Overview of PayPal Credit as a loan option.

PayPal Credit, a lending service from the payments giant, offers a flexible financing alternative for those looking to make large purchases or manage their cash flow. Let’s explore this loan option further and see how it works.

PayPal Credit is essentially a line of credit that can be used to pay for purchases online or at participating stores. Once approved, you will get a credit limit that you can use as needed. As with most loans, you have to pay back what you borrow, plus interest.

One of the main advantages of PayPal Credit is its ease of use. It is fully integrated into the PayPal platform, so you can use it for payments without needing to register or submit additional applications. Just select PayPal Credit as your payment method at checkout, and you’ll get an instant approval decision.

If you’re approved for PayPal Credit, you’ll get a three-month interest-free grace period for purchases made within the promotional period. This gives you time to pay off your balance without incurring additional fees. However, if you don’t pay off your balance within the promotional period, you will start paying interest on the unpaid balance.

Interest rates on PayPal Credit vary depending on your credit worthiness. However, in general, the rates are competitive compared to other loan options. Additionally, PayPal Credit offers flexible payment options that allow you to adjust your monthly payments to fit your budget.

One important thing to note is that PayPal Credit may not be available to everyone. Your approval will be based on factors such as your credit history, payment history, and income. If you have bad credit or a problematic payment history, you may not qualify for PayPal Credit.

Overall, PayPal Credit can be a convenient and flexible loan option if you want to make a large purchase or manage your cash flow. With an interest-free grace period, competitive interest rates, and an easy-to-use platform, PayPal Credit can be a viable alternative to traditional loans.

How to apply for PayPal Credit and use it for loans.

PayPal Credit is a versatile loan option that can be used to fund purchases and other financial needs. Here’s a guide on how to apply for and use PayPal Credit as a loan:

Stage 1: Apply for PayPal Credit

Visit the PayPal website or app and click “Wallet.”

Select “PayPal Credit” and click “Apply Now.”

Complete the application with your personal and financial information.

PayPal will check your eligibility and provide you with an approval decision.

Stage 2: Use PayPal Credit for Purchases

Once approved, you can use PayPal Credit to make purchases:

At checkout, select “PayPal” as the payment method.

Click “Use PayPal Credit” and log in to your account.

PayPal will apply your PayPal Credit balance to the purchase.

Stage 3: Use PayPal Credit to Transfer Funds

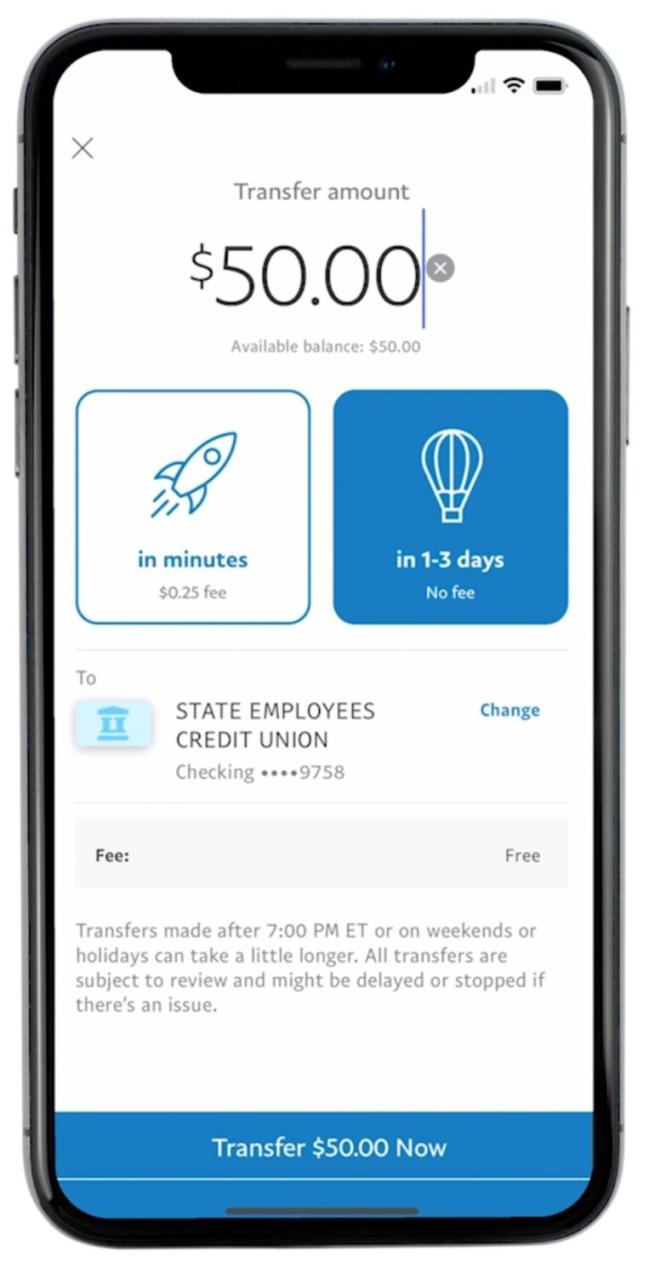

If you need cash, you can use PayPal Credit to transfer money to your bank account:

From your PayPal dashboard, click “Transfer”.

Select “From PayPal Credit” and enter the amount you want to transfer.

Review the details and confirm the transfer.

Loan Terms and Fees

Interest and fees associated with PayPal Credit vary depending on your eligibility. Generally, the annual percentage rate (APR) ranges from 14.99% to 29.99%. You can see your specific terms in your PayPal account.

You are not charged an annual fee or transaction fee to use PayPal Credit. However, late fees may apply if you miss a payment.

Benefits of Using PayPal Credit

Interest-Free Financing: You can enjoy interest-free financing on purchases paid in full within the promotional term.

Flexible Purchases: Use PayPal Credit for a variety of purchases, from online shopping to home improvements.

Access Cash Funds: Transfer funds from PayPal Credit to your bank account to cover emergency expenses.

Conclusion

PayPal Credit is a convenient and versatile loan option that can help you fund your purchasing and financial needs. With an easy application process and flexible terms, PayPal Credit is a great option for individuals looking for a loan solution.

Risks and fees associated with using PayPal for loans.

Finance friends, we’re going to dive into the risks and costs associated with using PayPal Credit as a lending option. Like everything in life, there are pros and cons to consider.

First, let’s discuss the risks. High interest is one of the main concerns. The annual percentage rate (APR) can be as high as 29.99% which can quickly balloon your balance if you don’t pay it off quickly. Additionally, regardless of your payment history, you will be charged a $29 late fee if you do not make your payment on time.

Other fees to be aware of include a $40 late payment fee. This is a one-time fee that is added if you miss two or more consecutive payments. An inactive account fee of $25 may also be charged if you do not use your PayPal Credit account for more than 12 consecutive months.

However, despite these risks, PayPal Credit also offers several benefits. For example, you can take advantage of a grace period of up to 6 months on certain purchases. This can provide considerable flexibility to pay off your balance without incurring interest.

Additionally, PayPal Credit integrates seamlessly with your PayPal account. This makes it easy for you to borrow and manage your loans directly from your digital wallet. And, unlike some other loans, you don’t need to go through a formal application process or credit check to get approved.

So, is PayPal Credit a good loan option for you? It depends on your financial situation and your ability to manage payments. If you need funds quickly and can pay them off in a short period of time, PayPal Credit could be a viable option. However, if you are looking for a longer-term loan with a lower interest rate, you may want to consider other options.

Ultimately, the best decision for your situation depends on many personal factors. Be sure to consider the risks and costs carefully before taking out a PayPal Credit loan. With the right information, you can make informed choices that meet your financial needs.

Can I loan money from PayPal?

Can you borrow money from PayPal? This is the answer

PayPal is one of the most popular online payment services in the world. With more than 400 million active users, PayPal has become one of the most common ways to conduct online transactions. However, have you ever wondered whether you can borrow money from PayPal? The answer is yes, but with certain terms and conditions.

What is Loan from PayPal?

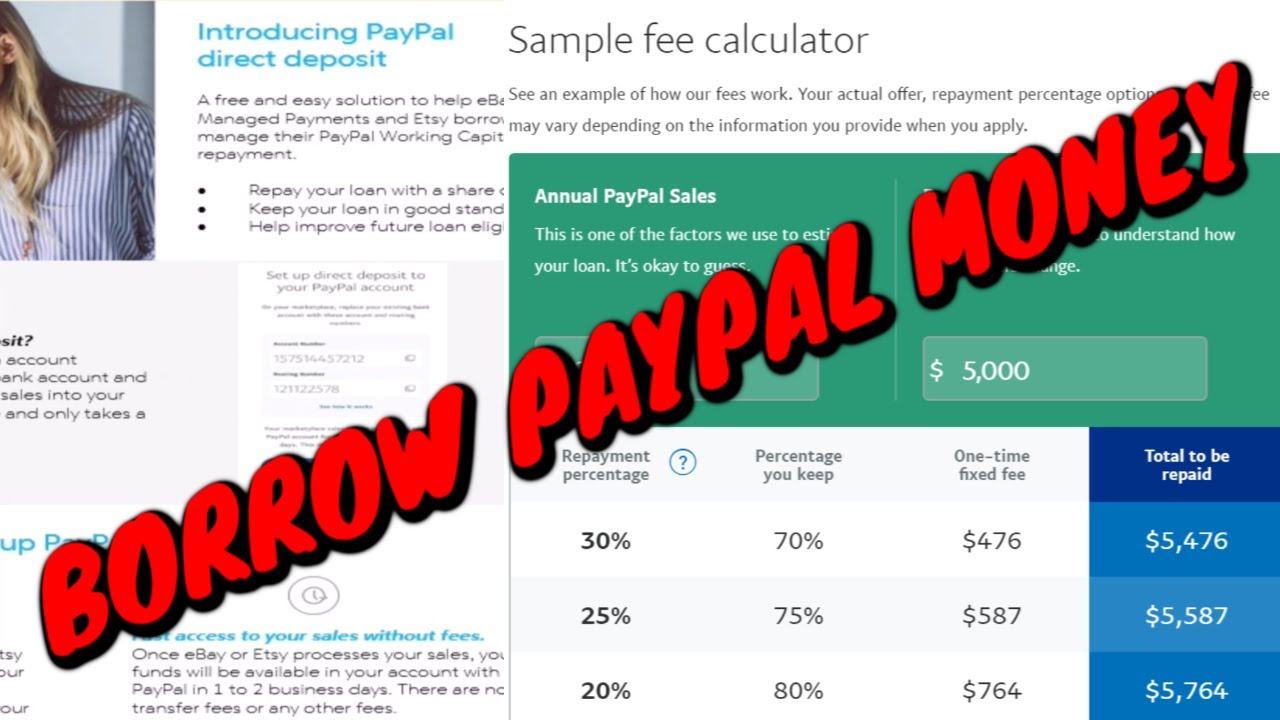

PayPal offers a lending service called PayPal Working Capital. This service allows you to borrow money to improve your business or for personal purposes. Loans from PayPal can be used for various purposes, such as increasing stock, expanding business, or paying debts.

How to Apply for a Loan from PayPal?

To apply for a loan from PayPal, you must meet certain conditions. Here are some steps you should take:

- Open a PayPal account : Make sure you have an active PayPal account and have been using this service for a long time.

- Identity verification : Make sure your identity has been verified by PayPal. If not, you must verify your identity by uploading a valid identity document.

- Determine the loan amount : Determine the loan amount you need. PayPal will offer several available loan amount options based on your transaction activity.

- Determine the loan term : Determine the loan period you need. PayPal will offer several available loan term options.

- Sign the agreement : If you agree to the terms and conditions of the loan, you must sign the loan agreement electronically.

Terms and Conditions for Loans from PayPal

Loans from PayPal have several terms and conditions that you must fulfill. Here are some examples:

- PayPal Account : You must have an active PayPal account and have been using the service for a long time.

- Identity verification : You must verify your identity by uploading a valid identity document.

- Transaction activity : You must have sufficient transaction activity with PayPal.

- Credit history : You must have a good credit history.

- Loan repayment : You must make regular loan repayments according to the loan period you specified.

Advantages of Borrowing from PayPal

Loans from PayPal have several advantages, such as:

- Fast process : The loan process from PayPal is relatively fast and easy.

- Without collateral : Loans from PayPal do not require collateral, so you don’t need to worry about the risk of losing assets.

- Competitive interest : Loan interest from PayPal is relatively competitive compared to other financial service providers.

- Flexibility : Loans from PayPal can be tailored to your needs, so you can choose the appropriate loan amount and loan period.

Disadvantages of Borrowing from PayPal

Loans from PayPal also have several disadvantages, such as:

- High interest : Interest on loans from PayPal can be relatively high, especially if you have a bad credit history.

- Additional cost : Loans from PayPal may have additional fees, such as administration fees and return fees.

- Limited loan amount : Borrowing amounts from PayPal can be limited, especially if you have a bad credit history.

- Dependence on PayPal account : Loans from PayPal are only available for active PayPal accounts and have sufficient transaction activity.

Conclusion

Loans from PayPal can be a good option if you need additional funds to improve your business or for personal purposes. However, make sure you meet the lending terms and conditions set by PayPal. Apart from that, make sure you consider the advantages and disadvantages of borrowing from PayPal before applying for a loan. This way, you can make the right decisions and avoid unwanted financial risks.