Steps to create an online payment platform.

Let’s explore the important steps to build a reliable and secure online payments platform. First of all, you need a deep understanding of the industry, including related financial laws and regulations. The next step is to create a clear business model that outlines your value proposition, cost structure, and target market.

At the technical stage, you should choose a reliable payment gateway that provides safe and efficient transactions. Make sure your payment gateway has advanced features like credit and debit card support, recurring payment processing, and fraud protection. Next, design a friendly and intuitive user interface to make it easy for users to make payments.

To ensure compliance, you must follow payment card industry security guidelines (PCI DSS). This includes securing customer card data, using strong encryption techniques, and regularly monitoring for potential vulnerabilities.

Once you’re ready to launch your platform, it’s important to conduct thorough testing to identify and fix any issues. Testing should cover all possible transaction scenarios, including regular transactions, refund transactions, and fraudulent transactions.

Lastly, an important step is getting customer feedback and continually updating your platform. Solicit feedback from users to identify areas for improvement and act on the feedback received. Additionally, monitor industry trends and new technologies to ensure your platform remains up-to-date and competitive.

By following these steps carefully, you can build an online payments platform that is secure, efficient, and meets the needs of your business and customers. Remember to prioritize security, compliance, and user experience, and continually improve your platform to stay ahead in an ever-evolving industry environment.

Legal and regulatory hurdles in creating a PayPal-like service.

The legal and regulatory hurdles of building a service like PayPal are important considerations when looking to launch an online payments platform. Let’s discuss some important points:

First of all, the operation of an online payment platform usually requires a license or registration in the relevant jurisdiction. This involves meeting requirements set by regulatory authorities, such as compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Additionally, businesses must comply with regional data protection laws such as the General Data Protection Regulation (GDPR) in the European Union. This includes the secure and appropriate collection, use and storage of customer personal information.

Another important aspect is cyber security. Payment platforms must have strong security measures in place to protect user data and prevent fraud. This includes data encryption, two-factor authentication, and real-time transaction monitoring.

Reliability is also important. The platform must be able to handle high transaction volumes without interruptions or outages. This requires a strong infrastructure and a responsive operations team.

What is no less important is customer satisfaction. The platform should provide an easy-to-use user interface and responsive customer service. Ensuring quick resolution of complaints or questions will build trust and encourage customer retention.

Furthermore, services like PayPal often rely on a network of partners to process payments. Building and maintaining strong relationships with these third-party providers is critical to smooth operations.

Finally, businesses need to consider the tax laws and regulations that impact e-commerce in different jurisdictions. Fulfilling tax obligations is very important to avoid fines or penalties.

Navigating these obstacles is certainly challenging. However, with careful planning, adequate legal preparation, and strong partnerships, businesses can build a secure, reliable, and compliant online payment platform that can compete with large services like PayPal.

Challenges involved in building an online payment business.

After building a solid foundation for your online payments platform, the next step is to overcome the challenges that may arise along the way. First, cyber security is a major concern. Customers should feel confident that their financial information is protected from theft or misuse. Your platform must implement strict security measures, such as data encryption and secure authentication protocols.

Furthermore, regulatory compliance is an important aspect. The payments industry is subject to various regulations, such as PCI DSS and GDPR. You must ensure that your platform complies with all applicable regulations to ensure legal and safe operations. Failure to comply may result in fines or even closure of the business.

Competition in the online payment industry is also very tight. It is important to differentiate your platform from others. Consider offering additional features, such as one-click checkout or integration with popular e-commerce platforms. Continuous innovation and exceptional customer service can also give you a competitive edge.

Additionally, scaling your platform to meet increasing demand can be a challenge. Handling large transaction volumes and ensuring high uptime is critical to the success of your platform. Robust system architecture and reliable infrastructure are critical to achieving effective scaling.

Lastly, building customer trust is critical to the long-term success of an online payments platform. Transparency and clear communication are essential to building trust. Consider providing regular updates on the status of your transactions and platform security. Handling customer disputes quickly and efficiently is also important to maintaining a positive reputation.

Overcoming these challenges requires careful planning, careful execution, and a commitment to providing safe, reliable, and innovative services. By overcoming these obstacles strategically, you can build a successful and rapidly growing online payments platform.

Can I create an online bank like PayPal? If so, how?

Building an Online Payment System Like PayPal: Is It Possible and How?

In recent decades, technology has advanced rapidly, making online payments easier and safer. PayPal, one of the most popular online payment systems, has become a reference for many online payment application developers. However, the question that often arises is, “Can I create an online payment system like PayPal?” The answer is, “Yes, you can!” But, of course, there are some things to consider and some steps to take.

Why Build an Online Payment System?

Building an online payment system has several advantages. First of all, you can improve the quality of service to customers by making it easy for them to make payments. Second, you can increase transaction security by using strong encryption technology. Third, you can reduce operational costs by minimizing the use of cash. Fourth, you can increase revenue by providing various types of payment services.

Steps to Build an Online Payment System

Here are some steps to take to build an online payment system like PayPal:

- Research and Planning

The first step is to do research and planning. You must understand customer needs, analyze competitors, and determine the type of payment services to offer. You also have to determine your target market, create a business plan, and determine a marketing strategy.

- Team Development

You should have a team consisting of software developers, security experts, and design experts. This team must work together to create a robust and secure online payment system.

- Use of Technology

You must choose the appropriate technology to create an online payment system. Some technologies that are often used are:

- Programming languages such as Java, Python, or PHP

- Frameworks such as Spring, Django, or Laravel

- Databases such as MySQL, PostgreSQL, or MongoDB

- Encryption technologies such as SSL/TLS or AES

- Interface Design

Good interface design can make users feel comfortable and safe. You should ensure that your interface has features such as notifications, transaction history, and security settings.

- Transaction Security

Transaction security is the most important thing in an online payment system. You must use strong encryption technology to protect customer and transaction data. You must also have an effective fraud detection system.

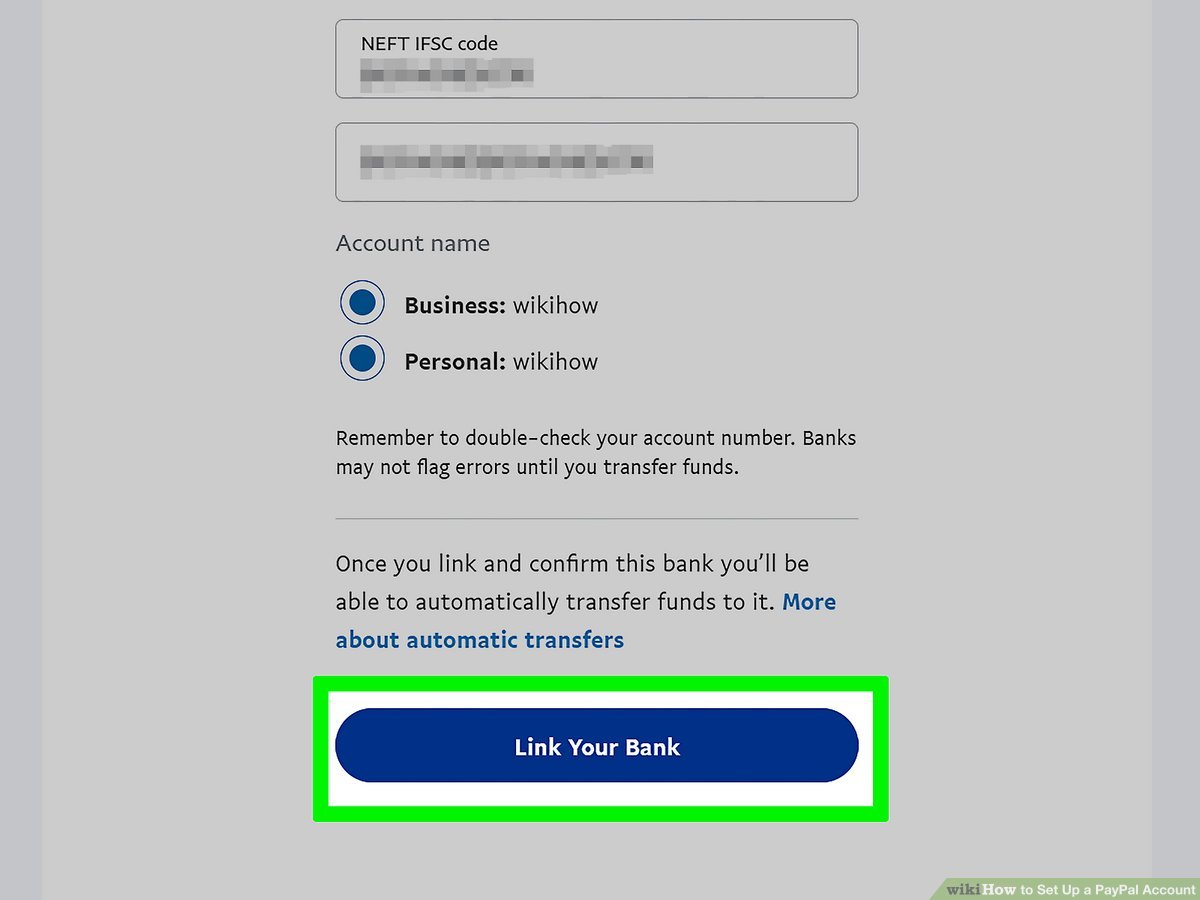

- Licenses and Regulations

You must ensure that your online payment system complies with applicable regulations and licenses. You must have a license from a financial regulatory body to carry out payment transactions.

- Testing and Deployment

Once your online payment system is ready, you should conduct thorough testing to ensure that your system is working properly. After that, you can deploy the system to production.

Technology Used by PayPal

PayPal uses several technologies to create a powerful and secure online payment system. Some of the technologies used by PayPal are:

- Programming languages such as Java and Python

- Frameworks such as Spring and Django

- Databases such as MySQL and PostgreSQL

- Encryption technologies such as SSL/TLS and AES

- Effective fraud detection system

Conclusion

Building an online payment system like PayPal requires several steps to be taken. You have to do research and planning, team development, technology use, interface design, transaction security, licensing and regulation, and testing and deployment. If you want to create a strong and secure online payment system, you must understand the technology used by PayPal and apply that technology in building your online payment system.

Reference

- PayPal. (n.d.). About PayPal. Accessed from https://www.paypal.com/us/about

- PayPal. (n.d.). Our Technology. Accessed from https://www.paypal.com/us/about/tech

- TechCrunch. (2017). PayPal’s Technology Stack. Accessed from https://techcrunch.com/2017/02/20/paypals-technology-stack/

- StackOverflow. (n.d.). PayPal’s Architecture. Accessed from https://stackoverflow.com/questions/17373921/paypals-architecture