limitations that come with unverified accounts and the steps you can take to overcome them.

Unverified PayPal accounts face limitations on the amount of funds you can receive. These limits vary by country, but generally range from $500 to $10,000 per month. While this limitation may not be a problem for occasional users, it can be limiting for those who plan to receive larger amounts.

To overcome this limitation, you need to verify your PayPal account. The verification process is easy and only requires a few simple steps. The most common is to link a bank account or credit card to your account. PayPal will send a small amount of money to your account, which you must then enter into PayPal as confirmation.

In addition to acceptance limits, unverified PayPal accounts also have other limited features. For example, you may not be able to withdraw funds or use certain services. Verifying your account will not only unlock your acceptance limit but also allow you to take advantage of all PayPal features.

Verifying your PayPal account is also an important step to improve security. By linking your financial information, PayPal can verify your identity and reduce the risk of fraud. This provides peace of mind for you and your customers.

Keep in mind that the verification process may take several days. During this time, your account will remain subject to restrictions. Once your account is verified, you will be able to receive funds without restrictions.

In conclusion, unverified PayPal accounts have several limitations, including acceptance limits. Verifying your account is a simple but important step to remove these restrictions and access all PayPal features. By following the easy verification instructions, you can immediately receive payment of the full amount in your verified account.

PayPal’s identity verification process.

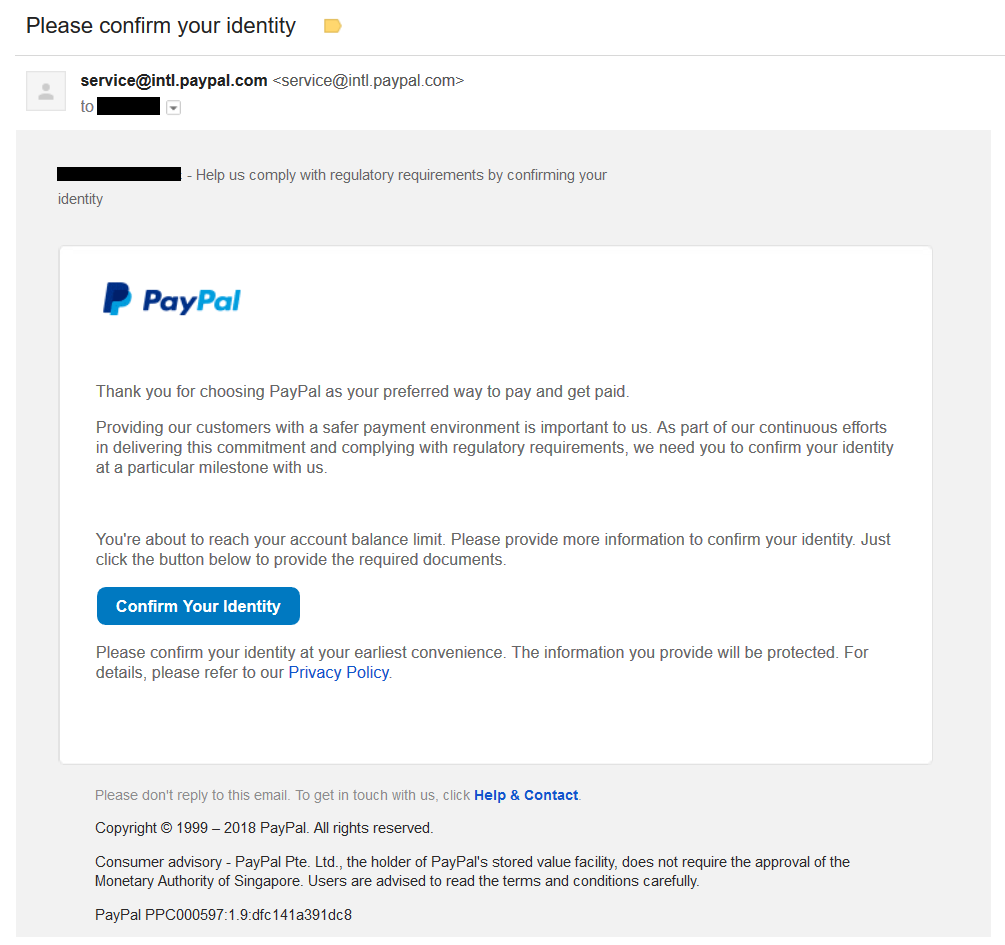

To ensure transaction security and comply with regulations, PayPal requires users to verify their identity. The verification process usually involves providing information such as name, address, telephone number, and government-issued identification card.

Without verification, you have limitations in receiving funds in your PayPal account. These limits vary depending on the country you live in and the currency you use. However, in general, you can only receive up to a certain amount in a certain time period.

Once you verify your identity, these restrictions will be lifted and you will be able to receive funds in larger amounts and more frequently. The verification process is usually quick and easy, and can be done online or through the PayPal app.

Apart from increasing the limit for receiving funds, identity verification also provides several other benefits. This can help protect your account from fraud and unauthorized access, and make your transactions more secure.

If you plan to use PayPal regularly to receive payments, it is highly recommended to verify your identity. This will ensure that you can access all PayPal features and receive funds without restrictions.

Here are some important things to remember about limits on receiving funds with an unverified PayPal account:

These limits vary depending on country and currency.

Verifying your identity by providing personal information will lift this restriction.

The verification process is fast and easy.

There are other benefits to identity verification, such as increased account security.

How to verify your PayPal account to lift limits.

Restrictions on Receiving Funds with an Unverified PayPal Account

As a PayPal user, it is important to understand the limitations of receiving funds with an unverified account. This step is crucial to maximize the benefits of the platform and ensure safe and smooth transactions.

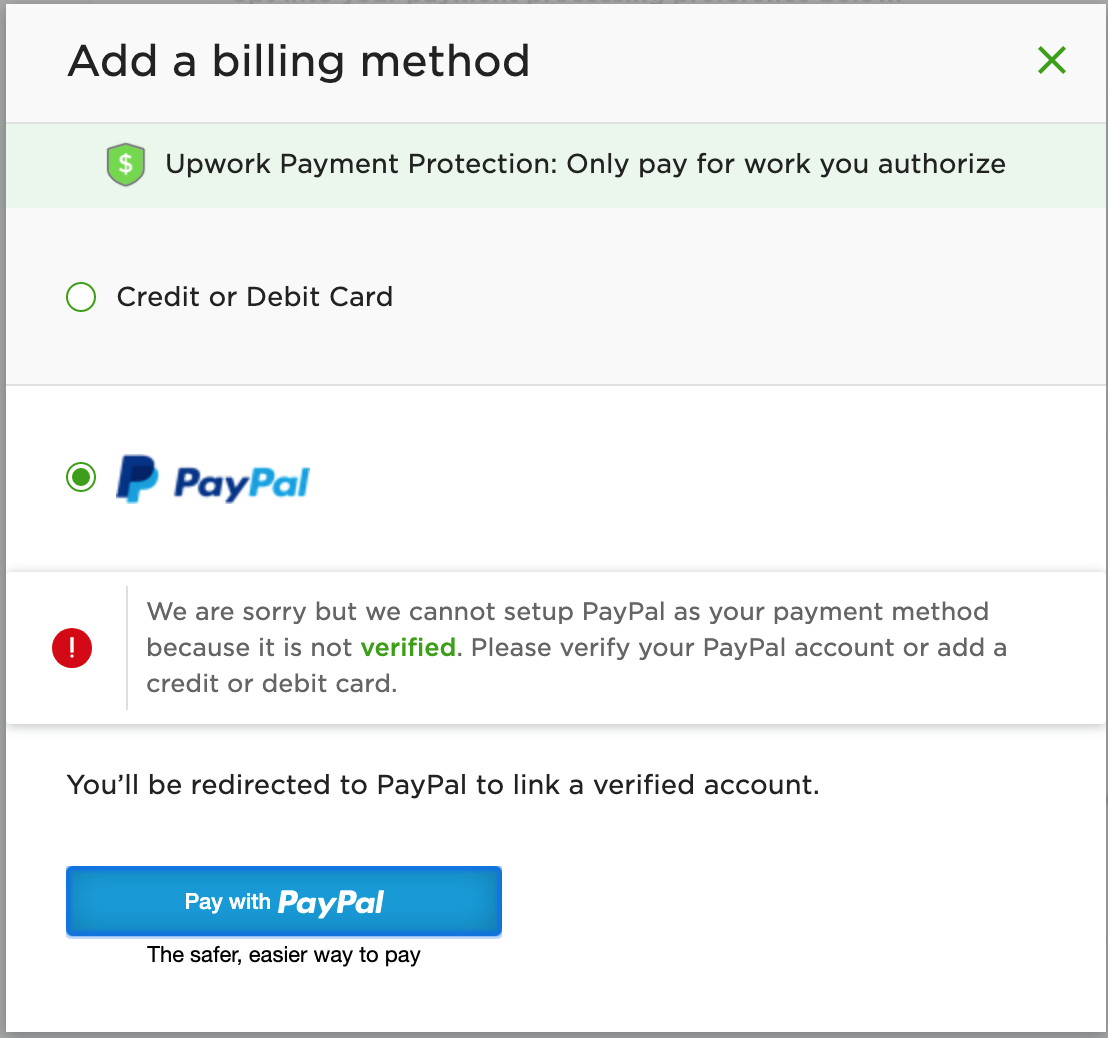

When signing up for a new PayPal account, you may be required to verify your account. This process usually involves linking a credit card or bank account to your PayPal account. By verifying your account, you not only increase your funds receipt limit, but also protect yourself from fraud and other suspicious activities.

Restrictions for unverified accounts vary depending on the country and currency you use. However, in general, you may only be able to receive a limited amount of funds in a certain time period. For example, in the United States, unverified accounts are typically limited to receiving $500 per month.

This can be a problem if you plan on accepting larger payments or want to use PayPal as your primary payment method. By verifying your account, you can increase your receiving limit to $10,000 per month or more, depending on certain factors such as your PayPal history and account activity level.

Apart from increasing the limit for receiving funds, verifying a PayPal account also provides other benefits. These include:

Increases the security of your account, reducing the risk of fraud and illegal activity.

Access expanded PayPal features, such as transaction tracking tools and buyer protection.

Build trust with customers and business partners, showing that your account is genuine and trustworthy.

The verification process usually takes only a few minutes. You can verify your account by following the instructions on the PayPal website. Once your account is verified, you will be able to receive larger amounts of funds and take advantage of all the benefits offered by the PayPal platform.

Therefore, if you want to maximize the benefits of your PayPal account and avoid limitations, it is highly recommended to verify your account as soon as possible. This process is safe, fast, and will give you peace of mind when using PayPal for your financial transactions.

Can I receive money from PayPal if my identity isn’t verified?

Receiving Money from PayPal without Identity Verification: Is It Possible?

PayPal is one of the most popular online payment services in the world. With PayPal, you can make online transactions easily and safely. However, there are several requirements that you must fulfill to be able to use PayPal optimally, one of which is identity verification. Can you receive money from PayPal if your identity has not been verified? Let’s discuss it further.

What is Identity Verification in PayPal?

Identity verification on PayPal is a process carried out by PayPal to ensure that you are the real person and not someone else using your identity. This identity verification usually involves submitting an official identity document, such as a KTP, driver’s license, or passport, to ensure that the information you provide is accurate.

Why is Identity Verification Important on PayPal?

Identity verification is important in PayPal for several reasons:

- Security : Identity verification helps PayPal ensure that you are the real person and not someone else using your identity. This helps prevent fraud and secure your account.

- Regulations : PayPal must comply with applicable financial regulations in each country. Identity verification helps PayPal ensure that you meet applicable regulatory requirements.

- Facility : Identity verification also helps PayPal provide you with better facilities, such as increasing transaction limits and providing access to other features.

Is It Possible to Receive Money from PayPal without Identity Verification?

Yes, maybe. However, there are several limitations and requirements that you must fulfill. Here are some things you need to know:

- Transaction Limits : If your identity has not been verified, your transaction limit will be lower. This means that you cannot receive large amounts of money from PayPal.

- Defrosting Time : If your identity has not been verified, the time to disburse money from PayPal will take longer. This means you have to wait a few days before you can cash out.

- Cost : If your identity has not been verified, then you may be charged a higher fee for making transactions.

How to Receive Money from PayPal without Identity Verification

If you want to receive money from PayPal without identity verification, then you must meet the following requirements:

- Create a PayPal Account : First of all, you have to create a PayPal account. Make sure you enter accurate and complete information.

- Add Payment Method : You must add a payment method, such as a credit or debit card, to receive money from PayPal.

- Request Money from the Sender : You must request money from the sender to be able to receive money from PayPal.

- Wait for Confirmation : You must wait for confirmation from PayPal that the money has been received.

Tips for Receive Money from PayPal without Identity Verification

Here are some tips for receiving money from PayPal without identity verification:

- Use a Credit or Debit Card : Use a credit or debit card to add a payment method on PayPal.

- Verify Email Address : Make sure you have verified your email address on PayPal.

- Use Telephone Number : Use your phone number to verify your PayPal account.

- Don’t Make Large Transactions : Do not make large transactions if your identity has not been verified.

Conclusion

Receiving money from PayPal without identity verification is possible, but there are some limitations and requirements you must meet. Identity verification is important to ensure the security and trustworthiness of your account. If you want to receive maximum money from PayPal, then you should verify your identity as soon as possible. This way, you can use PayPal more easily and safely.